The current banking panic is more evidence than ever of the impossibility of a "soft landing" for central banks. Faced with the Silicon Valley Bank bankruptcy and the growing risk of further incidents, anxiety has taken over and forced selling has followed on the markets. As in December 2019 during the repo crisis, or in March 2020 during the health crisis, central banks have recently intervened with unprecedented measures to avoid the worst. The concentration of the financial system is thus amplified, at the expense of the real economy.

New and unprecedented measures

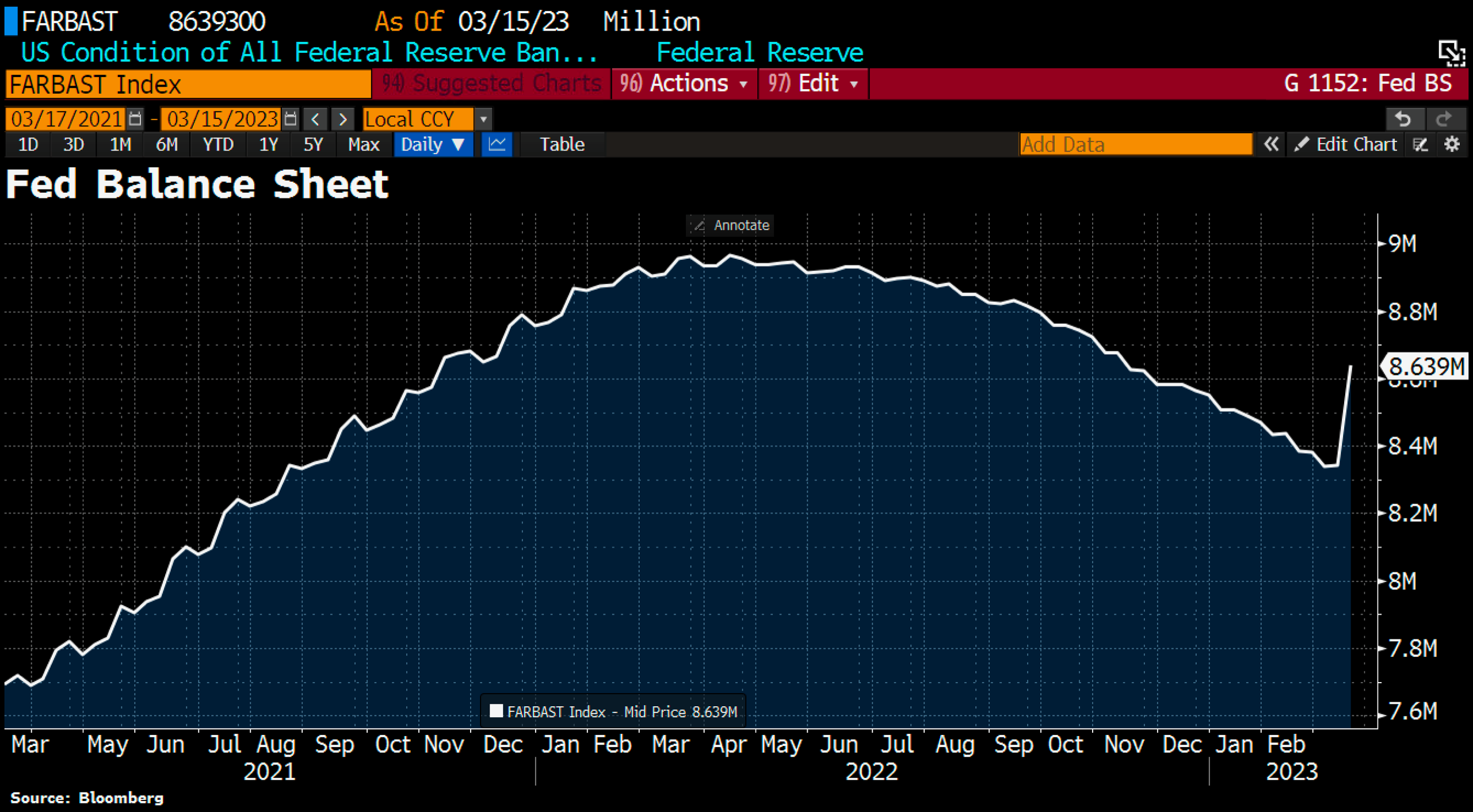

In just a few days, the U.S. central bank has already injected nearly $300 billion into the U.S. financial system, an amount greater than that used during the 2007-2008 crisis. It has thus erased half of the effects of the reduction of its balance sheet (linked to its monetary tightening) that it started last June in order to fight inflation. This "pivoting" is the scenario we envisaged at the beginning of the year... inherent to the dilemma of the monetary institutions (they have not - yet - reduced their rates, as we will see later).

