Investing Basics

Bars

Coins

Ownership

Storage

Gold & Silver in USA

Gold Market

Paper Gold

More Info

Invest in gold? Absolutely. But … how much?

Deciding how much gold and silver to hold in your portfolio should be a personal decision. Generally speaking, investors put about 10-15% of their wealth into precious metals. Although gold is under-allocated in investment portfolios, the majority of our clients invest around 10-15% of their assets in precious metals.

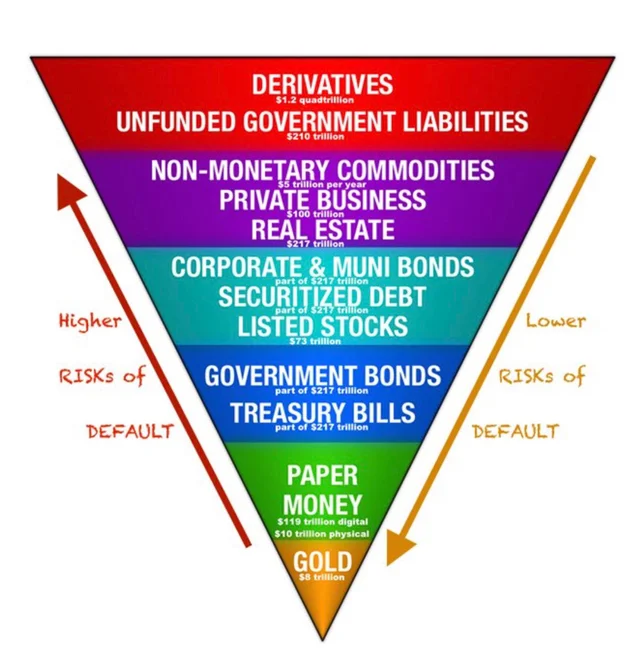

The first proponent of the "10% rule" was former U.S. Federal Reserve Governor and Harvard economist John Exter, via his eponymous "Exter's Pyramid", which illustrates the risks inherent in each type of asset class. According to him, during a financial crisis, investors will move out of less liquid debt-based assets and into more liquid physical assets. Physical gold, considered the safest of all assets, is at the base of Exter's inverted pyramid.

The composition of your portfolio should depend on your personal situation, your risk tolerance and your investment horizon. The economic and geopolitical context should also be taken into consideration. Changes in the economic environment may prompt you to review and rebalance your portfolio.

For instance, back in 2002, the world was in a government-deficit and runaway bank-credit crisis. At that time, Egon von Greyerz (a board member of Goldbroker.com) advised his investment clients to put up to 50% of their assets into physical gold. Mr. von Greyerz, who is recognized as one of the world’s foremost gold investment experts, sees the situation as a lot worse today. Wealth protection is more critical than ever.

He says, “Many investors ask what percentage of their financial assets should be in precious metals. Some investors who are really concerned about the financial system have 60-100% in gold, together with some silver. Having even 10% of your assets in gold will ensure the safety of your portfolio. Investors must themselves decide what percentage they feel comfortable with. In our view, the investment in metals should be sufficient to fall back on if there is a crisis in the financial system which prevents access to other investments or makes it impossible to raise cash from other assets. It is important to remember that gold and silver are a currency and offer instant liquidity. Throughout history, in every country where there has been a serious financial crisis, gold and silver have always served as a currency."

As Egon von Greyerz points out, it makes sense to diversify your precious metals investment with silver, an affordable metal used in many industrial applications. However, it is important to keep in mind that silver is more volatile than gold. This means that its price can outperform gold in a bull market, but also fall more heavily in bear markets. A recent study by Oxford Economics recommends putting 6% of your investment portfolio into silver.

By not putting all your eggs in one basket, you multiply the factors of return and reduce the risk of loss in your portfolio.