For the third year running, our forecasts for the price of gold have come true.

In December 2023, we pointed out that “the average trend in the price of gold at this stage of the cycle suggests the possibility of a potentially high-performance impulsive upward movement (up to +30% within 12 months)”.

Over the year 2024, the price of gold has in fact climbed by almost 30%... a performance unmatched for almost 15 years!

This forecast is remarkable in several respects. On the one hand, very few banks had anticipated such a surge in the price of gold. And secondly, forecasting such impulsive movements is often subject to uncertainty and volatility. Yet 2024 has confirmed the regularity of gold price cycles.

The year 2025 is proving just as strategic. Visibility on the fundamentals of the price of gold remains good. However, structural changes are taking place in the market, with overall investment demand on the rise and the importance of future macroeconomic dynamics. While a sharp fall in the gold price seems unlikely in 2025, attention is now focused on the intensity of the trend.

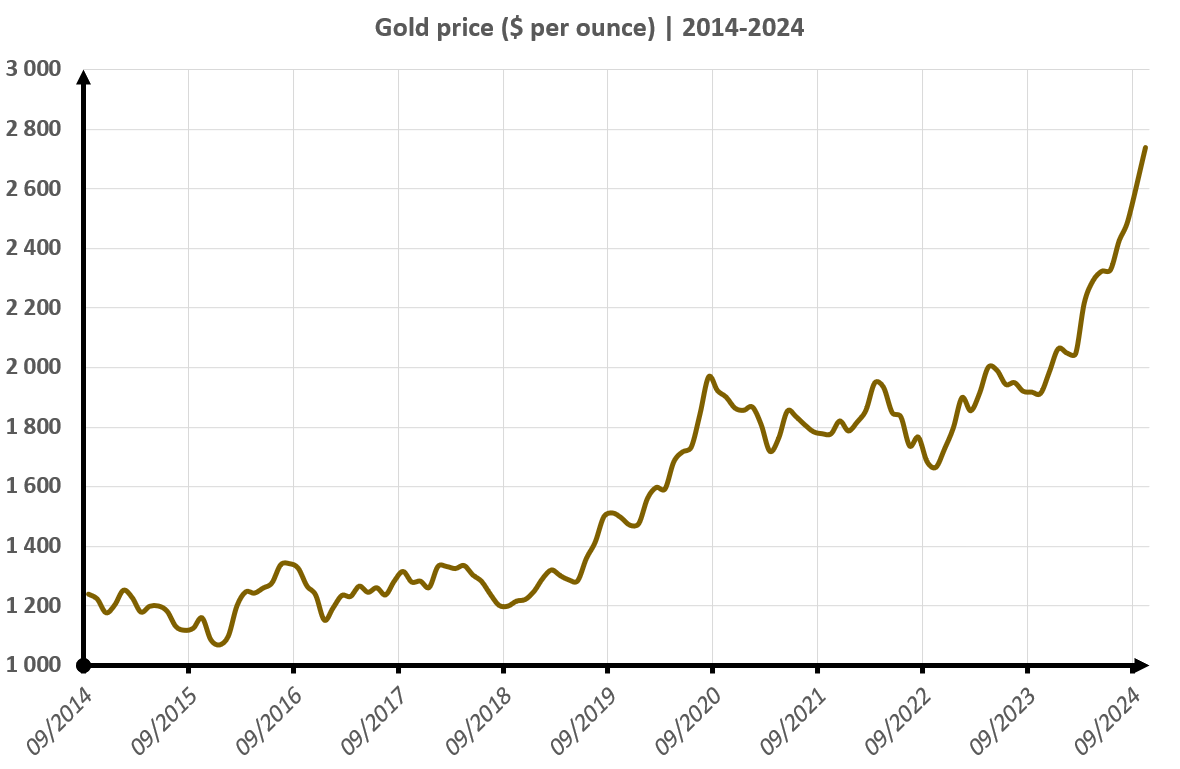

10-year gold price trend

After a period of decline in the early 2010s, the precious metal recorded a +70% rise between January 2017 and January 2021. This strong comeback propelled the gold price back to its previous highs of 2011. But this rise in the gold price peaked in the summer of 2020, in the midst of the COVID crisis and economic uncertainties.

