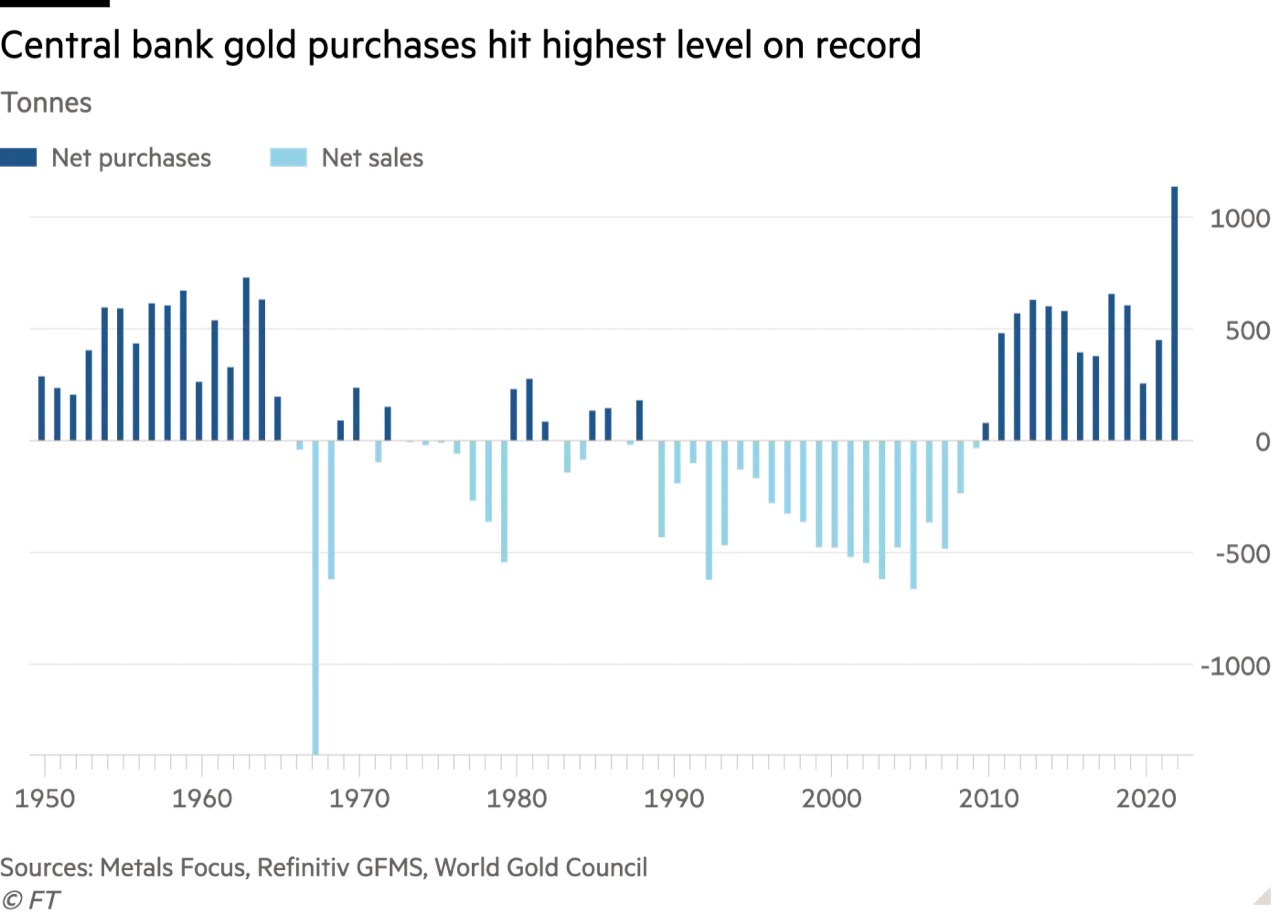

For more than a decade, the appeal of the yellow metal has been growing. Is this a sign of a future international financial system based on gold? We are not there yet. But clearly, demand for the precious metal has taken a new turn in the last year, and central banks are behind it. With more than 1,000 tons in 2022, they have been buying at a rate not seen since 1950 (when data collection began) and now account for 33% of monthly demand.

