As the dark years are approaching, the world is now approaching survival mode. Admittedly, if you go to a high class restaurant in New York, London or Zurich, there are no signs of misery but instead of incredible affluence.

What is happening to middle America or England has not yet reached Wall Street or the City of London where exquisite food is plenty and excellent wines are flowing.

This is of course no different to the end of eras with major excesses and decadence. It was the same at the peak of the Roman Empire 2000 years ago or in 1929 just before the Dow crashed 90%.

Main Street is already in survival mode with cost of living increases of a magnitude that ordinary people can’t afford. Energy, fuel, food, mortgage rates, rents and most things have gone up by 10-20% or more in the last year.

Everything has happened so quickly that people are in shock. But it is a fact that real MISERY has now hit ordinary people.

As Charles Dickens wrote in David Copperfield:

Annual income twenty pounds,

annual expenditure nineteen six,

result happiness. Annual income

twenty pounds, annual

expenditure twenty pound

ought and six, result misery.

For Main Street it is no longer a question of making ends meet but of economic survival.

The Fed and other so called “independent” central banks are doing all they can to exacerbate the crisis. The Fed’s official two tasks are stable inflation and full employment.

Stable inflation the Fed has in latter years defined as 2%. How did they arrive at that? They probably don’t know themselves since there is nothing good about 2%. Because an annual inflation rate of 2% means that prices double every 36 years which is highly undesirable.

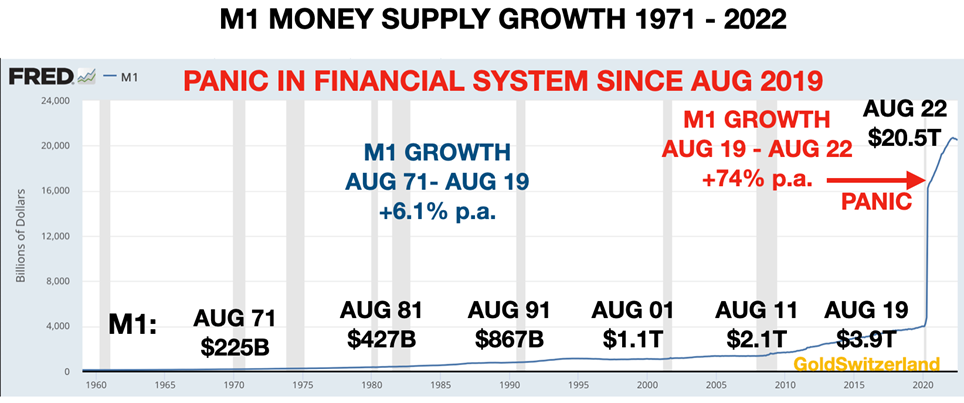

Anyway, even with pumping up M1 Money supply by $19 trillion between 2006 and December 2021 and keeping interest rates at 0% they still don’t have a clue why inflation is going up.

Many of us were laughing at Powell and Lagarde when they called the increase in inflation transitory!

Whilst clueless central bank heads are transitory, current inflation certainly isn’t.

Hyperinflationary Rocket

It is absolutely incredible that the heads of the Fed and ECB, the world’s biggest central banks, didn’t have the basic knowledge to fathom that unlimited free money for over 10 years is like a matchstick to light the biggest inflationary rocket in history.

Yes, it seemed to take a long time before the inflation rocket was set alight. The explanation is self-evident. There were different compartments in the rocket. Before the consumer prices were set alight, the inflation flame reached all the financial assets such as stocks, bonds and property.

Between 2009 and January 2021, the Nasdaq for example went up 16X, the S&P 7X and house prices went up 2X.

But conveniently for the Fed, this Hyperinflation in asset prices doesn’t count as inflation.

So the Fed could continue to fulfil its main purpose which is to make the rich richer. As the Fed was conceived by private bankers in Jekyll Island in 1910 for the main purpose of enriching the bankers and their friends, it is clear that this Elite group must be looked after first.

Zero Inflation And Zero Interest Rates

In the autumn of 2021, as the inflation flame reached consumers, the Fed, ECB and other central banks were stuck in their zero inflation and zero interest rates lethargy.

But as 2022 progressed, central banks around the world woke up to the fact that inflation is here to stay. Since the wealthy probably have diversified into real assets by this stage, it was then time for the bankers to start tightening without hurting their wealthy friends.

