By Grant Williams

A few weeks ago, I put a chart with which I am acutely familiar up on my Bloomberg. It is a chart I have studied every single day for over a decade, so by now I know pretty much every dip, every rally, and every sideways channel that makes up this particular pattern.

I remember where I was when the big moves took place, and I recall with great clarity my varying degrees of comprehension and incredulity over every meaningful change in direction.

I have lived every Golden Cross and died every Death Cross, cheered every bottoming pattern, and despaired each time the chart patterns signaled a breakdown in an upward trend; but above all, I have continued to remorselessly reassess my view of the investment case for this particular instrument, looking for signs — not evident in the charts — that would suggest it had run its course.

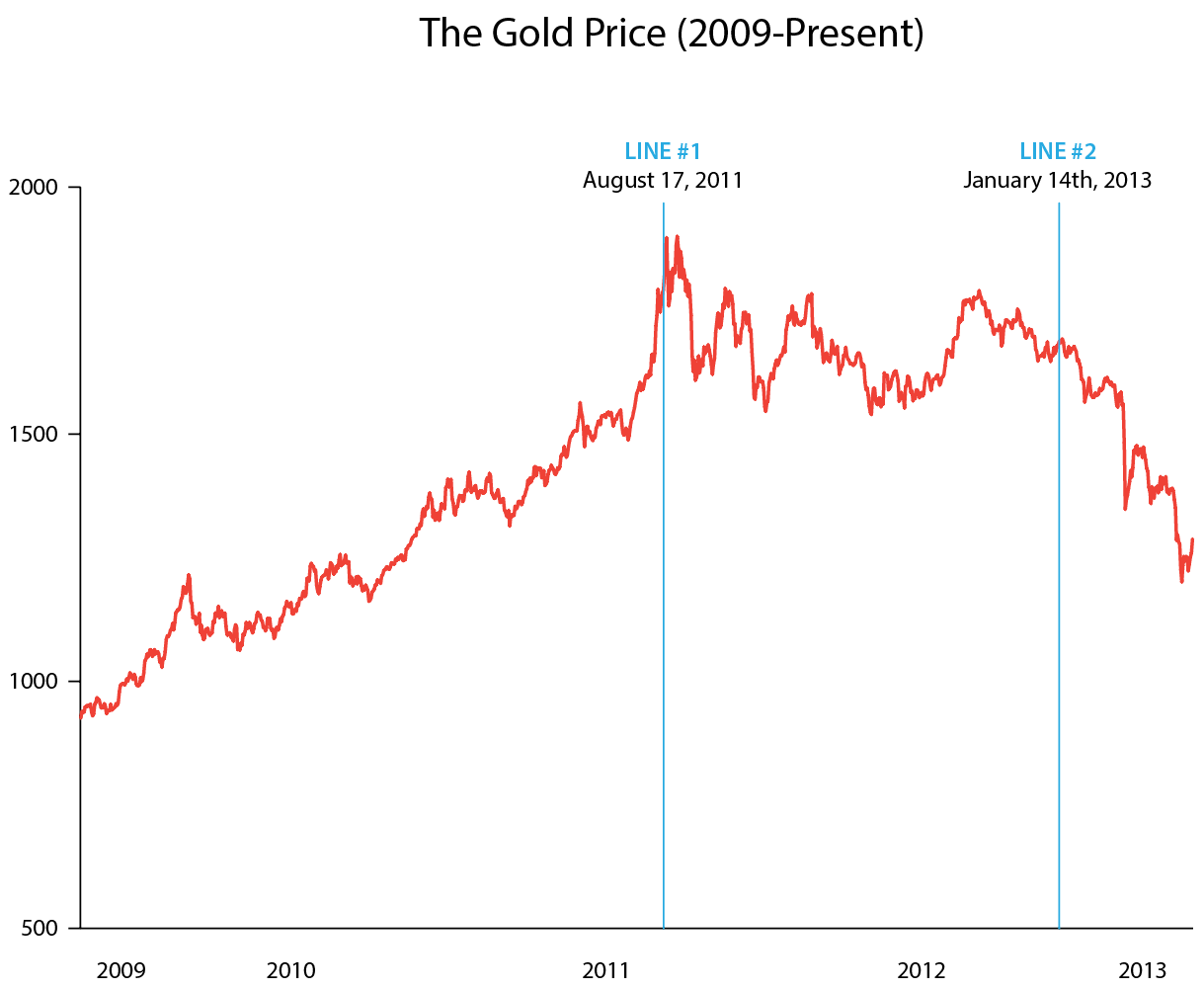

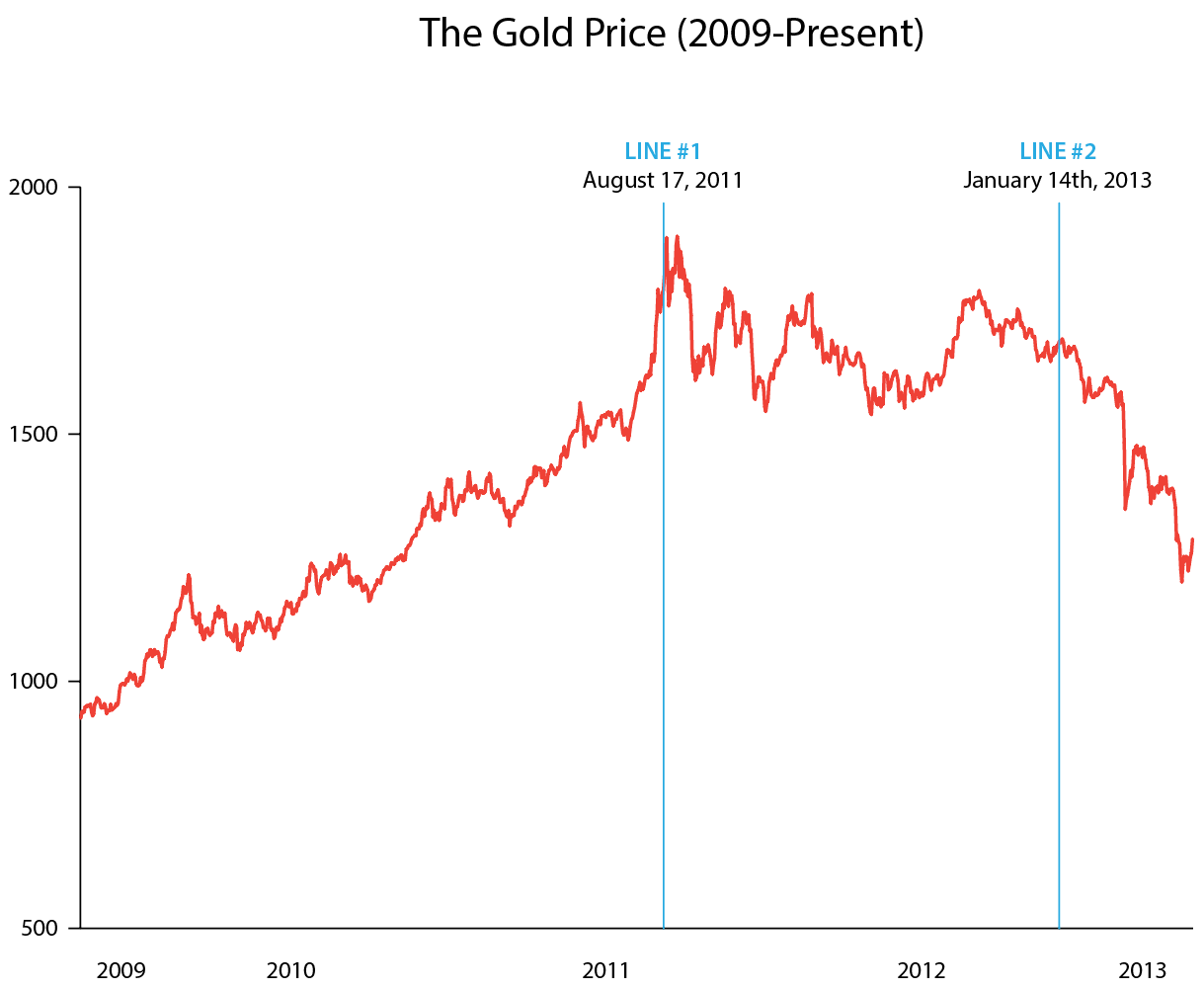

As I stared at the chart again, almost absentmindedly, I put two vertical lines on it, one representing August 17, 2011, and one that marked January 14, 2013; and suddenly, a concept that had been gnawing away at me for a while crystallized in my mind as those two lines pulled in a whole bunch of known knowns, known unknowns, and even a couple of unknown unknowns. It was a truly Rumsfeldian moment.

