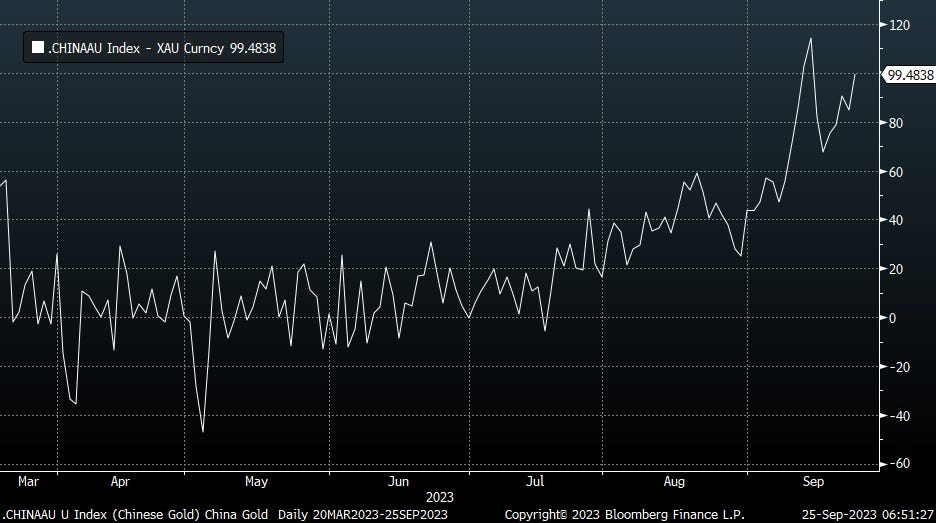

This week's chart shows gold prices in Shanghai. It illustrates the explosion of the premium on gold in China, and therefore the gap with prices quoted in London:

The price of gold falls in London while it rises in China. The divergence reported in my last article continues this week.

The Chinese gold and precious metals market seems to be following its own trajectory.

It has to be said that we are dealing with two distinct markets:

In the West, the precious metals market is almost entirely dominated by the "paper" market, where futures market participants determine the price of gold and silver through highly leveraged positions. The physical market plays virtually no part in price discovery mechanisms.

Institutional investors' exposure to precious metals is at its lowest level for the past forty years.

When they are exposed to gold, managers generally do so via derivatives, certificates or other ETFs, but rarely in the form of physical gold or silver.

A few individuals hold physical metals, but even the retail market is much less exposed to gold in Western countries than in Asian countries.

The number of individuals owning physical gold in Europe and North America is relatively low compared to previous generations.

In China, buying gold takes on a whole new meaning.

Last June, the People's Bank of China (PBOC) quietly launched a significant initiative, largely ignored by the media.

This initiative enables Chinese citizens to easily convert their renminbi savings, deposited in a bank account, into physical gold. The aim is to encourage a wider section of the Chinese population, including those on lower incomes, to invest in gold and silver bullion.

The Chinese can therefore create an account combining gold and yuan, and thus benefit from great flexibility in terms of yuan withdrawal, physical delivery, gold storage in warehouses, as well as gold purchase/sale operations.

The PBOC is extending its efforts to include millions of small clients who currently have little or no exposure to gold.

The Shanghai Gold Exchange (SGE), operates through price discovery based on physical exchanges, particularly for gold and silver. This pricing mechanism is based on actual demand versus physical supply. The Chinese gold market operates on a 1:1 ratio, meaning that a contract for one ounce is fully covered by one ounce of physical gold.

Unlike the COMEX, the SGE is not a market reserved for qualified investors who are obliged to take highly leveraged exposure, and where delivery procedures are highly complex. The Chinese Stock Exchange offers very simple delivery options and requires no leverage.

There is a much more direct link between the individual investor and the available physical metal, with immediate delivery on the Shanghai market. This market has significantly increased demand for physical metal in China in recent weeks.

An article in the South China Morning Post details the recent Chinese craze for gold. One of the gold traders interviewed in the article, Qiu, explains that small, one-gram grains of gold are particularly prized by Generation Z.

Unlike previous generations, who preferred larger gold products such as bars, these young consumers are particularly fond of one-gram "grains of gold".

The relatively affordable price of this pill-shaped product encourages young people to invest in gold, many of them finding it wise to set aside a few hundred yuan of their salary to buy one grain of gold a month.

