While all eyes are on the financial turmoil on both sides of the Atlantic, China is taking advantage of the situation to buy large quantities of gold. For the first time in several years, the People's Bank of China (PBoC) is once again publishing its purchasing data. This change in behavior is not insignificant, and testifies to the country's determination to establish itself as a major player in the gold market. According to official data, the Middle Kingdom is now the world's sixth largest holder of gold.

Increasing quantities of gold

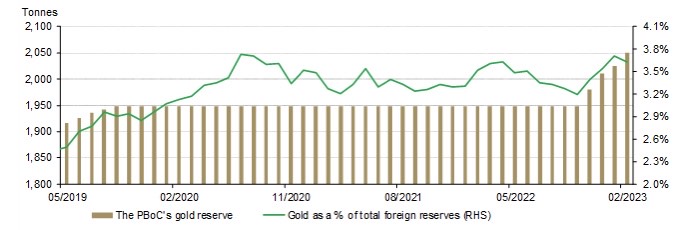

While many central banks are accumulating gold, the People's Bank of China is proving to be one of the main buyers at the start of this year. Since the end of 2022, it has been buying in significant quantities. Data from the BPoC and the State Administration of Foreign Exchange show that China increased its gold reserves for the sixth consecutive month in April, the fastest pace since September 2019. The country is said to have accumulated a total of over 100 tons in recent months, bringing its gold stockpile to more than 2,076 tons, according to official data.

Source: PBoC, World Gold Council

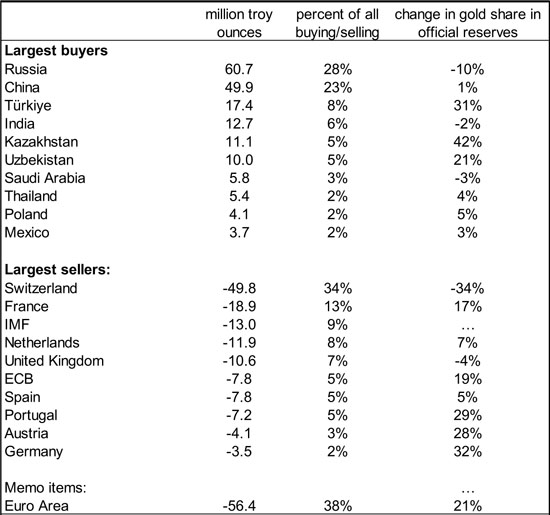

The reasons: rising geopolitical tensions - notably in Ukraine and Taiwan - the economic slowdown, and the country's desire to accelerate the de-dollarization of the world. Its many recent exchanges in currencies other than the dollar bear witness to this. So much so, in fact, that the yuan is now the most widely used currency for cross-border transactions in China. As such, the country's purchases of the yellow metal are likely to persist as long as the dollar retains its monetary hegemony... which is likely to be for a very long time. According to Thom Calandra, former editor-in-chief of the financial website MarketWatch, China should "continue to add to its reserves, highlighting the de-dollarization trend." According to the IMF, the Middle Kingdom is the second largest buyer of gold between 1999 and 2021.

Source : FMI « Les 10 principaux acheteurs et vendeurs officiels d'or de fin 1999 à fin 2021 »

On the other hand, the actions of the People's Bank of China go hand in hand with the country's economic recovery. Despite some structural weaknesses, industrial production is picking up with a 5.6% increase in April, and growth is picking up again with a 4.5% rise in the first quarter. According to Wang Lixin, Regional General Manager of the World Gold Council in China, “continued economic recovery is likely to benefit overall gold consumption growth” and "global geopolitical and financial market risks remain high, and investors are likely to focus more on safe-haven assets such as gold”.

China breaks its silence

Over the past two decades, China has only occasionally published the amount of its gold purchases. In particular, it reported an increase in reserves in 2016 and 2019, before remaining completely silent between 2019 and 2022.

If buying gold anonymously is a common phenomenon among central banks, the Chinese government has been abusing it for several decades in order not to reveal the possible extent of its gold stockpile. But since November 2022, the economic and geopolitical context has changed, and China is now making its data fully accessible to the public. According to analysts, this action was prompted by a very specific ambition. For Willem Middelkoop, Investment Director and founder of the Commodity Discovery Fund, “It's no coincidence that China has just started to publish their gold purchases again. They are putting the world on notice that they have an international currency." Gold has always been seen as the currency standard par excellence.

Underestimation of actual gold stocks

2,076 tons: is this the true amount of China's gold stock? Probably not. If the opacity of Chinese power is well known to the general public, it seems particularly present when it comes to the quantity of bullion held by the country. Given that China is the world's second-largest economy, that it has substantial foreign exchange reserves but few gold reserves (officially 3% of its reserves), and that it has been trying for several years to accelerate the multi polarization of the world, it has always seemed astonishing that the country is only the sixth-largest holder of gold. On the other hand, the Middle Kingdom is not only the world's biggest importer of gold, but also its biggest consumer and producer. In the 2010 decade, the country produced around 15% of all gold mined worldwide.

The official figures are all the more confusing in that, on the one hand, the central bank buys monetary gold, while on the other, a large number of Chinese investors buy non-monetary gold. As non-monetary gold purchases are all made on the Shanghai Gold Exchange (where exchanges are registered for tax purposes), they are automatically made public, unlike the others. And in 2014, the president of the Shanghai Gold Exchange declared that "the PBoC does not buy gold through the SGE” so it can easily misrepresent the total amount of its stock... in addition to making its gold purchases in dollars in order to diversify its reserves (gold being quoted in yuan on the SGE).

Determining the exact quantity of bars held by the BPoC is complicated. Based on numerous studies, it is estimated that its reserves exceed 4,000 tons, i.e. twice the official figure. China has been able to actively intervene in the gold market since the 1990s, when it recorded a current account surplus thanks to Deng Xiaoping's liberal measures. In view of its economic condition over the last three decades (marked by a permanent current account surplus) and the phenomena mentioned above, it seems unlikely that the total amount will be in the region of 2,000 tons.

Gold purchases set to continue

Against a backdrop of financial panic in the United States, the price of gold persists today at a peak close to 2,000 dollars an ounce. The banking crisis and growing concerns about global growth appear to be key drivers of demand for the safe-haven metal. Central banks have been very active on the gold market, with a 228 ton increase in global reserves in the first quarter, a record - over such a long period - for twenty years. After record purchases in 2022...

The current trend is set to continue, as there is no sign of another bank failure in the USA or on the Old Continent. On the contrary: as time goes by, the situation is becoming increasingly uncontrollable for monetary authorities. A new incident could occur at any moment. The size of the international financial system and the concentration of banks have accentuated the consequences of possible contagion.

In this respect, the People's Bank of China is seeking more than ever to diversify its reserves, while remaining discreet as we saw earlier. The aim is to establish itself as a dominant power in the event of a reform of the international economic system, following the example of the United States in the aftermath of the Second World War. In fact, at the various economic forums and conferences held at the start of this year, the role China intends to play in the gold market is regularly discussed.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.