In my macro bulletin published last Thursday, titled, "Rate Hikes Claim New Victims", I analyzed the reasons for Blackstone's default in the real estate sector and the risk of contagion of this crisis linked to the devaluation of bonds.

Barely 24 hours after this publication, the Blackstone default was overshadowed by the collapse of Silicon Valley Bank (SVB), the 16th largest US bank by assets.

This is an historic event, as it is not only the largest bank failure since the 2008 crisis, but also the second largest retail bank failure in U.S. history.

The collapse of SVB was a direct result of the sharp increase in interest rates that caused the bank's book value to decline.

Market risk quickly turned into credit risk, and within hours a bank run brought the bank to its knees.

Silicon Valley Bank was considered solid and had not invested in any risky instruments.

In 2021, taking advantage of a boom in client activity (tech companies and high-income individuals), SVB enjoyed a significant cash inflow. Its deposits rose from $61.76 billion at the end of 2019 to $189.2 billion at the end of 2021. This influx was so large that the bank had to make emergency investment choices. The SVB was a commercial bank and became an investment bank. The bank decided to buy more than $80 billion of mortgage-backed securities (the famous MBS, which we talked about last week with Blackstone), which it kept in its portfolio until their maturity (HTM), and without any protection (hedging).

This may seem risky today, but it was a rather prudent decision in 2021. Many other financial institutions have done exactly the same, placing MBS in an HTM compartment: a mark-to-market loss on these securities, since they are not sold before maturity, does not create a risk of loss. One may still wonder why the bank did not hedge such a large sum. Perhaps the cost of this insurance was too high... In any case, the bank is paying a high price for this risk management mistake made in 2021.

97% of these MBSs had maturities of ten years or more, with a weighted average yield of 1.56%. However, the Fed's interest rate hike in 2022 and 2023 caused the value of SVB's MBS to fall, putting the bank in the same position as Blackstone.

Why is the value of MBS falling?

Because investors can now buy long-dated "risk-free" bonds from the Fed, with a 2.5 times higher yield. There is no longer demand for very long-dated securities that pay such low yields.

This devaluation of MBS does not pose a liquidity problem as long as the SVB retains its deposits. At maturity, these securities even pay more than they cost!

So no worries, unless an event forces the bank to sell these securities.

And this is exactly what happened on Thursday...