By now, there is no doubt a distinct three-way split amongst those who have made it all the way to the third paragraph of this week's TTMYGH. There are some new readers who are wondering what asset the chart reflected, as well as many who are already rolling their eyes and muttering to themselves "Really? Gold? AGAIN?" — and finally there are the overwhelming majority who have already scrolled to the "...and finally" page, chuckled at the cartoon, and moved on to more edifying fare.

Yes, it's one of those weeks when I must ask your indulgence while I ramble on about a subject close to my heart that has recently been a source of great frustration. And yes, it's gold — particularly, the bizarre price action of the last six months, which has run counter to most logical assumptions, given the various macro factors bringing influence to bear on the yellow metal.

Cyprus should have been a hugely positive tailwind for gold. But it wasn't. The ongoing money printing should have provided support for gold. But it hasn't. The talk of tapering should have had a minor but noticeable effect on gold, given its healthy recent correction. But it didn't. Sustained data suggesting a voracious appetite for the physical metal not only in Asia but in Western countries, too, should have led to a bounce on the COMEX. But it hasn't.

The whole thing is as baffling as Kim Kardashian's fame.

But let's get back to that chart and those two lines — here it is and there they are.

Source: Bloomberg

You're going to hear about this chart a few more times before we're done today, so take a good long look at it.

The first vertical line, labeled August 17, 2011, marks the day that Hugo Chavez, then president of Venezuela, demanded the repatriation of the 99 tons of gold (worth $13 billion at the time) that was being held at the Bank of England on behalf of his country. That was roughly half the gold held overseas by Venezuela and about 27% of its total holdings, which amounted to 365 tons:

(Bloomberg): "We've held 99 tons of gold at the Bank of England since 1980. I agree with bringing that home," Chavez said today on state television. "It's a healthy decision."

Chavez, who has said he wants to eliminate the "dictatorship" of the U.S. dollar, has called on Venezuela's central bank to diversify its $28.7 billion in reserves away from U.S. institutions. Some cash reserves, which total $6.3 billion, will be shifted into currencies from emerging markets including China, Russia, Brazil and India, central bank President Nelson Merentes said today at a news conference.

Earlier today Chavez said he plans to take control of the country's gold industry to halt illegal mining and boost reserves.

The government is preparing a decree to stop illegal miners exploiting deposits of gold and coltan, an ore containing tantalum, used in mobile phones and video-game consoles, he said....

Venezuela's 365.8 metric tons of gold reserves makes it the 15th-largest holder of the precious metal in the world, according to an August report from the World Gold Council. Venezuela's gold holdings accounted for about 61 percent of the nation's international reserves, according to the report.

The Bloomberg article concluded with the following paragraph:

Gold futures for December delivery rose $8.80, or 0.5 percent, to $1,793.80 an ounce on the Comex in New York. Prices touched a record $1,817.60 on Aug. 11.

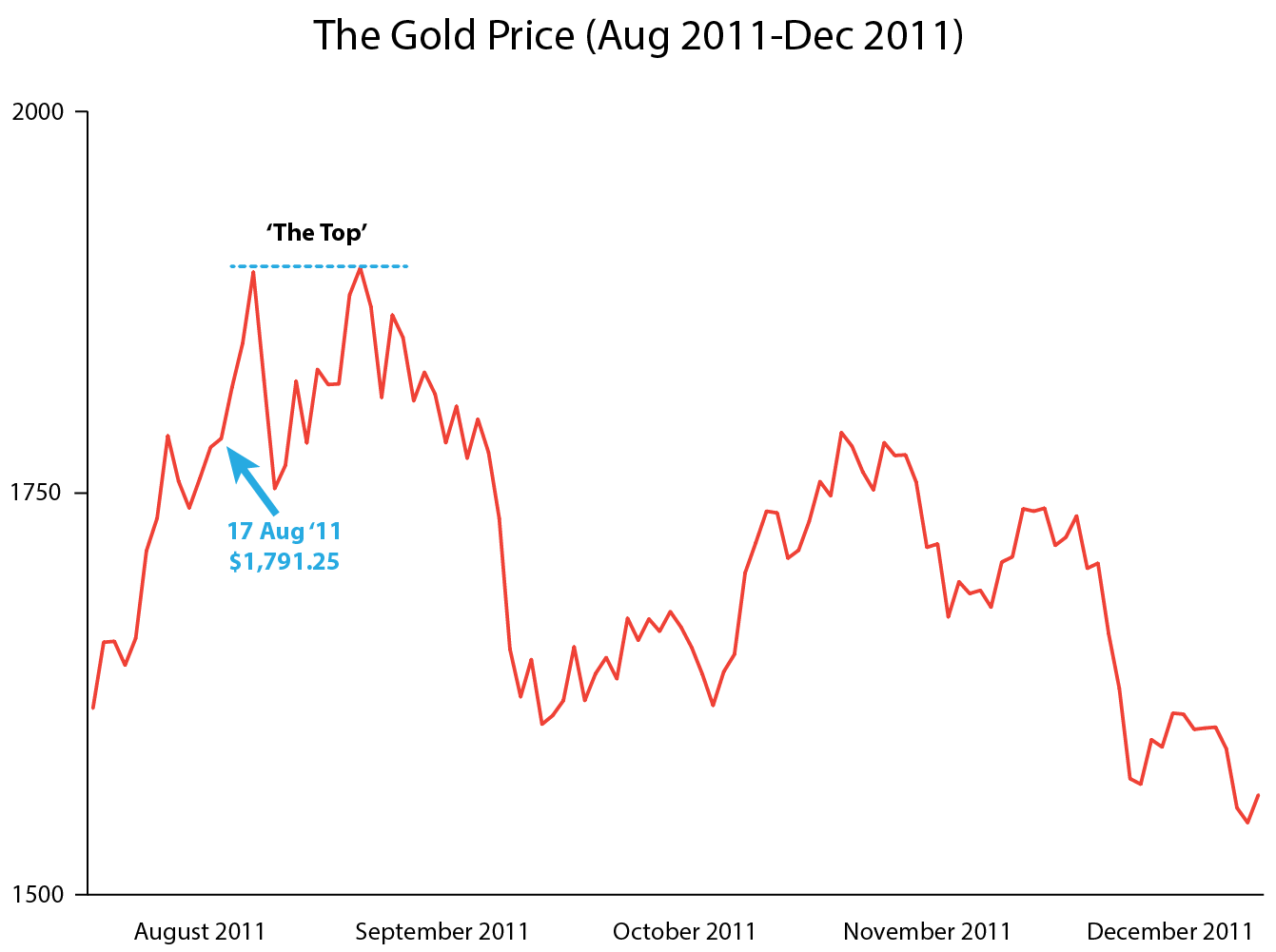

If we now take a look at a close-up chart of the gold price around the time of Chavez's announcement, something very interesting emerges.

Source: Bloomberg

As you can see, the immediate reaction to the commencement of the global game of central bank musical chairs was perfectly understandable and completely explicable: the price soared (to a new all-time high, no less). After all, that's what generally happens when somebody says "I want a large amount of a reasonably scarce commodity and I want it now" — or at least that's what generally happens if said commodity needs to be bought in the open marketplace.

Except...

In this case, essentially all that happened was that a stocky man in one country asked if a group of no doubt bespectacled men wearing white coats in another country would kindly return to him something they had been looking after for the last 19 years.

That something had been fully segregated and held in custody on the off chance that the stocky man might want to sell some of it to raise cash — or just for safekeeping, in case he were to be visited in the night by a random group of tall, thin men with a collective penchant for berets, facial hair, and cigarillos who seemed largely disinclined toward him.

And so, after the initial reaction that took gold to its new all-time high and through the $1900 barrier, the price began to fall. Fast.

Within 17 trading days the price had fallen 16%, bottoming at $1608 on September 28. During that time, nothing much happened in the world — unless you count the Arab Spring and the Libyan civil war, Moody's downgrading of Japan to Aa3 and the resignation of the Noda cabinet, Ben Bernanke's promising more QE at Jackson Hole, Hurricane Irene hitting New York City, the SNB's pledging to print unlimited Swiss francs in order to defend a peg to the euro at 1.20, or the beginning of the "Occupy" movement — so it was hardly surprising that the price would fall.

In one way, the gold market's reaction to the stocky man's request was surprising, but in another way it was understandable — it all depended on the underlying reality of the situation.

