Some investors choose to defer their investment in gold, arguing that gold is “too expensive.” This argument can be viewed from two angles.

On the one hand, it is clear that gold is “expensive” in absolute terms: its rarity and special status make it an inherently expensive asset. This is unlikely to ever change. On the other hand, considering gold to be “too expensive” relative to other assets or its potential for growth is more debatable. The gold price depends on solid long-term fundamentals and a complex set of shorter-term factors.

It is also true that certain periods give rise to significant corrections in the price of gold, historically opening up major windows of opportunity. This article therefore aims to measure the opportunity cost incurred by an investor who decides to delay investing in gold.

Gold: an asset with long cycles

Gold offers a risk/return ratio comparable to that of the major global stock indices. However, its price behavior differs significantly from that of the equity markets. While equities often move rapidly and sometimes sharply, gold seems to follow longer-term, more structural trends, as evidenced by the study of its cyclicality.

The history of the gold price is marked by prolonged periods of growth, followed by sometimes severe corrections that can last several years. We can cite, for example, two major waves of price gains: the first between 1968 and 1980, the second between 2000 and 2012, before a new dynamic began in 2016. Between its peak in 1980 and its low in 2000, gold lost nearly two-thirds of its value. Similarly, between its peak in 2011 and its low in 2015, it depreciated by about half.

These prolonged corrections are enough to dampen the enthusiasm of investors who fear entering the market at or near a peak. Conversely, this type of trajectory is rarer on major stock indices, which tend to have shorter and more volatile cycles. However, should we conclude that it is possible, or even desirable, to partially or totally defer an investment in gold on the grounds that its cycles are more spread out over time?

Data sources : yfinance

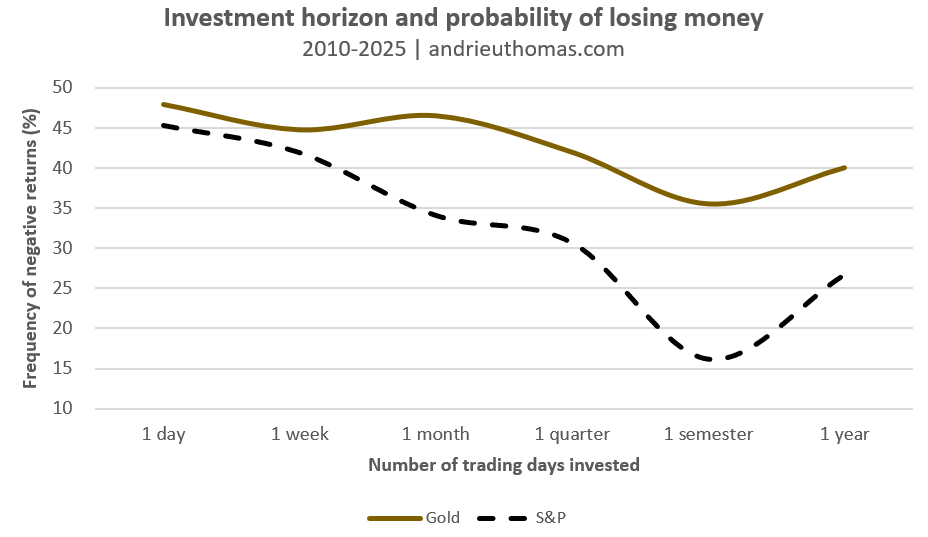

When we carefully examine the probability of loss, i.e., the probability that a return will be negative over a given period, a completely different picture emerges. Since 2010, nearly 48% of daily changes in the price of gold have been zero or negative, compared with just over 45% for the S&P 500, which is one of the world's most bullish equity indices.

However, if we extend the investment horizon to six months, the probability of a loss falls to 35% for gold and 16% for the S&P 500. It then tends to rise again on an annual basis for both assets. It is therefore clear that extending the investment horizon significantly reduces the probability of loss. However, it should be noted that while the S&P 500 has a lower risk of loss in terms of frequency, the losses that do occur are generally more severe due to the sensitivity of equities to crashes.

This observation highlights a fundamental rule: the longer the investment horizon, the less the investor should focus on the current price of the asset, since its implied probability of loss decreases, all other things being equal.

Finally, we could have looked at the behavior of volatility, i.e., the instability of prices depending on the frequency of portfolio reallocation. We would have found that volatility, often equated with “risk,” decreases as the investment period lengthens. This phenomenon reflects a characteristic behavior of the fractal structures observable in the price of gold.

