While gold has been the big winner in recent years, many other metals are now becoming increasingly scarce. Rising demand for metals is mainly driven by the energy transition (electric vehicles, photovoltaic panels), electronics, data centers, artificial intelligence and communications networks.

At the same time, the growing difficulties associated with mining production, whether due to geopolitical, environmental or technical constraints, are fuelling a structural deficit between supply and demand, exerting sustained upward pressure on prices. Over the past five years, silver, platinum and copper prices have risen by +110%, +26% and +70% respectively.

These performances have common causes: growing industrial needs and production that is struggling to keep pace. Growing demand for these metals is thus leading to a structural readjustment of the market. Let's take a look at the fundamentals of a market under pressure, and the outlook for the coming years.

Increasingly rare metals?

Silver and platinum have one major thing in common: supply is no longer able to satisfy ever-increasing demand. However, prices for these metals are struggling to maintain a sustained upward trend, which is not providing mining companies with sufficient incentive to increase production. Meanwhile, demand for copper is set to grow structurally over the next few years, driven by the energy transition. Although the reddish metal remains relatively abundant today, supply tensions could intensify in the medium term.

For investors, silver offers several advantages. Despite being more volatile than gold, it offers a faster and more pronounced upside potential during phases of economic recovery. However, unlike gold, silver and platinum are highly sensitive to economic cycles and industrial demand. It therefore makes sense to invest in these metals when economic conditions are favourable and demand is expanding.

Platinum, on the other hand, represents an interesting compromise between precious and industrial metals. Demand is more diversified than for palladium, with less dependence on the automotive industry. In terms of production, silver and copper are mainly mined in Latin America, while platinum production is highly concentrated in South Africa.

It should also be remembered that silver is mainly a mining by-product (secondary production), often mined alongside zinc, gold, etc. This characteristic limits producers' ability to adjust their production to the demand for silver. This geographical concentration of production, combined with low supply elasticity, creates the risk of lasting shortages on world markets, particularly for silver and platinum. And this dynamic is set to continue in the years ahead.

The outlook for silver in 2025?

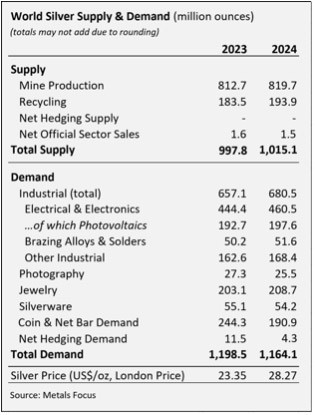

According to the Silver Institute, the silver market is set to record its fifth consecutive annual deficit in 2025, albeit a slightly reduced one. Global demand is expected to fall slightly to 1.15 billion ounces, while supply is expected to increase by +1.5%, “limiting” the deficit to around 117.6 million ounces (Moz). This imbalance is largely due to industrial demand, which is currently the main driver of the market.

Source: Silver Industrial Demand Reached a Record 680.5 Moz in 2024

In fact, over 60% of silver is used in industry, notably in solar panels, electronics and semiconductors, where it remains the best conductor available, as well as in industrial batteries and sensors.

In 2024, silver demand for industry reached a record 680.5 Moz, up +4%. It is set to grow by a further +3% in 2025, crossing the 700 Moz threshold for the first time. This momentum is driven by silver's growing role in green and digital technologies: solar, electric vehicles, 5G, data centers and artificial intelligence. The Silver Institute points out that global photovoltaic installations should themselves reach a new record in 2025, mechanically supporting demand. Last year, silver demand for photovoltaic panels accounted for almost 17% of all metal demand.

On the supply side, world mine production rose slightly in 2024 (+0.9%) to 819.7 Moz, with recycling up +6% to 193.9 Moz. This is the highest level for twelve years. However, these factors do not offset global demand, which, although down slightly (-3%) to 1.16 billion ounces, remains driven by industrial uses.

As a result, silver prices are likely to continue to trend upwards in 2025. Nevertheless, the sensitivity of silver demand to economic activity could entail certain risks. In the opposite case, a return to demand for jewelry or investment could unbalance the market and encourage a new wave of price rises, in addition to the high level of demand for industry.

Platinum is in short supply

Like silver, the platinum market is also experiencing a structural deficit. Rarer than gold, platinum is produced at just 170 tons a year, 70% of which comes from South Africa. The metal's high geographical concentration makes it particularly vulnerable to logistical, geopolitical and climatic risks.

In 2025, global mine production fell by 13% in the first quarter, due to severe weather conditions in South Africa, and South African refined production declined by 10%. Moreover, global platinum inventories are also limited and steadily declining: they are estimated at 2.16 million ounces in 2025, down 31% on 2024. This represents less than three months' supply of global demand. Against this backdrop, a supply shock could quickly cause prices to soar.