Reality 1:

The stocky man's gold was sitting in a cage beneath the Bank of England, untouched and untarnished, exactly where it had been left 19 years earlier.

In this event, the stocky man's request was hardly worthy even of a news headline; and even if, in their desperate need for constant tantalizing fodder, the 24-hour news channels felt compelled to report on it, it's hard to see past something mundane like:

"Stocky South American Man Decides to Move Something He Owns from One Place to Somewhere Else"

Hardly compelling.

OK, so the tabloids might have opted for something a little more ... creative, like:

"Hugo and Get My Gold!" or

"Venez-Wailer! Caracas Crackpot Brings Back Bullion" or even

"Victor Hugo! Chavez Gives BoE the Hump" (Hey, this is fun!)

... but it's difficult to understand how, in practical terms, the news should have elicited any measurable response in the price at all, unless...

Reality 2:

The stocky man's gold had been lent out many times over to bullion banks in order to generate a small return on an otherwise unproductive asset; and in order to deliver it to him as requested, its custodians would have to terminate leases, obligating the lessees to go into the market and buy it back in order to be able to deliver it.

Now if THAT were the case, the normal forces that used to apply to what were once referred to as "free markets"¹ (a quaint concept that dates back to the 20th century) would have dictated that the price would leap higher as those lessees chased a commodity in restricted supply amidst ravenous demand.

But no. That's not what happened. That's not what happened at all.

After the post-Chavez tumble, gold traded largely sideways (as can clearly be seen in the shaded blue "channel"), looking for all the world as though it were forming a base. But then came line #2:

Source: Bloomberg

¹ (Wikipedia): A free market is a market structure in which the distribution and costs of goods and services, along with the structure and hierarchy between capital and consumer goods, are coordinated by supply and demand unhindered by external regulation or control by government or monopolies. A free market contrasts with a controlled market or regulated market, in which government policy intervenes in the setting of prices.

Now, earlier this year I gave a presentation entitled "Risk: It's Not Just A Board Game", in which I laid out the mechanics of fractional reserve banking as they apply to gold and highlighted a trail of breadcrumbs that led those willing to follow it into a weird and wonderful forest where central banks lend out their gold to bullion banks who then sell it to fund lucrative carry trades of one sort or another whilst simultaneously helping keep a lid on the price of gold.

(If you haven't watched it and have 20 minutes to spare, may I suggest you pause your reading, click on the link above, and watch the video between the 14:28 and 33:50 marks? It lays out visually a lot of the ingredients for today's jambalaya.)

In this twilight world of gold manipulation, the central banks and bullion banks prosper and everyone else scurries around trying not to get stepped on.

The problem with this little arrangement is that, in a world where central bank ZIRP has sent trillions of dollars in search of any return greater than zero, trades that offer pretty certain payback profiles, such as this one, get extremely crowded, and people tend not to want to flee from the forest one at a time but rather all at once when the weather shifts.

Line #2 marked a major shift in the weather, it turns out.

January 14, 2013, was "The Day That Will Live In Give-It-To-Me", as the Bundesbank announced that it wanted its 300 tons of gold returned from the custody of the Federal Reserve Bank of New York to the far more comforting environs of the Bundesbank vault in Frankfurt. (If you'd like to see a short video of gold already sitting in that vault, the Bundesbank has very kindly put one, complete with heavy doors, big keys, metal cages, and creaking doors leading to shelves stacked with bullion, here).

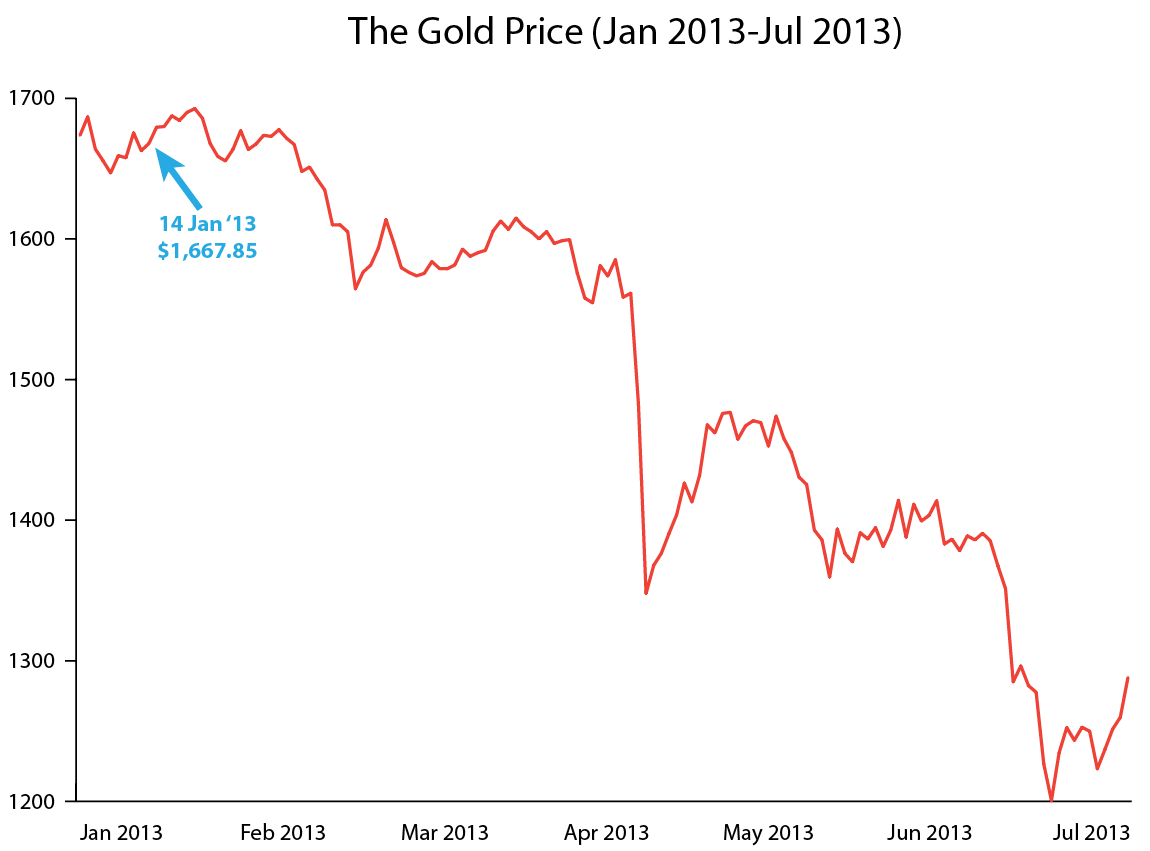

Another close-up, this time of the price action of the metal in the aftermath of the Bundesbank's decision, throws up yet more confusion if we apply the two possible realities surrounding the original Chavez request:

Source: Bloomberg

Once again, an initial move higher quickly morphed into a concerted move lower; and this time, with the quantity of gold required to be delivered to satisfy the Bundesbank three times greater that demanded by Chavez, the downward move in the price was correspondingly greater — to a degree that has caused consternation amongst gold watchers all around the world.

Oh, by the way, it's probably nothing and hardly worth mentioning, really, but that 300 tons of gold demanded by the Bundesbank will, it seems, all be delivered safe and sound to Germany ... in seven years:

(Bundesbank): By 2020, the Bundesbank intends to store half of Germany's gold reserves in its own vaults in Germany. The other half will remain in storage at its partner central banks in New York and London. With this new storage plan, the Bundesbank is focusing on the two primary functions of the gold reserves: to build trust and confidence domestically, and the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.

