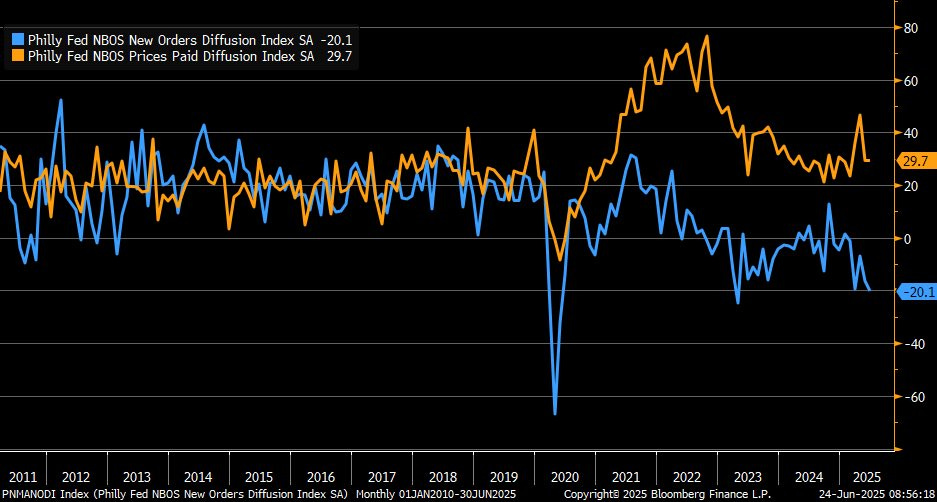

A chart recently published by Liz Ann Sonders, Chief Strategist at Charles Schwab, vividly illustrates the current economic impasse in the United States. It concerns the Philadelphia Federal Reserve's services index, and more precisely the widening gap between two of its key components: on the one hand, new orders - shown in blue - and on the other, prices paid by businesses - in orange.

What's striking is the unprecedented disconnect between these two dynamics. On the one hand, orders are plummeting, indicating a clear weakening in demand. On the other, prices paid remain high, indicating that inflationary pressures remain strong despite the economic slowdown. This discrepancy is one of the most obvious signs of a stagflationary context, where sluggish growth and high inflation coexist.

According to Liz Ann Sonders, this configuration reflects not only weakening economic momentum, but also increasing difficulty for companies to pass on rising costs to their customers. This creates an unfavorable environment for investment, hiring and confidence. Leading indicators are thus delivering an unambiguous message: the economy is slowing down, but prices are not.

This graph reveals a major economic paradox: demand is clearly slowing down, as evidenced by the persistent fall in new orders, which, in theory, should exert downward pressure on prices. However, this is not the case. Prices paid remain high, revealing a resilient inflation component, even in the absence of final demand pressures.

So where does this inflationary inertia come from? Several structural factors explain the persistence of inflation, despite the slowdown in activity:

- Wage costs, which continue to rise in many sectors in the United States, particularly in low-productivity services. The labor market remains tight in some industries, forcing employers to maintain wage increases to attract or retain employees, without necessarily being able to offset this with higher volumes.

- The delayed effects of the expansive fiscal policy pursued since 2020: subsidies, public investment and tax breaks have injected massive amounts of liquidity into the economy, creating a form of persistent demand inflation, even after the post-Covid recovery.

- Persistent bottlenecks in certain supply chains, notably for imported components or services related to energy, real estate or healthcare.

- Increased concentration in certain sectors, which reduces competition and enables certain large companies to impose rigid prices, unaffected by the slowdown in demand.

The result is a worrying decoupling: consumption weakens, companies receive fewer orders, but their costs remain high - weighing on both their margins and overall economic momentum.

This stagflationary stalemate considerably complicates the Fed's action, as it finds itself trapped between rigid structural inflation and stalled growth.

This structural imbalance - with inflation persisting despite an economic slowdown - is helping to weaken the dollar. On the foreign exchange markets, investors now seem to have accepted the idea that the Federal Reserve is caught in a trap: unable to raise rates without destroying activity, but equally unable to lower them without rekindling inflation. This strategic impasse weakens the credibility of the US central bank, a fundamental pillar of confidence in the greenback.

