The silver market is at a critical juncture, marked by a growing dislocation between the physical and paper markets. On July 11, no less than 483 million ounces were sold short in a single hour on the COMEX:

This is equivalent to around 57% of the world's annual mine production - a spectacular attempt at downward pressure designed to curb a bullish breakout. But the operation backfired: prices rebounded above $37.50 an ounce, pushing these short positions into the red. The operators behind these massive sales may now be forced to hedge on a physical market already under pressure.

At the same time, physical withdrawals continue. On July 11, 616,339 ounces were withdrawn from the “Eligible” category on the COMEX, including 645,497 ounces by JP Morgan Chase Bank NA. Total stock (Registered + Eligible) now stands at 494.9 million ounces. These outflows are part of an underlying trend: the continued erosion of available inventories.

Open Interest increased by 8,636 contracts, equivalent to 43.18 million ounces. This reflects an intensification of speculative activity, but also growing pressure on the futures market. The COMEX/LBMA arbitrage strategy used by the major banks seems to be reaching its limits.

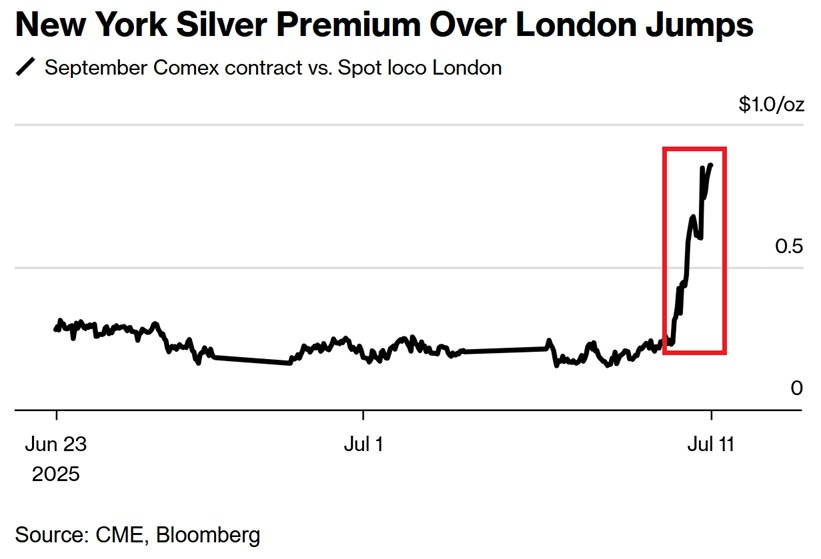

The EFP (Exchange for Physical) premium, which measures the cost of converting a COMEX futures contract into physical silver, rose from almost zero to over $0.80 per ounce in the space of 48 hours. At the same time, the spot price jumped by over $2, topping $38 an ounce. This type of movement is not linked to speculation, but to urgent physical demand: someone, somewhere, is now prepared to pay a high price for real metal, immediately.

This tension comes at a time when the United States is tightening up its mineral sovereignty policy. A 50% tax on copper imports has just been introduced, with the aim of keeping strategic metals - copper today, perhaps silver tomorrow - on national soil. The emblematic example is the opening of the Aurubis metal recycling plant in Augusta, designed to capture secondary copper to supply the infrastructure, AI, energy and defense sectors. The message is unambiguous: critical resources must remain in the country.

This policy is part of a broader strategy to secure supply chains for critical minerals, particularly in the Americas. Argentina is becoming a key player in this recomposition. Washington is acting methodically, through diplomacy, legislation and economic incentives, to guarantee long-term access to these materials.

Among these resources, silver's status is being reassessed. Its place in the energy transition and digital technologies is becoming central. Rising EFP premiums signal that the market is beginning to recognize this. When futures contracts trade well below the access price of the physical metal, it indicates a willingness to pay more to secure supply - a signal of strategic scarcity, not speculative arbitrage.

Historically, only metals such as copper or nickel had this kind of national priority in times of war or major industrial construction. Silver now seems to fall into the same category.

On a global scale, the battle for control of mining flows is intensifying. China, long dominant in Africa, is seeing its hold weakened by political instability. In Europe, positions remain unclear. But everywhere, metals are becoming tools of power.

