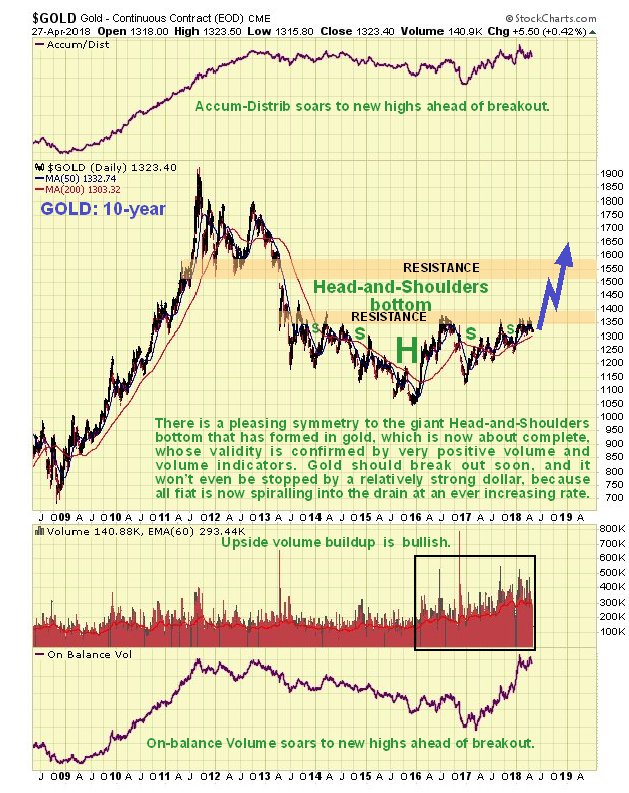

Gold continues to build towards a breakout from a major base pattern, a giant Head-and-Shoulders bottom that we can see to advantage on its latest 10-year chart below. At present it is battling the headwinds of a dollar rally, but a dollar rally won’t stop it, because when we talk about a dollar rally, we mean against other fiat, and all fiat is in the latest stages of a long journey to oblivion, which actually started way back in 1913 with the creation of the Federal Reserve, and accelerated dramatically following Nixon’s elimination of the gold standard in 1971, and started to enter the terminal blowoff phase following the 2008 financial crisis that led to an orgy of money creation culminating in QE.

On the 10-year chart it looks like “all systems go” for gold, with the price advancing steadily towards the neckline resistance at the upper boundary of the pattern on greatly increased volume, which has driven volume indicators to new highs, a very bullish sign. Take a good look at the volume on this chart – it has been expanding steadily since the price rose out of the final bearmarket low late in 2015. Most of this volume has been upside volume, which is why the volume indicators have been advancing strongly and recently advanced to new highs. This has been going on for WELL OVER 2 YEARS. So do you think that this bullish action for all this time is going to be derailed by a dollar rally lasting 2 weeks, or even 2 months? No, thought you didn’t – me neither.

Now we will examine the latter part of this giant Head-and-Shoulders bottom on a 3-year chart. Here we see in more detail the trend of higher lows since the late 2015 bottom, itself clearly very bullish, as is moving average alignment, with the 200-day rising steeply, but not too steeply. Again we see the impressive big buildup in upside volume, that drove volume indicators to clear new highs at the start of the year, and On-balance Volume has been flirting with new highs recently. This chart is also useful because on it we can see where any somewhat deeper reaction due to a continuation of dollar strength is likely to terminate, at one of the two supporting trendlines from the lows that are shown, and it is considered much more likely that any such reaction will stop at the higher trendline. Furthermore, as we will see later when we look at the dollar charts, it could turn up here and break out almost immediately if the dollar should now roll over and drop.

Whilst the 6-month chart is of limited use technically, it does show that gold is actually at a good point to turn up here, as it is close to a zone of support which is underpinned by the rising 200-day moving average in quite close proximity. This looks like a pretty good point to undertake more accumulation of battered down gold stocks.