In light of recent events and future potential, all indications are that this trend may well continue.

When the dollar takes the elevator, gold takes the stairs. Even if it takes longer, the yellow metal goes through history. While the power of a currency remains dependent on the ephemeral power of a government.

In the face of the current transformation of the world economy, gold seems to be the safe haven asset par excellence, especially for central banks. Many of them are seeking to diversify their reserves in the face of inflation, rising geopolitical tensions and, last but not least, with the aim of realizing their more or less realistic ambition to de-dollarize. According to Ruchir Sharma, investor and editorialist at the FT: "The oldest and most traditional of assets, gold, is now a vehicle of central bank revolt against the dollar."

Accelerated De-dollarization Will Increase Demand for Gold (@julienchler)

— GoldBroker (@Goldbroker_com) May 31, 2022

➤ https://t.co/zewWQxscPe#dedollarization #dollar #money #debt #Fed #gold pic.twitter.com/5OWS4qIWgg

Throughout the second half of the 20th century and into the 21st century, there have been attempts to de-dollarize. The most recent are those of Iran in the early 2010s, when the then president announced that he "wanted to stop all trade in dollars" following financial sanctions imposed by the United States and the European Union. And Russia's when its government called for "rethinking the role of the dollar" a few years ago. But nothing before has given rise to a movement on the scale of the current one.

In March 2022, the U.S. freeze on Russia's dollar reserves marked a significant tipping point in many countries' drive to "de-dollarize the world." A few weeks after the conflict began, IMF Deputy Managing Director Gita Gopinath, declared that "Western sanctions could undermine the global dominance of the US dollar in the future." Her message quickly proved to be true as leaders of the BRICS countries increased their meetings and announcements in this direction. So much so that U.S. Treasury Secretary Janet Yellen saw this movement as a danger indicating that "financial sanctions linked to the dollar could undermine its hegemony."

