This week, Treasury Secretary Janet Yellen made a surprising statement, expressing regret for having considered inflation to be "transitory" last year :

Yellen sur l'#inflation : "Je regrette d'avoir dit que c'était transitoire." pic.twitter.com/ZncqFHY6fc

— Or.fr (@Or_fr_) March 14, 2024

This latest admission comes on the heels of Jerome Powell's last week, also acknowledging his failure in the fight against inflation: the Fed Chairman had announced that he would not wait for inflation to reach 2% before cutting federal funds rates.

The Fed, and now the Treasury, are now preparing the markets for higher inflation.

The latest figures confirm the return of inflation.

The consumer price index (CPI) rebounded to 3.2% in February, double the Fed's target, corresponding to an annualized rate of 5.4%. This is the fourth consecutive month of rising prices. As a reminder, the figure was just 0.9% last October, leading many economists to predict the end of the inflationary period. In the end, it turns out that what was considered transitory was not inflation, but rather the slowdown of this movement!

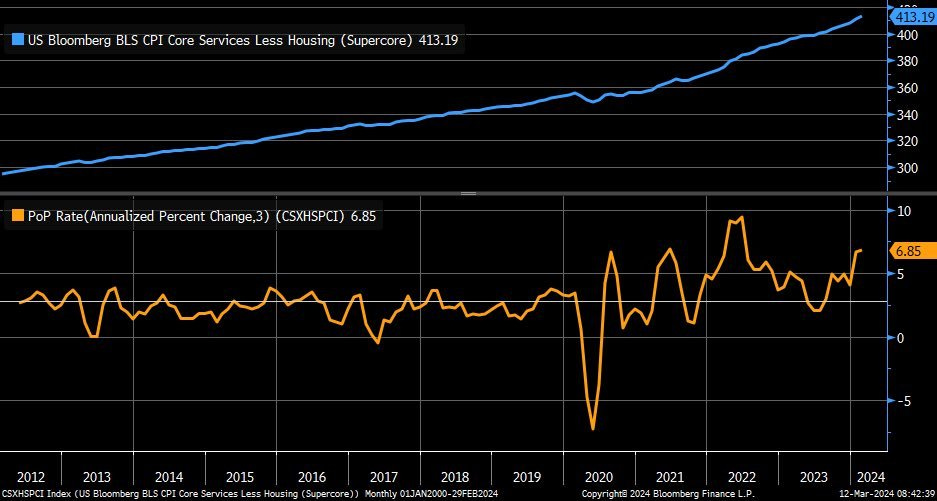

Over a three-month annualized period, "Supercore" inflation rose by 6.9% in February. (Reminder: core services inflation, excluding housing inflation, is a key measure tracked by the Fed, also known as "Supercore" inflation).

In January, this indicator jumped by 0.7% month-on-month, marking the biggest increase since September 2022. In February, it rose by a further 0.5% month-on-month, following several increases in 2023.

This return of inflation is similar to what happened in 2021, when inflation took off. As a reminder, the figures were similar in March 2021. In one year, the annualized CPI rate had risen from 5.4% to 16%.

The scenario is beginning to bear similarities to what happened in the 1970s, when out-of-control federal spending led to a second wave of inflation.

More worryingly, inflation expectations are rising again. This upturn in expectations is also reminiscent of what happened in 2021: it's the first time in a year that these expectations have started to rise again.

What drove up inflation in February? Food (+6%), car insurance (+20%), airline tickets (+30% in just two months), and housing costs.