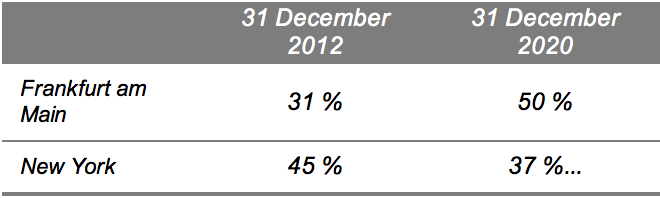

The following table shows the current and the envisaged future allocation of Germany's gold reserves across the various storage locations:

Source: Boeing/Distance.to/TTMYGH

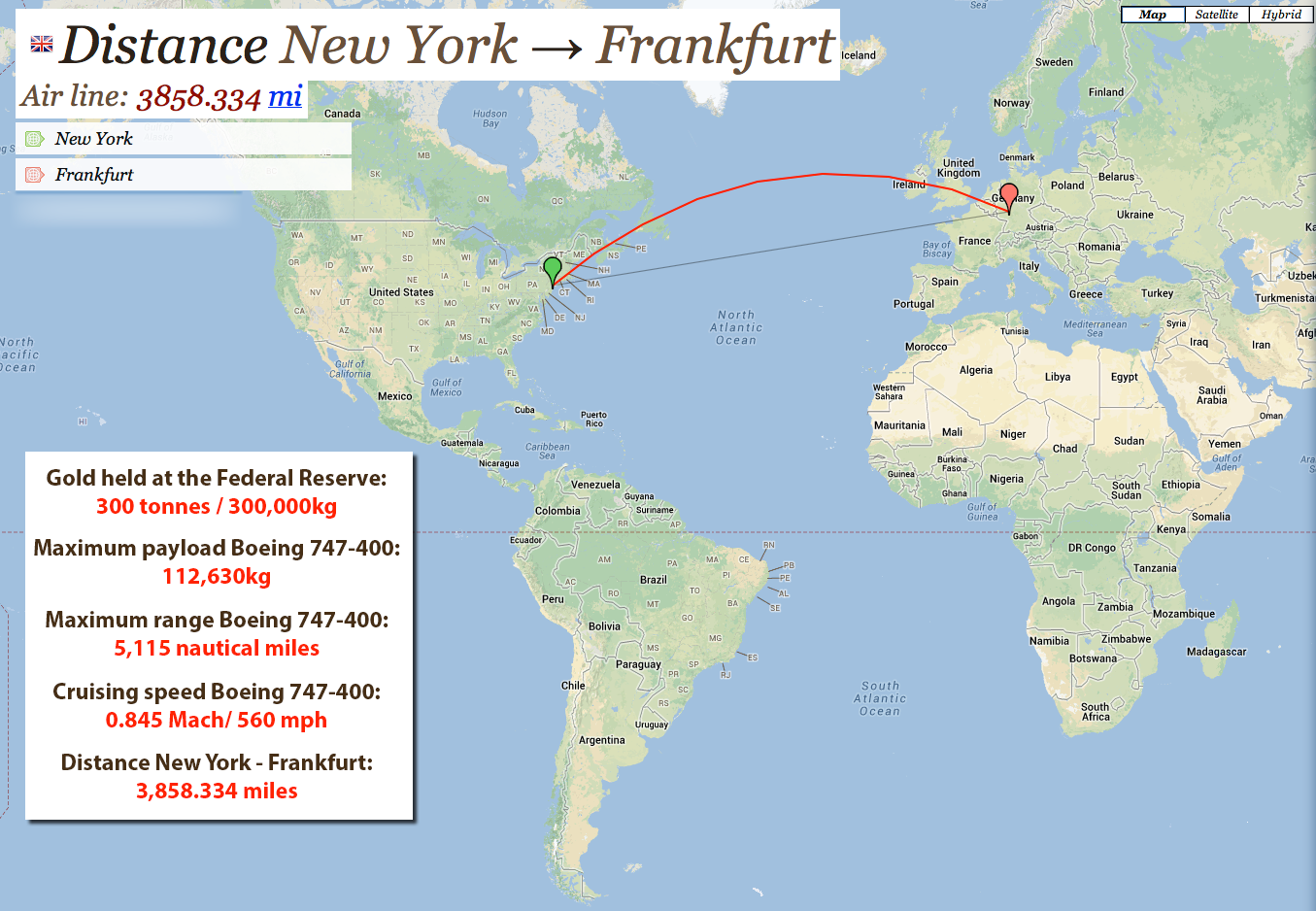

OK ... time for a little math, methinks:

The Bundesbank wants to repatriate 300 tonnes of gold, which is, of course, sitting, untouched, at the Federal Reserve in New York.

That 300 tonnes equates to 300,000 kilograms.

A Boeing 747-400, set up in a standard cargo freighter configuration, has, according to its manufacturer, a maximum payload of 112,630 kg, a range of 5,115 miles (4,445 nautical miles), and a typical cruising speed of 0.845 mach (560 mph).

The distance between New York and Frankfurt is 3,858 miles.

So the German government could charter three 747-400s, send them to New York, load them up with their gold, and still have 37,890 kg of space left, which would allow for the mother of all shopping trips to Woodbury Common Premium Outlets in Harriman, NY, where Angela Merkel could buy enough Ann Taylor outfits to ensure a fresh one for every EU crisis meeting between now and 2016 ... okay, 2015.

By way of additional perspective, between takeoff and landing, if those on board wanted to watch the entire Lord of the Rings trilogy (theatrical versions, minus the credits, NOT the extended versions), they would be forced to circle Frankfurt airport for fifteen minutes before touching down.

But ... seven years.

SEVEN.

Y-E-A-R-S.

Now, I'm aware that there is a maximum amount of gold which is insurable in any one shipment (though I don't know exactly what that amount is), but if we go to extremes and assume it's as little as a single tonne (1,000 kg), that would mean flying our three 747-400s a total of 300 times; and with each plane flying once per day, that would take 100 days.

But not seven years.

And so, with all that in mind, let's jump aboard the good ship Hypothetical and play a little "What If?"

1: What if central banks don't lease their gold reserves out; and, in fact, all the gold they own is stored exactly where they say it is, in the exact quantities accounted for on their balance sheets?

Well, if that were the case, I think it's safe to say that we could probably make a few fairly basic assumptions, including the following:

A) The line items in central bank balance sheets that accounted for bullion reserves would all simply say "Gold" (as they do at the Bank of Japan and the IMF).

B) Central bankers would not make speeches that refer to gold leasing operations.

C) It would be impossible for any European central bank to make a €300mn profit over a 10-year period by leasing out its gold.

D) Any gold repatriation requests would be fulfilled as immediately as practicable.

So, those are a few of the assumptions associated with "What If #1", but how do they look in the cold light of day? Let's step through them again.

A) As far as their balance-sheet line items go, the world's major central banks differ to an extent:

The Federal Reserve lists its gold holdings as:

"Gold (including gold deposits and, if appropriate, gold swapped)"

The Bank of England has what's left of theirs as:

"Gold (including gold swapped or on loan)"

The ECB opts for:

"Gold (including gold deposits and gold swapped)"

And the SNB goes with:

"Gold holdings and claims from gold transactions"

B) In July of 1998, then-Fed Chaiman Alan Greenspan famously said the following before a Senate Committee:

"Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

But a far-less-publicized comment was made, again by Greenspan, at an FOMC meeting in 1993:

"I have one other issue I'd like to throw on the table. I hesitate to do it, but let me tell you some of the issues that are involved here. If we are dealing with psychology, then the thermometers one uses to measure it have an effect. I was raising the question on the side with Governor Mullins of what would happen if the Treasury sold a little gold in this market. There's an interesting question here because if the gold price broke in that context, the thermometer would not be just a measuring tool. It would basically affect the underlying psychology."

Alan! I'm surprised at you. Ayn would not be happy to hear you talk like that.

C) In November of 2012, the Austrian Central Bank governor held a press conference:

(BullionStreet): Austria announced earning a whopping 300,000,000 euros through leasing its 280 tons of gold in the last ten years.

Replying to questions in the country's parliament, Austrian central bank, National bank (OeNB) governor Wolfgang Duchatczek said 224.4 tonnes (around 80%) of Austrian gold reserves were in the United Kingdom, around 6.9 tonnes (around 3%) are in Switzerland and around 48.7 tonnes (around 17%) are in Austria itself.

The OeNB said that the reason to store gold abroad was that because in a time of crisis it could be speedily traded. Since 2007 Austria's National bank had had a constant reserve of around 280 tons of gold.

Through leasing of its gold the Austrian National Bank has in the last 10 years earned around 300,000,000 euros.

D) Seven years. S-E-V-E-N ... Y-E-A-R-S.

Which brings us to What If #2:

2: What if the gold in the central banks vaults has been rehypothecated and is no longer held in quantities even approaching those advertised? What would happen then?

Well, if that were the case, there might be a great need for this or that central bank to buy a lot of gold in a hurry, and in such dire straits that the bank(s) would at least want the price not to take the inevitable path higher that would normally accompany such a set of circumstances. If there were some way to make it actually go down in the face of such demand, well, that would be amazing, not to mention remunerative — but surely that's impossible, right?

Hmmm...

Apart from peculiar moves in the gold price, there have been some absolutely extraordinary developments regarding the world's biggest stockpiles of physical gold.

First up, the COMEX warehouses.

Metal stored in the various COMEX warehouses is split into two designations: "eligible" and "registered". The difference between them is crucial:

(COMEX 101): Eligible [metal] that has been purchased (and paid for) by a long at some point in the past (that they are currently paying storage fees for) and is eligible for delivery at any point that the client wants. It has been assigned to the clients, who have the serial numbers of their bars.

