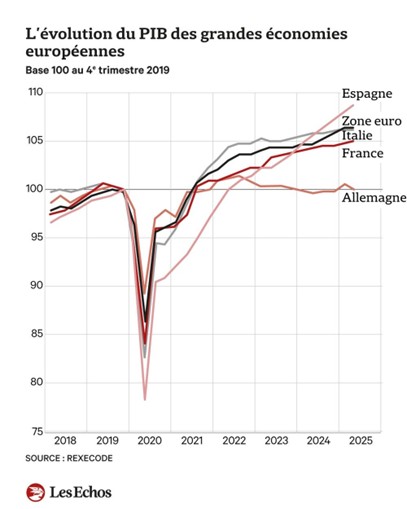

In our previous article, we discussed the great decline of Europe. However, some might argue that, despite everything, economic growth remains strong, proving that the continent still has a chance in international competition and that there is reason to remain hopeful. In this chart from Rexecode (base 100 in the fourth quarter of 2019, just before Covid), Spain and Italy stand out in particular, along with France. These countries are performing better than Germany, long held up as a model:

GDP growth in major European economies

However, on closer inspection, this growth appears largely artificial. It is not the result of a program of deregulation, liberalization, and tax cuts à la Javier Milei — which is the only way to stimulate healthy long-term growth and would be perfectly justified in our overregulated and tax-burdened economies. No, Argentina is not a model for Rome and Madrid, even if they have taken some good measures (cutting subsidies for the energy transition in Italy, Spain's exit from the European electricity market). This growth is based primarily on massive use of public money.

European public funds are pouring into Italy and Spain and largely explain their GDP growth. In France, it is based on spiraling public debt, while in Germany – constrained by a constitutional rule limiting the deficit to 0.35% of GDP – activity is stagnating, held back by soaring energy costs and the loss of its traditional markets, particularly the automotive industry, which is struggling to navigate the shift to electric vehicles. But the coalition has agreed to abolish this rule and invest heavily in the defense industry, so it's a safe bet that Berlin will soon be posting artificial growth as well...

Italy plans to spend €13.5 billion on building a bridge linking Sicily to the mainland – set to become the world's longest suspension bridge – despite the lack of any proven need and the risks associated with the area's seismic activity. Meanwhile, the Lyon-Turin railway line is expected to cost more than €26 billion (according to a 2012 estimate by the Court of Auditors, which has not been updated since): a project of similar scale, significantly longer and more expensive for passengers than a simple plane ticket. On August 8, Prime Minister Giorgia Meloni welcomed the fact that “the European Commission has today approved the disbursement of the seventh instalment of the National Recovery and Resilience Plan (NRRP), equal to €18.3 billion, following the fulfilment of all the set objectives." The NRRP also exists in France, but there it is financed by debt. Italy is free to rejoice, but this money comes from Brussels, in other words from states in deficit, and therefore from debt.

Increasing public debt for low-growth growth is clearly not a viable model. And the EU does not have the power of the US to impose the euro on the world and finance its deficit through global savings. Since the beginning of the year, the euro has appreciated by around 15% against the dollar, but this trend may not last and could even reverse.

In any case, the two main international currencies remain paper currencies issued by deficit-ridden states; overall, both are losing value, as evidenced by the gold price.

Everyone will know what to do when faced with the inconsistency of governments.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.