The market has yet to factor in the inflationary risk. For the time being, the market is accepting the Fed’s forecasts, namely that the inflation observed in the United States is transitory.

In 2011, the inflationists kept repeating that the effects of Quantitative Easing were going to create inflation, while hoping that the central banks’ printing of money would spread to the real economy… But, each month, the reality of the figures brought them back down to earth. Carried along by globalization and the digital revolution, the deflationary wind took away all hope of seeing this printing of money spread beyond simple financial assets.

In 2020, a dike broke and everything was turned upside-down.

This time, it is the people who have not yet gotten the measure of this paradigm shift that are hoping this movement will stop. Each new figure brings them back, in turn, to reality.

The figures on inflation come as a stinging reminder for those who are still in denial.

The latest figure on production prices is up 6.6% in May, i.e. the biggest annual rise in history.

Inflation is only just starting to gauge the historic devaluation of the currencies. You don’t print $10 trillion’s worth of money and get away without any knock-on effect on the cost of living.

Between 2010 and 2011, this inflation was concentrated around the value of financial assets. This explains, among other things, the exorbitant cost of getting on the property ladder today...

...and the absurd valuation of some stocks listed on the stock market.

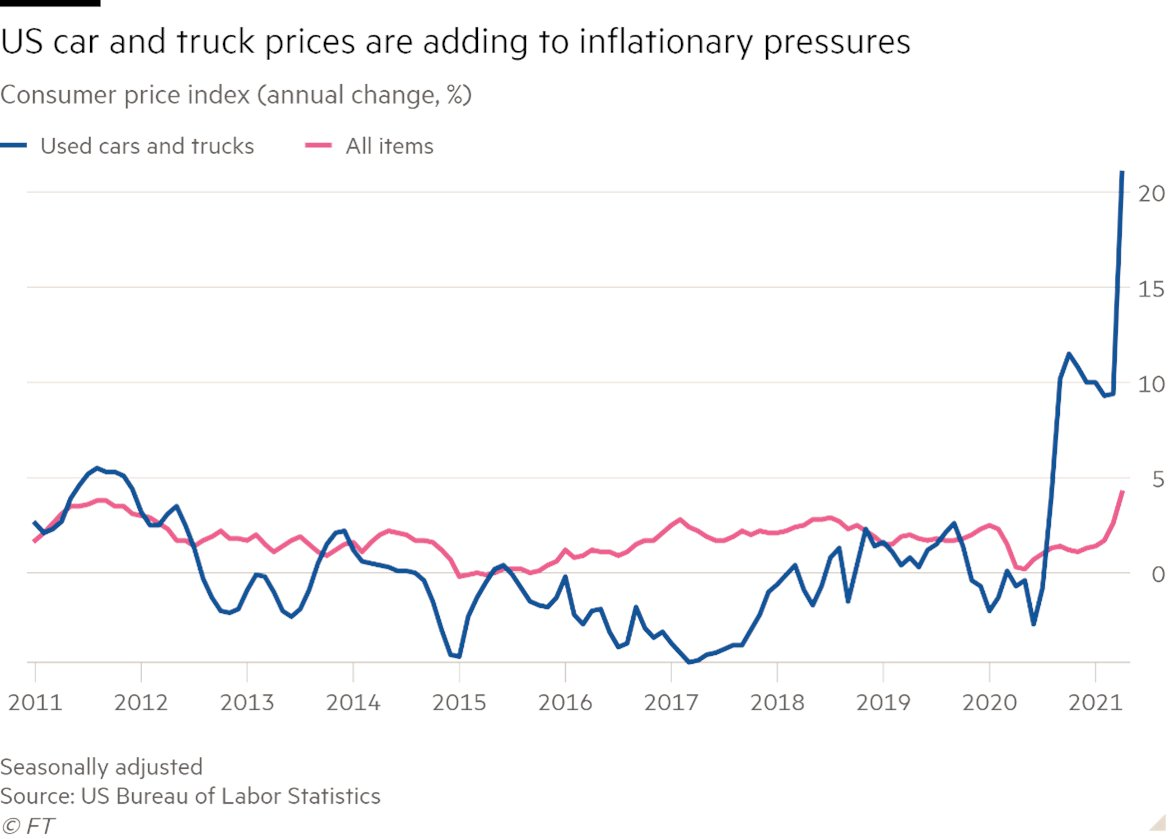

Today, this inflation is starting to spread into the real economy...