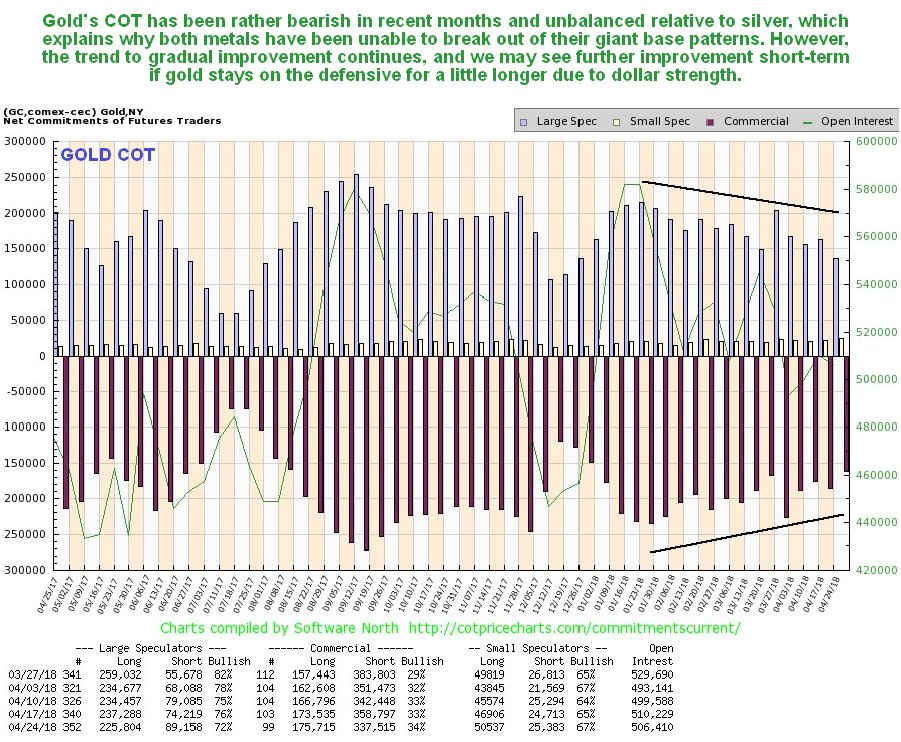

A concern that we have had since late January is that gold’s COT structure seemed prohibitive of a significant rally, simply because the Commercial short and Large Spec long positions were too high, in marked contrast to silver’s which have been decidedly bullish, and that has proved to be the case as gold has not advanced since late January. There is good news here though, for as we can see on the latest COT chart below, even though positions are still in middling ground, they are in an improving trend, and they could improve further if we see more dollar strength over the short to medium-term, although it is believed that they have now eased sufficiently to permit gold to break out.

Now we will look at the dollar whose impressive rally over the past couple of weeks has caused gold to drop back. Although this rally has broken it out of what looks like an intermediate base pattern, it nevertheless rates as a countertrend rally at this point because it has brought it up to resistance close to a quite steeply falling 200-day moving average, and moving averages remain in bearish alignment, as we can see on the latest 6-month chart below. Thus it is interesting to observe that a bearish “gravestone doji” formed on Friday, where it advanced intraday but was beaten back by selling so that by the close it ended up back where it started at the open - this is a bearish development for the near-term, although it would be negated by a move above Friday’s intraday high.

The 2-year dollar index chart does not look at all encouraging for dollar bulls. While bulls may derive some comfort from the fact that the dollar has broken out above the downtrend line from the late 2016 peak, it has not broken out of the adjusted parallel downtrend channel shown, and is instead at its upper boundary, at resistance and at its falling 200-day moving average, a combination of circumstances that should at least lead to its pausing here, if not reacting back, especially as it has become overbought on its short-term oscillators. Going just on this chart, the dollar could be done here and turn tail and go into decline again, which would be good news indeed for both gold and silver.

It is worth zooming out and looking at the dollar index also on its 5-year chart, because on this chart we see that it may be at the lower boundary of a giant Broadening Formation. Whilst these patterns are bearish in nature, what quite often happens with them at this stage is that a period of wild and erratic trading ensues which is followed by a breakdown from the pattern and a collapse. Thus we could see a more significant advance by the dollar over the medium-term before it turns lower again.