In a year's time, these young people will have accumulated an average of a dozen grains of gold. Each one-gram gold grain cost around 500 yuan ($68.57) at the beginning of the year. Today, the price has risen to around 600 yuan. For these young people, gold is more precious and more reliable than any stock!

Young couples and middle-class women prefer gold bars. Particularly popular are 10 and 50 gram bars.

According to another trader interviewed, Fang, this attraction for physical gold can be explained by growing economic and political uncertainties: gold is becoming more credible than other traditional assets, whether real estate or equities.

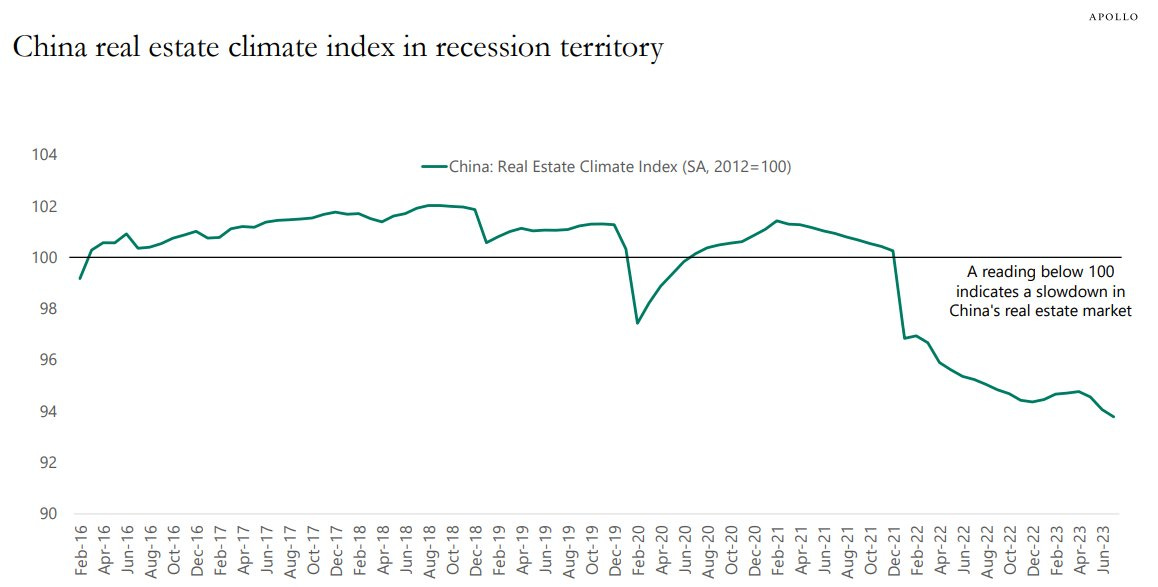

China's real estate sector has officially been in recession for a year:

The collapse of Evergrande and the arrest of its CEO have heightened fears of a downturn in China's real estate sector.

The Chinese equity market is not in very good shape either. It is at its lowest level since 2001 compared with the US markets:

Gold also has greater appeal in China due to the stock market's recent underperformance relative to precious metals. The context is very different from that in Western countries, where a significant correction in real estate and a notable decline in stock markets have yet to take place.