These 4 years of rise (2016-2020) were followed by 4 years of stagnation, despite rebounds linked to the return of wars and inflationary tensions. Nevertheless, gold did not fall, as physical demand remained robust, while mining companies struggled to be profitable with a price durably below $1,700 per ounce. What's more, contrary to the expectations of many investors, rising interest rates did not cause gold to fall!

| Forecast for the year | Expected performance | Actual performance | Variance (actual - forecast) |

| 2022 | +0% | -0,23% | -0,23% |

| 2023 | +10% | +13,08% | +3,08% |

| 2024 | +30% | +27,1% | -3% |

| 2025 | +10% | - | - |

| Average | - | - | -0,01% |

Our forecasts have thus followed the gold cycle. In 2022, we pointed out that “if we refer solely to the information that is provided to us by the modeling of the past prices, one could imagine the gold price remaining stable, overall, between now and the end of 2022”. Subsequently, 2023 marked a first turning point. The bearish force capitulated, and the price of gold was able to test new highs without success. Gold's +10% rise in 2023 prompted a first change in market psychology. The bull market of 2024 could now begin!

With an average forecast error of -0.01% over the last 3 years, the cyclical method appears to be the most solid, consistent and accurate basis on average for predicting, at least in part, the destiny of financial asset prices. This method is described in greater detail in my book "Cycles et Fractales pour investir en bourse" (paperback).

