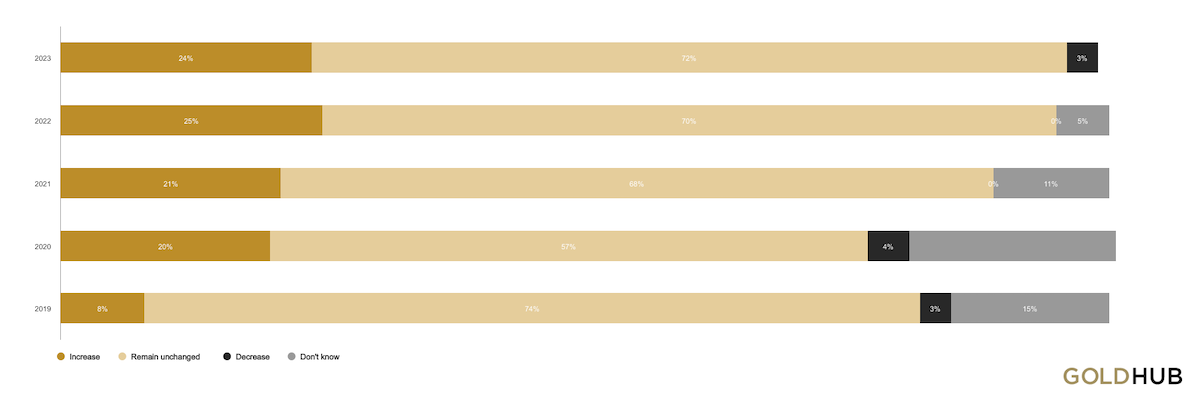

Following a historical high level of central bank gold buying, gold continues to be viewed favourably by central banks. Our 2023 survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months. Furthermore, central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys. By contrast, their views towards gold’s future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.

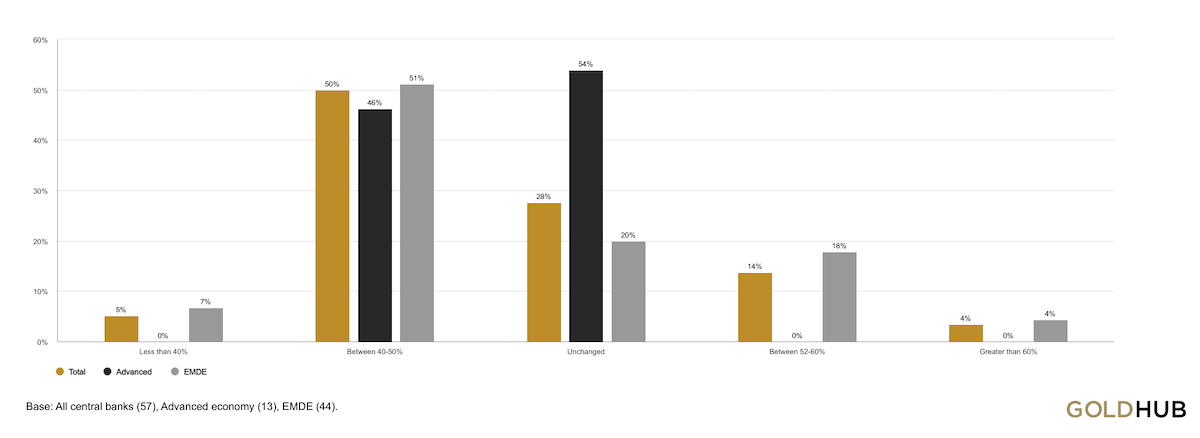

Half of central banks surveyed believe the percentage of reserves in USD in 5 years will be between 40-50%, while just over a quarter believe it will remain unchanged.

What proportion of total reserves (foreign exchange and gold) do you think will be denominated in US dollars 5 years from now?