The DXY index, which measures the value of the US dollar against a basket of major currencies, has just reached its lowest level since 2022. This downturn is far from insignificant, revealing a structural weakening of the greenback in the eyes of international investors. Long buoyed by high interest rates and the relative resilience of the US economy, the dollar is now under the dual pressure of an economic slowdown and a loss of monetary credibility.

The dollar's slide has accelerated sharply in recent months. The DXY index has fallen from 110 to 96, a spectacular drop of almost 13% since its peak - a decline rarely seen over such a short period.

But a more political threat looms on the horizon: that of a direct confrontation between Donald Trump and Jerome Powell.

This week, Donald Trump stepped up his attacks on Federal Reserve Chairman Jerome Powell. On Truth Social, he called him “very bad” and “stupid”, accusing him of unfairly delaying interest rate cuts when other central banks are already acting. He even hinted at the possibility of removing him, indicating that he might well “change his mind about that”.

Even more worryingly, Donald Trump has publicly stated that he is already considering Jerome Powell's successor, claiming to have “three or four candidates in mind”, and suggesting that he could unveil his choice as early as September or October 2025 - several months before the official end of Powell's mandate, scheduled for May 2026. This unusual timetable is perceived by the markets as an explicit challenge to the Fed's independence.

Jerome Powell, for his part, reminded Congress that protectionist policies - such as the tariffs promised by Trump - risk fuelling inflation, thus justifying a more cautious approach to rates. But the markets were not reassured: these tensions helped push the dollar down, as investors now embrace the idea of a more politicized and less credible Federal Reserve.

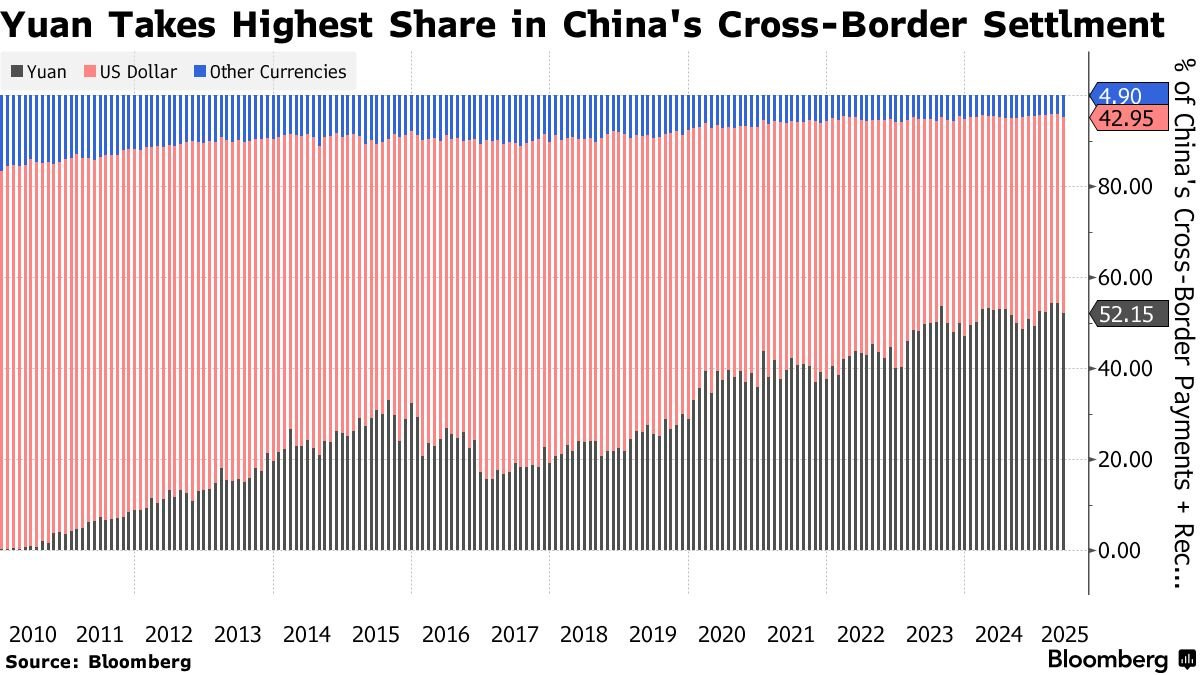

In this climate of widespread mistrust of the dollar and US economic policy, a fundamental trend is gathering pace: de-dollarization. China, at the forefront of this strategy, is methodically reducing its dependence on the greenback. Beijing now prefers to settle its energy and strategic exchanges in yuan, particularly with raw material-producing countries such as Russia, Iran and certain African nations.

