China's unreported gold purchases could be more than 10 times its official figures, as the country quietly tries to diversify away from the US dollar, say analysts, highlighting the increasingly opaque sources of demand behind bullion’s record-breaking rally.

Publicly reported buying by China’s central bank has been so low this year – 1.9 tonnes purchased in August, 1.9 tonnes in July and 2.2 tonnes in June – that few in the market believe the official figures.

🇨🇳 China Gold Reserves : 2,304 tonnes https://t.co/OgDpQ0KltP pic.twitter.com/5z0A8rT5zo

— GoldBroker (@Goldbroker_com) November 12, 2025

Analysts at Societe Generale estimate based on trade data that China’s total purchases could reach as much as 250 tonnes this year, or more than a third of total global central bank demand.

The scale of the country’s unreported purchases highlights the growing challenges facing traders trying to work out where prices go next, in a market increasingly dominated by central bank purchases.

“China is buying gold as part of their de-dollarisation strategy,” said Jeff Currie, chief strategy officer of energy pathways at Carlyle, adding that he does not try to guess how much gold the People’s Bank of China (PBOC) is buying.

“Unlike oil, where you can track it with satellites, with gold you can’t. There’s just no way to know where this stuff goes and who is buying it.”

Traders say they are turning to alternative sources of data to gauge demand, such as orders for freshly cast 400-ounce bars with consecutive serial numbers – which are typically refined in Switzerland or South Africa, shipped via London and flown to China – for evidence of the country’s purchases.

“This year, people are really not believing the official figures, especially about China,” said Bruce Ikemizu, director of the Japan Bullion Market Association, who believes China’s current gold reserves are nearly 5,000 tonnes, double the level it publicly reports.

Central banks have been buying up huge quantities of bullion in recent years, fuelling a rally that has pushed the gold price above US$4,300 per troy ounce. World Gold Council (WGC) data shows that over the past decade, gold’s share of global reserves outside the US has climbed from 10 to 26 per cent, making it the second-largest reserve asset after the US dollar.

