Investing Basics

Bars

Coins

Ownership

Storage

Gold & Silver in USA

Gold Market

Paper Gold

More Info

Whether you trade or mine or recycle or sell precious metals, you must understand how to price them. Determining the value of precious metals is not quite as straightforward as pricing assets such as equities or fixed income.

In this page, we explain how gold and silver prices are set, answering questions such as:

• What is “the fixing” and who sets these prices?

• What are spot and futures prices?

• What are the sources of spot and futures prices?

• What are precious metals?

What are precious metals?

A precious metal is a rare, naturally occurring metallic chemical element of high economic value. Gold, silver, platinum, iridium, rhodium and palladium are precious metals.

What types of firms deal with precious metals?

There are four types of firms in the industry:

• Exploration/development

• Mining

• Consumers

• Recyclers

Who are the consumers?

There are three categories of consumers:

• Industrial

• Jewelry producers

• Investors

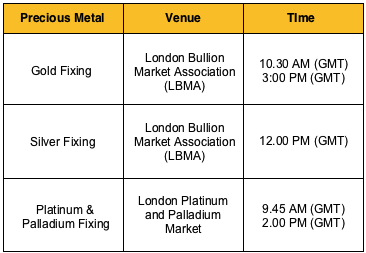

What is the fixing?

The fixing (or fix) is a daily process, an agreement between participants on the same side in a market to buy or sell precious metals at a fixed price, or to maintain market conditions such that the price stays at a given level, by controlling supply and demand. Orders are changed throughout the proceedings as the price is moved higher and lower until such time as the orders are satisfied and the price is said to be “fixed”.

On March 20, 2015, the historic London Gold Fix was discontinued and replaced by the LBMA Gold Price, for which ICE Benchmark Administration (IBA) became the administrator.

IBA hosts an electronic auction process for the LBMA Gold Price. This process is independently administered and tradeable, electronically and physically settled, conducted in dollars, with aggregated and anonymous bids and offers, and published on-screen in real time.

The LBMA Gold Price is set twice daily in US dollars at 10:30 am and 3:00 pm each business day.

What are spot and futures prices?

These are the two types of prices.

The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the futures price, which is the price at which the two participants in a futures contract agree to transact on the settlement date.

What are the sources of pricing?

Spot Prices

OTC Markets: A decentralized market of securities not listed on an exchange, where market participants trade by phone, fax or electronic network, instead of on a physical trading floor.

Financial institutions act as market-makers and offer a bid/ask which acts as the spot price.

Large Banks & Bullion Traders: Banks and bullion traders trade large volumes of precious metals for their clients. They buy and sell precious metals as part of the trading process and, as a result, are reliable sources of precious metals spot pricing.

Futures Prices

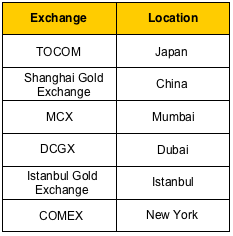

Exchanges: Precious metals futures contracts are traded in major exchanges around the globe. These exchanges are a key source for precious metals futures prices.

The major precious metal exchanges are as follows:

Is there an official closing price for precious metals?

Unlike stocks, which are listed on venues (e.g. NASDAQ, NYSE) with official trading hours and closing prices, precious metals trade all around the world in multiple over-the-counter markets, for practically 24 hours per day. As a result, there is no “official closing price” for precious metals.

Firms that require the capture of a daily “closing price” as a part of their business process have two options:

1. Use the Fix Price for the metal.

2. Use a “Closing Price” calculated by their data vendor. Most data vendors calculate closing prices using a specific, documented methodology. For instance, one of the methodologies used is to take a snapshot of spot prices at a precise time during trading.

What are the official trading hours for precious metals?

Precious metals trade in OTC markets around the globe. Trading starts Sunday at 6:00 pm EST, when the Japan markets open, and ends Friday at 4:30 pm EST, when the U.S. markets close. There is also a 45-minute period from 5:15 to 6:00 pm EST, Monday through Friday, when trading is closed.