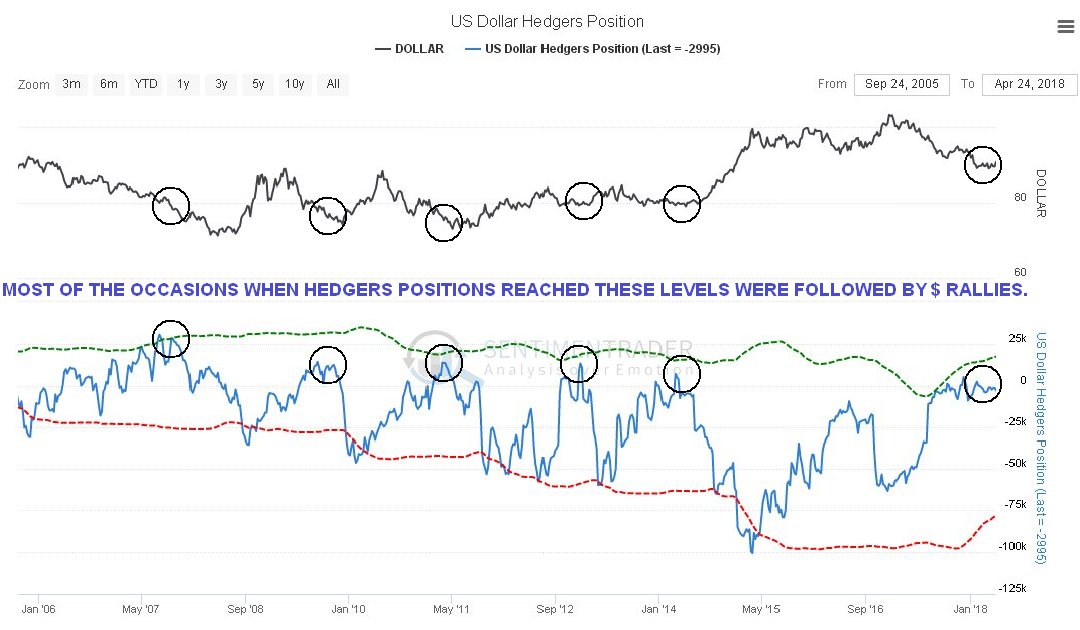

The latest dollar Hedgers chart supports the idea of a larger dollar rally developing here, for as we can see Hedgers positions are at levels that in the past have led to significant rallies.

Chart courtesy of sentimentrader.com

One would think, based on the continuing and even accelerating abuse of the dollar involving profligate spending and careening deficits that it would be incapable of staging a significant rally at this juncture. So what is going on here, why is a dollar rally possible? First of all, it is very important with respect to gold and silver to remind ourselves that the dollar would only be rallying against other currencies, other fiat – all the main global currencies are being debased and reduced in value at breakneck speed, and that includes the dollar. Next we should understand that the power of the Neocon Cabal that runs the United States and its various overseas interests rests on the continuation of the dollar as the global reserve currency, and the recycling of dollars by those who accept payment in dollars into Treasuries. It is a system that enables the United States to indulge in unlimited spending and push the bill for it off onto to the rest of world, since all they have to do to receive good and services from the rest of the world is to print up more and more paper in the form of dollars and Treasuries, created these days electronically, and hand them over in exchange – it can run careening deficits in perpetuity in the confident knowledge that it can inflate away the debts at some point in the future. The reason that the dollar is rallying now is that the Fed is treading a fine line raising interest rates gradually, while the vassal States like Europe and Japan have been ordered by their Master to keep their rates lower, in order to create a differential – a big enough difference to attract sufficient capital into the US to prop up the dollar and the Treasury market. The economy may slow and the stockmarket crash, but they’ve got no problem with that, as the bond market is far bigger and thus much more important to them than the stockmarket, and Trump can be squarely blamed for a stockmarket meltdown and ensuing economic hardship and booted out at the next election, and replaced with someone more congruent with Neocon policy.

If the dollar is knocked off its throne as the global reserve currency, that’s it, the show’s over and the United States becomes just another country – another country with an outsize and crippling debt problem. This is the reason that the US will go to any lengths, including invading and destroying other countries, to maintain the dollar’s dominance – both Iraq and Libya naively made the mistake of thinking they could stop using the dollar and use something else like the euro and gold, so they were invaded and destroyed. They would do exactly the same with Russia and China if they could get away with it because Russia and China are taking steps to circumvent the dollar, but they are bigger and more powerful and most importantly could nuke the aggressors if faced with attack.

