Investing Basics

Bars

Coins

Ownership

Storage

Gold & Silver in USA

Gold Market

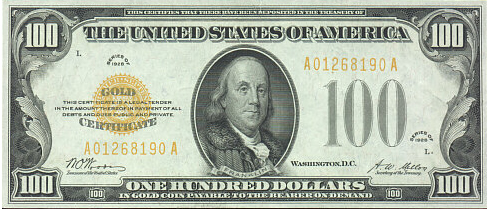

Paper Gold

More Info

This Investor’s Guide is for anyone interested in gold, silver, and the history of money. In it you will find the key elements of the inner workings of the market, the players, the reasons they buy and sell gold, and how they do it. We use several tools (articles, charts, interviews, videos with simple explanations) that will help you understand the gold market and the different solutions for investing in gold and silver.

Why Should You Buy Precious Metals?

In times of economic and monetary crises, such as now, the savvy investor buys gold to protect his or her wealth. Gold has played its role of reserve of value for thousands of years. The level of debt has reached epic proportions that make it impossible to reimburse and, in such a complex and interconnected financial system, default from one of the major players in the economy (financial institution, government...) could trigger a systemic collapse. So, the rational investor turns to tangible and liquid assets that are neither backed by debt or the responsibility of a third party: precious metals.

The Gold Market

The price of gold evolves constantly, five days a week, around the world, from the open of the Asian market on their Monday morning (Sunday 3pm EST) to the close of the US markets on Friday (4:00pm EST). A benchmark price, called “the fixing", is determined twice a day. According to estimates, the daily volume of combined paper and physical gold was 139 million ounces in 2013, worth $196 billion.

- 105 million ounces are traded daily between clients of the London Bullion Market Association.

- 32.15 million ounces on the COMEX and other futures venues

- 1.16 million ounces via ETF funds

- 0,56 million ounces traded via consumer demand

If we compare the trading volume of the GOLD:USD pair to the other pairs, USD:EUR, USD:JPY, gold is the sixth most-traded currency every day.

Recently, several indicators, such as the GOFO rate turning negative and major deliveries on the Shanghai Gold Exchange, are signaling significant stress on the physical gold market.

How do I Invest in Gold?

There are several ways to invest in precious metals, and the simplest and safest way is to buy bars and coins. It is also possible to invest in “paper gold” financial instruments.

Paper gold

These financial products (ETF funds, futures, certificates and gold mining stock) are generally recommended by banks and destined for speculation. They should be viewed with a risk/reward perspective. The fees are minimal because they require little administrative work and handling. However they do not offer the same guarantees as physical gold and expose you to intermediation and, thus, counterparty default risk, such as default by your bank or broker.

Physical gold

When buying gold, one looks for an easily identifiable and tradable product. This is why refiners produce marketable gold bars and gold coins with weight, purity and brand inscribed on them. Prices are determined by weight in gold, to which is added a premium for refining and producing. The smaller the bar or the more detailed a coin, the higher the premium. For example, the premium on "Good Delivery" 400oz bars traded on the international market is lower than the premium on 1kg (32.15 oz.) bars. For the private investor, however, the 1kg bar is much more practical and offers more liquidity.

Which Bars and Coins to Buy?

All investors ponder this question, and there is no one right answer. It depends on your capital and the liquidity you seek. As an investor, you want to accumulate as much metal as possible so you should look for products with the most attractive premiums. You must also consider future liquidity, and the possible necessity of a partial resale of your precious metals.

Let's take a simple example:

Mr. X has decided to buy $70,000 worth of gold. The most attractive option is the 1kg bar, which comes with a 2.0% premium. With the (December 17, 2015) spot price of $1,054.55 per ounce, the purchase price, including premium, is $34,582.66.

Mr. X can buy two kilograms for $69,165.32. But he’s not getting optimal liquidity because if he needs $10,000 quickly in the future, he will have to sell a whole kilogram, the equivalent of $34,582.66, and pay a premium on this amount. He will surely want to re-invest the remaining $24,582.66 and will have to pay yet another premium.

A better allocation of his capital would be as follows:

- One 1kg bar, for $34,582.66

- Ten 100g bars, for $34,752.20 (premium 2.5%)

The total amount invested would be $69,334.86 and a portion of the remaining money ($665.14) would cover eventual storage fees.

How to Store Your Precious Metals?

Once you have determined which gold bars or coins you want to buy, an essential question remains: Where to store them? There are several solutions available, but your priorities should be maximum safety and liquidity.

Home storage

Home storage is the least expensive solution, but it exposes the risk of theft. In addition to the problems of oxidation, hiding bars or coins in your home, burying them in the garden or burying them in a wall, means running the risk of them falling into the wrong hands, or even being forgotten (especially in the event of the owner's death). Note that keeping precious metals at home is generally not covered by insurance.

Safe deposit box

A safe deposit box is usually rented at a bank branch. It is an economical solution but does not include insurance for the contents, which are often "secret". Renting a bank safe deposit box raises several issues. What would happen if the contents of the safe deposit box were to disappear? The frequency of such incidents should not be exaggerated, but a safe deposit box is not an absolute guarantee. What would happen if your bank went bankrupt? In case of a political or financial crisis? How can you access the safe deposit box if the branch is closed (bank holiday)? You may not be able to get your gold back when you need it most.

Secure storage outside the bank

In order to limit the risks and inconveniences inherent to bank or home storage, the best solution is to entrust your physical gold to a private company specialized in the storage of precious metals. For optimal security, the investor must hold a storage certificate in his own name and have direct access to the vault.