This week, the hikes in shipping costs started to rise sharply again:

While the first stage of this inflationary drive was focused on commodities, it is now starting to spread to services, with the transportation sector being the first sector impacted.

This contagiousness in the price rises is an essential point that many observers are failing to spot.

If we look at the inflation figures component, a substantial portion of the rise is being attributed (for the time being) to the rise in the prices of these commodities. The rise in the Service, Food and Energy components is, ultimately, fairly moderate - for now.

When one looks at the current correction to certain commodities prices, one might be tempted to think that this inflation is going to return to very low levels.

To assume as much, however, would be to forget the phenomenon of contagion that is initiated when inflation gets going.

Processed products are now the next thing in inflation’s sights. For instance, the price of meat is on the brink of taking off in the United States, with a rise of +40% over the next few weeks predicted. China has already put price control mechanisms in place on pork, corn and wheat.

The manufacturing companies won’t be able to look on impassively for long: they will be forced to pass on the price rises to the consumer.

A lot of investors are claiming, today, that this contagion will lead, in the end, to the exhausting of demand, which will destroy the inflation we are witnessing.

This hope is contradicted, in any case, by the figures, which are instead showing that the United States is seeing a strong uptick in demand, in what has been a very distinctly reflationary movement for several months.

This can be seen in the figures for credit consumption:

The American consumer is back, after the brutal change of trend recorded at the start of this year.

Others are putting forward the wages argument: the other brake on this spreading of inflation is the level of real wages. If wages do not follow this rise in prices, this movement will have a hard time continuing. The real wages level has collapsed in the United States in just a few weeks.

Here again, however, the situation is quickly becoming untenable. The latest report on U.S. jobs shows that half of employees’ gains are concentrated on the lowest salaries. In other words, the rise in inflation is starting to have an effect on the lowest incomes. Hiring is becoming increasingly difficult, particularly in the catering industries. In California, a barista can now expect to earn more than a teacher, and this is obviously putting social pressure on the entire workforce... It is a classic consequence that one finds in all brutal cycles of inflation. If the inflation doesn’t spread to the level of wages, the system gets jammed up and is transformed into stagflation, which is even more difficult on the social front: the prices of all the things people need go up, and the real value of everything people earn is diminished. This is certainly not a path that is easy to take from a political point of view, but, in order to avoid seeing this inflation turn into a social nightmare during his term of office, one has to anticipate that Biden will reserve a substantial portion of his stimulus plan for pay rises.

Another consideration that is prompting numerous observers to play down this comeback on the part of inflation: the bonds market is certainly not anticipating the lasting return of a prolonged rise in prices.

The U.S. ten-year bond, indeed, has just fallen below the support that had served it well in its consolidation movement, initiated after the hike at the start of this year:

Some investors are even seeing, in this rebounding of the 10-year bond, an additional signal that the temporary inflation linked to the aftermath of the Covid-19 pandemic will soon be at an end.

This reading of the situation is to some extent biased, however, because this market is strongly influenced by the purchases made by the central banks. Jim Reid gives us an image that tells us quite a lot, on this subject: “The only thing more complicated than unlocking a golf swing is working out bond markets in an era of extreme intervention [on the part of the central banks]".

The Fed is increasingly active in the bond market and is buying up an ever larger share of the debt issued by the U.S. Treasury.

How can we put a figure on the value of a bond, under these circumstances?

What value does this indicator actually have in real terms, measured against the inflation that is to come?

The bond market is masking the technical state of bankruptcy that the U.S. state is in: the forecast for the annual federal deficit is $4.3 trillion, which is $1 trillion more than last year - and that’s a conservative estimate. The state is spending far more than it is collecting in taxes; that is, in theory, a situation of bankruptcy. The monetization of the debt and the controls on interest rates provide the possibility of avoiding this bankruptcy. Without the Fed, the Treasury would be unable to borrow at such low rates, and the country’s fiscal situation would be unmanageable.