The major gold price cycles

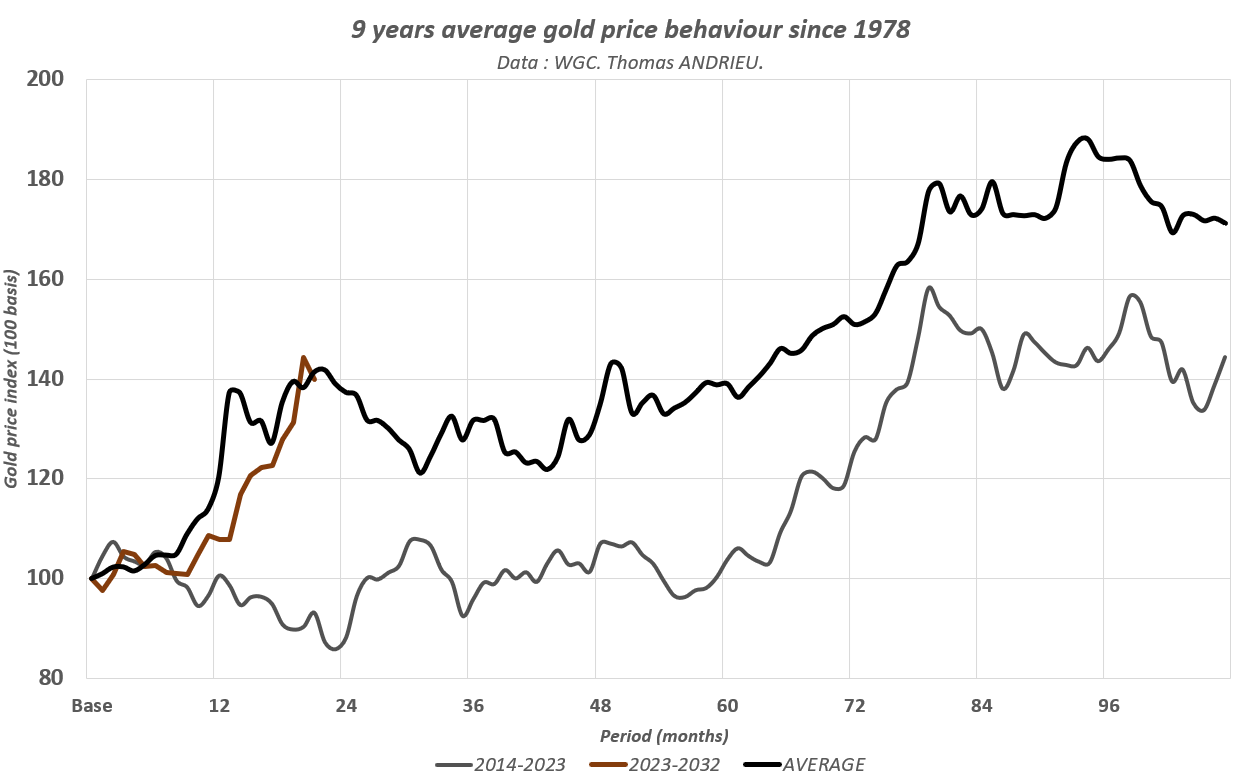

The chart below shows the expected trend in the price of gold over 9 years (since 1978). The red curve indicates our current position within this 9-year cycle. There is a significant symmetry between the historical gold price trend at this point in the cycle and the current trend. This symmetry explains the accuracy of the +30% rise forecast for the past year. The previous cycle (2014-2023) also showed great symmetry.

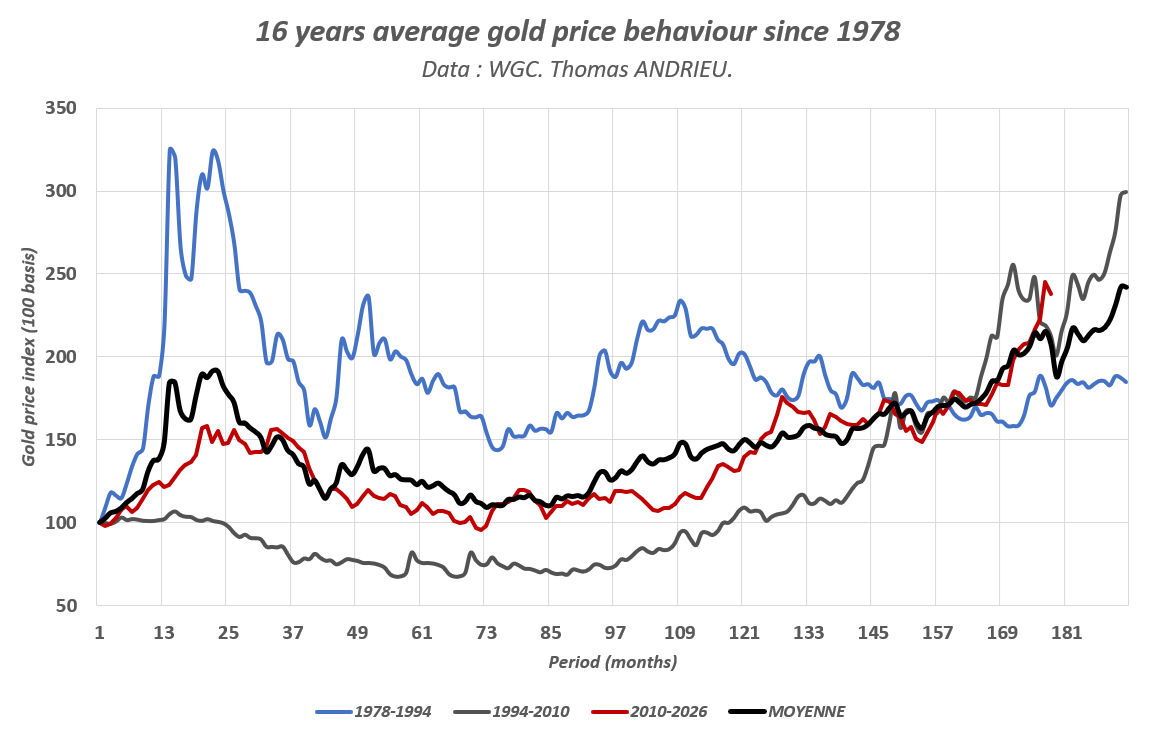

What's more, the 16-year cycle reveals similar patterns. Gold's price evolution since 2010 faithfully reproduces the trends observed since 1978. In recent months, gold has even slightly outperformed its long cycle.