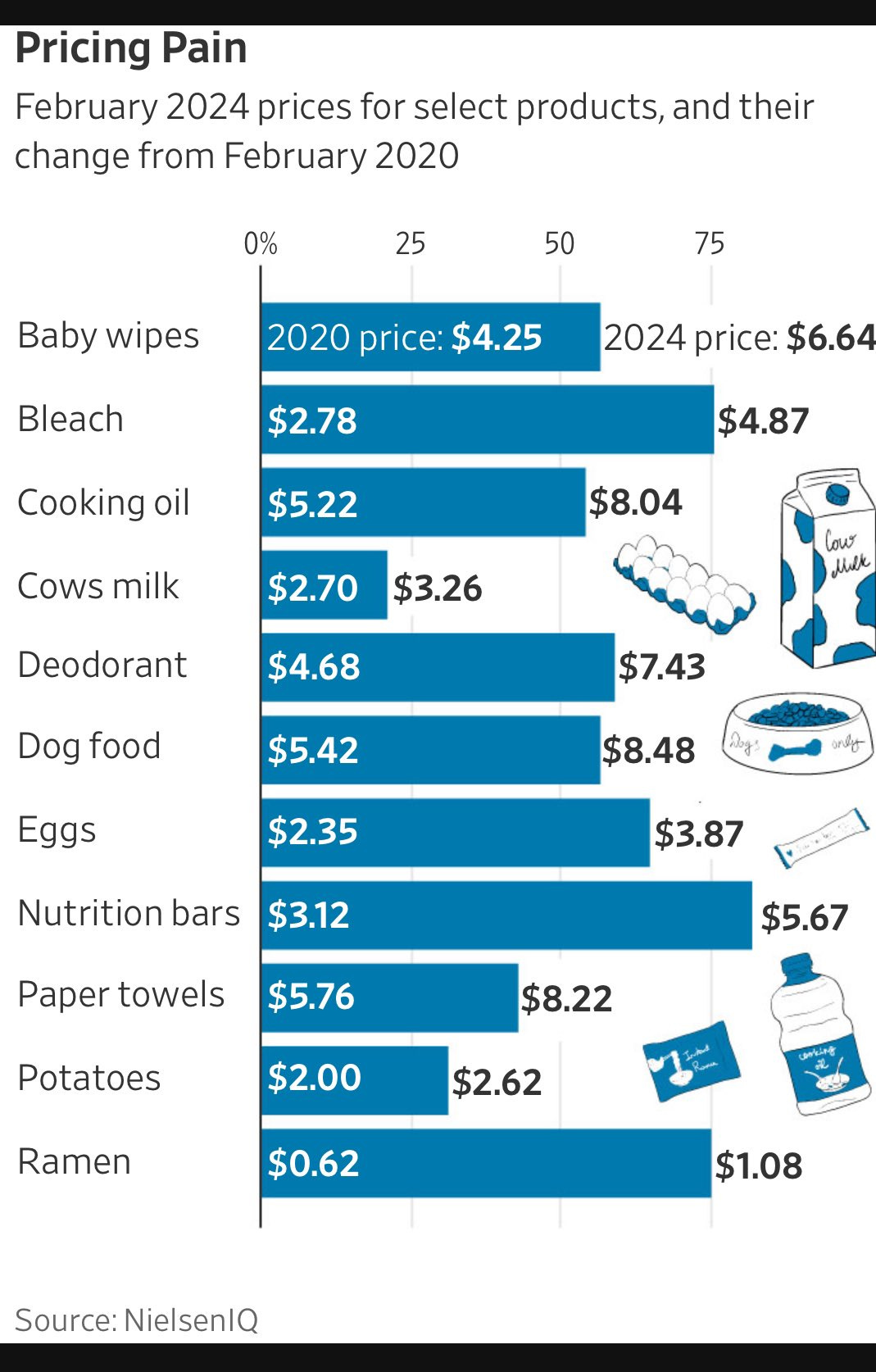

In four years, most consumer goods have seen spectacular price rises:

