American real estate is currently experiencing an even more dramatic correction than in 2007. Prices are falling at a rate not seen since the post-war period:

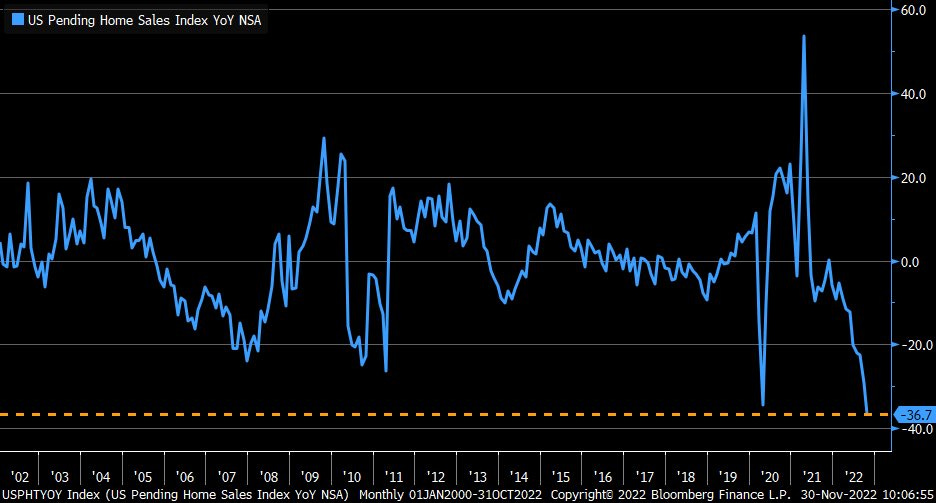

This drop in prices is accompanied by a historic decline in the number of sales, of -36.7% compared to last year:

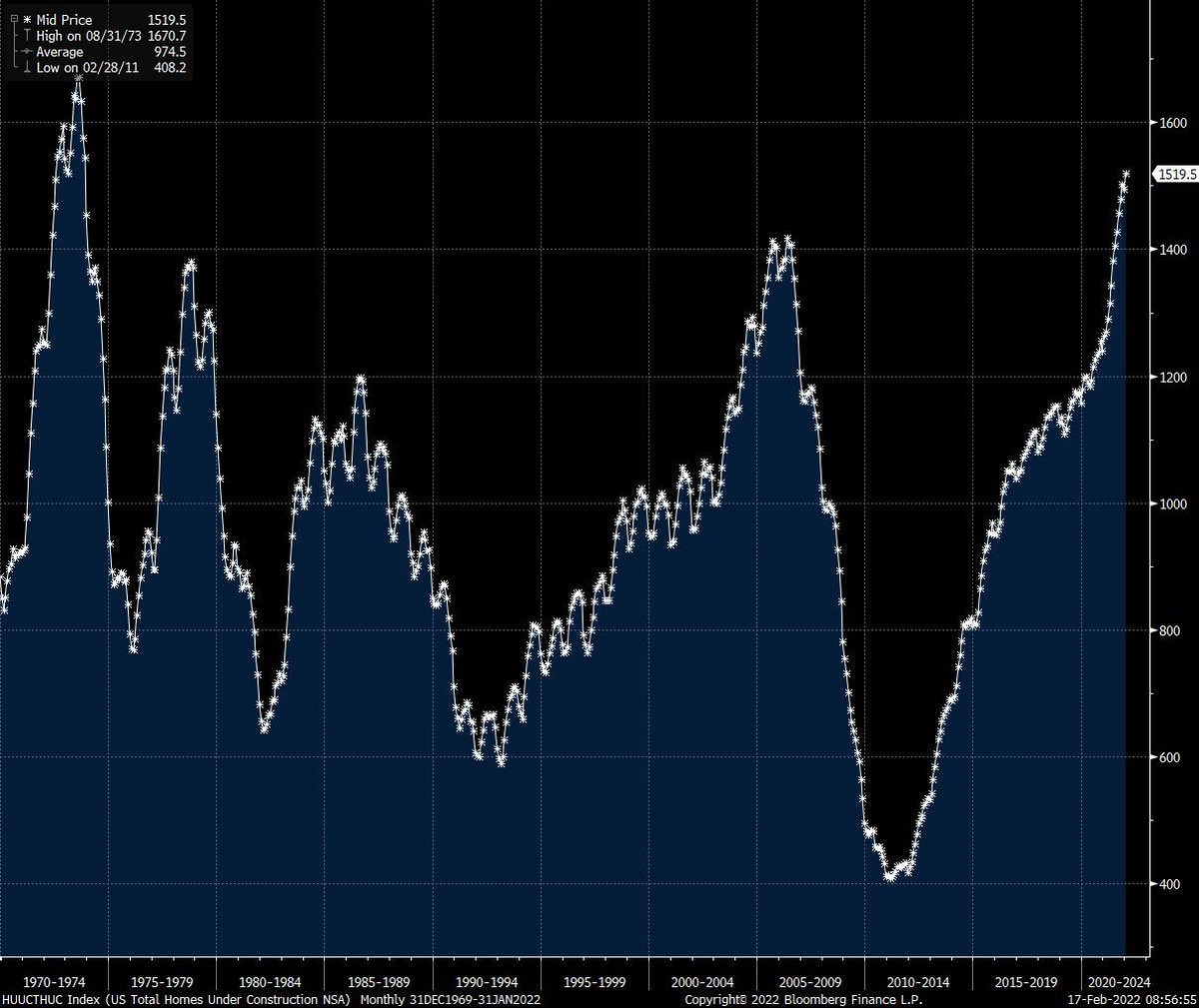

In my February 22, 2022 article, I wrote, "The inventory of homes under construction in the U.S. has not been this high since the last inflationary shock."

"Longer lead times are holding up sales and increasing future inventories, which is weighing on the sector's prospects. More and more people are buying with no down payment: the margin effect is as strong as it was in 2006, just before the last real estate crisis. Price levels are even higher than during the last crisis. As in 2006, the demand that was kept artificially high due to near-negative interest rates is fading away. Even if the desire to build one's dream home is still there, the transition from dream to project is now coming up against rising rates."

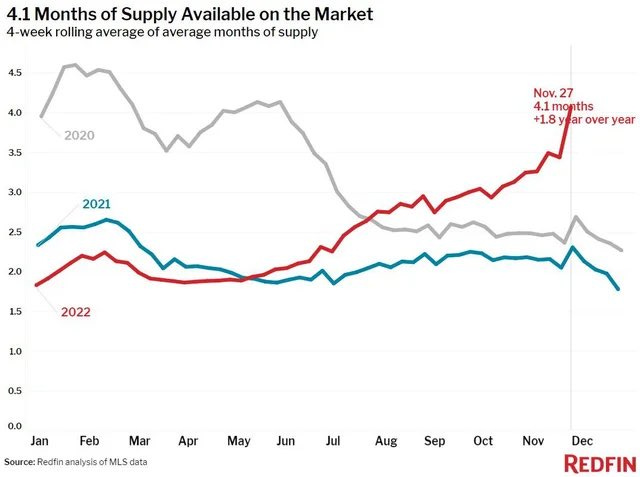

Rising rates initially impacted the inventory of properties for sale. We have now entered the liquidation phase, with a very clear impact on prices.