Investors deceived in 2022

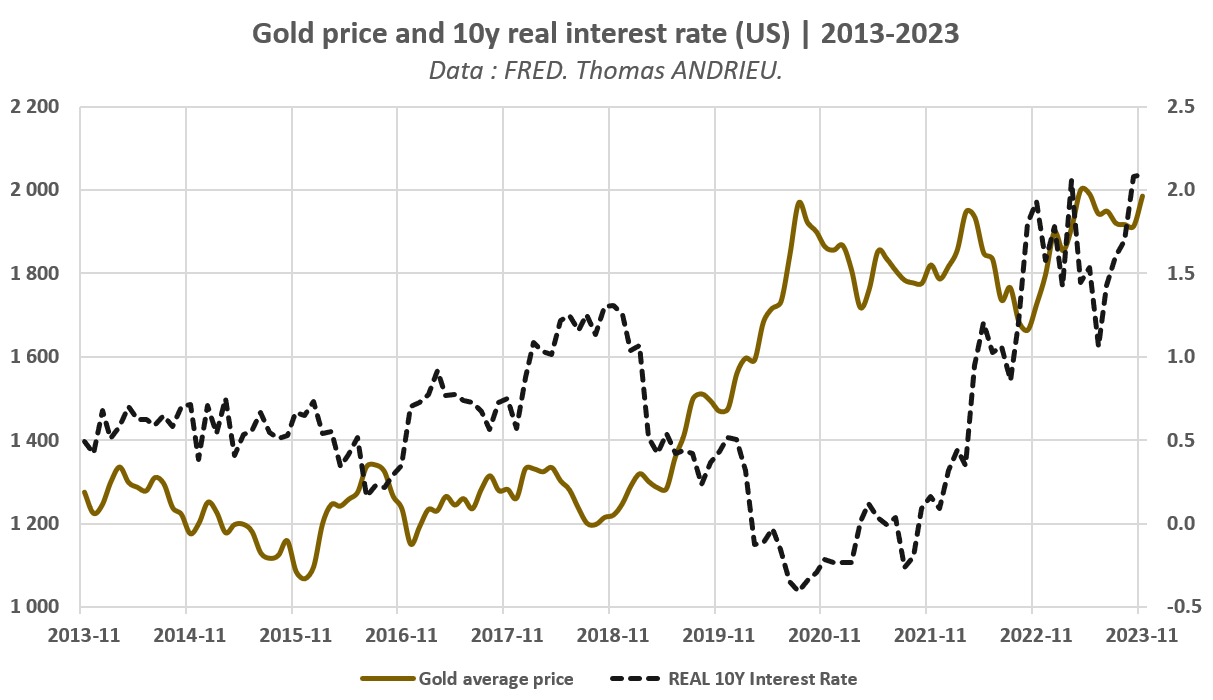

Between 2020 and 2023, the price of gold underwent a prolonged correction after four years of almost uninterrupted growth. Many investors expected a sharp decline in the precious metal, convinced that rising interest rates would make it less attractive. However, this prediction did not come true. While the price of gold remained stagnant between 2020 and 2022, the dramatic rise in key interest rates did not lead to the decline that many had predicted.

Data sources : yfinance

It is true that gold prices tend to be supported by falling real interest rates, as this reduction in the yield on other assets makes gold “more attractive.” However, the reverse is not necessarily true: a rise in real interest rates is not enough on its own to permanently dampen gold's appeal and cause its price to fall. This recent episode clearly demonstrates that gold benefits from periods of monetary easing, but often proves remarkably resilient when returns on other assets increase.

A second golden rule is therefore not to reduce the value of gold to an overly simplistic interpretation of the “risk” or “attractiveness” of the external financial environment. Its price reflects more complex dynamics, which need to be examined in detail.

How long will the decline in gold prices last?

