Bitcoin is often referred to as “digital gold,” but its price performance since the beginning of the year has been nothing like that of the precious metal: while it has been stagnating around $100,000, gold has been breaking record after record. How can such a difference be explained? It seems to be down to private individuals.

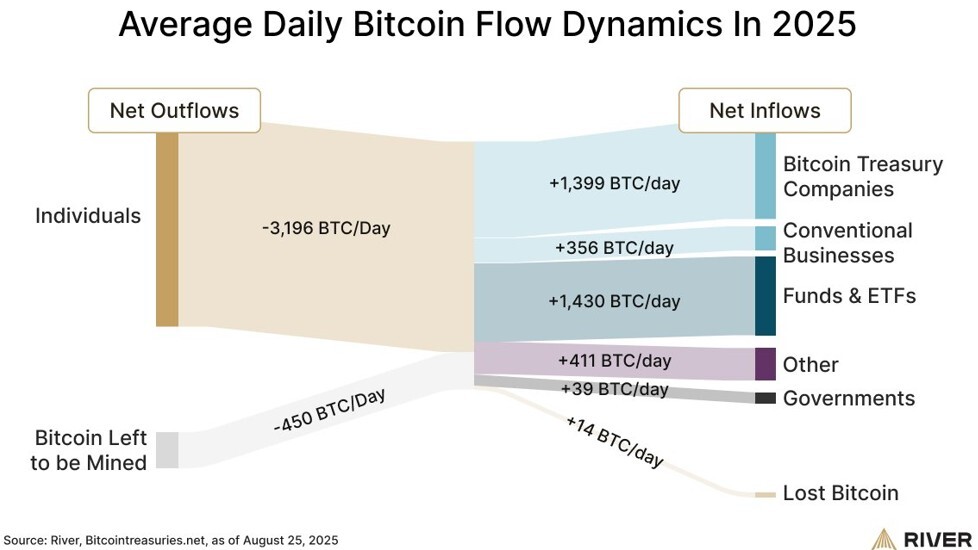

The research firm River provides a very convincing explanation for the sluggishness of the price of bitcoin: individuals are selling. In fact, institutional demand (bitcoin treasury companies, ETFs, etc.) is six times greater than the production of new bitcoins by miners (450 BTC/day). The price should skyrocket, but there is a massive seller at the moment: private individuals, selling more than 3,000 BTC/day.

During previous bull runs (2017, 2021), individual investors rushed in when prices rose, amplifying the movement. There was a kind of hysteria, FOMO (Fear of Missing Out), and the media reported on it daily. However, many bought a little late in the cycle and sold in panic mode as soon as the peak had passed, accelerating the fall in prices this time around. A number of them must have been wiped out and are not coming back.

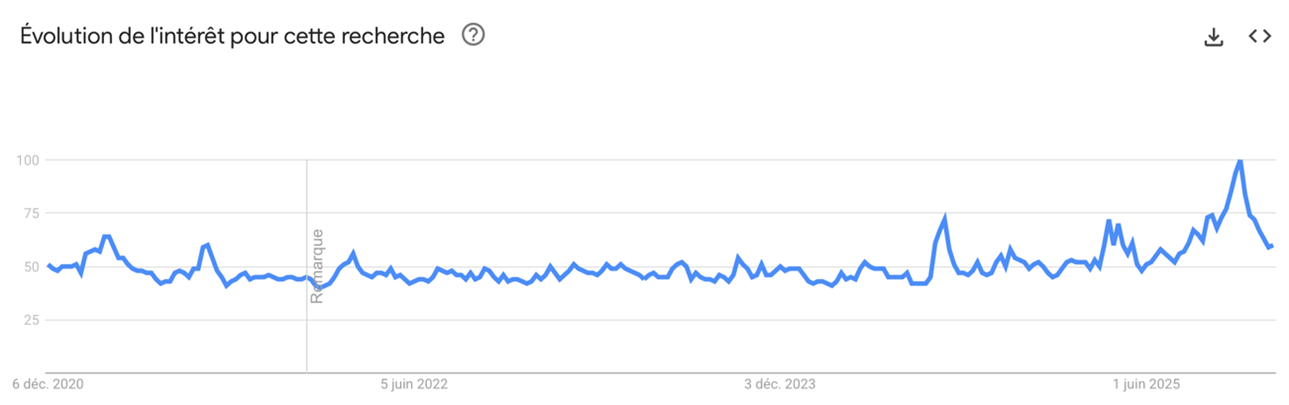

Conversely, the gold price is experiencing remarkable uptrend in 2025, with individuals contributing significantly to this rise. A good indicator is to look at the occurrence of the term “Gold” on Google Trends worldwide, which summarizes searches made on the engine. There is a sharp increase in the second half of the year, precisely when the ounce exceeded $4,000. This suggests the arrival of new buyers rushing to gold – while, on the bitcoin side, it is dead calm.

Clearly, the high volatility of bitcoin – and its declines of up to 80% between market peaks and valleys in each cycle (four years, corresponding to halvings) – have ultimately deterred many retail investors. Many have been burned by it. Gold, on the other hand, offers greater stability and its cycles are less severe. These are two rare assets, to be sure, but their behaviors are very different; they cannot therefore attract exactly the same types of investors. From there to selling bitcoins in order to switch to gold was only a small step for some investors

But isn't this move too sudden? That's what the BIS (Bank for International Settlements, “the central bank of central banks”) suggests in its latest quarterly report from December 8: According to it, individuals are fueling the rise in gold and stocks to such an extent that one could speak of a bubble. A correction is possible, but the fundamentals of gold remain solid in the face of government budget deficits and central bank money printing. The key is to maintain a long-term perspective and remain confident. It will be interesting to follow these developments in the months and years to come.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.