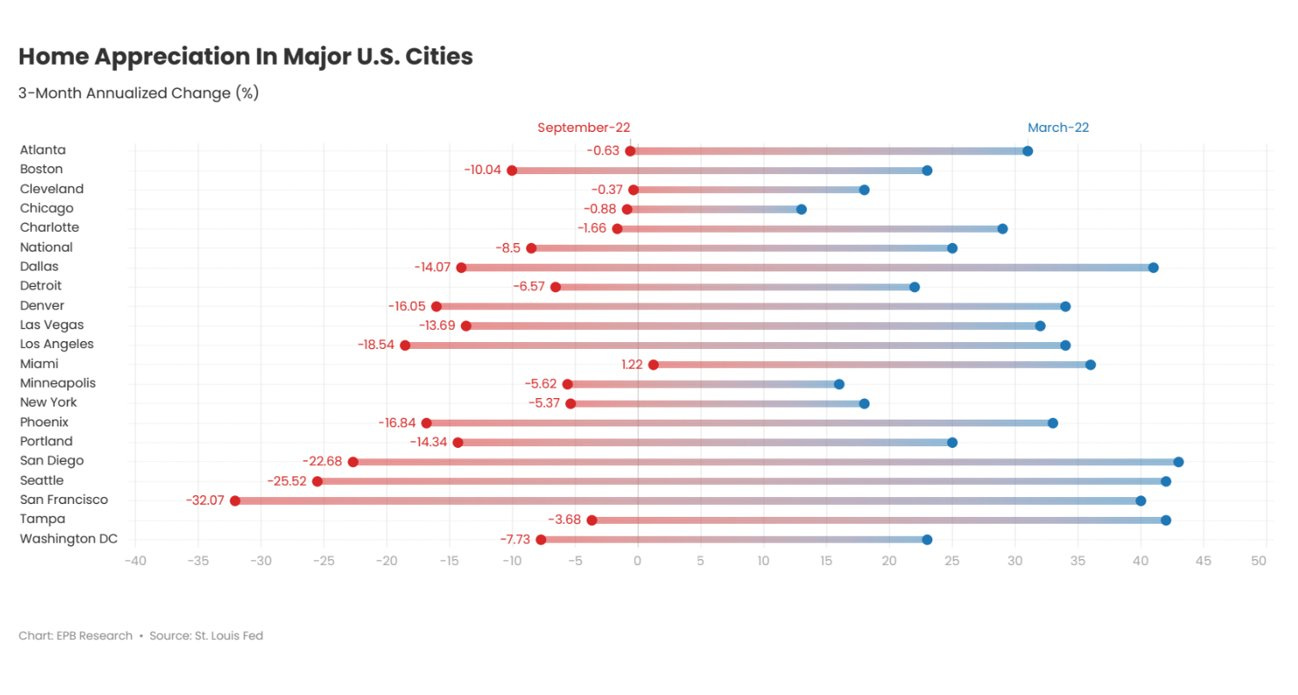

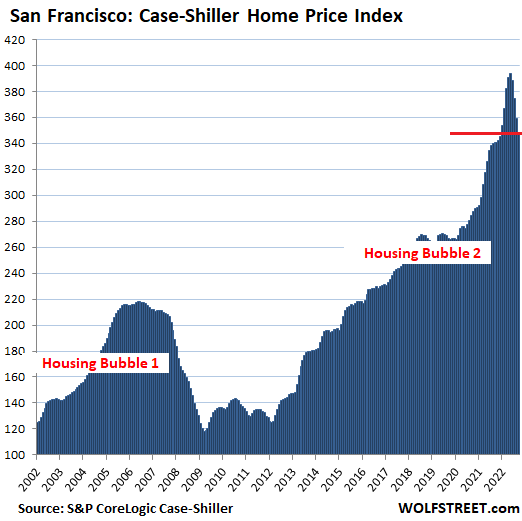

The speed of the correction is staggering. In some American cities such as San Francisco, we have gone from a +40% increase in three months (March 2022) to a -32% decrease in three months (September of the same year)!