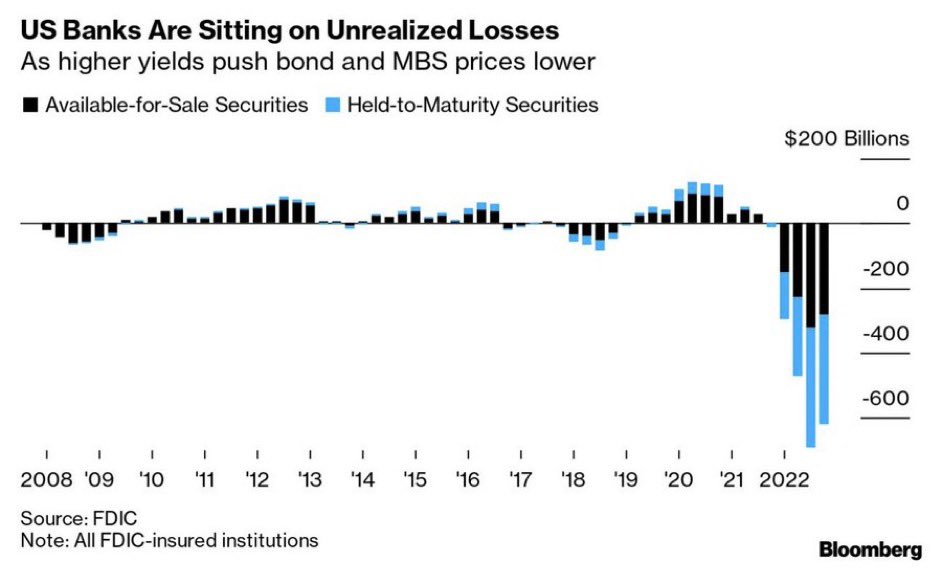

At the same time, the Fed has set up a new program called BTFP, which allows banks to borrow massively (the total capacity of the fund would be $2 trillion, according to JP Morgan). And, in an unprecedented measure, the securities placed as collateral for these loans are established at face value (when the security was issued) and not at market value (i.e. their current value), while American financial institutions hold unrealized losses estimated at more than $600 billion. This gives the banks almost unlimited borrowing power. In fact, if the amount of this program is reached, what will prevent the Fed from increasing it or establishing a new one?

To take the measure of this phenomenon, during the sovereign debt crisis, the ECB used 50% trims on Greek sovereign bonds - based on their market value - as a means of fiscal discipline. If the ECB had done what the Fed is d¡oing now, the situation for Greece and the eurozone would be completely different today. But the euro does not have the hegemony of the dollar and the ECB the importance of the Fed...

Federal Reserve Balance Sheet (Fed)

Unrealized losses of U.S. banks to date, estimated at $600 billion by the Federal Deposit Insurance Corporation (FDIC)

Nevertheless, this mastery of time by issuing new debts is only an illusion because everything is changing... and the vice is tightening more than ever for the monetary institutions. Thus, the future consequences will only grow as this headlong rush continues. Unless central banks decide on a paradigm shift or manage to control the situation until a central bank digital currency (CBDC) is implemented.

Need for dollars

Despite the current banking panic, central banks have announced several interest rate hikes. In particular, the Bank of England has undertaken a 0.25% increase, bringing its rates to 4.25%. The Swiss central bank recently raised rates by 0.5%, despite the Credit Suisse banking collapse.

These decisions are driven by the level of inflation, which remains very high - and whose effects cannot be ignored. This is especially true since price increases remain anchored in most Western economies, as evidenced by the acceleration of inflation in the UK in February - to 10.4% - after several months of slowdown.