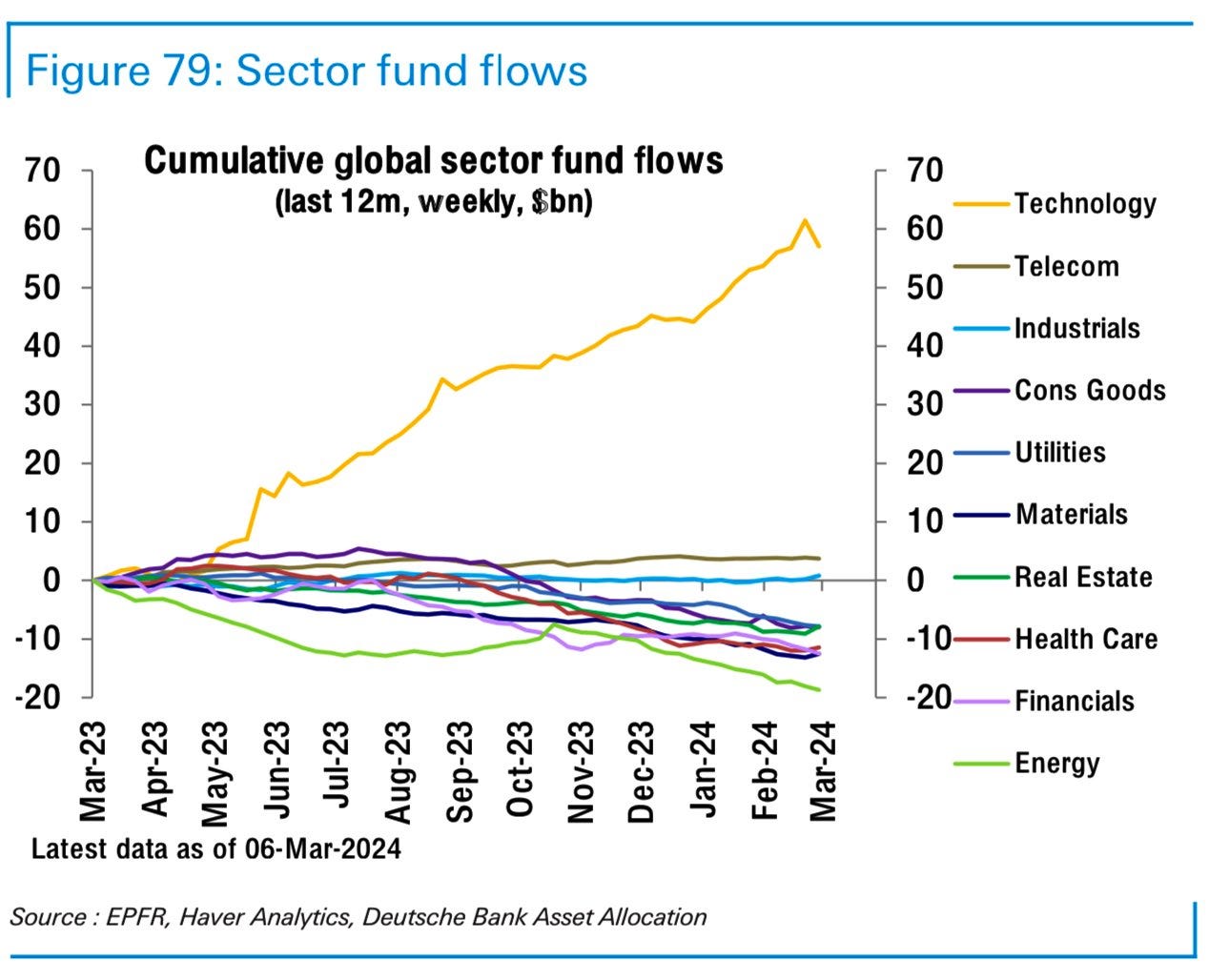

The 1970s scenario seems to be repeating itself, as the same causes are producing the same effects. Public spending fuels inflation in an environment of high interest rates. The Treasury acts as a veritable liquidity pump, benefiting its creditors in ever-increasing amounts. The influx of cash from interest repayments on US debt fuels liquidity bubbles on the markets, favoring tech stocks and crypto-currencies in particular.