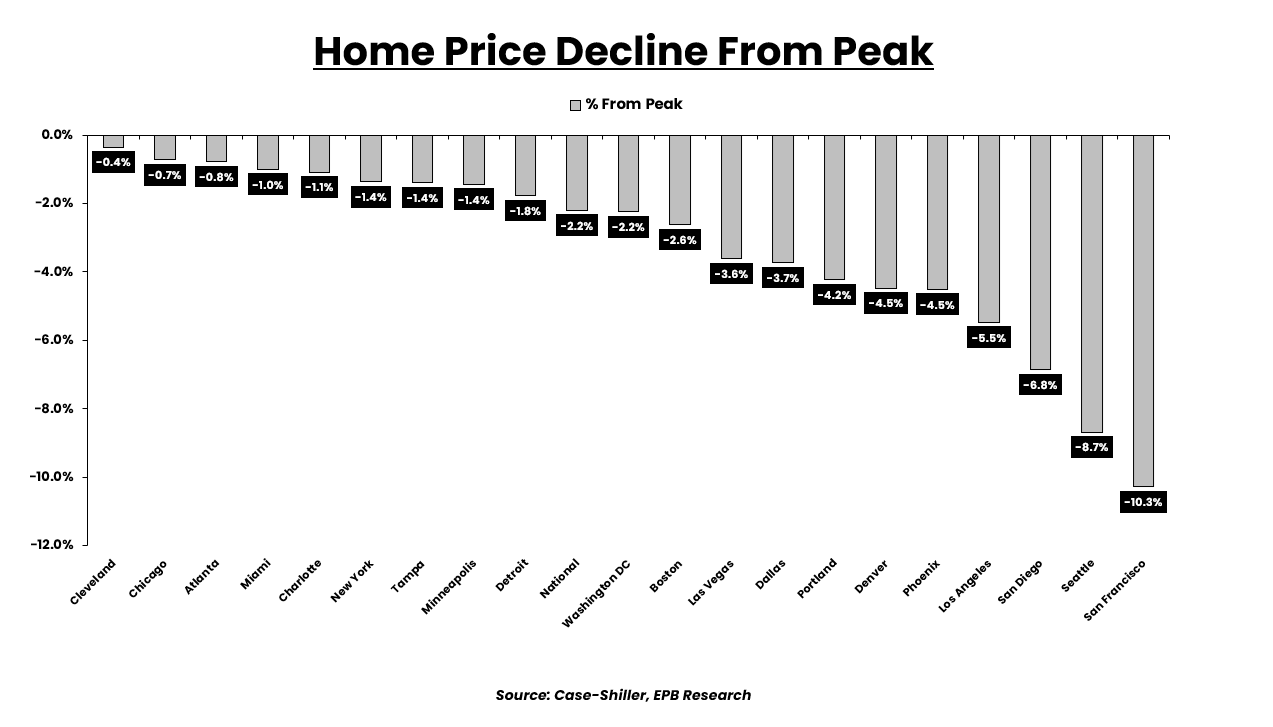

In fact, San Francisco holds the record for decline since peaking in the spring of 2022, with a -10% drop in just a few months:

This San Francisco real estate bubble is bursting faster than it inflated, at an even faster rate than the first bubble in 2007:

How do you explain such a drop and the speed of such a reversal? A simple image is enough:

A house valued at $600,000 in 2021 costs only $10,000 less today, at the beginning of the real estate correction. In the end, this is not a big problem, as the correction is very small. On the other hand, that same house is no longer affordable at all. With the increase in real estate rates, the monthly payments to be paid by the potential buyer have increased by 50% compared to 2021. Even if the price correction is small, no one can afford to buy this house. In just a few months, the market has become totally frozen.

The shock generated by the rise in interest rates has already had an impact on prices, but also on the number of properties put up for sale, which has doubled in just a few months:

