How does the price of gold coordinate the players in the gold market? Investors, miners, central banks, funds, individuals, etc. How has the behavior of each of these agents been historically influenced by the price of gold? This question is rarely asked by market specialists and yet deserves to be explained. In effect, we can see that the price of gold has a significant influence on the behavior of market players, and vice versa.

Throughout this article, we will show that an increase in the price of gold generally induces:

- A significant increase in investment demand.

- A large variation in demand from ETF funds.

- A decrease in demand from central banks.

- A decrease in the amount of gold mined.

- An increase in the supply of recycled gold.

Gold market elasticities: the power of scarcity

Beyond the structure of gold supply and demand, it is important to relate the evolution of supply and demand to the price of gold. Indeed, an increase in the price of gold will not be the same if it is generated by an increase in demand from central banks, or by an increase in investment demand from individuals and professionals. Similarly, the supply of gold will have a very different impact on the price of gold depending on whether it is an increase in the quantities of gold mined or resales of physical gold.

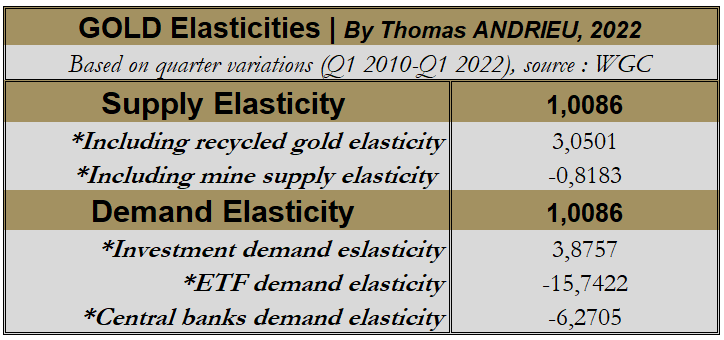

In microeconomics, elasticity is measured to assess the change in demand or supply for a 1% change in the market price. In the table opposite, we have compiled all the detailed data on the supply and demand of gold in an exclusive way. We have then made the relationship between the evolution of certain types of demand, and certain types of offers, in relation to the variation of the price of gold. This gives us the table of (average) gold elasticities for the period 2010-2022.

As a reminder, the elasticity is read as a function of one. If the elasticity ratio is greater than one, it means that a 1% increase in the price of gold leads to a greater than 1% increase in the demand or supply under consideration. Also, an elasticity between zero and one will mean a smaller increase in supply or demand for a 1% change in the price of gold. Conversely, an elasticity ratio of less than zero will mean a decrease in supply or demand for a 1% increase in the price of gold.

Thus, supply and demand are always in equilibrium. It should therefore be noted that an increase in the price of gold leads to an almost similar increase in supply on the one hand and demand on the other. But the detailed study of elasticities reveals the true nature of gold, and the mechanics that drive the players in this market.

The sensitivity of the demand for gold...

So how does the demand for physical gold react to the price of gold? Globally, a quarterly increase of 1% in the price of gold leads to a similar increase in demand. But there are irrefutable differences in the behavior of the various demands. Thus, we have selected three major types of demand: investment demand (coins and bullion), demand from ETFs and the like, and demand from central banks.

We then observe quite marked behaviors of each type of gold demand:

- Investment demand. Demand from investors in physical gold has averaged 30% of all demand since 2010. The elasticity of investment demand is particularly high (e = 4). This means that, on average, a 1% increase in the gold price will translate into an increase of almost 4% in investment demand. Conversely, investment demand falls four times faster than the gold price during periods of falling gold prices.

- ETF demand. ETF demand is not a significant demand in the gold market (just 3.6% of physical gold demand on average). However, the influence of different funds in relation to the gold price speaks for itself. The elasticity of demand for ETFs (and similar) is indeed considerable (e = -15.75). In other words, a 1% increase in the price of gold will result in a decrease of almost 16% in demand from ETF funds. The measurement of the elasticity of ETF demand should be taken with caution, however, because ETFs can sell gold (negative demand). However, the influence of these funds becomes important on the gold price as the variation of ETF demand is very volatile.

