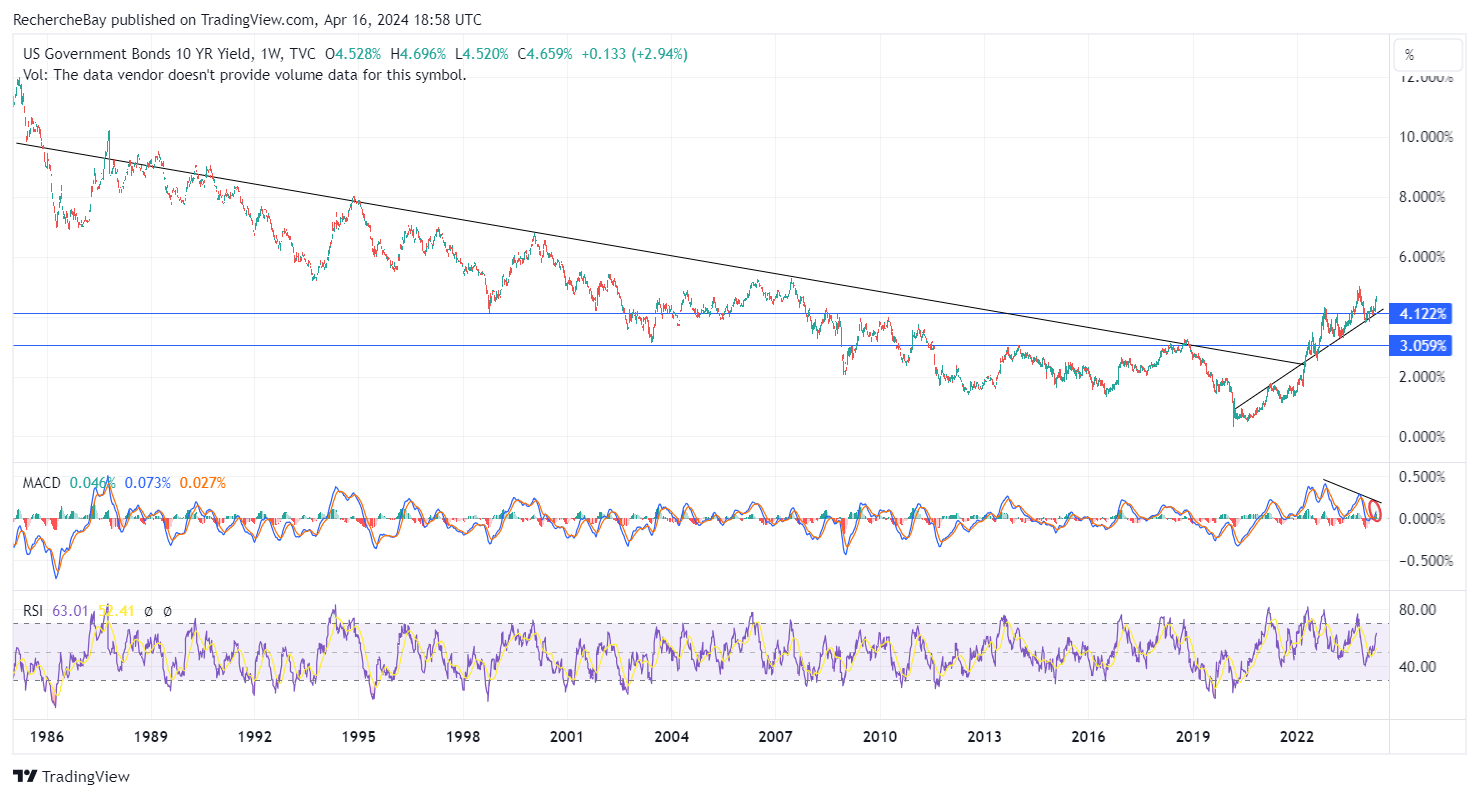

US 10-year yields have resumed their upward trend.