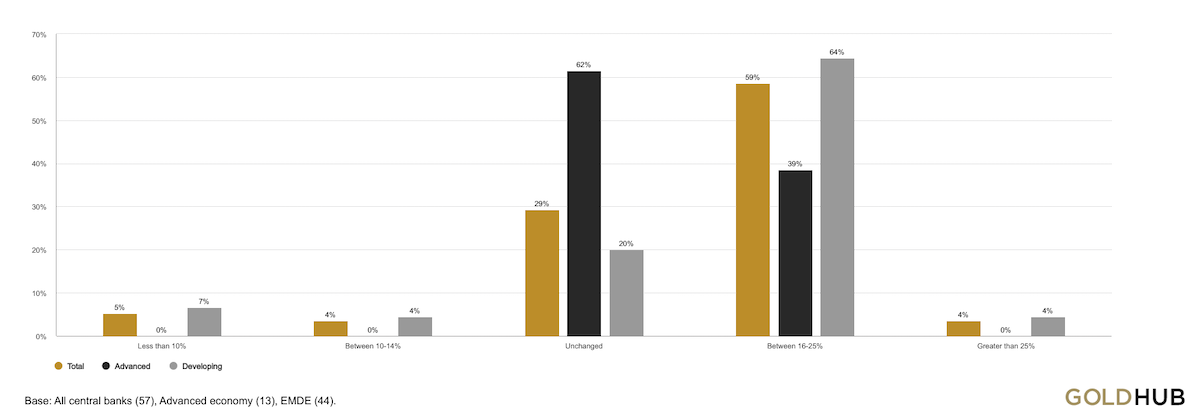

A majority of central banks expect a slight increase in the proportion of total reserves being denominated in gold over the next five years, with developing economies primarily driving this view.

What proportion of total reserves (foreign exchange and gold) do you think will be denominated in gold 5 years from now?

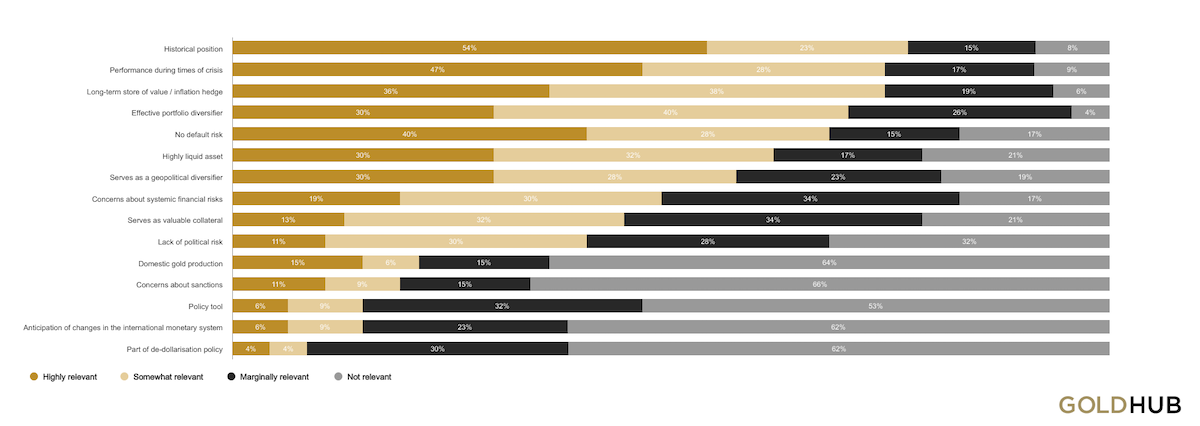

Historical position remains the most relevant factor in organizational decisions to hold gold.

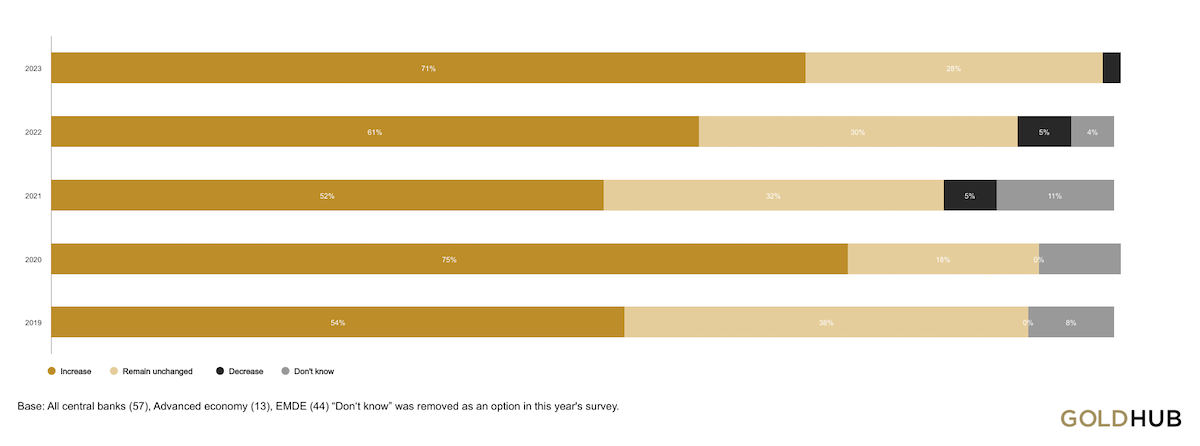

7 in 10 central banks surveyed believe that gold reserves will increase in the next 12 months. This is a 10-point increase from last year.

Similar to last year, a strong majority of respondents do not expect the level of gold reserves in their institution to change over the next year. Around a quarter anticipate an increase.

Original source: World Gold Council

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.