Globally the Fed and their fellow banks, are without exception always behind the curve. So they flooded markets worldwide with worthless printed money at zero cost for much too long.

And now they are waking up to the fact that the accelerated money printing (debt creation) since 2019 is not just inflationary but hyperinflationary. So the inflation rocket is now fully ignited and has just started its journey.

Powell, Lagarde and at least 32 other central bankers in the world have gone from lethargy to panic mode and are thus coordinating a series of rate increases globally.

Money Printing To Infinity

Since ordinary people in the world are now suffering substantially due to massive inflation of everyday expenses, they no longer can make ends meet.

The next move we will see in many countries is the resumption of money printing or QE. In the UK, the new Chancellor Kwarteng (finance minister), decided to give major support to businesses and individuals with lower taxes and social charges, energy subsidies etc. The total cost will be in the hundreds of billions of pounds over coming years. The already weak pound fell another 5% and rates surged. The pound is now down 24% since May 2021.

So the consequences of this give-away UK budget will be higher inflation and higher cost of living for people. This is a vicious cycle that will be followed by most nations as they enter the race to perdition.

This Time Is Different!

Stock market investors have for decades been so uber-confident of their banker friends saving them from any major losses that any fall in the market is a buying opportunity.

Thus we have a whole generation of investors that have never seen a sustained bear market as they have always been saved by central banks.

But this time is different! Take my word for it. Central banks are now on a course to deflate all asset markets. As usual they will go on for longer than anyone expects.

And eventually it becomes a vicious cycle with higher rates, higher inflation, still higher rates and more inflation until both central banks and markets panic as the world enters a depressionary hyperinflation.

It might be difficult to fathom that we can have a depression and hyperinflation simultaneously. But as asset prices collapse (remember they are not measured in the inflation numbers), prices of consumer products will surge.

And that is exactly what we are seeing the beginning of now.

Stocks are down around 25% so far, bonds are down, property markets under pressure and food, energy, fuel, mortgage rates are doubling or trebling for many borrowers.

It Ain’t Over Until The Fat Lady Sings

This is the perfect storm. But remember it has only just started and as I have stated in numerous articles and interviews, this won’t be over until the fat lady sings.

When will she sing? Well, if this is the end of a very major cycle as I believe it could be, it might be a decade or longer before she sings.

We must of course remember that nothing goes straight down and there will be violent corrections that initially will make investors euphoric. But most reactions will be short lived so buying the dips could be very dangerous.

We should first see hyperinflation taking hold properly and stock and property markets go down by at least 75% and possibly 95%. Bonds won’t stop going down until rates are 20%+. Many bonds will go to ZERO as borrowers default, including many sovereign states.

The US or EU won’t call it a default. They will just create a new currency like a CBDC (Central Bank Digital Currency) and with a magic wand make all the debt they have created disappear.

But you can’t make debt disappear without consequences. If debt is written off or swept under the carpet, the value of the assets that the debt supported will also implode. And that is how the world goes from a depressionary hyperinflation to a deflationary depression. At that point, much of the financial system will default.

The above scenario is the inevitable consequence of a world that has lived above its means for a century and especially since 1971. Few people realise for example that the US has increased its debt for 90 years with just a handful of years exception.

Global Debt $2.5 Quadrillion

With global debt, contingent liabilities and derivatives of around $2.5 quadrillion, there are a lot of assets/liabilities which need to implode before the world can show healthy and debt free growth again.

Epic Money Printing Bonanza

Before the deflationary implosion, the world will experience the most epic money printing and debt creating bonanza in history. That will mark the last desperate attempt by central banks and governments to solve a debt problem with more worthless debt.

This bonanza will be a grand finale of the fireworks which will mark the end of another era of financial and economic failure.

Boom and busts are of course a feature of economic cycles and have always happened in history. What the world is experiencing for the first time is a global event with every country and every central bank involved. So the magnitude is so much greater this time and that by a massive margin.

Like with all forecasts, we are here talking about probabilities. As we all know, there are few certainties in life. But we do know that risk is higher than at any time in history. Never before has the world experienced epic bubbles of this magnitude on a global level.

As a friend of mine states, it might happen but not in my lifetime. This attitude is part of sound human optimism that “it won’t happen on my watch”. But now is not a time to be overconfident but to be humble and prepared.

Anyway, we are talking about risk and not certainties. And when risk is high we must be prepared and protect ourselves. Remember that no one will sell you fire insurance after the fire has started.