The price of gold is therefore continuing on its usual cyclical trajectory, and it is reasonable to assume that this trajectory will be broadly followed in 2025.

What can we expect in 2025?

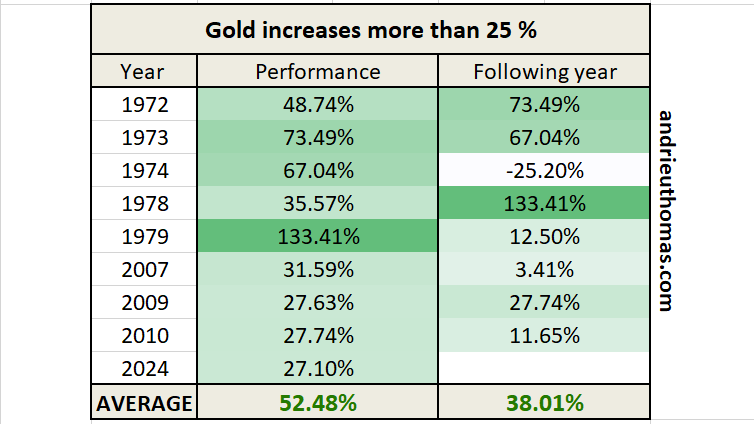

Since 1970, the price of gold has only recorded an annual performance in excess of +25% on nine occasions! In other words, the empirical “probability” of gold rising by +25% over a year, independently of any cyclical dynamics, is 16%.

What's more, almost 90% of the years in which the price of gold rises by more than +25% are followed by another year of increases. In other words, an annual increase of more than +25% in the price of gold is often a sign of momentum, leading to a more sustainable uptrend for the following year. The average rise over the following year is +38%, or +25% if we exclude the exceptional rise of 1978. This average performance falls to +13% if we disregard the highly volatile 1970s.

This statistical observation leads us to be rather optimistic about the trajectory of the gold price in 2025. However, this observation contradicts the 9-year and 16-year cycles. The 8/9-year cycle suggests stagnation, or even a fall in gold to levels between $2,400 and $2,500 an ounce (-8.5% at this stage of the cycle). Nevertheless, the 16-year cycle suggests an average rise of around 10% at this level of the cycle (+8% to +11% in particular). From this general observation, it seems that the risk of a major downturn is excluded in 2025.

Consequently, it is possible that the continuation of bullish momentum could support an increase of around 10%. Such an increase could target new highs around $2,900, or even $3,000, over the course of the year. In the opposite case, i.e. a moderate rebound in inflation, with less marked rate cuts and continued growth, the loss of momentum is likely to lead to stagnation.

Major banks see gold price at $3,000

Most banks, with the notable exception of JP Morgan and a few others, missed gold's sharp comeback in 2023 and 2024. What's more, the year 2024 marks significant buyer flows. In fact, investment demand more than doubled in the space of a year! At the same time, demand from central banks remains at a very high level, although the pace of gold purchases has moderated.

The return of investors, absent since 2022, also shows that the rise in the gold price is sustained. These purchases may be motivated by speculation (ETFs, short duration, etc.) or by the search for protection in a tense geopolitical context, with economic risks looming in late 2025/early 2026. Thus, major banks such as Goldman Sachs and JP Morgan anticipate a gold price of $3,000 in December 2025 (and $38 for silver). Similarly, UBS sees gold at $2,900 by December 2025. These forecasts would be in line with our previous analysis.