- Central bank demand. Central bank demand is about three times the demand for ETF funds (more than 10% on average over twelve years). Overall, it is quite rare for central banks to sell gold. In fact, this has only happened twice since 2010, in the last quarter of 2010 and more recently in the third quarter of 2020. Clearly, "central banks sell a little gold every ten years". Nevertheless, the measured elasticity is very interesting (e = -6). Therefore, a 1% increase in the price of gold will generally result in a decrease of more than 6% in central bank demand. Conversely, central banks generally increase their redemptions when the price of gold decreases.

The sensitivity of the supply of gold...

The same study can be done on the supply of physical gold. The supply of physical gold is simpler, and is broadly divided into two types. On the one hand, 75% to 80% of the physical gold supply comes from the mines. The remaining part is the supply of recycled gold. The study of elasticities is therefore extremely important to determine the evolution of the profitability of mining companies or the presence of a "surplus" of supply.

- First, with respect to the mining supply. Mining supply has a lot of market power. And it is likely that a significant rise, or even a major collapse in the gold price, could only occur if there were a major shock to mining supply. Moreover, the elasticity of mining supply measured between 2010 and 2022 is, quite noticeably, negative (e = -0.82). That is, a 1% increase in the price of gold generally leads to a 0.82% decrease in mining supply. However, this relationship is not very strong. The mining supply has thus increased from about 700 tons per quarter in 2010, to nearly 800 tons in 2015, and 900 tons in 2020. Moreover, we know that the price of gold is globally correlated to its mining production cost. In this sense, it is more likely that the rise of gold over time is initially due to an increase in production costs followed by a reduction in supply, and finally, the sustainable increase of the gold price.

- Next, we can consider the behavior of the recycled gold supply. It appears that an increase in the price of gold results in an average increase of three times the supply of recycled gold (e = 3). Also, this reflects the selling interest that some individuals or companies may have in selling their gold as soon as a rise in gold price occurs. Therefore, it also means that sellers do not necessarily look at the selling price in the long run. Indeed, a very rapid increase in the supply of recycled gold, for a lesser increase in the price of gold, shows that prices are less important to sellers who prefer to look at the general trend. Often, selling gold becomes a liquidity imperative (need to sell gold for cash).