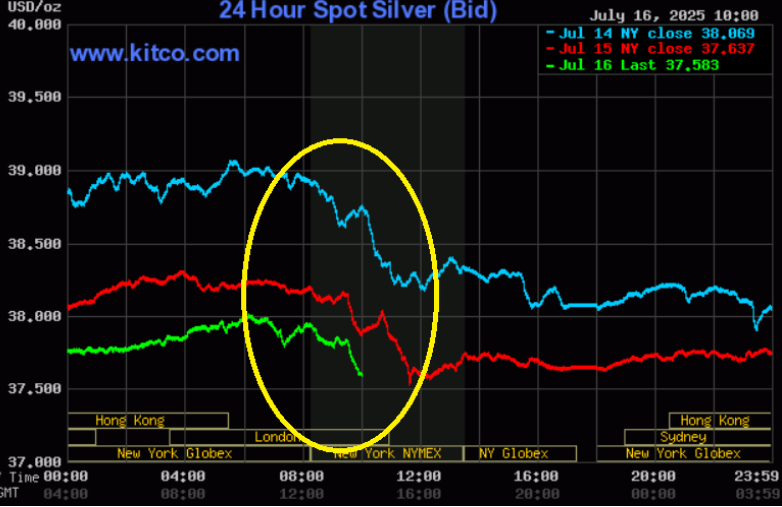

Given this context, the key factor driving current price rises is no longer paper, but the imbalance between physical supply and demand. Short selling, historically dominant, is now only a secondary factor - for the time being. What's driving the market today is the growing appetite for physical silver in the face of constrained supply. Asia continues to buy aggressively, while the United States is trying to contain prices.

The Chinese market is giving clear signals: stocks in Shanghai warehouses fell by 90 tons this week to 1,213 tons. Buying premiums are widening, a sign of local supply tension. In London, premiums are +4.24% above spot, with silver at $39.45 per ounce. Citigroup now expects the rally to extend beyond $40 in the coming months, with a target of $43 within 6 to 12 months. The bank is bullish on silver, but believes that gold may have peaked in the short term.

The contrast is striking: while Western banks are still trying to manipulate silver prices via the paper market, physical demand is not weakening - on the contrary, it's accelerating. Silver falls during COMEX opening hours, then rises when China buys:

If the trend continues, the COMEX could find itself trapped between record open interest and a scarcity of deliverable metal.

Silver's bullish momentum can also be explained by the combination of sustained physical demand, a tense geopolitical context and massive investment flows. The announcement of a 30% tariff on imports from Mexico - the world's leading producer - has heightened interest in the metal as a safe-haven asset.

The year 2025 marks the fifth consecutive year of structural deficit on the world silver market, and this imbalance between supply and demand shows no sign of running out. ETF inflows have exceeded 2,500 tons since February. The price of silver has already surged by over 35% since January, following a 21% gain in 2024. The most optimistic projections now point to targets of $45 or even $48 an ounce.

Industrial demand remains solid, with a clear upturn in China and Europe. Even in the USA, despite fears of recession, industrial activity has not fallen significantly. On the investment front, ETFs reached 1.13 billion ounces in June, while long positions in futures rose by 163% in six months.

The only point of fragility concerns the US retail market, where some investors are taking profits at these price levels. Conversely, demand in India and Europe remains firm, particularly in jewelry, where the high cost of gold is encouraging the development of gold-plated silver as an alternative.

This year's deficit is expected to exceed 117 million ounces, and could extend into 2027 or even 2028. The absence of new large-scale mining projects, combined with development lead times of 15 to 20 years for any new mine, severely limits the supply response capacity. The only possible short-term growth will come from the expansion of existing projects.

In contrast to past booms (1980, 2011), the current bull cycle appears more resilient, supported by sustained investment flows, a favorable macroeconomic context, and a prolonged structural deficit.

In the short term, short sellers of silver will be doing their utmost to invalidate the recent bullish breakout and break the technical threshold of $37 per ounce, which has become a key support. Their aim is to regain the upper hand by bringing the silver price below this level, in order to trap recent buyers and trigger forced sales.

But buyers are not yet safe: the market remains under high tension in the face of massive selling pressure. On the COMEX, the “commercials” - generally bullion banks or well-capitalized institutions - alone hold the equivalent of 12,000 tons of naked silver short positions, i.e. without physical hedging. Additionally, there is a short position equivalent to around 2,000 tons on the SLV, the main silver-backed ETF, i.e. almost 10% of its float. This level of short interest is extremely high.

The cost of borrowing SLV shares - the largest ETF backed by physical silver - continues to climb, a sign of a growing imbalance between supply and demand. By the morning of Wednesday July 16, there were virtually no shares left available for rent, reflecting a saturation of the secondary market.

This rise in the borrowing rate indicates that the quantity of shares in free circulation (float) is tightening sharply. In other words, investors are holding on to their shares rather than lending them out, drying up liquidity for short sellers. When the cost of borrowing an asset soars, it's often a sign of a tight market, in which pressure on shorts is increasing and bullish movements can rapidly amplify if a short squeeze is triggered.

This tightening of the float reflects growing confidence in the value of physical silver and increased commitment from SLV holders, who prefer to hold on to their positions despite financial incentives to lend.

The confrontation between these short positions and growing physical demand (visible in EFP spreads or Chinese premiums) promises a fierce battle in the weeks ahead. If the bullish side manages to stay above $37, and neutralize the selling pressure without a sharp pullback, the potential for a short squeeze becomes real, and the next technical target could then be well above $40 per ounce.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.