Since the downward trend in rates was interrupted in 2022, the upward movement of the 10-year has continued to rebound on a very strong support:

The decline in the 10-year that began in October 2023 never managed to break through this new uptrend. The support level was tested in December 2023, and since then, the 10-year has rebounded upwards with a strong impulse over the last three weeks:

The rise of the US 10-year is even following a parabolic trend since the start of the year, on its way to its October 2023 peaks:

If this trend persists, US bonds are on the verge of another cascade of declines, which would lead to increased unrealized losses on the balance sheets of financial institutions and central banks.

What are the reasons behind this upturn in US 10-year yields?

The rebound in 10-year rates coincides with a change in the Fed's rhetoric. All of a sudden, just two weeks after Powell called rate cuts "premature", the Fed suddenly adopted a totally opposite perspective.

In December 2023, the Fed declared that it had beaten inflation. Today, many observers are wondering whether the Fed was too quick to declare victory. Will this change in tone be seen as another monetary policy mistake? After declaring in 2021 that inflation would be transitory, the Fed may have made another mistake by declaring its fight against inflation over too soon.

Faced with such a change in tone, the Fed's baseline scenario suddenly indicated three rate cuts in 2024, whereas none had been anticipated just two weeks earlier. This turnaround deeply unsettled the markets.

Following the abrupt change in monetary policy in December 2023, US 10-year yields resumed their upward trend, and a few months after this radical turn, the United States was faced with a new wave of inflation.

Disinflation, which was on every analyst's lips, has suddenly vanished.

The manufacturing PMI indices show a further rise in prices in March, the strongest in twenty months:

In March, the Consumer Price Index (CPI) rose for the second consecutive month, the first time this has happened since September 2023.

The CPI figure, which measures prices paid by producers, almost doubled year-on-year, reaching its highest level since October 2023.

The graph of 3-month and 6-month annualized Core PCE figures shows a clear resumption of the inflationary trend:

In February, core PCE prices rose by 0.26%, while January was revised upwards to 0.45%. The three-month annualized rate jumped to 3.5%, while the six-month annualized rate rose to 2.9%, compared with 1.9% in December.

This is very bad news for the American consumer, who is already struggling to cope with the effects of the first wave of inflation.

Consumers are taking on debt to cope with inflation.

Personal interest payments are about to surpass 2008 levels. They now represent 3% of personal consumption, excluding mortgage interest, marking a significant increase of 1.6% on three years ago:

The share of personal interest repayments in the consumer budget is rising more than ten times faster than in 2008.

The second phase of inflation is starting, with interest rates already at record levels on credit cards and car loans.

There is no longer any room for maneuver for the consumer, and the prospect of a further rise in 10-year rates in a context of rising inflation poses a direct threat to Americans, who this time will be faced with a double increase: in prices and in rates.

This situation exposes them to the risk of a credit event, which is why the likelihood of a market correction has increased in recent weeks.

This risk is reflected in the rebound in gold prices relative to mining stocks. The GOLD/GDX chart rebounded this week:

However, mining companies have potentially improved their margins with the recent rise in gold prices. Despite the rebound in March, they are intrinsically less expensive than at the start of the year, as their free cash flow potential has grown faster than their market capitalization.

Investors seem less concerned about these valuations and are more sensitive to the risk of an imminent market correction. Risk aversion is stronger than appetite for a sector that has been devalued.

Physical gold remains a sought-after asset in these risky times. A credit event would probably boost demand for physical metal.

In the event of a general market correction, paper gold will probably be sold, but it is also conceivable that we could see a resumption of physical demand from Western investors, who currently have very little exposure to gold.

Many of the analysts we spoke to this week agree on one point: for demand for gold to be as intense in the West as it is in Asia, Western markets would have to undergo a correction similar to that seen in the East, and rising interest rates would also have to cause Western investors to turn away from the real estate market. Only when these conditions are met will we see a similar craze for gold in the West: the same causes will produce the same effects. Perhaps then, savers in the USA and Europe will better understand why Asians are buying gold and silver today.

According to these analysts, until we are confronted with the same problems, such as declining markets and real estate, we won't be able to understand this rush to the physical precious metal that began last year, and which is now accompanied by a rush to ETFs.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.