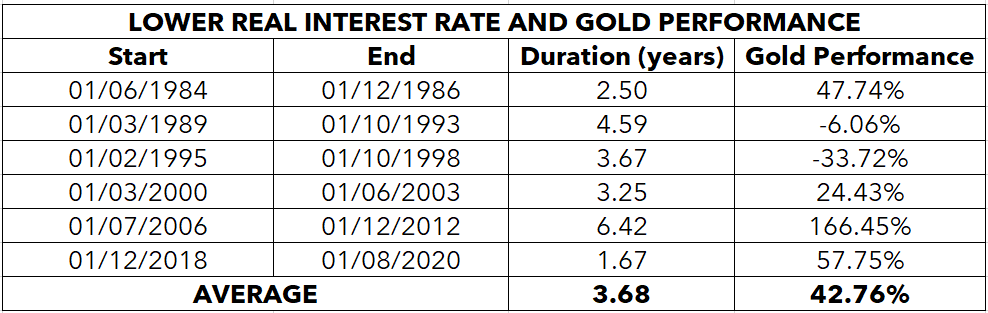

Finally, a decisive factor in the rise of the price of gold is the fall in real interest rates. At the start of 2024, we pointed out that a fall in real interest rates lasts an average of 3.6 years (which is also the length of the short economic cycle). Thus, we pointed out that “a 20% to 30% rise in the price of gold would propel the price of the yellow metal to $2,500 and $2,700 per ounce. Similarly, a performance of 40% over four years would set a target of nearly $3,000 an ounce for 2027/2028”. In fact, falling real interest rates are often a key factor in the rise of the gold price. On average, the price rises by +40% in the three and a half years when interest rates fall. A rise of +27% in 2024 would therefore leave a potential of around 10% to complete this movement.

Neglected mining companies?