Registered [metal] that is sitting in the COMEX warehouse and can be used to settle a contract. Apparently, shorts can buy this [metal] from bullion banks at the current price and use it to settle the contract.

If holders of metal in the warehouses want to take delivery of their gold, it is first designated as "eligible". This is essentially a "hands off" notice, so that the metal won't be used to meet other deliveries. Once designated as such, it can be delivered to the owners at their instruction.

The COMEX and the LBMA (London Bullion Market Association) hold two of the world's three largest stockpiles of gold, with the third being the aggregated totals of the various ETFs (the largest of which, GLD, stores its gold at HSBC's vault in London in what are called LBMA Good Delivery Bars, each one weighing 400 oz. and conforming to various standards of purity, etc.).

OK, so far, so good. Now we need to venture a little deeper into the twilight forest, folks. So stay with me, no stragglers, and those of you at the sides and rear of the group might want to fashion these sheets of tinfoil into some sort of headgear.

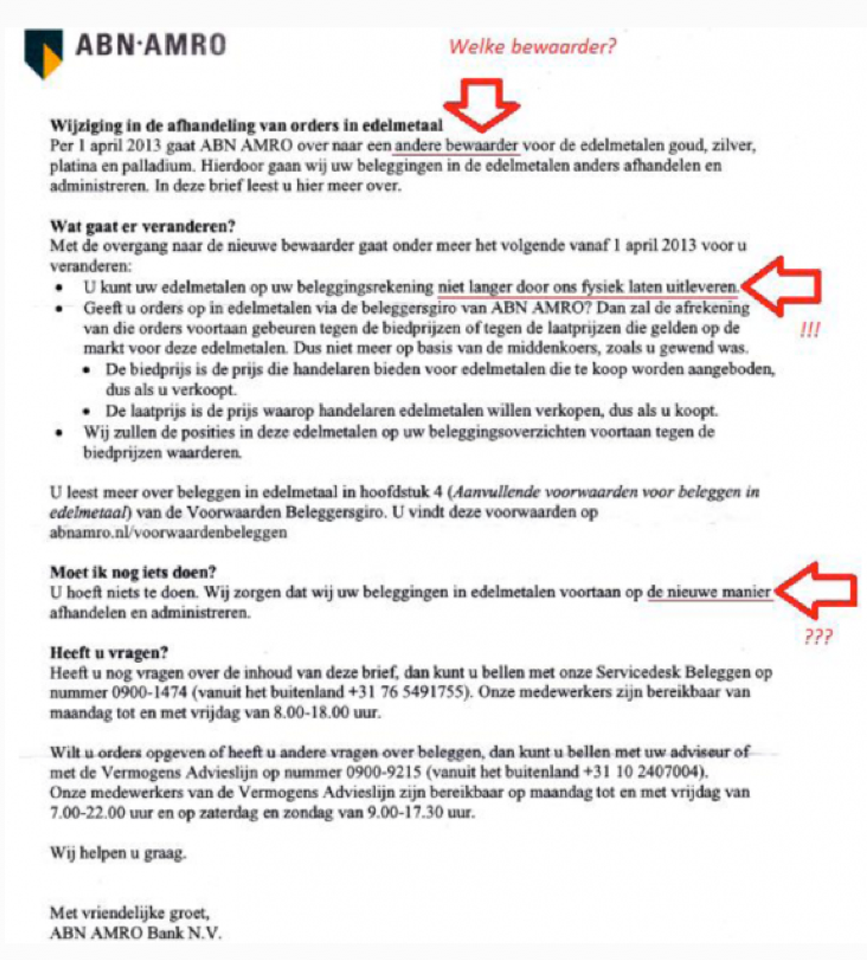

It all began, bizarrely enough, on April Fool's Day, with a letter from ABN Amro, a Dutch state-owned bank:

Source: Silver Doctors

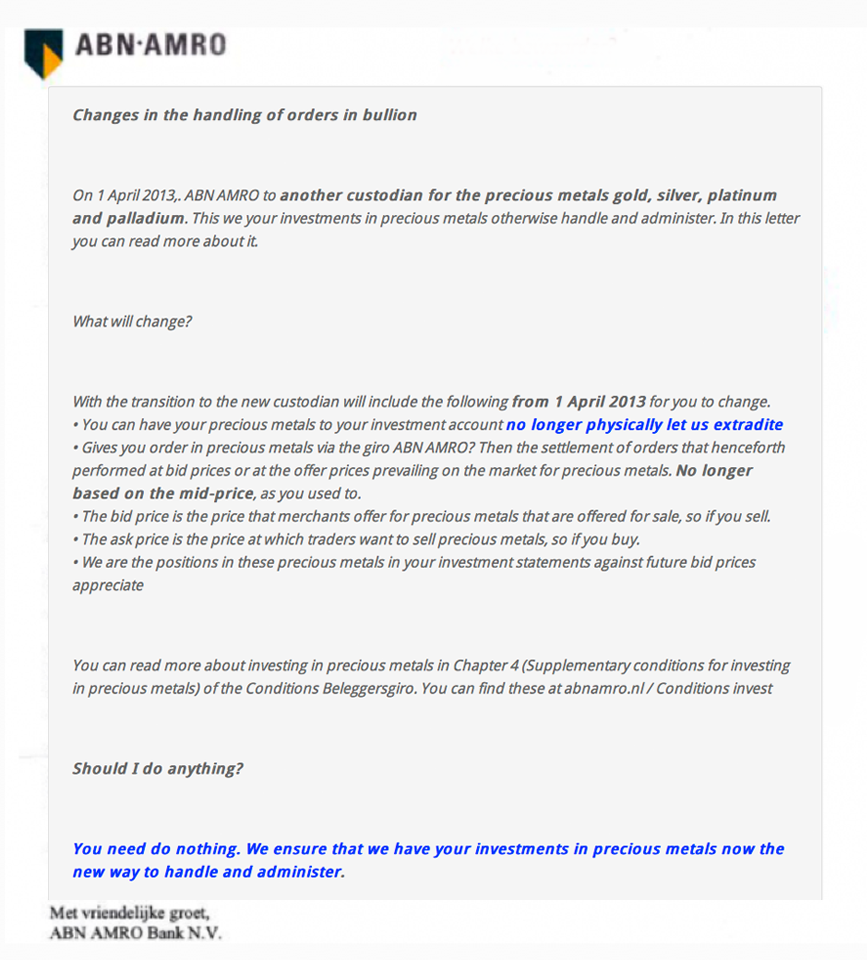

The letter was translated by, amongst others, the Silver Doctors:

Source: Silver Doctors

Paraphrasing, ABN declared that any holders of physical gold that had custodied their metal with the Dutch bank would, henceforth, be cash-settled and could not request physical delivery of their gold (or silver — TTMYGH is very definitely an inclusive publication).

There's a word for that where I come from: confiscation.

Next up were rumours of wider metal shortages at the LBMA (the London Bullion Market Association, where ABN transacted) which were highlighted by Andrew Maguire in an interview with King World News:

... over the years, basically what you would do is you would sell gold, sell silver, financed almost for nothing, take that money and invest it. Then, obviously incentive was there because it had built up to such a large (short) position, they were so over-collateralized, that it was important to defend the price (of gold and silver) from rising because they didn't actually have the physical.

What's happened now is they are in a position where that leased gold is being asked for, and they don't have it. I know of a very large client who actually turned up for his bullion, was refused his bullion, and told he would be settled in cash. I felt I should go public with that (on KWN).

I must say I had some really distressed emails. What they were asking is, "What should I do?" All I could say to them is, "If I had physical stored in any bullion bank related warehouse, whether it be COMEX or LBMA, I would remove it right now."

We all know that default will not be called a default. It will be settled with cash. I do not believe for a minute that the Fed can't print a few billion (dollars), whatever it costs, to bail out the bullion banks for cash. Why wouldn't they just bail them out with cash? It's just an electronic keystroke. People will be sitting on the sidelines and they will not get any physical [gold]....

[ABN AMRO] really was the tip of the iceberg. What happened was that we saw that first bullion bank create the first visible default of the LBMA fractional reserve system ...

Not good. Not good at all. But coincidentally (of course), the bars at the LBMA which were supposedly in dangerously short supply are the exact same type of bars that sit in the vault of HSBC London on behalf of the GLD ETF.

More on that later.