The increase in this flow of liquidity completely cancels out the effect of the Fed's restrictive policy: while the Fed is withdrawing liquidity from the system, the Treasury is injecting even more! Against this backdrop of high US indebtedness, higher rates have an inflationary effect.

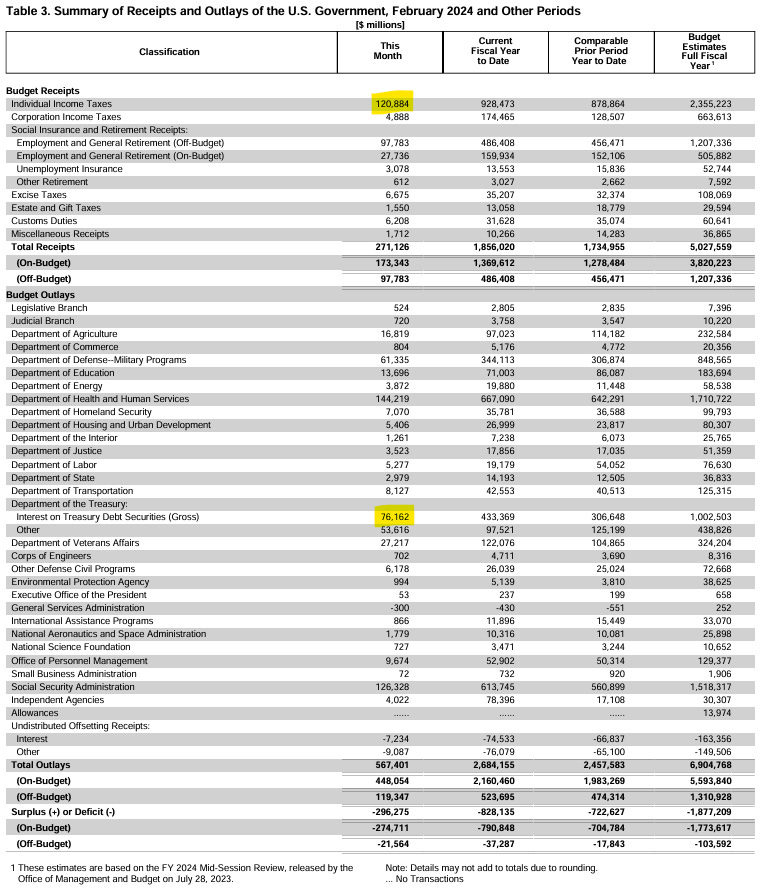

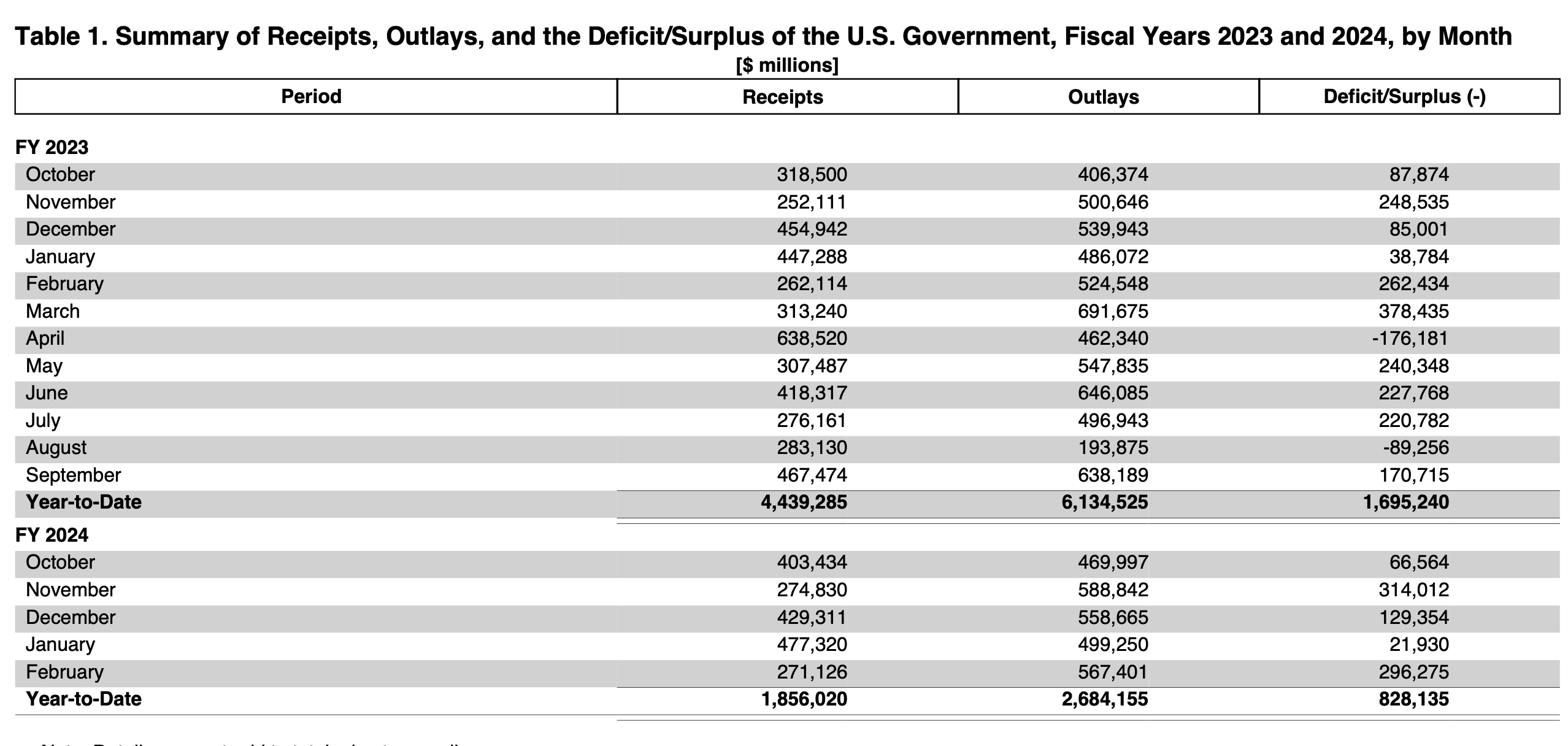

In February, the US spent $567.4 billion and collected $271.1 billion, resulting in a deficit of $296.34 billion. An amount 110% greater than total tax revenues.

Debt interest repayments amounted to $76 billion, more than half the amount generated by income tax, estimated at $120 billion.

The deficit for the first five months of the current fiscal year stands at $828 billion, compared with $722 billion for the first five months of the previous year.

This represents an increase of 14.6% over the previous year.

This year marked the highest deficit-to-GDP ratio in a non-recessionary environment in history.

The deficit has exploded, mainly due to the colossal interest payments made by the Treasury on its debt.

These gigantic sums feed the markets and sustain inflation.

When Janet Yellen admits that she made a mistake in describing inflation as transitory, she does so at the very moment when the US government is further increasing its deficit, thus paving the way for the next inflationary wave.

Faced with this new context, gold price is reacting by hitting new record highs.

This week, it's silver's turn to start a significant upward movement.

In weekly variation, the price of silver is attempting a new take-off from its consolidation zone:

On a shorter time scale (four hours), silver's breakout is significant.

Silver mining is finally taking off, outperforming gold mining. The SILJ/GDXJ graph highlights this very significant change:

This is the first time that silver has outperformed the yellow metal since gold soared two weeks ago. Open interest on silver is low, which is a very positive signal for the continuation of the uptrend. Silver premiums in Shanghai remain high, with a difference of almost $2 between the London and Chinese markets, encouraging arbitrage and supporting silver prices in the short term. A historic rally, which would propel silver much higher, may be closer than we think.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.