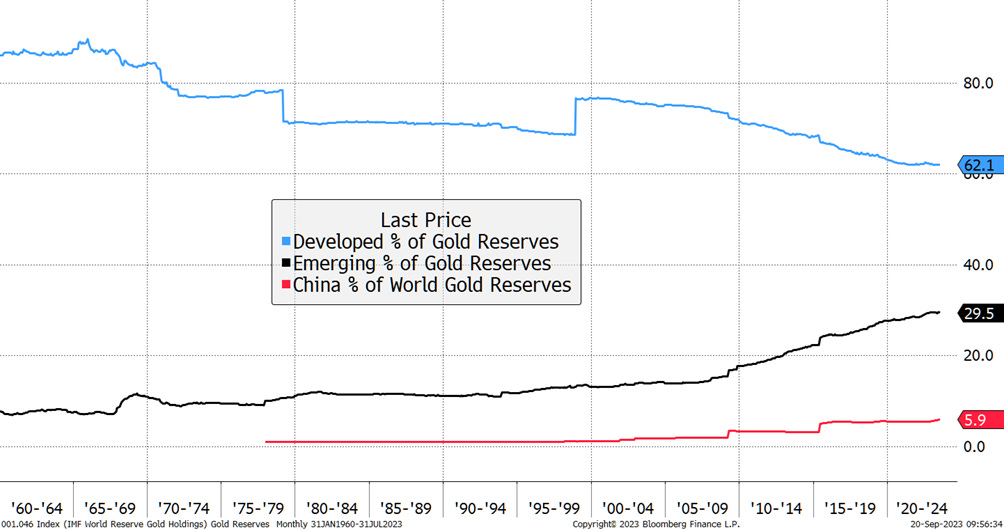

This new gold rush is transforming the yellow metal market. China's dominance is becoming increasingly evident:

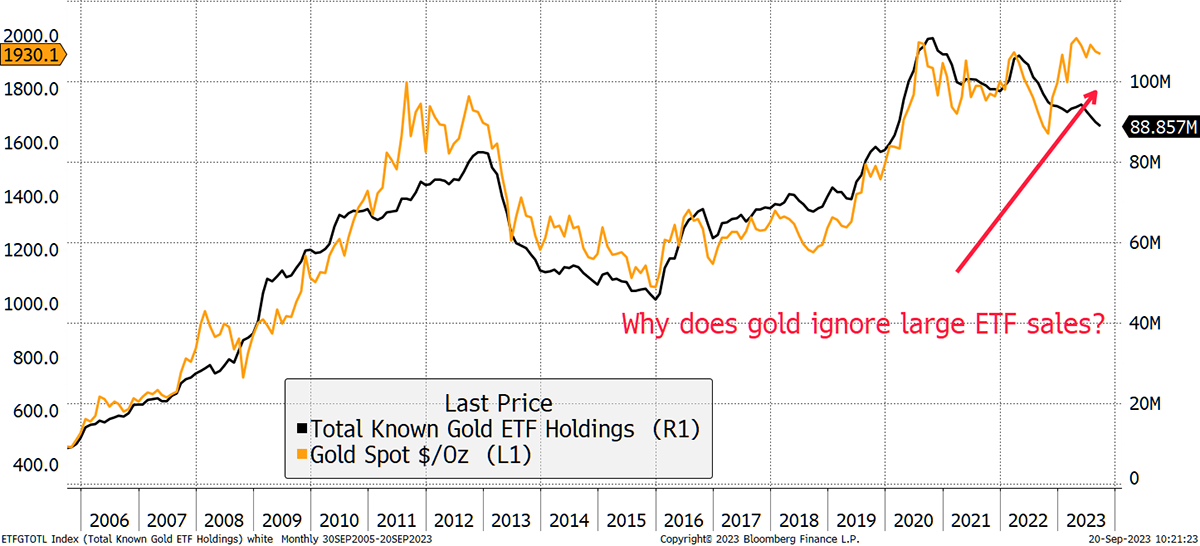

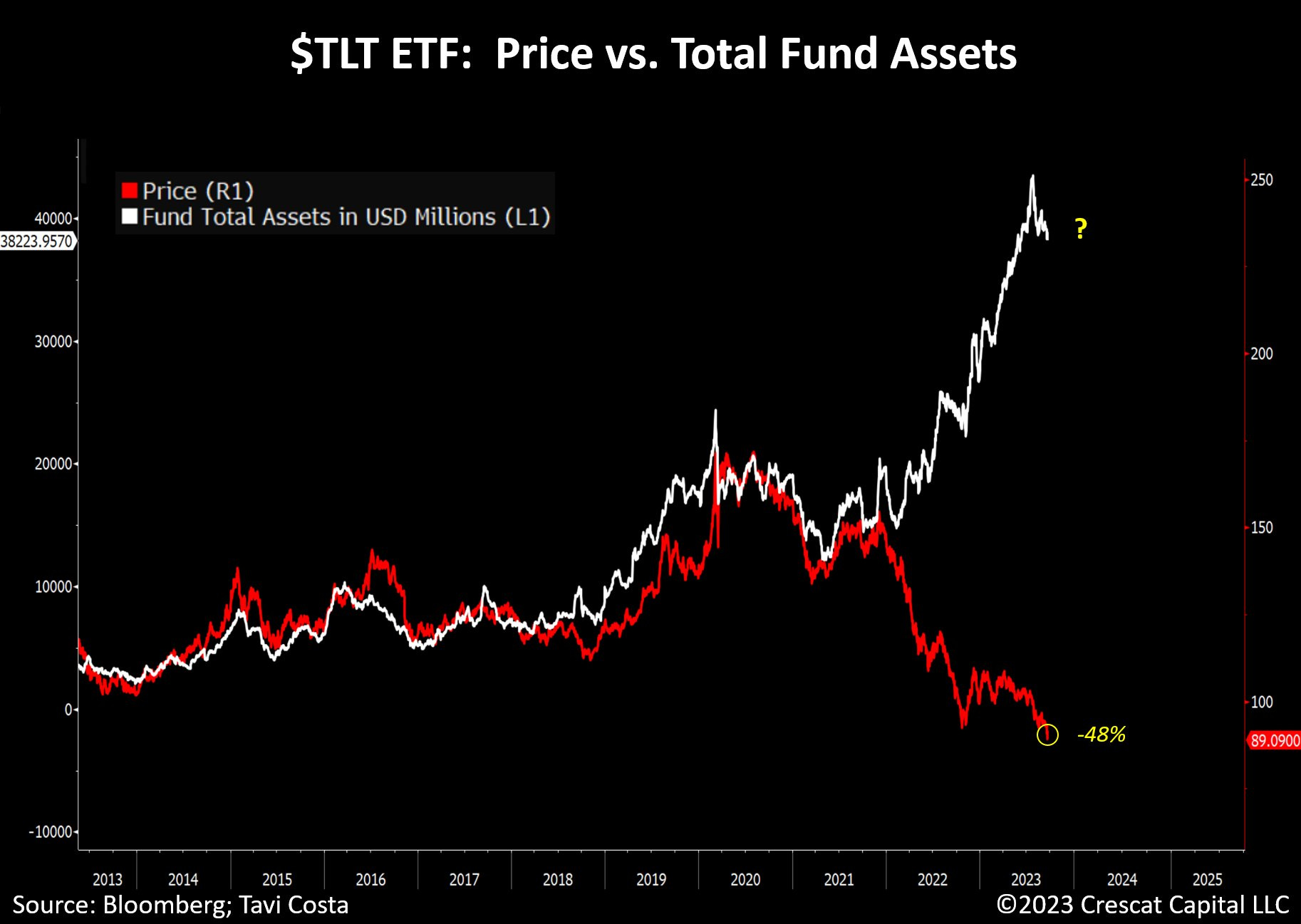

New physical demand from China is supporting gold prices, at a time when Western countries are withdrawing from ETFs. For the first time since their introduction, ETFs no longer have a direct influence on the price of gold. If the allocation of these ETFs corresponded to the price of gold, gold would be quoted at $1600:

If we combine Chinese reserves with the reserves of these ETFs, we see that this time the correspondence is respected:

Western investors dumped gold in anticipation of a rise in real interest rates, which traditionally has a downward impact on gold. They sold gold and bought a record level of Treasuries.

Problem: the rise in rates was so severe that these buyers are now stuck with huge unrealized losses!

To illustrate this situation, Otavio Costa has published a chart comparing the holdings of the TLT ETF with the performance of the index:

Losses on HTM (hold-to-maturity) assets are virtual, as their holders generally hold them to maturity.

But they now appear on institutions' balance sheets.

The SVB bankruptcy revealed that in the event of liquidity problems, HTM assets become a time bomb, triggering a solvency problem. When the institution encounters liquidity problems, unanticipated losses have to be recorded, and it finds itself forced to sell these assets.

HTM assets are moving from "Hold to Maturity" to "Hide to Maturity" status on many balance sheets!

The solvency threat facing many institutions is undoubtedly one of the main reasons why Chinese citizens are turning to the purchase of gold to protect their savings.

China Makes its Mark on the Gold Market (@julienchler)

— GoldBroker (@Goldbroker_com) May 30, 2023

▶ https://t.co/TYQAoTWuPj#China #BPoC #gold #dollar #dedollarization pic.twitter.com/yMWTSdoqjZ

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.