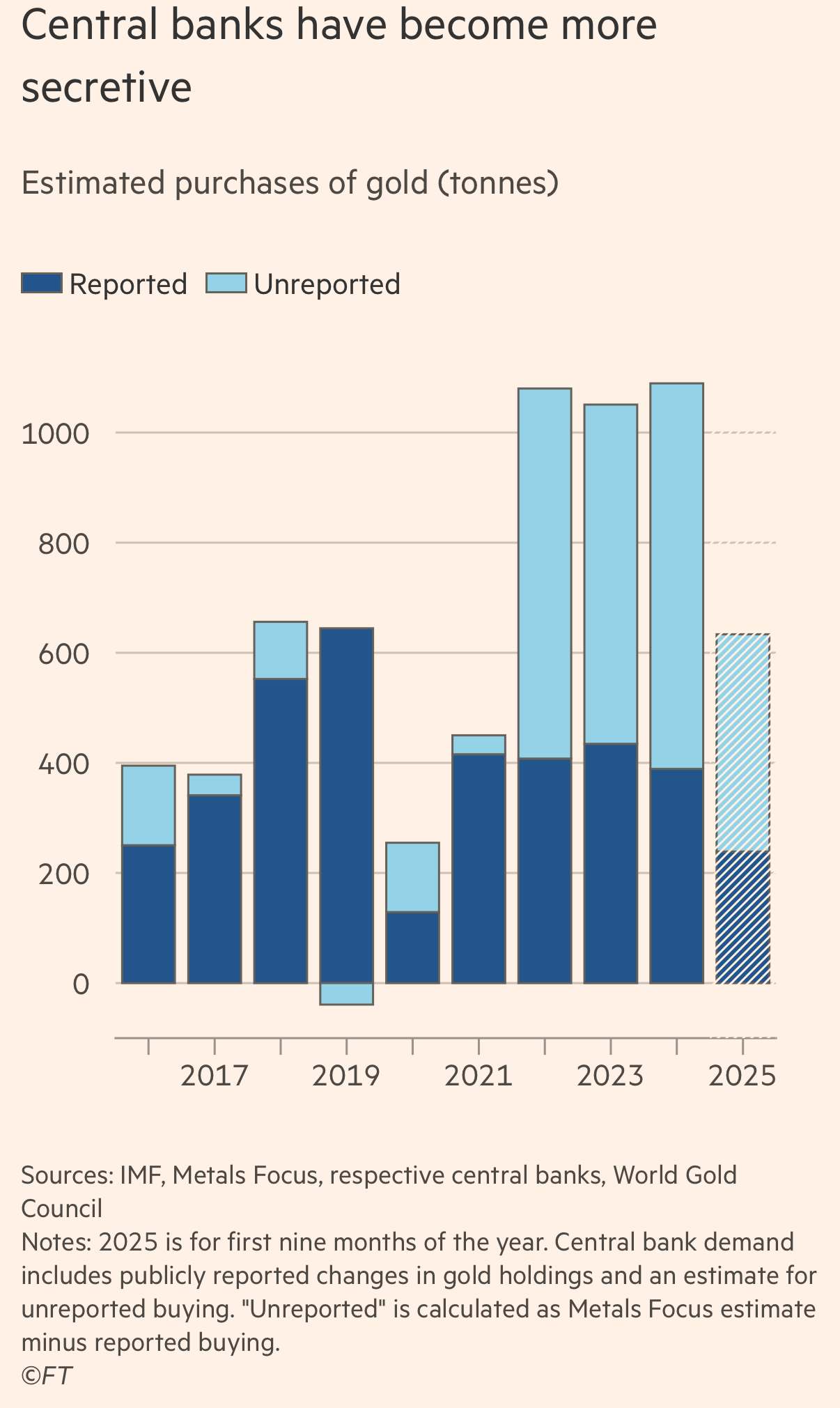

Yet fewer and fewer of these purchases are being reported to the International Monetary Fund, which collects data on a voluntary basis.

In the most recent quarter, only about one-third of official buying was publicly reported, down from around 90 per cent four years ago, according to WGC estimates based on Metals Focus data.

Central banks may choose not to report their gold activity to avoid front-running the market, or for political reasons. Some fear that publicly buying bullion, which is often a hedge against the US dollar, could worsen relations with the Trump administration.

“It makes sense to just report the bare minimum, if need be, for fear of reprisal from the US administration,” said Nicky Shiels, analyst at Swiss refinery MKS Pamp. “Gold is seen as a pure USA hedge. In most emerging markets, it is in central banks’ interest to not fully disclose purchases.”

Sellers may also be keen not to move prices against themselves by announcing their intentions. Former UK chancellor Gordon Brown’s well-publicised statements in 1999 that the Bank of England would sell half its gold reserves helped push prices even lower, and the sale yielded just US$275 per ounce on average, about one-fifteenth of today’s price.

Michael Haigh, an analyst at Societe Generale, said this opacity makes the gold market “unique and tricky” compared with commodities such as oil, where the Organization of the Petroleum Exporting Countries plays a role in regulating production.

“What is different with gold is that the tonnage going in and out of central banks is so impactful. Without having clarity on that, it is a bit more of an issue.”

China is the world’s biggest producer and consumer of gold, but also among the least transparent, leaving analysts to run their own numbers based on import data, guesswork and tips.

Its official gold-buying programme, which is managed by the State Administration of Foreign Exchange (Safe), part of the PBOC, has officially bought just 25 tonnes so far this year. Reserve gold is typically stored either in Shanghai or in Beijing.

Safe has one-year and five-year targets for its purchases of gold, and current holdings remain far below target, according to a former Safe official.

The purchases are made not only by Safe and its intermediaries, but also by China’s sovereign wealth fund CIC and the military, which are not mandated to disclose their holdings on a timely basis.

One proxy for Beijing’s official buying is to look at UK gold exports to China, because the large bars favoured by central banks are mainly traded in London. Using this method, Societe Generale estimates that Safe will import about 250 tonnes this year.

Another method is to calculate the gap between China’s net imports and domestic gold production, and the change in the amount held by commercial banks or purchased by retail consumers.

Using this method, Plenum Research, a Beijing consultancy, calculates a “gap” attributable to official buying of 1,351 tonnes in 2023 and 1,382 tonnes in 2022 – more than six times the public purchases China made in those years.

Complicating the picture is China’s status as the world’s largest gold miner, accounting for 10 per cent of global production last year, which means that it also has the option of buying bullion domestically for its reserves.

As China expands its gold holdings, it is also courting developing nations to store it in the country. Cambodia recently agreed to place newly purchased gold, paid for in renminbi, in the Shanghai Gold Exchange’s vault in Shenzhen, according to a person close to the deal.

China Aims To Become Custodian Of Foreign Sovereign Gold Reserves

— GoldBroker (@Goldbroker_com) September 25, 2025

▶ https://t.co/Y45Nd6iRZN pic.twitter.com/vpAfoi7DHO

Many gold analysts will not even hazard a guess as to the true scale of purchases by the PBOC.

Original source: The Business Times

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.