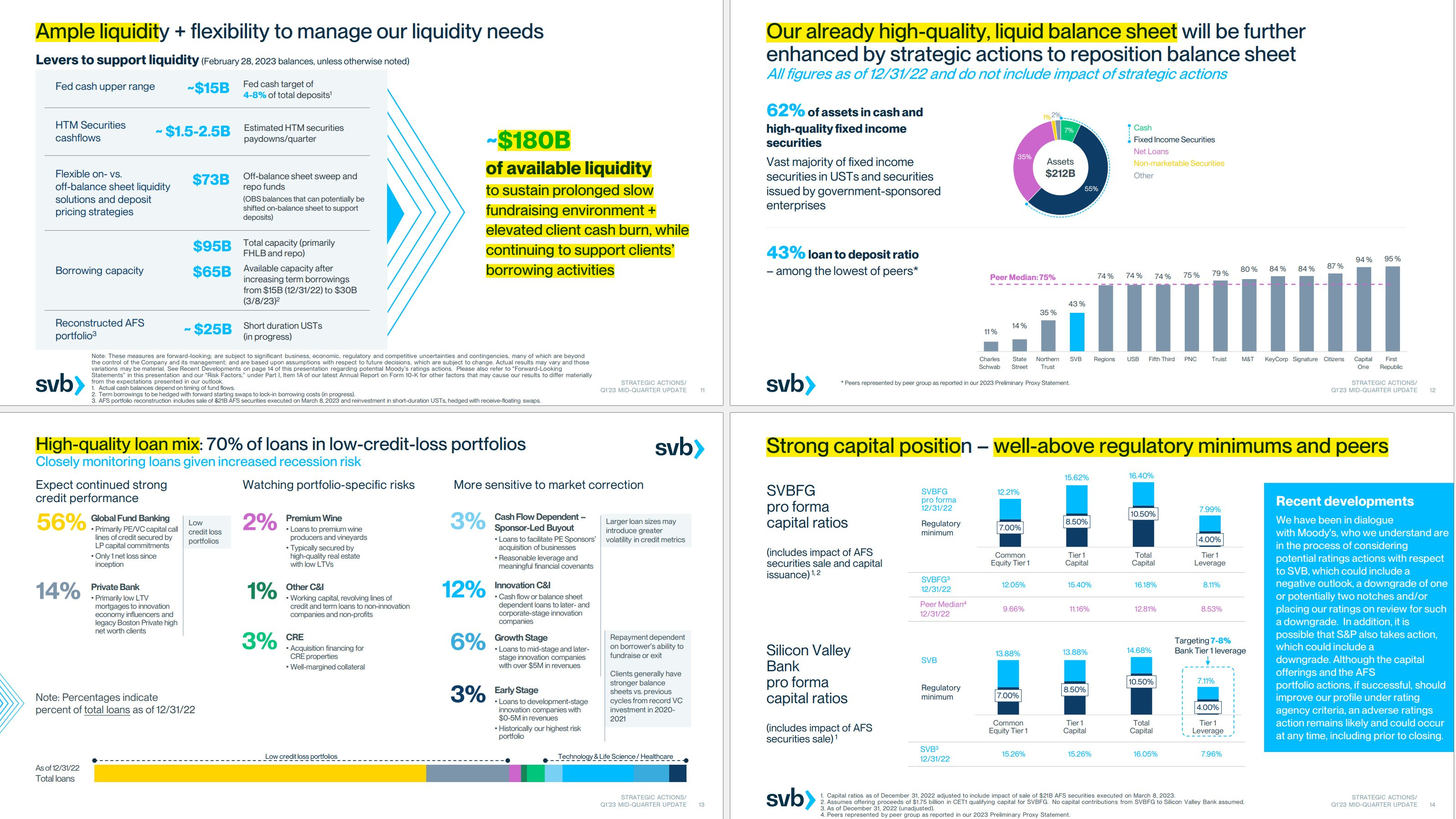

Silicon Valley Bank announced that it had liquidated $21 billion of available-for-sale securities (AFS), with a loss of $1.8 billion, as well as raising an additional $2.25 billion in equity and debt. This surprised investors, who were under the impression that SVB had enough liquidity that it did not have to sell its AFS portfolio.

The sale, which was supposed to be a simple accounting rebalancing, caused panic among the bank's clients. Within hours, the bank's solvency was called into question, particularly on social networks. Immediately after the SVB's announcement, an electronic bank run was triggered first on the online bank, before spreading to physical branches.

Contagion spreads: Desperate customers line up outside First Republic Bank to take their money out - after SVB bank collapsed and sent shockwaves through market https://t.co/tq0ZYFMElc

— GoldBroker (@Goldbroker_com) March 12, 2023

For most observers, this situation is directly attributable to Jerome Powell and the members of the Federal Open Market Committee, who contributed to the crisis by raising interest rates too sharply.

But it was the bank run that turned these "safe" assets into "risky" assets. Without the panic, there would have been no losses, because the bank could have held its MBS securities until maturity.

The situation is now critical. Shareholders will never get their money back.

The chart of Silicon Valley Bank's stock speaks for itself:

![]()

SVB stock has fallen dramatically from over $700 a year ago to around $30 today. It will hover around $0 next week. While creditors can hope to get something back, shareholders have no hope.

In this kind of situation, suppliers (institutions that have lent money or are awaiting payment for services rendered to ensure the development or operation of the bank) sometimes have a chance to be paid, but the priority of the FDIC (Federal Deposit Insurance Corporation) is to reimburse all depositors, whether they are insured or not.

In the event of a bankruptcy, the FDIC may decide to create a bridge bank to protect or possibly sell the assets. In this case, the assets are transferred to this new entity, while the rest remain in the old, failed bank. All claims are then eliminated. This is probably the preferred option. Depositors will certainly get their assets back. But the need for action is particularly urgent because SVB's clients include nearly half of Silicon Valley's high-tech companies. These companies used the bank for their day-to-day operations. Without a quick fix, jobs in America's tech heartland will be at risk.

Beyond the systemic risk to the US tech ecosystem, the bank run phenomenon could spread to the entire banking sector. Every bank that owns long-dated bonds purchased before 2021 risks suffering the same fate as the SVB in the event of a run on its deposits.

The Fed must take the risk of a bank run very seriously. The threat of a default by these banking institutions is real and the contagion effect must be taken into account. As we have seen with the SVB, social networks accelerate panic movements. And if a bank run can force a mark-to-market of these bonds, there is a lot of money to be made by taking short positions on the banks. The funds have understood this very well.... First Republic, Western Alliance, Signature, Pacwest, but also other crypto-currency related institutions like Tether, USDC are now the target of short funds.

Should these funds be allowed to plunder institutions that have only implemented prudential decisions (investing in securities deemed the safest in the market) and are now on the front lines because of a monetary policy mistake?

The Fed must show humility. It must admit the failure of its monetary policy, forget about its fight against inflation which has become secondary, open a window of financing for these securities that have become risky and lower rates to prevent the spread of bank runs.

It is urgent that the Fed act to remove this immediate risk.

The failure of the SVB shows us that everything can change in just a few hours. On Monday, the bank published a reassuring report on the state of its reserves:

The SVB was indeed not in a situation comparable to Lehman Brothers, it was not infested with toxic assets with a leverage of 31x. Without Thursday's bank run, things would have been fine for the bank.

Today, the reassuring speeches of the banks always imply the absence of a run on their deposits.

At this level of risk, buying physical gold and storing it outside the banking system is essential to protect your savings.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.