The yuan is now used for 52% of China's cross-border payments, compared with 43% for the dollar. This gradual shift illustrates a deliberate diversification of trade, marking an evolution in the global monetary system.

Many analysts missed this monetary turning point, continuing to assert that the yuan, due to its total non-convertibility, could never displace the dollar in international trade. These are often the same people who have downplayed the remonetization of gold. Yet China has just taken a major step by inaugurating a storage facility in Hong Kong, designed to facilitate the internationalization of its gold market.

From June 26, two new contracts will be listed on the Shanghai Gold Exchange (SGE): iPAu99.99HK and iPAu99.5HK. These contracts enable the physical delivery of gold in Hong Kong, marking a major step forward in the integration of the yuan into the global precious metals trade.

Within this framework, SGE has established a dedicated delivery warehouse at the Bank of China (Hong Kong), to facilitate settlement and delivery operations for foreign investors. Trading rules and contractual parameters are detailed in the official appendices, and remain subject to SGE's current standards.

To encourage international participation, the SGE has announced that it will exempt foreign members from storage, handling and exit fees for all deliveries via Hong Kong until the end of December 2025. This measure is clearly designed to attract the interest of international players.

Finally, institutions wishing to become involved in transactions on these new contracts will need to submit an official application via the dedicated SGE form, in accordance with current regulations.

With this initiative, China is taking a further step in the internationalization of its gold market, by facilitating yuan-denominated transactions outside the mainland. This reinforces Hong Kong's role as a strategic hub, while affirming Beijing's desire to offer a credible alternative to the dollar-dominated monetary system.

In other words, China is now offering its trading partners the possibility of using the yuan as an exchange currency backed by a tangible asset: gold. This is no mere logistical development, but a structuring monetary initiative. It paves the way for a gradual redefinition of the rules of international trade, at a time when confidence in the dollar and US Treasuries has been seriously shaken.