Central bank reserves: gold on the rise

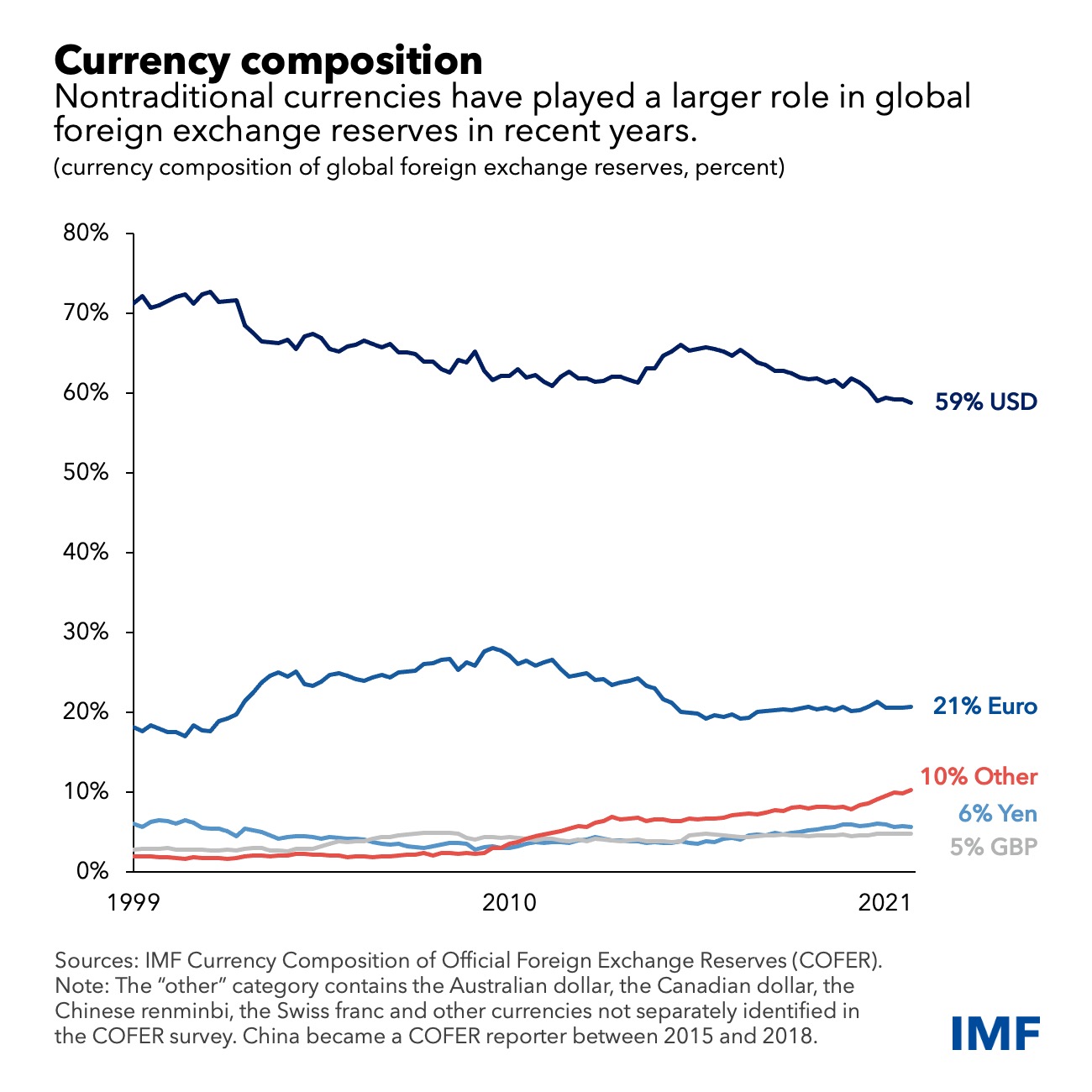

Today, the share of the US currency in global foreign exchange reserves is 59% according to the latest IMF data, compared to 71% at the beginning of the century.

While this is a significant development, no currency has the means to compete with the dollar, and no country is showing the slightest ambition to do so at the moment.

Although the yuan is gaining in importance, statements about making it the next hegemonic standard are unrealistic. China's economic fragility and its permanent capital controls show that the country cannot achieve such a changeover for the moment. A multipolar monetary system seems to be opening up.

In order to protect themselves from possible sanctions such as those suffered by Russia, many countries are therefore choosing to turn to gold because it is, by nature, beyond the control of any state. John Reade, strategist at the WGC, said that "countries have recognised that the gold that Russia holds, because it’s outside of anybody else’s control, is useful in situations where you might not be able to access any other reserves" before adding that "Western sanctions on Russia have caused many non-aligned central banks to reconsider where they should hold their international reserves."

According to the IMF, 30 percent of the world's countries are now subject to sanctions by the United States, the European Union, Japan and the United Kingdom, up from 10 percent in the early 1990s. And according to figures from the World Gold Council, the bulk of gold purchases in 2022 were made by central banks in countries not aligned with the West. In addition to Turkey, which was the largest buyer of gold last year (and which plays a two-way game between the East and the West), China, India, Russia, Qatar, and Egypt are among the countries that accumulated the most gold in 2022.

These purchases have increased by 152% annually over the past year, and have allowed the yellow metal to continue its steady rise to this day.

What can we expect in the future?

According to a survey of 83 central banks, "more than two-thirds of central bankers surveyed believe monetary institutions will increase their gold holdings in 2023." So far, time is proving them right as central banks have accumulated gold at the fastest pace on record in the first two months of 2023, according to a report by the World Gold Council.

This trend continued during the banking panic that began in March.