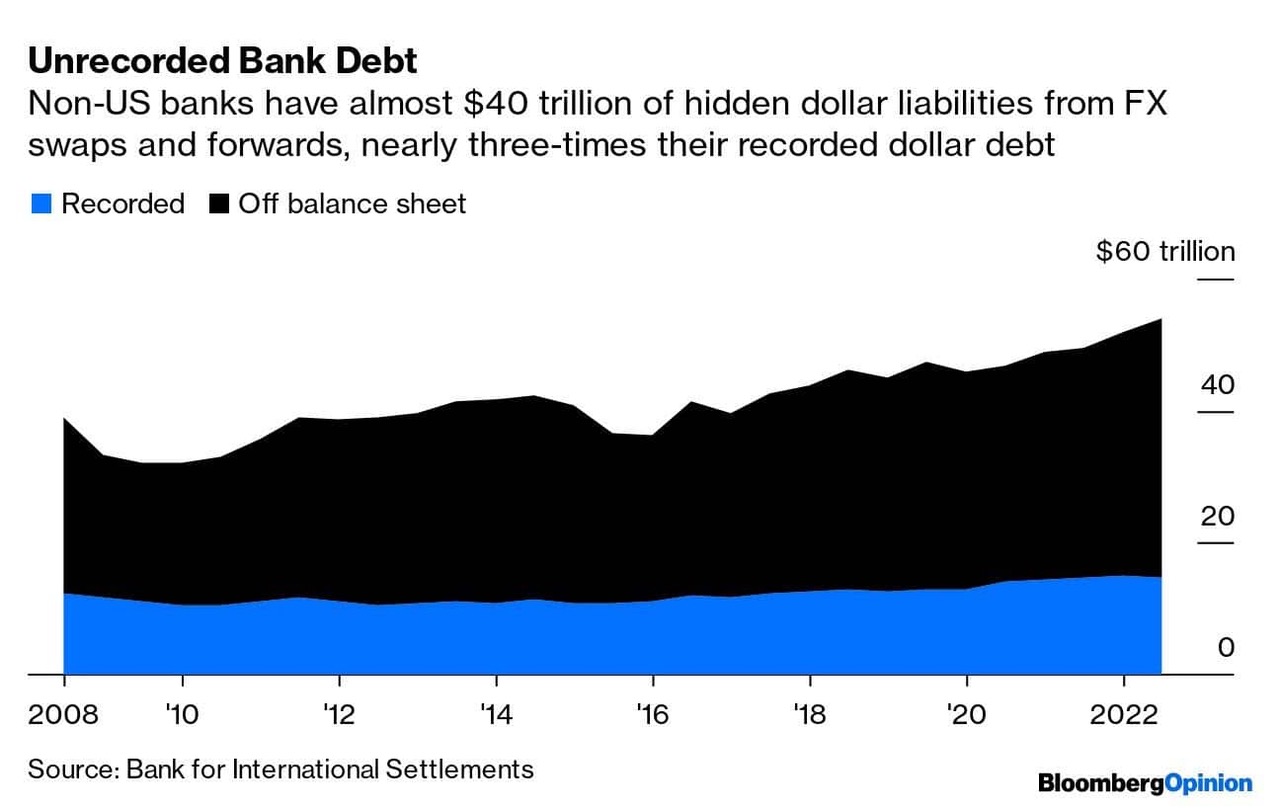

Moreover, central banks outside the United States are not so much afraid of the effects of their rate hikes on financial stability, but rather of those of the Fed. The appreciation of the dollar, driven mainly by the Fed's monetary policy, presents a systemic risk. Faced with higher financing costs in dollars, European banks - among others - could find themselves confronted with major risks due to the large share of US currency in their off-balance sheet.

According to the Bank for International Settlements, non-US banks (not headquartered in the US) held nearly $39 trillion in hidden derivatives debt on their balance sheets at the end of 2022.

For this reason, after the recent purchase of Credit Suisse by UBS, (which prevented the Swiss bank from going bankrupt and thus a systemic crisis), all Western central banks have coordinated to ensure a better distribution of dollar liquidity. The dollar swap lines (regularly renegotiated loans) distributed by the Fed to the main Western central banks will henceforth be established on a daily rather than weekly basis, in order to ensure that European financial institutions have permanent access to dollars in the event of a banking panic.

The day after this communiqué, the Swiss National Bank obtained $100 billion, which it lent directly to Swiss financial institutions to ensure their needs in American currency.

The last time such a scenario occurred was during the 2007-2008 crisis when Lehman Bank failed. The central bankers of the Fed met and provided liquidity in dollars to avoid a major contagion of the banking crisis. The parallel with recent times is striking... but the amounts today are much larger.