We are seeing a massive tectonic shift of economic power in the world, from the old corrupt, burned out Western powers to the rising eastern powers in Asia, especially China of course, whose economy is destined to eclipse that of the US before much longer. The rising powers do not want to kneel before the US hegemon with its hundreds of military bases spread all around the world and its policy of “gunboat diplomacy” like the old British Empire, i.e. do what we tell you to or we’ll send our aircraft carriers over and blow you to bits. They understand that the Achilles Heel of the US Empire is the dominance of the dollar and Treasuries and the “we’ll shut you out if you don’t comply” SWIFT system of payments. They also understand that the way to curtail US power and “send them home” is to finish the dollar as the world’s reserve currency, and they are working assiduously towards this objective. The cornerstone of this policy is to buy up as much of the world’s gold bullion as they can with the eventual aim of backing their currencies with it (the Yuan, but also the Ruble and others). When they do this, the dollar will really collapse towards worthlessness, the US economy will implode and it will simply be impossible to properly fund the bloated gargantuan military with the result that the overseas hegemonistic adventures will end, and hundreds of military bases will become ghost towns with tumbleweeds blowing through them, and Israel may suddenly find itself very alone. The Asian powers will of course not move to back their currencies with gold until they are in a better position to resist the military aggression from the US that this will provoke – they are not that stupid. This is why they are beefing up and modernizing their military capability as fast as they can.

Needless to say, the US Neocons are not going to take this lying down, which is why they are moving forward with their plans to try to take down Russia and then China as fast as they can. As mentioned above they cannot attack them directly because of their nuclear capability, if they could they would. So they are going after them economically, and starting with Russia because its economy is much more modest than that of China. Once you understand this, everything falls into place, a kind of “Eureka” moment if you will – the Western fomented coup in the Ukraine to install a pro-Western puppet government in a country that can later be used as a missile platform, the sanctions imposed on Russia after it “invaded” the Crimea, the conspiracy with Saudi to crash the oil price several years back to inflict economic damage on Russia, the false flag gas attack on Syria a few weeks ago partly to claim that Russia was complicit to justify more sanctions etc etc, and of course the endless anti-Russia hate campaign in the controlled Western media, in order to try to justify these actions and prepare the public mind for possible future military action against Russia. China should take note of all this, because if Russia goes down, China is next, and in fact the Neocons are “champing at the bit”, and showing it by imposing tariffs on China in an attempt to weaken its economy, not seeming to realize that tariffs work both ways.

What the Asian powers should do is organize themselves into a defensive axis. Russia should throw a nuclear umbrella over Iran, and also Turkey if it wants to join the club – Turkey has foolishly been courting the European Union in the past, and allowing the US to use its military bases. It should desist in both these endeavors and align itself with Russia, which happens to be a lot closer than the US. China should buttress Russia economically to lessen the impact of the Western economic assault. Most of the countries of Europe are vassal States of the US, little more than stooges – you would think that Poland would know better after having been walked all over in both directions for centuries – by hosting NATO missiles pointed at Russia, it is really asking for it, ditto the Baltic States and Romania. Japan is also a vassal State of the US, which puts it in a most perilous position indeed, for while it may suit the Neocons to have it bristling with missiles pointing at nearby China, such action will make it a target, a very close and densely populated one at that.

The late Larry Edelson pointed out in Winds of World War 3 and on numerous other occasions that there is a very dangerous confluence of war cycles that peak in the years 2019 – 2020, and the way things are shaping up it doesn’t look like the world is going to get through this period without major conflict. Sadly, Larry did not live long enough to see his predictions become reality, but then again, maybe he wouldn’t have wanted to.

If you have read this far you will understand that what we are looking at here is the accretion of two gigantic opposed axes of power, the axis of the West, and the Asia axis, that will comprise the two sides in a potential 3rd World War. The pieces are all falling into place. We have not seen the sort of predatory aggression being displayed by the US Neocons and their vassal states since the time of Hitler and the Nazis and as history amply demonstrates – if you keep looking for trouble you are going to find it.

With regards to the timing of the Asian powers backing their currencies with gold, as mentioned above, they cannot be expected to do so until they are ready to face the potential military repercussions that may and perhaps probably will result, as the Empire becomes desperate and even more reckless. When it happens, gold will do a moonshot.

Original source: Clivemaund

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.