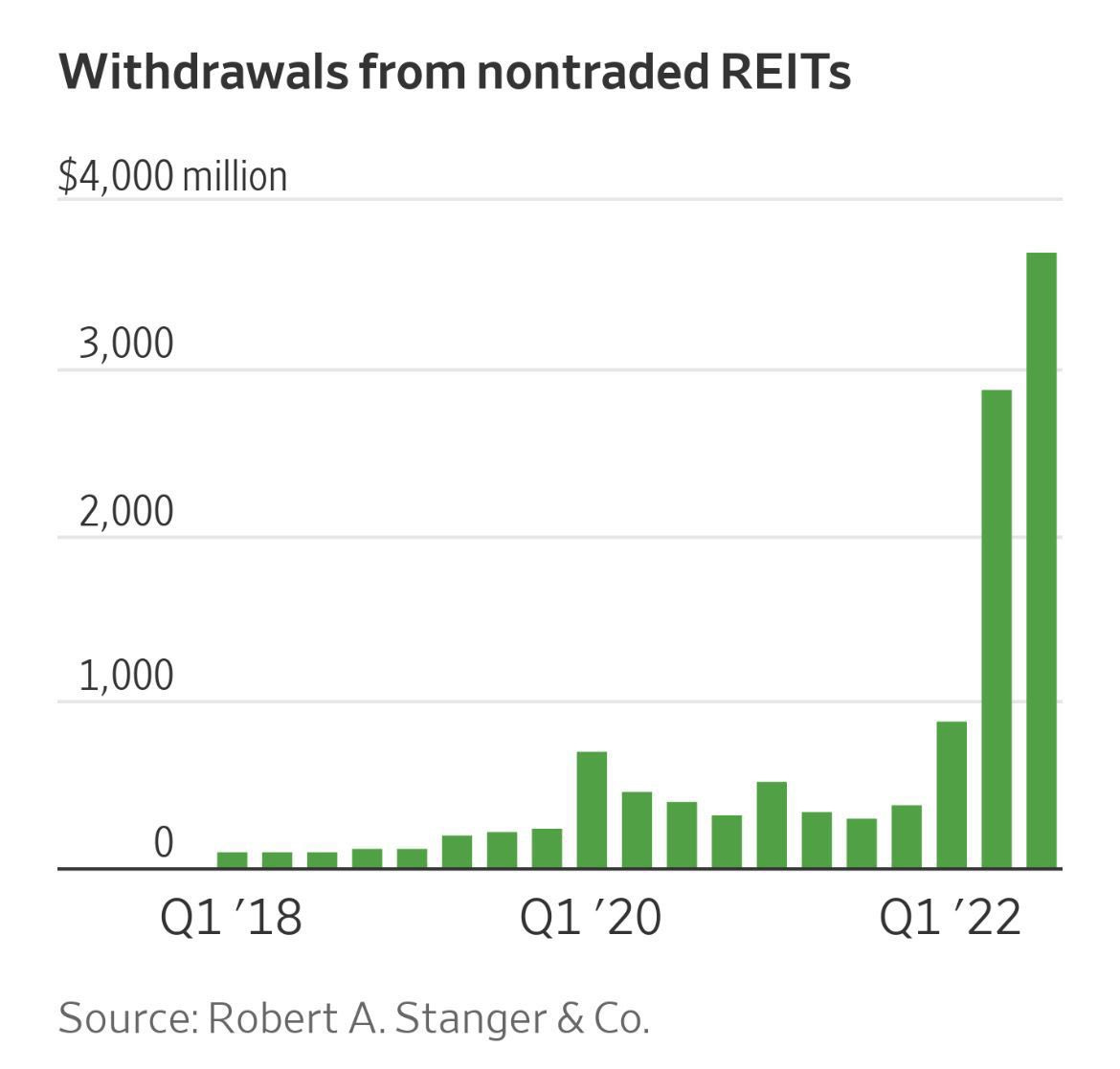

The speed of the real estate downturn is creating a panic in U.S. Real Estate Investment Trusts (REITs).

In the third quarter of 2022 alone, withdrawals from these real estate funds are approaching $4 billion, twelve times the amount at this time last year:

Listed REITs are already showing significant declines and are the source of these massive buyback requests.

But there is a much riskier sector. This is the private non-listed REITs, where investors cannot measure the amount of their losses because the funds only report their results once a year.

The Blackstone Real Estate Income Trust (BREIT) is one such fund. It is one of the most widely subscribed and celebrated funds in the REITs market.

The numbers are mind-blowing.

First of all, assets outstanding have been accumulating at an extraordinary rate.

Launched in 2017 by Blackstone, BREIT is a private equity fund consisting of non-listed REITs. Between 2017 and 2021, the fund raised $60 billion (!) from private investors. As of last June, its net asset value (NAV) reached nearly $70 billion. If this fund were listed as a public REIT, it would be in the top five largest assets in the real estate sector!

The fund's profitability and fee levels are also incredible.

Sales commissions are 9.06% spread over seven years, management fees are 1.25%, and performance fees are 12.5% of net after a 5% threshold. In total, the annual fee is 3.62%!

BREIT is a cash machine for Blackstone, with over $2 billion generated annually.

As long as real estate is moving up, no one looks too closely at these fees. But when the market turns, it's more complicated. When the music stops, everyone wants to get out at once, especially since the fees are based on an asset value that doesn't yet reflect the price correction that's underway... So logically, withdrawal requests accelerate.

To meet the demands, Blackstone can sell the liquid portion of its portfolio invested in commercial real estate. This is what the fund did in December, when it divested two of its major properties, the MGM Grand and Mandalay Bay hotels in Las Vegas.

As the demands for withdrawal from the BREIT accelerate, the fund is forced to sell its assets to meet them.

But those sales will soon be insufficient to cover the volume of requests, forcing the fund to block withdrawals.

This is exactly what just happened:

This week, Starwood, one of the world's largest real estate fund managers, was also forced to limit redemptions from its Starwood Real Estate Income Trust (SREIT) after investor requests for withdrawals exceeded the monthly limits set by the investment vehicle.

The limitations are coming one after another. We are seeing a real run on REIT funds.

As with BREIT and SREIT, real estate funds are turning into real traps for the millions of people who have invested heavily in these products in recent years. The risk of capital loss was clearly specified, but these investors are now discovering the withdrawal lock and illiquidity of their investments, risks that very few of them had anticipated.

After the crash of the crypto-currency exchange platforms, this real estate crisis is likely to be a major blow to a second class of paper assets. The amounts invested in these products are even larger than those invested in cryptos. The potential damage is major.

Perhaps their investment choices will turn out to be winners. Here, the investment mistake is more about the level of confidence in the counterparty.

A paper investment is still the promise of a counterparty: the exchange platform in the case of cryptocurrencies, or the investment fund in the case of real estate.

For readers who have chosen physical gold as insurance against future monetary turmoil, these two crises are a real warning. As the year comes to a close, it is imperative that we ask ourselves questions about our confidence in the counterparties to our investments. If we own gold through certificates, metal accounts, ETFs or funds, everything must be done to test the risk of blocking withdrawals; blockages forced by the solvency problems of the counterparties involved in these investments.

An ounce of paper gold is a promise that a counterparty will convert the value of an ounce of physical gold into hard currency. Properly assessing counterparty risk is essential today. In this context, we understand the importance of holding physical gold directly and in one's own name, eliminating the risks associated with the existence of intermediaries.

In the same way, exposure to gold via investments in mining stocks must be done with full knowledge of the facts: who really owns the stocks and what happens if one of the counterparties involved in holding my stocks (brokers, clearing houses) suddenly has a liquidity problem and has to block movements?

Here again, the choice of counterparties is as important as the choice of the investment itself!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.