In the fourth quarter, labor costs rose by 3.2% compared to the previous quarter, while expectations were more in the range of +1.6%.

In recent months, inflation has shifted from goods and services to wages. Energy prices are falling, but inflation is spreading to other parts of the economy.

Inflation spreads from one sector to another, in successive waves. One sector leads the rise, then the others catch up. This is a classic phenomenon in an inflationary cycle.

Jerome Powell seems to have understood that the fight against inflation is far from over.

His speech to Congress was much less conciliatory than his last appearance. Every few weeks, the Fed Chairman once again muddies the waters and indicates that he will raise rates as much as necessary until he wins his battle against inflation.

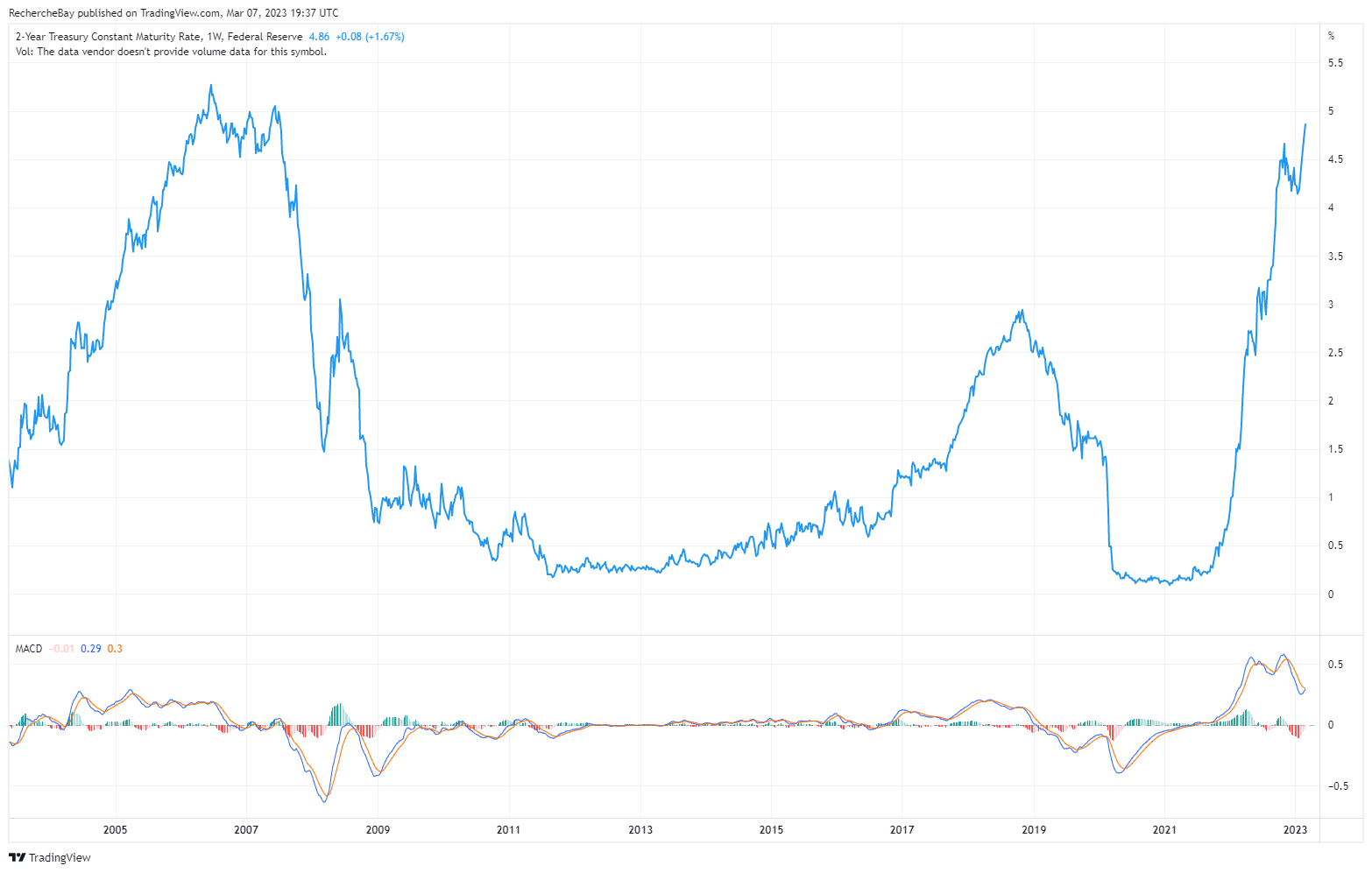

As soon as he finished his speech, rates went back to highs. The US 2-year is approaching 5%, a record level since the 2008 financial crisis:

Rates have gone from 0% to 5% in a few months!