The bond market is no longer operating under the initial conditions in which it was designed. It now constitutes one of the tools that the central bank is using to control, as best it can, the relaunching of the U.S. economic machine, by supporting the U.S. fiscal effort.

The bond market is equally problematic in Japan, which can no longer attract enough private investors to buy up its debt. The Bid/Cover ratio of the latest auction on the Japanese 10-year bond reached its lowest level since 2015: despite the promises made by the Japanese Central Bank, the Japanese bond market has still not returned to normal and is only functioning thanks to the Bank of Japan’s purchases.

In Europe, too, this market has now become entirely controlled by the ECB. Virtually all of Europe’s public sector debt is held by the central bank.

The latest public auctions reveal the increasingly firm grip that the ECB has on the control of public debts:

The central banks are more focused on controlling these bonds markets than on the consequences of the inflation, brought about, of course, by their interventionist policies.

The logical consequence of the two joint phenomena (inflation + control of rates) is a collapse in the real yields. The U.S. 10-year real yield is plunging to levels not seen since 1981:

The last time we saw a plunge like this, the chair of the Fed at the time, a certain Mr Volker, took a bazooka to the problem by brutally raising interest rates, a move which stopped the inflationary cycle of the previous years dead in its tracks.

All eyes are now fixed, this Wednesday, on the chair of the Federal Reserve, Jerome Powell.

The slide in real yields leaves him with no choice but to raise the rates, and to do so aggressively, even... at a time when the U.S. government is asking him to lower them to finance its stimulus plan!

Mr Powell has been backed against the wall and there is a clamor of voices calling for him to act as quickly as possible.

The famous hedge fund manager Paul Tudor Jones is already letting it be known that he will continue to invest in assets that protect him from inflation if Mr Powell continues to ignore this inflation.

Paul Tudor Jones says the Fed's credibility is at risk with inflation view https://t.co/aSM9mpvaxm

— CNBC (@CNBC) June 14, 2021

The CEO of JP Morgan, Jamie Dimon, is also flagging up the lasting nature of the inflation in this context, in which the Fed is letting it take its course.

Jamie Dimon says JPMorgan is hoarding cash because 'very good chance' inflation is here to stay https://t.co/dxqsm3O6vz

— CNBC (@CNBC) June 14, 2021

These first examples of positions being adopted are occurring at a time when very few investors have moved on values that protect against the rise of inflation.

But the positioning on the part of investors is very complicated in this context.

The intervention by the central banks on the markets is scrambling the message. Assets that have become at risk, in this inflationary backdrop, are being given excessive valuations. By contrast, the values that protect against the upcoming inflation are still being evaluated at very low levels.

At any event, this is a very favorable backdrop for assets like gold.

In the weekly charts, gold is testing its breakout and forming a bullish flag whose target is the highest point it reached last summer

The current backdrop is even more favorable for silver.

100 million ounces have been bought since the launch of the Silver Squeeze movement in February… without any movement in the price of silver.

The short speculators are continuing to add short positions, despite the rise in industrial demand (+8% since January) and investment demand (+26% since the start of the year).

The control of the futures prices on the Comex is now taking place in a totally different context.

“Shorting” a silver futures contract is easier to do when inflation isn’t going at as much of a gallop as it is today.

Right now, every flash sale on the Comex is attracting new investors who are looking for investments to hedge against the inflation, which they see as increasingly durable.

These investors are very pleased to find an asset whose price offers them the same valuation level as 40 years ago... Silver is far and away the cheapest commodity today.

In terms of the charts, silver is on the point of outperforming gold once again; the bullish trend in the gold/silver chart has just been tested and rejected again, below the MA50.

This performance is being reflected on the GDXJ index which is traditionally bearish when silver outperforms gold.

Looking at the charts, GDXJ is nicely ensconced on its MA 200 on the daily charts, at the bottom of the upward channel that was begun amid the general indifference that has reigned since the start of April. The second consolidation breakout offers, at $50, a final support to validate the upcoming bearish movement in the mining stocks.

Original source: Recherche Bay

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.