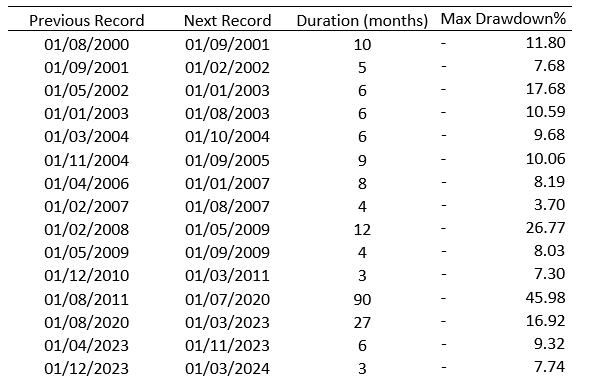

Since 2000, the average time between two historic highs of the gold price has been less than four and a half months, with an average decline of 7% from the previous peak. However, this statistic has a significant bias. If we exclude corrections lasting less than two months, which we consider too short to reflect a genuine underlying trend, the average length increases considerably: between two records, the interval exceeds thirteen months, and the average decline reaches 13.4% from the previous peak.

In other words, when no new high is recorded for more than two months, it is likely that a correction will set in and last for an average of thirteen months, with a decline of around 13.4% from the peak.

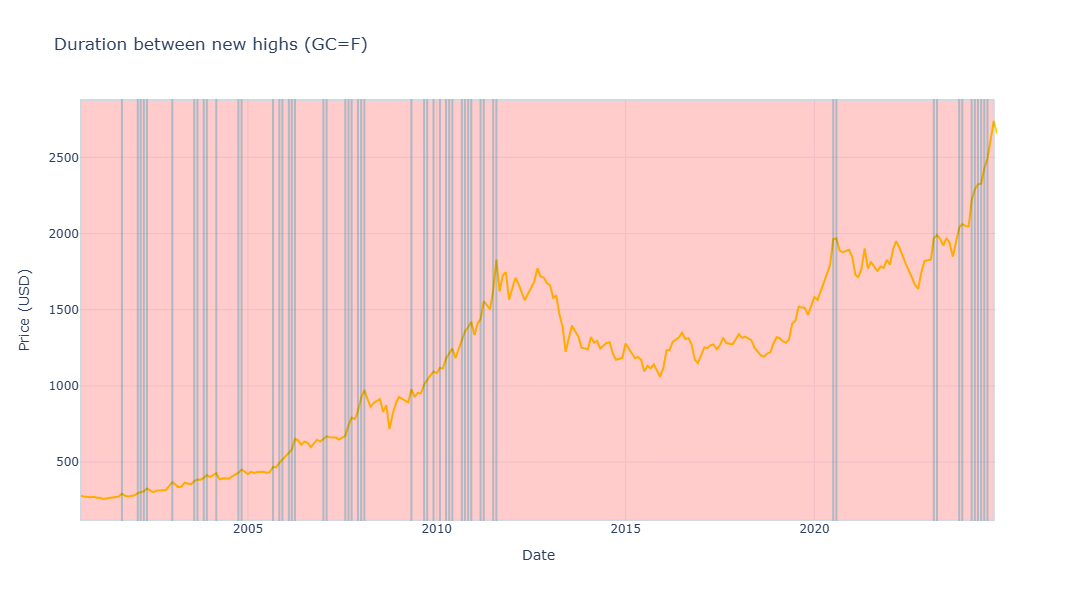

Data sources : yfinance

The chart above shows, in red, the periods during which the price of gold remained below its previous all-time high. We can see that between 2011 and 2020, gold experienced its longest downturn since 2000, lasting 90 months, or nearly seven and a half years, with a maximum decline of 46% from its peak. Similarly, the second-longest correction phase lasted from 2020 to 2023, with a maximum decline of 17% from the peak.

Data sources : yfinance

In other words, corrections in the price of gold rarely last more than a few months, and even more rarely a whole year. When these periods of decline extend beyond ten months, they are most often structural corrections, which can last for several years. However, even in the unlikely event that an investor had bought at the peak, their maximum historical loss would not have exceeded 17% since 2020, or 45% since 2011.

It should be noted that an investor who committed their capital at the peak in 2011 would have recouped their initial investment in 2020. But fourteen years later, they would have enjoyed a total return of +72%, representing an annualized return of around 4%! In short, even the “worst investor” in gold, someone who had tied up their entire portfolio at the all-time high, would have actually preserved and increased their purchasing power, outperforming inflation over the period. This observation is far from anecdotal...

The third rule of investing in gold is therefore to remember that the investor is less concerned about the entry point, as the interval between gold records tends to remain relatively short. There are, however, notable exceptions that would be unwise to ignore. But even these, when viewed over a sufficiently long time horizon, remain profitable, to the point that the “worst investor” scenario ultimately proves more enviable than it appears.