Towards an ever more concentrated financial system

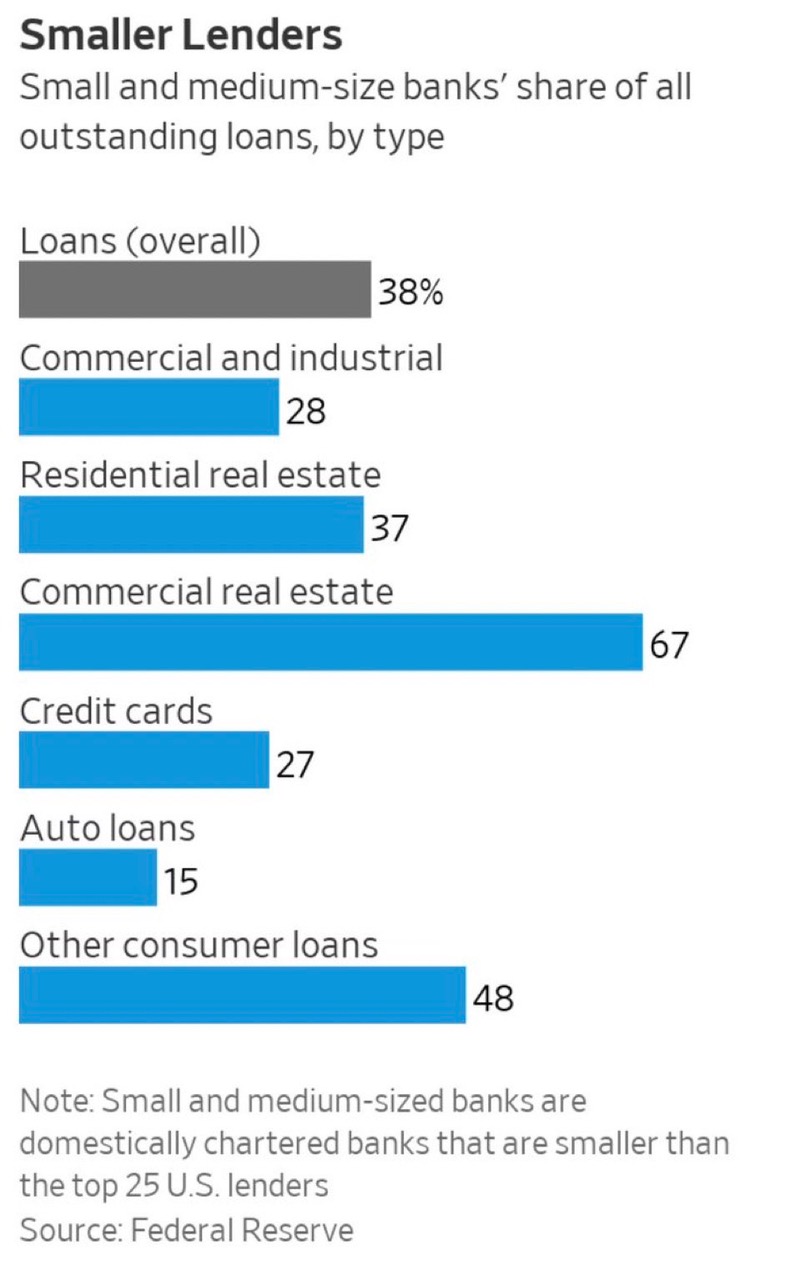

These incidents on the markets are particularly harmful to small and medium-sized banks, which are experiencing massive deposit withdrawals, especially in the United States. Panicked by financial instability, American depositors prefer to withdraw their cash or place it with large banks, recently announced as the only ones "protected in future bank failures" according to Treasury Secretary J. Yellen.

This is in addition to many of the challenges faced by these banks. According to economist Torsten Sløk, "Regional banks are impacted by higher funding costs, deposit risks, regulatory pressures, and asset declines, including future credit losses from the lagged effects of Fed hikes."

While these banks (those weaker than the 25 largest banks) account for 38% of total loans in the United States, their weakening represents a long-term threat to the country's economic activity. Especially since the annual growth of American productivity has been only 0.5% since 2008, whereas it was close to 2% between 1870 and 1970.

The United States is thus moving towards a highly concentrated financial model, reminiscent of that of the USSR or the Chinese model under Mao Zedong, both of which eventually showed their limits...

Conversely, what is commonly referred to as the "German miracle" or the "Chinese economic catch-up" (since the inauguration of Deng Xiaoping in 1978) are examples of the success of a decentralized financial system. The large volume of regional public banks and savings banks in Germany and China allowed for a relatively high velocity of money and a large distribution of credit for productive economic activity. This has helped to stimulate their respective industries and contributed to the prosperity of the economy.

Thus, the intensification of banking concentration (which is not limited to the United States and which has already been underway for several years in many countries) amplifies the control and power of these banks over citizens and states, and risks deeply damaging the economic fabric of these countries in the medium and long term.

Gold benefits from the situation

Faced with this situation, in a period of uncertainty, the price of gold has continued to rise since the beginning of March. It recently exceeded $2,000 per ounce on the London Stock Exchange, before stabilizing at around $1,950.

Given that financial instability does not seem to be abating, and that the Fed is beginning to slow the pace of its interest rate hikes (it just raised rates by 0.25% when it was initially forecasting 0.5%), everything suggests that the price of the yellow metal will remain around current levels in the weeks and months to come, or even continue to rise.

Investors prefer to buy gold rather than bonds (as real rates remain negative), and many central banks continue to increase their reserves of yellow metal in order to de-dollarize, diversify their reserves, and protect themselves from possible state sanctions.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.