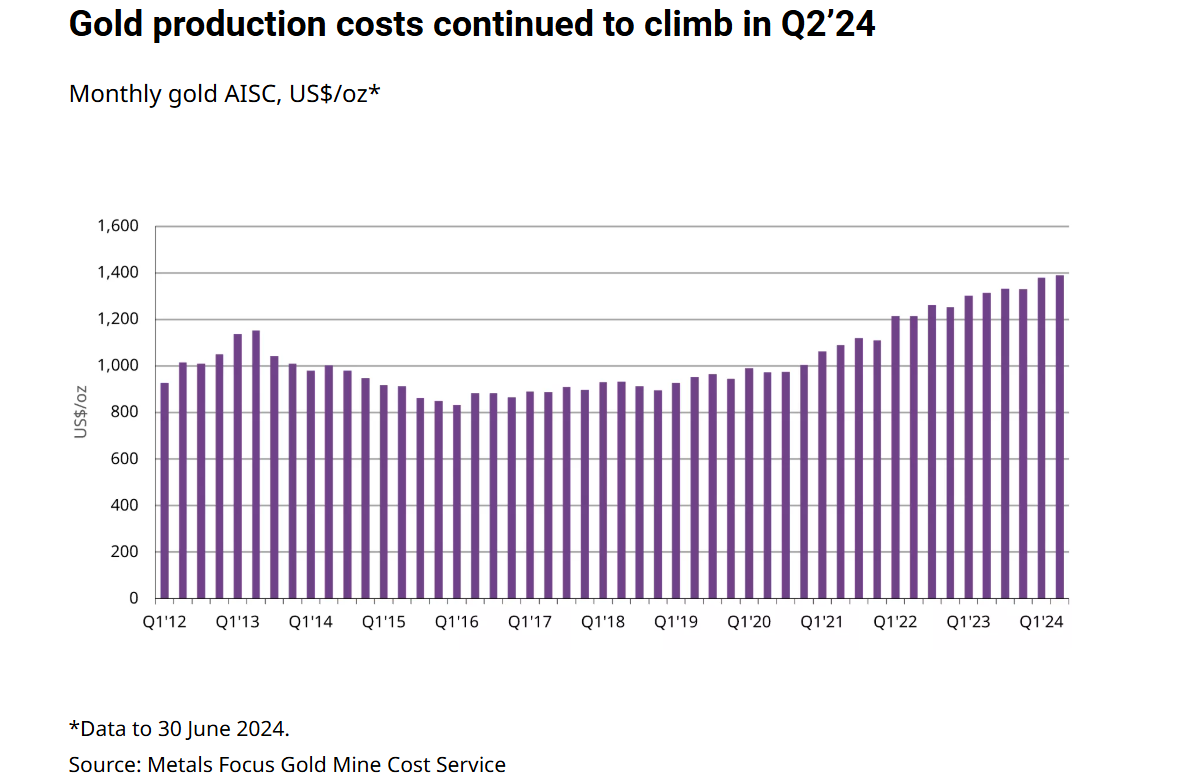

According to data from the World Gold Council, the cost of producing an ounce of gold has climbed significantly, reaching almost $1,400 in the summer of 2024, up 6% year-on-year. This corresponds to a “fundamental price” for gold of between $2,100 and $2,250 in June 2024. A further rise in production costs in the second half of 2024 could therefore justify current gold price levels.

In other words, the cost of producing gold is rising faster than inflation. This suggests that the adjustment in the price of gold must be at least as great as the inflation in costs in order to satisfy a still sustained demand. In the long term, we know that the gold production cost is the determining factor, and accounts for most of the eternal metal's value.

Conversely, higher production costs do not necessarily benefit mining companies, as they too face rising costs. What's more, the stagnation of the gold price between 2020 and 2024 has weighed on mining companies' profitability, while their costs have risen.

Risk of technical overheating?

On October 30, 2024, we signaled the risk of a peak in the gold price due to the record number of open contracts on the derivatives market. This signal confirmed a peak in the gold market on the same day, followed by a correction of almost 8%, mainly due to the easing of volatility on the markets following the re-election of Donald Trump.

L'intérêt ouvert sur le marché de l'or est à son plus haut depuis 2020 et 2016 (surchauffe technique sur les contrats ouverts ?). https://t.co/HuTfVPZyIj pic.twitter.com/sts5MGN98c

— Thomas ANDRIEU (@ThomasAndrieu_) October 30, 2024

As a matter of fact, the gold market recorded a level of derivatives activity as high as in 2020 (major peak) or 2016 (major dip). It's possible that we'll see the same kind of signal in 2025, given that the return of investors makes the market particularly sensitive to any variation in interest and volume.

Source : Commitments of Traders (COT) Charts - Barchart.com

From a long-term perspective, the price of gold is testing the top of its very long-term channel (logarithm), and almost the top of its long-term channel (since 2014). Note that the real value of gold (adjusted for inflation) is on the verge of reaching an all-time high (surpassing the 1980 peak of $2,750 per ounce in today's dollars). A sustained breakout of the gold price above this level would appear to be an important signal in the history of the precious metal. Similarly, a return of gold to its levels of 10 years ago seems utopian today, given the very high production costs facing mining companies.

Conclusion

Gold's average performance since 1978 is +6.3% p.a., with a volatility of +16%. A very reasonable performance for a measured risk, lower than that of stock market indices. However, some years can show exceptional performances, close to +30%. In this respect, 2024 will go down in history as a record year for the yellow metal.

For the third year running, our gold price forecast has proved correct. Applying the same methodology, the most likely scenario for 2025 is for gold to rise by an average of around 10%. This would push the gold price close to the symbolic $3,000 threshold, also monitored by most major banks. Nevertheless, this hypothesis is highly dependent on momentum, and more specifically on investor interest and the state of the economy. In the case of a pullback scenario, it is possible that gold could retreat by 8% on the basis of the 9-year cycle. But the hypothesis of a sharp decline in the gold price seems unlikely in a context of steadily rising production costs since 2016.

Traditionally, the main factors driving up the price of gold are falling interest rates, rising geopolitical risks and recessions at this stage of the cycle. Last but not least, persistent structural inflation is helping to drive up production costs, which in turn is boosting gold's value.

Further decryption would inevitably lead us to the conclusion that gold remains true to its constancy.

After all, as Lao Tzu said, "gold and jade fill up the room. No one is able to protect them"…

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.