Phenomena of compensation of the players

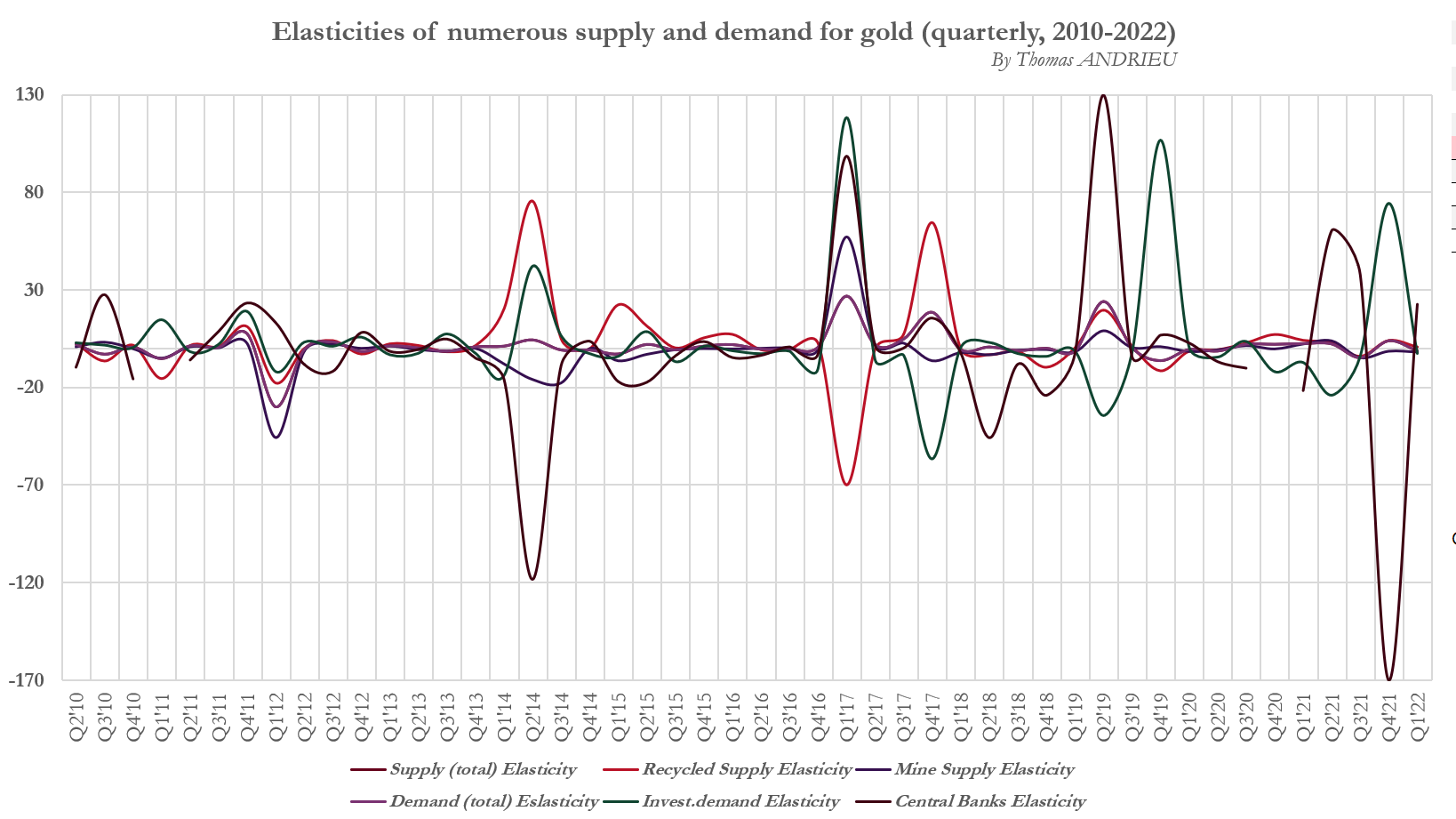

Finally, let's look at an interesting phenomenon... The compensation of the behavior of the players in the gold market. In the graph below, we have represented the evolution of the different elasticities. In other words, we have represented the evolution of the sensitivity of the supply or demand of agents according to the price of gold. Thus, we can see that a change in the behavior of certain market players (miners, central banks, recycled gold, etc.) will often result in a similar change in the behavior of other players.

For example, the elasticity of the supply of recycled gold evolves in a way that is globally inverse to the elasticity of demand from central banks. That is to say that a stronger increase in the supply of recycled gold in a bull market will certainly translate into a stronger reduction in the demand for gold from central banks. There is therefore a compensating phenomenon: the abnormal behavior of the supply of recycled gold translates into abnormal behavior of central banks. The same phenomenon can be observed with many players. In 2016, recycled gold supply reversed its behavior (capitulation), as did mining supply and central bank demand. At that time, gold sellers were increasing supply as the price fell, which was abnormal and signaled a change in psychology. Only such large changes in behavior can drive a powerful trend.

In general, elasticity undergoes an extreme type of behavior. Most of the time, the behavior of gold market agents is "normal" and regular. Then, exceptionally, agents experience large changes in behavior. An elasticity that is too high is therefore less relevant for measuring the behavior that would be usual among agents. This is the case, for example, with the very high elasticity of demand for ETF funds.

In conclusion

In short, the gold price appears to be a means of coordinating the players in the gold market. The exclusive study of elasticities, which measure the sensitivity of supply or demand to the gold price, allows us to draw several conclusions. First of all, an increase in the price of gold generally leads to a strong increase in investment demand, a great instability in the demand for funds which can produce large price variations, but also a more or less marked decrease in demand from central banks. On the supply side, an increase in the price of gold generally implies a slight reduction in mining supply, as well as a fairly marked increase in the supply of recycled gold.

In this sense, an increase in the price of gold in the long term is only possible if mining production costs increase, if holders of gold hold it permanently, or if investment demand increases. Moreover, it appears that certain players such as central banks or ETF funds can influence, sometimes quite significantly, the price of gold in the short or medium term.

Finally, an interesting conclusion is that gold sellers are willing to sell their gold without necessarily looking at the price. Gold buyers accumulate gold when it goes up. This explains a lot of the bullish behavior of gold over the very long term! In literary terms, this tells us a certain truth that shines through: gold is generally priceless in the eyes of those who own it.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.