It should also be noted that the platinum market is highly fragmented:

- 38% of demand comes from automotive (catalysts)

- 27% from jewelry

- 27% from industry

- 8% from investment

By 2025, global demand should reach 7.96 Moz, down -4%. Automotive demand could fall slightly (-2%), due in particular to the decline in diesel and the rise of electric vehicles. Jewelry demand is expected to increase by +5%, to 2.1 Moz, driven by India and China. On the other hand, industrial demand is expected to fall sharply (-15%), particularly in Asia (glass and chemical industries).

Consequently, the drop in interest in platinum is offset by mining difficulties. Further production difficulties in Africa, or an upturn in industrial demand, could support a rise in the platinum price, which is rather volatile.

Copper, a metal of the future?

Each electric vehicle requires an average of 83 kg of copper, compared with around 23 kg for a combustion-powered vehicle. Added to this are power grids, data centers and batteries, which amplify the pressure on demand. Against this backdrop, the International Energy Agency (IEA) anticipates a 30% shortfall in global copper supply by 2030, due to the slow pace of mining development. In fact, it takes around ten years on average from exploration to production.

At the same time, supply remains highly concentrated: almost 70% of the world's copper production comes from five countries: Chile, Peru, China, the Democratic Republic of Congo (DRC) and the United States. This geographical concentration makes demand vulnerable. For example, Chile, the world's leading producer, has seen its production fall by 2.5% in 2024, while the DRC faces persistent political and energy tensions.

Nevertheless, the International Copper Study Group (ICSG) forecasts an overall surplus of refined copper for the years 2025 and 2026, breaking with previous deficit trends. This surplus is estimated at 289,000 tons in 2025, rising to 209,000 tons in 2026. This turnaround is explained by an increase in supply, while demand is slowing down, notably due to trade tensions and an economic slowdown in China.

In detail, global copper mine production is expected to grow by +2.3% in 2025, to around 23.5 million tons (Mt), driven by the ramp-up of Kamoa-Kakula (DRC), Oyu Tolgoi (Mongolia) and Malmyz (Russia). In 2026, growth could accelerate slightly to +2.5%. On the demand side, ICSG forecasts growth in apparent utilization of +2.4% in 2025, slowing to +1.8% in 2026.

Can the trade war destabilize the market?

We have shown that the demand for silver is mainly driven by industry. The main risk to this demand therefore lies in the possibility of a global economic slowdown, or in the growing trade tensions between the major powers.

China, the world's leading manufacturer of photovoltaic and electronic products, occupies a central position in the industrial value chain and in demand for silver. An increase in tariffs on Chinese imports by the United States, or retaliatory export restrictions by Beijing, could significantly dampen industrial demand for silver and lead to increased price volatility.

For copper, the situation is even more critical. The United States imports over 44% of its copper, much of it from strategic regions indirectly linked to China, such as the DRC, Chile and Peru. Faced with the threat of a 10% import tax, US refined copper imports jumped to 200,000 tons in April 2025, totaling 455,000 tons over the first four months of the year, more than double the figure for the same period in 2024.

This anticipatory movement, motivated by the fact that import costs remain lower than the feared tax, has unbalanced the world market, creating localized shortages outside the United States. Once U.S. inventories have been filled, the introduction of tariffs could end up generating no significant tax revenue, while keeping global supply under pressure.

The introduction of such taxes would therefore have an essentially inflationary effect. These metals are essential to the functioning of the economy. Thus, a trade war or recession may dampen certain components of demand in the long term, but given their essential and predominantly imported nature, it is more likely that such tensions will lead to a rise in the price of these metals in the USA, rather than a collapse in global demand.

Metals to rebound in 2025

Since the beginning of the year, silver prices have risen by +25%, copper by +17% and platinum by +33%. As we have pointed out, this momentum is based on structural production shortfalls for silver and platinum, and sustained industrial demand for copper.

On closer examination, it is clear that silver and platinum prices are still below their historic highs of 2011, unlike gold, which has already broken through its record highs. Thus, the potential for catching up remains significant: silver could still rise by almost +40% to regain its peak of $46 per ounce, while platinum has a theoretical potential of +90% from its last peak. Copper, meanwhile, is now sustainably above its 2011 levels, reflecting its increasingly central role in the economy.

In 2025, the underlying trend for metals remains favourable. A sustained breach of the $34 mark for silver, as well as consolidation above $1,300 for platinum, could confirm this upward momentum. However, risks remain: a global economic slowdown or an intensification of trade tensions could put the brakes on this surge. At the same time, the fact that copper is holding above its 2022 record high reinforces the idea of a new cycle of sustained high prices, based on structural demand.

Conclusion

The dynamic is set to intensify for many metals in 2025: silver, platinum, copper, etc. This trend is based on both persistent tensions on the supply side and structurally high demand. Neither trade threats nor the risk of recession appear, at this stage, to be dampening market prospects. On the contrary, the year 2025 confirms a gradual and lasting reallocation towards strategic metals. Are metals the new black gold of tomorrow? That's the big question.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.