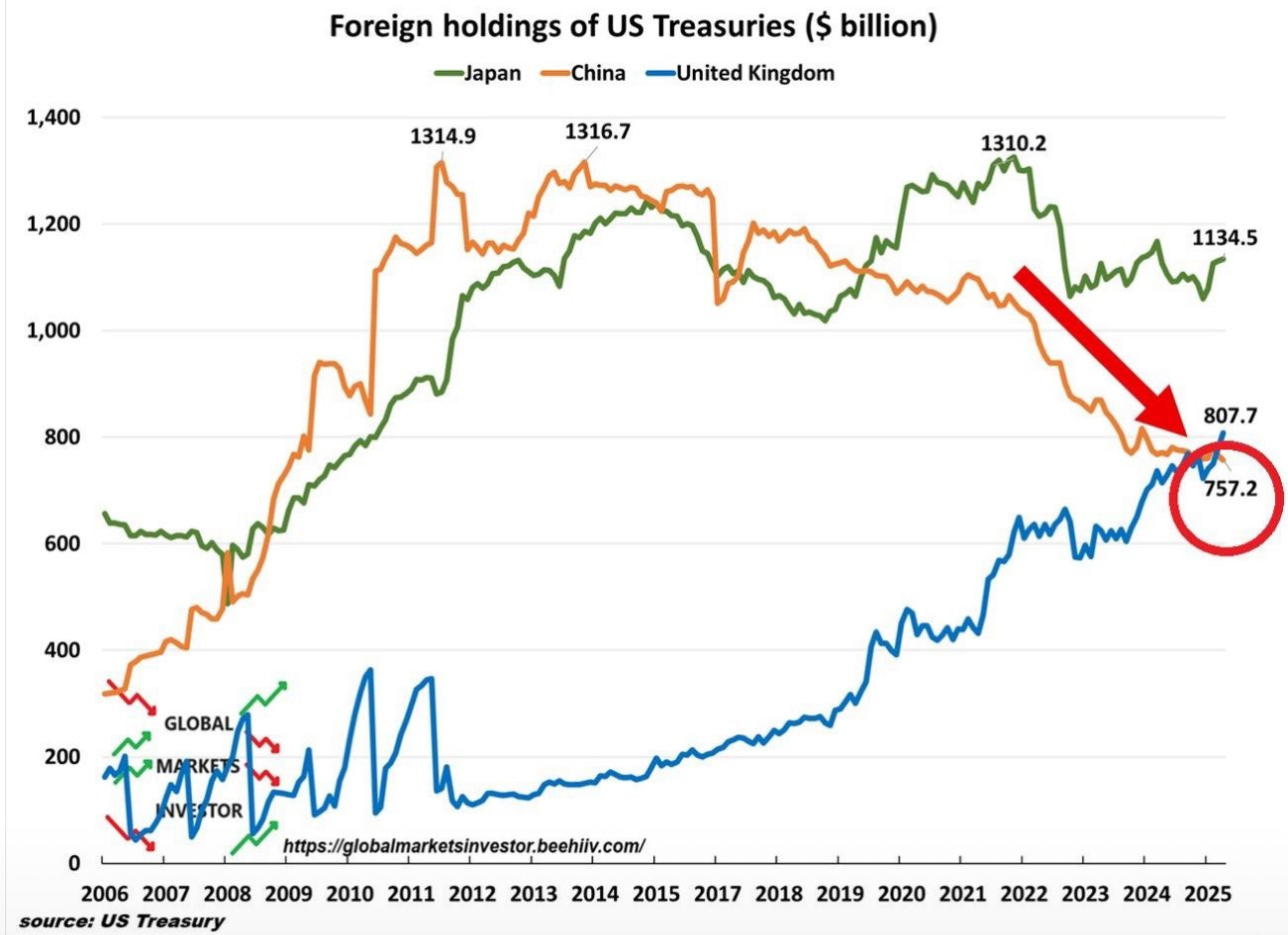

At the same time, the People's Bank of China has been reducing its holdings of US Treasury bills at a steady pace for several years, thus weakening one of the traditional pillars of US debt financing.

China, once the largest foreign holder of US debt, reduced its exposure to $757 billion, from a peak of $1.3 trillion. This withdrawal reflects a deliberate strategy of reserve diversification, aimed at mitigating geopolitical vulnerabilities and prioritizing domestic liquidity needs in an increasingly uncertain global environment.

This gradual withdrawal from US Treasuries is part of a broader strategy to reallocate Chinese reserves. While Beijing is actively reducing its holdings of US debt, it is at the same time stepping up its purchases of gold - a move that is now structural and is regularly observed in official statistics, but also via undeclared channels.

Gold has thus established itself as a genuine strategic alternative to the dollar. Less exposed to sanctions, outside the SWIFT system, and recognized as a universal store of value, the yellow metal enables China to guard against the geopolitical risks arising from its dependence on the Western financial system. By strengthening its gold reserves, Beijing gains monetary autonomy and acquires a liquid, neutral asset that can be mobilized in the event of trade or diplomatic tensions.

Gold is also becoming a concrete tool for de-dollarization. With the Shanghai Gold Exchange and now a physical delivery platform in Hong Kong, China is offering its trading partners a gold-backed yuan settlement mechanism. This alternative model, still in its infancy a few years ago, is now taking shape and could ultimately redefine international trading standards.

In short, China's accumulation of gold goes beyond the simple logic of diversification: it is part of a long-term geo-economic strategy designed to erode the centrality of the dollar in world trade and strengthen the country's financial resilience in an increasingly multipolar international order.

🇨🇳 Chinese Gold Reserves https://t.co/jedmSee9M5 pic.twitter.com/rzw7gft5tS

— GoldBroker (@Goldbroker_com) June 20, 2025

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.