OK... so now we have the set-up. Regular readers will remember the massive takedown in gold that we saw in April. For any new readers, I wrote about it, so I won't go over it again today. Instead, let's take a look at some of the other bizarre action I mentioned, and that will require a trip to the warehouses — and the assistance of the great Nick Laird of Sharelynx.com, who is the single best resource for precious metals charts anywhere on the web. Nick has very kindly allowed me (and by extension you, dear reader) access to his work this week, so if you click on the source links beneath the charts on pg. 17, you will go to his site.

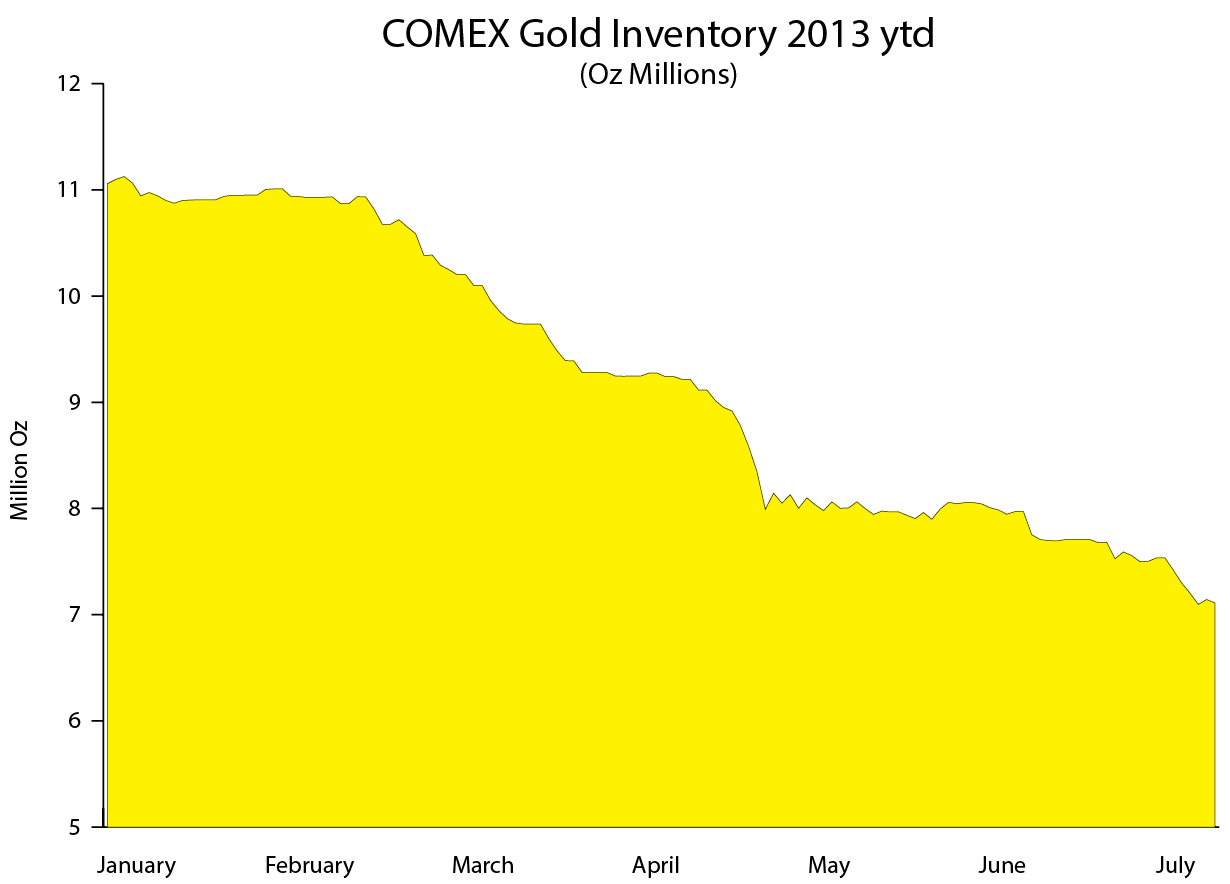

Let's begin our little foray into the warehouses with a look at what has happened to COMEX gold inventories thus far in 2013:

Source: Bloomberg

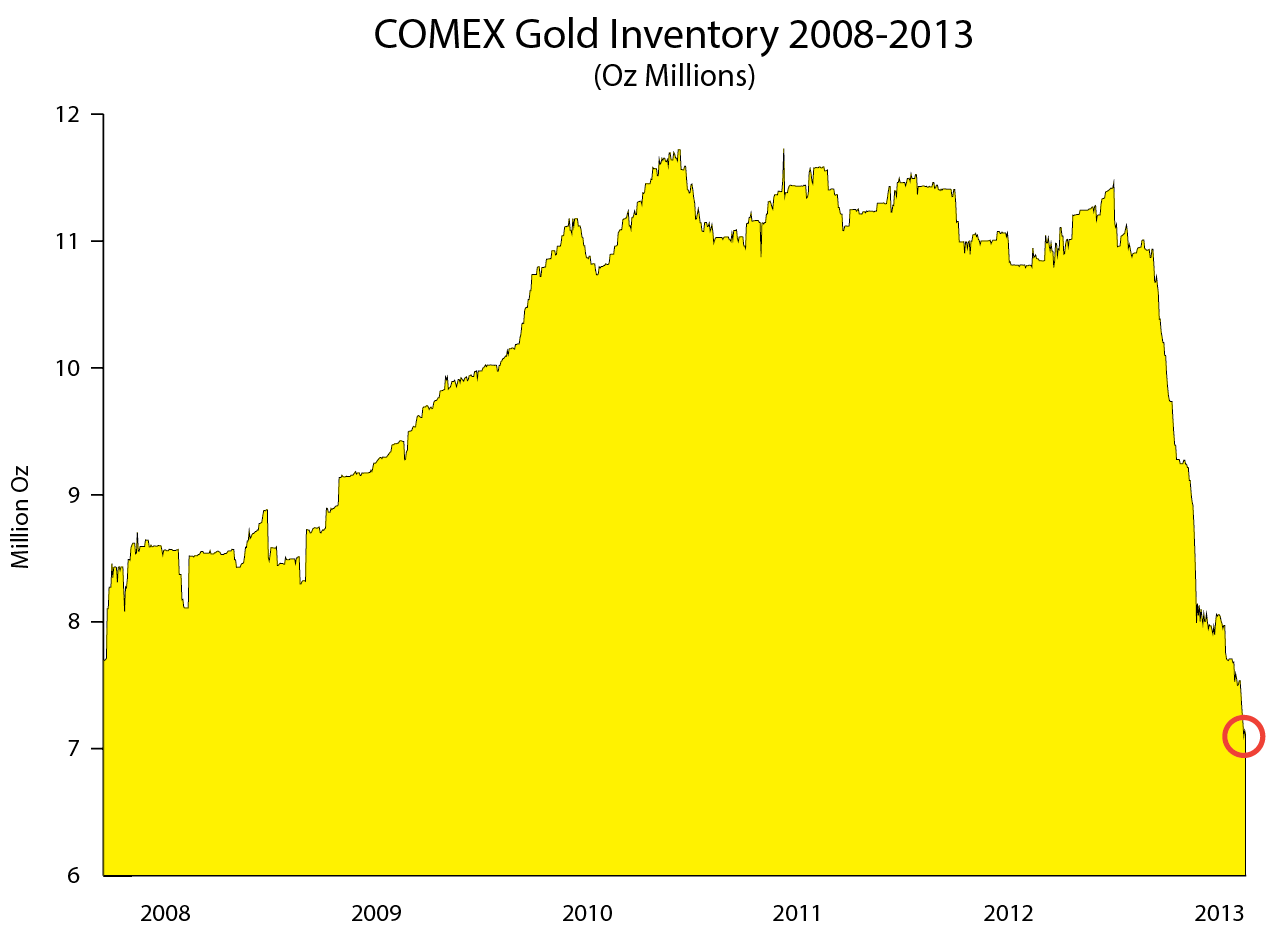

A steady decline. However, the extent of that fall becomes clearer if we take a step back and look at the COMEX inventory over the last five years, at which point "steady" becomes "precipitous":