This new rise in rates is putting pressure on the price of gold. The yellow metal is holding above $1,800, en route to its support just below that level:

The relative strength of gold is surprising in an environment where rate expectations are rising again:

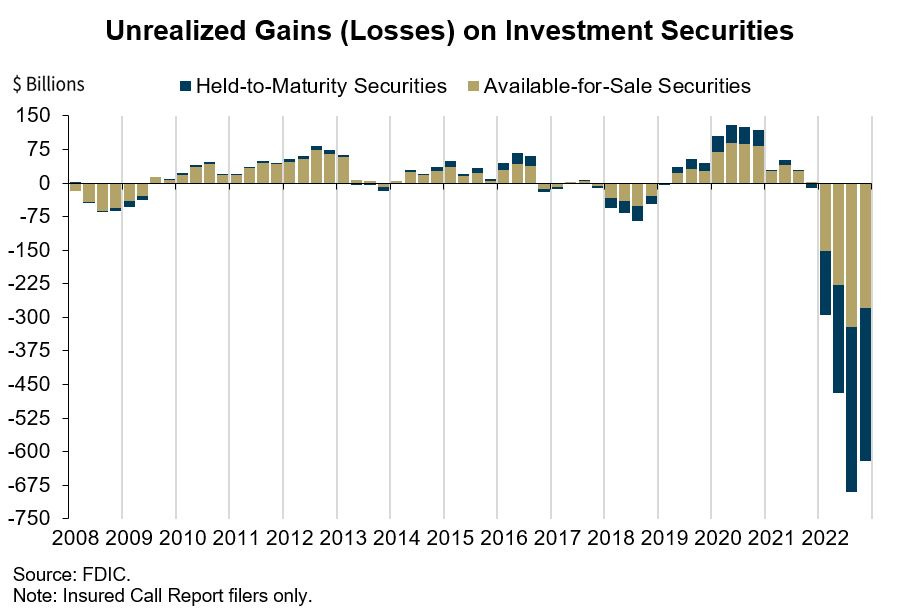

The sudden rise in rates has already caused a cataclysm in most bond securities:

These losses are already being felt in some European life insurance companies.

In the United States, Blackstone's BREIT fund is once again in the news. I had already explained the setbacks of this fund in my December 2022 bulletin.

This week we learned that prior to its decision to block withdrawals, the fund faced more than $3.9 billion in redemption requests, of which it was only able to meet 30%. New redemption requests for the $71 billion REIT fund remain completely blocked.

Blackstone is caught up in the real estate market collapse, which is not yet measured by the level of household insolvency, nor by prices. But this real estate crisis is different from 2008. This time, it is primarily affecting the solvency of holders of real estate securities caught up in the sudden rise in interest rates.

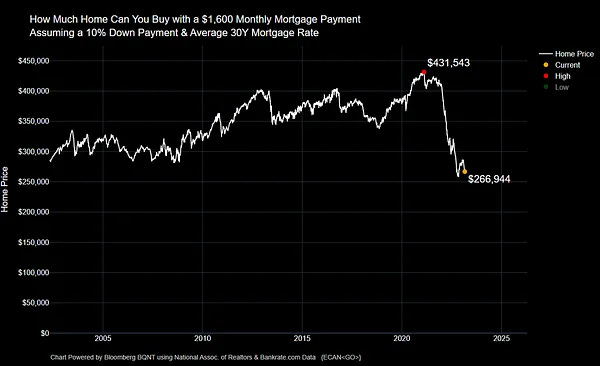

The increase in interest rates has had a strong impact on the purchasing power of American households:

As the real estate market freezes, Blackstone is unable to generate enough cash to meet repurchase requests. Properties sold by the fund are not enough to fill the capital drain, and Blackstone had to default on €531 million of commercial mortgage-backed securities (CMBS) in Finland. These securities were purchased in 2018. The real estate private equity firm is forced to preserve its cash by defaulting on debt it cannot repay. Commercial real estate is the market most affected by the industry freeze. But mortgage-backed securities (MBS) are also down sharply, and their holders are suffering substantial losses on these products.

Households are doing much better!

Most American homeowners took advantage of the low rates of previous years to refinance their property at a fixed rate. They can now pay their mortgage payments by borrowing on a risk-free CD (Certificate of Deposit), which provides them with a comfortable 5% income and allows them to pay off a 30-year mortgage they took out only two years ago at a rate of 2.5%!

Households are benefiting from the rise in interest rates, but the MBS securitized during their loan repurchases are showing significant losses. As in 2008, the banks have infected the market with products that have become toxic. And as in 2008, the presence of these products is now reducing interbank liquidity, due in particular to the decline in confidence between counterparties. That said, 2023 is not 2008. The Fed has set up a liquidity tool that allows these banks to have a "safe-deposit box" within the Fed itself, which for the time being avoids a liquidity crisis on the interbank market.

Another change from 2008 is that most CMBS products are now held by the Fed itself, which acquired almost all of them during its securities buyback operations in its Quantitative Easing phases. The Fed now holds $2.6 trillion in MBS securities! Unlike in 2008, when Americans borrowed at variable rates, the loss generated by the rise in rates is recorded in the Fed's accounts and the Fed is not obliged to record these losses in "Mark to Market". The losses recorded on these products will be added to the "deferred losses" in the Fed's books: this accounting technique allows the US central bank to defer these losses and combine them with other potential gains from the future securitization of better paying bond products. The Fed has played a premeditated role in absorbing the losses associated with the rate hike.

While households have been spared the housing crisis for the time being, the blowout explosion of the industry (real estate agents, developers, builders) will have repercussions for the entire US economy.

The recession has already hit real estate. The consumer, who has so far been resilient, will soon be hit by the impoverishment effect induced by the crisis in the sector.

The other victim of rising interest rates is the Treasury: the US is on the verge of a sovereign debt crisis. I will discuss this in detail in future bulletins.

Future negotiations on raising the debt ceiling will be heated. The ceiling will certainly be raised, no doubt about it. However, this episode will allow us to better understand the level of credit risk generated by the increase in sovereign debt refinancing.

The study of this risk is a fundamental element for our analysis of the gold market.

We'll talk about it next week!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.