What we do know for certain is that future historians will tell the world what really happened and when. I would love to come back down to earth for a short while to experience future experts and historians say that this was the most obvious collapse in global history. And still virtually no one sees it today.

Well, as I often say: “Hindsight is the most exact of all sciences!”

When Risk Is Extreme Extraordinary Caution Required

Stocks

In my articles since mid August, I have warned about Epic Collapses of Stocks, Debts, Currencies etc and 30% Stock Crash.

Well the crash is here and now. The S&P is down 15% since mid August and another fall of the same magnitude is quite probable in the next couple of weeks. But even if that fall takes place and we see a temporary pause and correction, the secular bear market has only started.

Currencies

Since 1971, the dollar and all other currencies have lost 97-99%. This is measured in real terms against the only currency which has survived in history – GOLD.

So currencies are in a race to the bottom and there is no prize for coming first in this race. All currencies can obviously not fall at the same time against each other and therefore they take turns. It has been a half century race and no currency has the stamina to be in the lead all the time.

Overall the Swiss franc has been the star performer due to probably the best managed economy in the world. When I started working in Geneva in 1969 one dollar cost me 4.30 Swiss francs. Today the same dollar costs me 0.98 Swiss francs. This means that the dollar has lost 77% against the Swiss.

To talk about a strong dollar in this case is clearly ridiculous. So for the moment the dollar is showing temporary strength. But that is likely to change relatively soon as it catches up on the downside.

When the current monetary era comes to an end within possibly 5-8 years all currencies will be worth ZERO. This is no different from any monetary era in history.

Gold

Out of laziness and convention gold is measured primarily in US dollars. Even in UK, Germany or media for example, it is always the dollar price of gold quoted.

But just as UK or German house prices are not quoted in dollars nor should gold. If the pound or euro is your base currency, you should measure gold in that currency.

The absolute correct way is of course to quote gold in grammes. What is the purpose to measure REAL money – GOLD – in a fiat currency when fiat currencies always go to ZERO over time. Yes, it might feel good to measure gold in a depreciating currency but it certainly doesn’t reflect the real value of gold.

Gold measured in dollars is temporarily weak. But has very little to do with gold but with the dollar which currently is overvalued.

If you measure gold in euros, pounds, yen, Australian dollars etc, gold is very near the highs. It will soon be in US dollars too.

The Wall Street Journal just had a major article with the title “Gold loses status as haven.”

Without exception, these articles always appear at the bottom of a market.

Banking System – Global Warning

Investors’ financial health is now under serious attack.

If as I believe, stocks are entering a secular bear market and won’t stop until they are down 75-95%, most investors are in severe trouble. If also bonds and property will crash, there are few safe asset classes left.

Gold and silver stocks have major upside potential. But if held within the financial system they are subject to custodial risk. Better to hold these stocks with direct registration.

With the current problems in financial markets, combined with global debt levels, including derivatives, the heavily leveraged and fractured banking system is also extremely risky.

All banks globally are now under pressure as the debt crisis deteriorates and most debtors cannot service their debts at these higher interest rates. Next step will be that banks will experience a major increase in bad debts as well as accelerating defaults.

The strong dollar will also put a massive burden on dollar loans globally and especially emerging markets.

With the problems in Europe, most European banks are now extremely fragile.

If we add to that the $2 quadrillion derivative bubble, the world is now approaching a financial storm of historical proportions.

Personally I would not keep any major amounts of liquidity within the financial system.

Wealth Preservation

The ultimate form of wealth preservation is gold and silver.

But it serves no purpose to hold your wealth preservation assets within a risky banking system. Even worse of course to hold paper gold or silver in ETFs or other fund structures.

Substantial amounts of physical precious metals are held within the major Swiss banks. The two biggest Swiss banks are heavily leveraged and are running from one major credit or derivative loss to the next in the billions of Swiss francs. And they are changing top management almost as fast as ordinary people change their shirt. Definitely not a sign of health.

Gold and silver should be held in physical form in your own name with the facility to access it personally.

Precious metals held in banks are not insured.

Insurance companies are likely to incur major losses on their assets as their primary investments of stocks and bonds crash in value. Therefore it is essential to hold metals in vaults that are safe without insurance.

Remember that there will be shortages of many products including food and other essentials so keep some reserves.

Sadly the world is now entering the Dark Years as I have discussed in many articles.

But remember that after having prepared yourself, the most important things in life are family and friends. That is a support circle which will be the most critical in coming years.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.