Source: Bloomberg

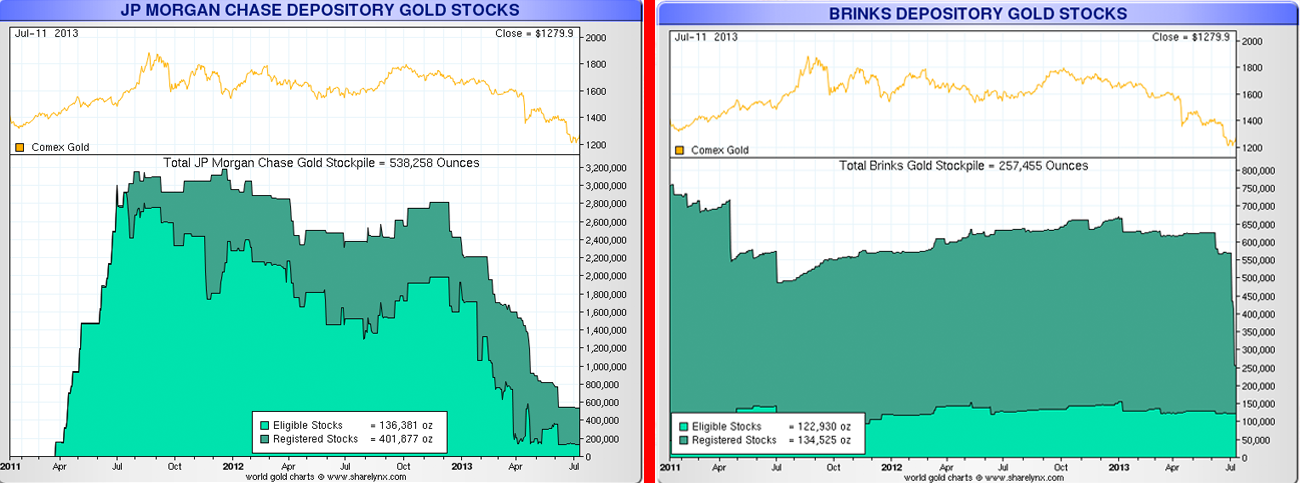

That's the overview, but what does it look like in the individual warehouses? Well, initially it was JPMorgan that was seeing steady outflows (chart, below left), but that has now spread to Brinks (below, right):

Source: Sharelynx

LBMA data isn't available, BUT everybody's favourite chart of the holdings of the various gold ETFs most definitely IS available. Much ink has been spilled over it, but before we dig into that, let's take a look at the chart:

Source: Bloomberg

That's another steep decline, and it has been interpreted as implying a bearish attitude to owning gold via ETF; but in reality, due to the mechanics of the GLD ETF, it is anything but that. All it DOES show is that a lot of gold is leaving the warehouses, yet again. Where it is headed, we don't know.

Oh... did I mention that the bars held on behalf of the GLD ETF at HSBC's vault in London (right next to the LBMA) have the exact same specifications as the bars in short supply over at the LBMA itself? I did? Oh... OK.

Let me attempt to explain the idiosyncracies of the GLD ETF.

Although every ten shares of GLD are supposed to be a proxy for one ounce of gold, in order to exchange your shares for that gold, you have to have what is termed a minimum "basket" size. That is 100,000 shares. These shares are created (and redeemed) by only a limited (but mostly rather familiar) group of "authorized participants":

JPMorgan, Merrill Lynch, Morgan Stanley, Newedge, RBC, Scotia Mocatta, UBS, and Virtu Financial

These authorized participants transfer gold to the trustee (HSBC London) for share creation and receive the shares in return. The redemption process works the same way but in reverse and can only be activated in round "baskets" of 100,000 shares (with a basket currently equating to around $13,000,000 — hardly a retail trade).

It is worth noting that any and all trades on the NYSE consist of a buyer and a seller of paper. Period. Even if a 100,000-share block trades, it is, at that point, still paper.

Things get a little interesting here, so I'm going to turn it back over to Andrew Maguire, who does a fantastic job of explaining some of the peccadilloes of this mechanism:

... there are a number of ways this "allocated" gold backing the shares in the ETF can be diluted/hypothecated in order for the bullion banks to "manage" their physical reserves.

If, as is often the case, there is insufficient allocated inventory available to the bullion bank at the current Comex driven & discounted spot fix price to create the necessary new GLD shares backed by allocated gold, then it is possible for a bullion bank to borrow short these GLD shares from the ETF instead of providing the required Allocated physical to the trustee to meet this obligation, thereby "fly wheeling" this physical demand in order to meet obligations elsewhere, likely at the day's gold fix. This obviously has the effect of manipulating price lower vs. the true immediate supply/demand fundamentals, as no allocated physical metal has to be bought on the open market at that day's fix to meet this new share demand, as should be the case.

This is now the point where transparency evaporates. The AP claims to be short GLD while concurrently claiming to be backing it with an equal size long "UNALLOCATED" spot gold position. However, LBMA unallocated gold accounts are run upon a fractional reserve requirement and leveraged around 100/1, so there is very little need to back this transaction with any real physical at this point; this is left until later.... To unwind this short GLD position, the bullion bank has to ALLOCATE the required amount of unallocated gold and then transfer this gold back to the trustee, thereby receiving back the required # of shares in order to repay the original GLD shares sold short.

So, to recap, we have the following set of facts in place:

1. Central banks have, over the years, leased out an undetermined amount of their gold.

2. In January, Germany demanded repatriation of a large amount of gold from the NY Fed.

3. That repatriation will take an extraordinary (and unexplained) seven years to complete.

4. The price of paper gold futures contracts has been hit incredibly hard since April.

5. Physical gold is being withdrawn at a phenomenal pace from multiple custody locations.

6. Rumours have been rife of shortages at LBMA and COMEX warehouses.

7. Investors & central banks are buying physical in record amounts.

8. In the face of massive physical buying, "the gold price" continues to fall.

Given that knowledge, one might assume that, in the rush to perfect ownership of physical gold, certain "interests" that happen not to be in a position to deliver said commodity to large, important, and extremely powerful customers might want to try and "shake the trees" a little to see what drops out.

The trees have been shaken mightily, and it certainly looks as though some weak holders of the GLD shares have delivered bullion into the hands of the authorised participants — but is it enough? I doubt it.

Meanwhile, over at the COMEX, gold is being removed from the warehouses, bound for destinations unknown. We can't tell for certain where it is headed, but I suspect a significant amount is being placed in private storage, out of the grasp of the bullion banks who need it the most.