As the SVB affair reverberated and the systemic bank Credit Suisse was bought out in a panic by its Swiss rival, UBS, the gold price continued to rise while the dollar fell. The inverse relationship between the yellow metal and the U.S. currency has once again been verified. And this trend is likely to continue if we look at future developments:

- Banking panics will continue in the U.S. in the coming months. The Fed's monetary tightening will cause more deposit withdrawals and many banks will be at risk of failure.

- As mentioned in previous articles, the US central bank will then have to employ new measures and will lower interest rates again; this will have a negative impact on the dollar's value and therefore a positive impact on gold.

- The Fed will have to choose between fighting inflation and financial stability. Its primary role being price stability, it will probably choose the fight against inflation.

A trend that should continue in the long term

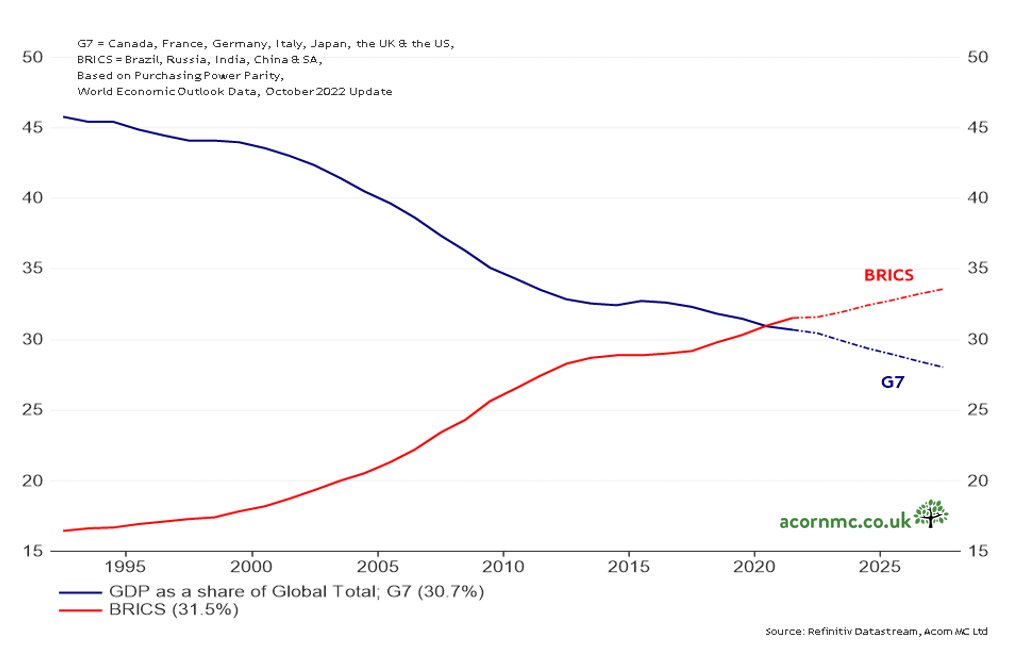

Looking at the major gold buying countries in recent years, which are primarily members of the BRICS, one can also deduce a longer-term perspective.

This group of five countries has accounted for 50% of global growth over the past decade, and its share of global GDP continues to grow. Some analysts estimate that it has even surpassed that of the G7 countries for the first time and would now contribute more than 30% of global GDP.

Demographically, these countries today represent more than 40% of the world's population and this will be the case tomorrow since the growth of India should allow this rate to stabilize. In 2050, the world's most populous country will have approximately 1.7 billion inhabitants, i.e. nearly 18% of the world's population.

Their combined growth will then lead to an inevitable shift in the balance of power.

From these evolutions, we can fear a more fragmented world at a time when unity becomes more necessary than ever given the contemporary challenges. Democracy, and only democracy as a political system, can solve these challenges. But only if it wants to. First, the international economic system must be rethought.

But until then, more and more countries will accumulate physical gold as a protection against the uncertainty of the future.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.