Factors that influence the price of gold

The price of gold is essentially driven by two distinct dynamics. On the one hand, there is a fundamental force, which manifests itself in long periods of appreciation or sustained decline. On the other hand, there is a short-term dimension, marked by the profound difficulty investors have in determining the optimal entry point, given the rarity and unpredictability of short cycles. While gold price fluctuations can be explained in the short term by monetary factors or episodes of heightened risk, there is still only one real determinant governing its long-term trajectory.

Data sources : yfinance

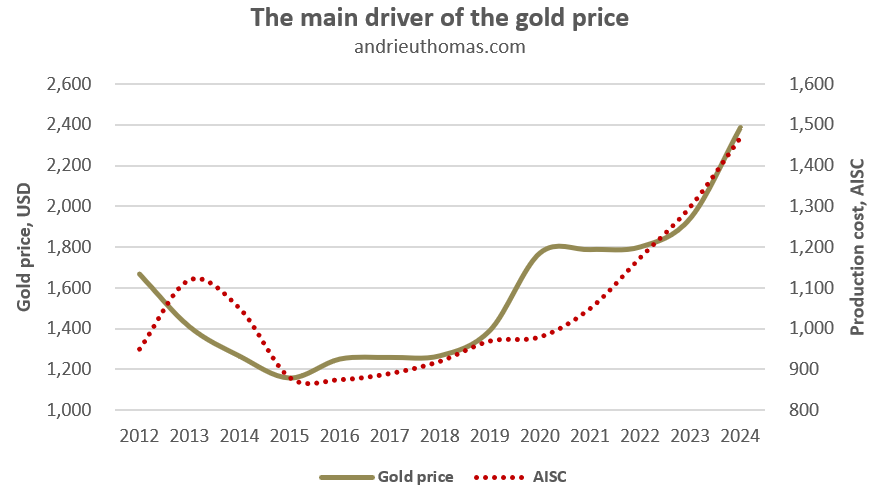

The price of gold appears to be largely dependent on the economic constraint represented by its production cost. Extracting an ounce of gold is becoming increasingly expensive, meaning that its price must remain within a range that is both attractive to mining companies and high enough to discourage massive accumulation by investors. We have also shown that investment demand is generally characterized by positive elasticity, which can fuel a surge in prices until demand from jewelers or central banks contracts.

Thus, gold does not need a massive resurgence in buyer appetite to see its value rise: the mere scarcity of its supply is enough to cause its price to rise. This is what makes it a truly unique asset. Close observation of its performance between 2012 and 2024 reveals that around 70% of fluctuations in its price are due to changes in production costs. This phenomenon also sheds light on the formation of major long-term trends, which are often linked to the difficulties encountered by mining companies.

As a result, gold is a rare asset that should not be viewed as a mere “speculative” asset with no fundamentals.

Conclusion: the golden rules!

Is gold “too expensive”?

A historical study of data relating to gold leads to unanimous conclusions:

- The longer the investment horizon, the less attention the investor pays to the initial price level. When the holding period increases, short-term fluctuations become less important. The key factor then becomes the asset's ability to preserve and increase purchasing power over time. This time lag smooths out volatility cycles and puts less favorable entry points into perspective.

- Gold cannot be reduced to a simple barometer of “risk” or “attractiveness” in financial markets. Above all, it embodies a thousand-year-old store of value, which is also a tool for portfolio diversification. Viewing it solely as a stress indicator or the antithesis of risky assets is therefore simplistic and inaccurate.

- Since the early 2000s, even investors who chose the least opportune entry points would have seen their investments significantly outperform inflation over the course of a decade. This ability to generate positive real returns, even in unfavorable conditions, illustrates gold's resilience over the long term and its appeal as a strategic asset.

- Gold is a rare asset whose value is based on economic fundamentals, which is nothing like a simple “speculative” asset. Its rarity, universality, and lack of default risk make it an essential, even indispensable, pillar of our society.

We have shown that an investor who believed gold was “too expensive” for several years would, in effect, have reduced their investment horizon, thereby increasing their risk of loss. Furthermore, gold should not be viewed solely through the prism of monetary or geopolitical conditions. It should also be emphasized that holding gold for a sufficiently long period of time can transform even the “worst investment” into a potentially attractive allocation.

In short, gold should be considered primarily for its intrinsic scarcity, not solely for its media exposure.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.