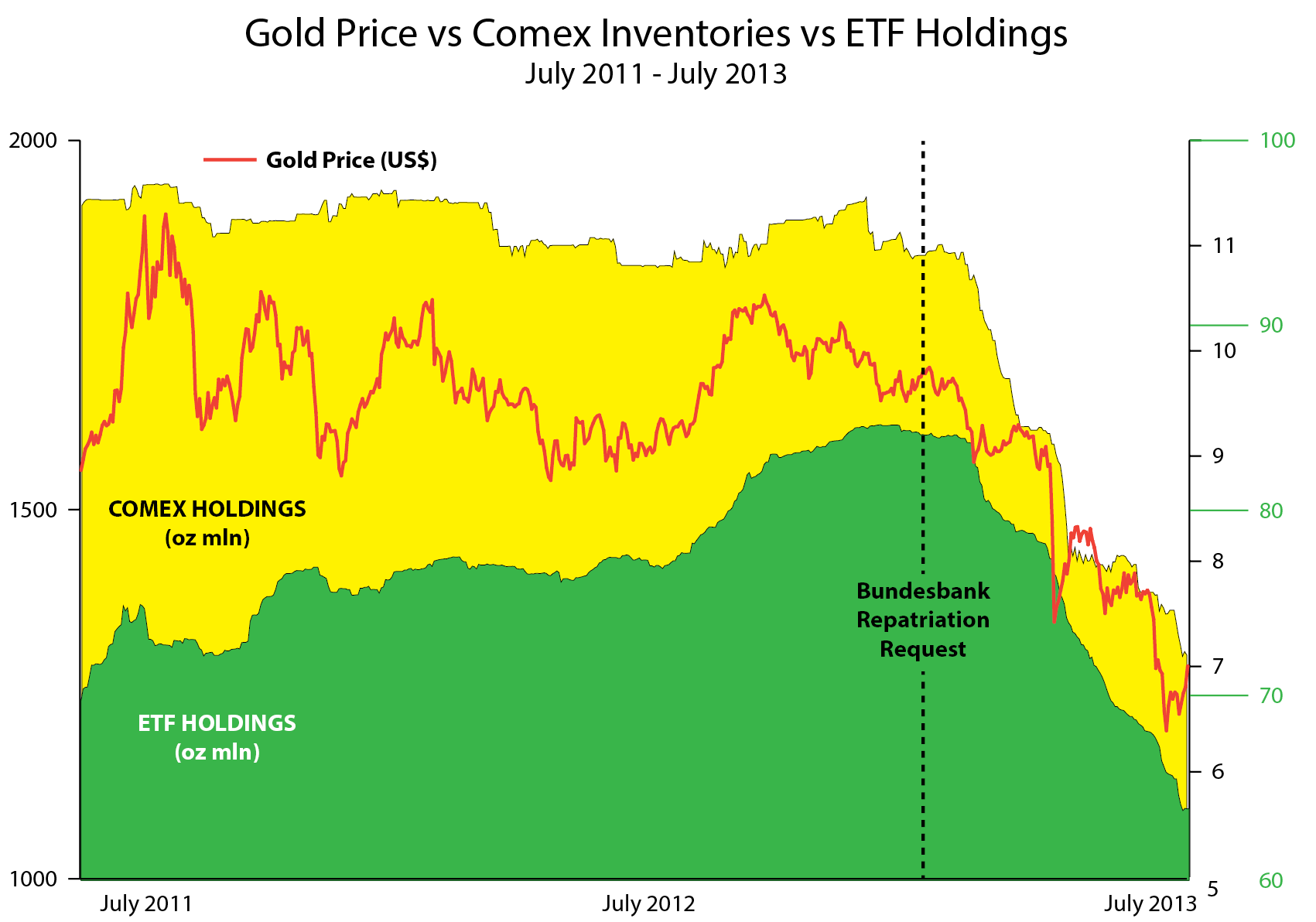

So what does all this look like if we put it together on one chart? Well, it looks like this:

Source: Bloomberg

As you can clearly see, virtually from the day that Germany demanded to have its gold delivered back to the Bundesbank, three very clear phenomena have occurred:

1. The gold price, which had been trending sideways, has plummeted.

2. The physical gold held at the COMEX has been pouring out of the warehouses.

3. The amount of physical gold held by the ETFs has stopped rising and started falling. Fast.

Coincidence? I very much doubt it.

Wanna know what I think, folks? I think the central banks have been leasing their gold out for decades to the bullion banks and now find themselves in the rather precarious position of needing to reclaim that which they are supposed to own before the shortfall is exposed. I think that creates a big problem for both sides of that little scheme.

I think the smash in paper was specifically designed to shake out loose holders — and it has worked to a degree, but only amongst the weaker holders of the ETFs, who tend to "rent" gold rather than own it. I think the stronger hands have been getting their gold out of the official warehouses as fast as they can; and central banks in places like China, Russia, and all over the rest of Asia and South America have been trying to buy and, crucially, to take delivery of physical gold while they still can.

I also think that retail investors — particularly here in Asia — are, unfortunately, compounding the banks' problems by using the weakness in the paper markets to acquire as much physical metal (or, as it's known in this part of the world, "wealth") as they can.

To paraphrase Everett Dirkson, "A few hundred ounces here, a few hundred ounces there, and pretty soon you're talking real problems."

Now, call me old-fashioned if you will; call me a conspiracy theorist, a goldbug, a wacko — whatever you like — but if you do, will you please give me an explanation as to why this gold is vanishing, where it is going, and who is taking delivery of it? Because, from where I stand, the evidence points to the beginning of the unraveling of the fractional gold lending market, and THAT spells trouble.

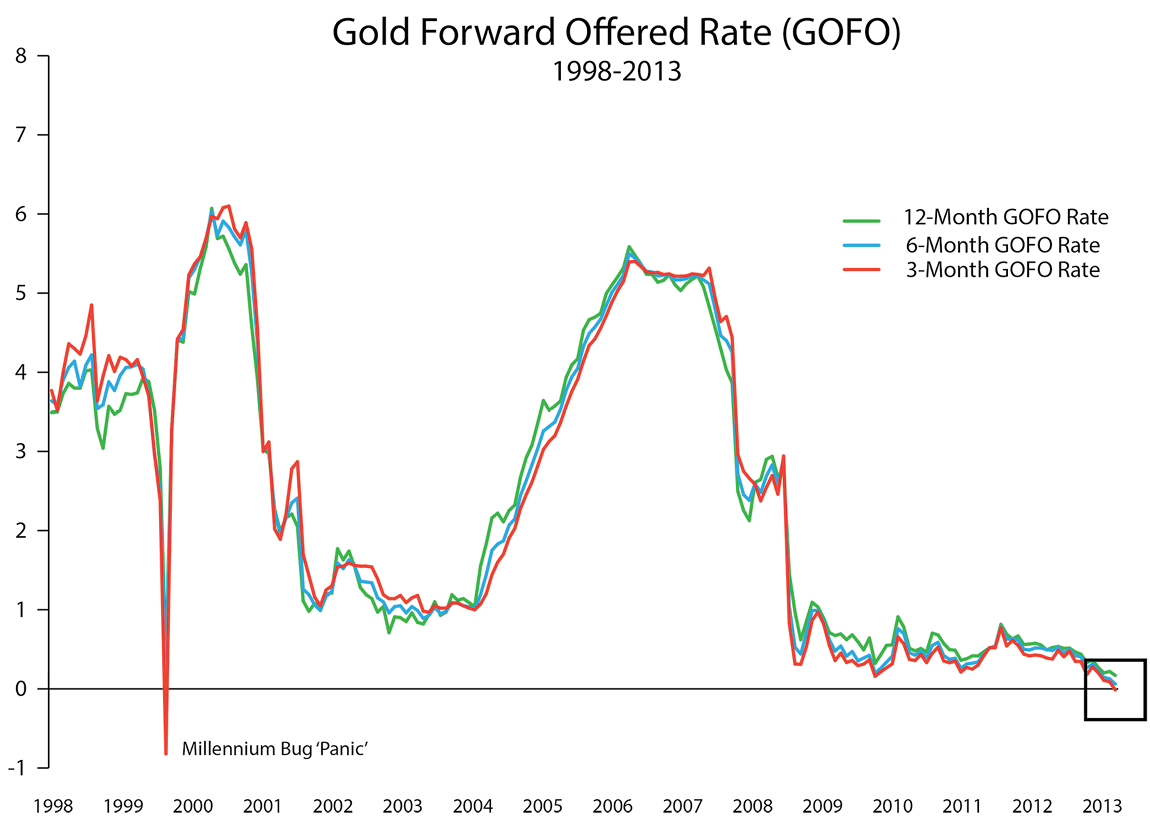

There's one last puzzling development that does however fit neatly into the scenario laid out here today, and that is the curious action of something called the GOFO rate. GOFO is the Gold Forward Offered Rate, and it is the rate used for gold vs. dollar swap transactions. If you hold gold and want dollars in a hurry, you can use your metal as collateral, which reduces your rate significantly.

Source: Bloomberg

Ths week, the GOFO rate did something it has only ever done a handful of times in its long history: it went negative out to three months, which means somebody was willing to pay to have gold instead of dollars right now.

The FT takes up the story:

(FT): The cost of borrowing gold has risen to the highest since the post-Lehman Brothers scramble for supplies, as the bullion market adjusts to a new era in which western investor demand is less dominant.

The niche gold lending market, largely the preserve of a few big banks and central banks, has been uneventful in recent years as investors have built up large holdings and lent them out on the market, keeping rates depressed.

But as investors have turned sellers in recent months, availability of gold in the lending market has been squeezed, bankers said.

The squeeze has triggered a sharp rise in gold leasing rates — the implied interest rate for lending gold in the market in exchange for dollars. The one-month gold leasing rate has risen from 0.12 per cent a week ago to 0.3 per cent on Tuesday, the highest since early 2009.

The move reflects the dramatic shift in the gold market over the past few months as investors have liquidated their holdings en masse, triggering a 25 per cent collapse in prices since the start of the year.

Strong buying in Asia has created additional demand for physical gold, with refineries operating at full capacity to meet orders.

The lack of liquidity in the leasing market has pushed gold forward rates, known as "gofo", into negative territory, meaning that gold for future delivery is trading at a discount to physical market prices — a rare situation that has occurred only a few times in the past 20 years. The last time forwards were negative was in November 2008, when a scramble for physical gold spurred a sharp price rally.

The degree to which the underlying structure of the physical gold market has changed over the last few months has yet to make itself apparent; but the first time we get an "event" that makes it necessary for people who don't have gold to buy some, and for people who do own it to have more, we will see how things have changed.

The gold price has been falling heavily for several months, but when the need to own gold jumps again — and it will; this is a long way from over — all the pieces of this jigsaw puzzle of the weird and wonderful forest of gold manipulation that we have dropped onto the table will slot neatly into place.

What if, when that happens, there just isn't enough gold to go around?

Original source: Mauldineconomics

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.