The next Federal Reserve policy meeting is not until December 14. Nonetheless, the US 3-Month Treasury Bill market is already pricing in a hike to the key interbank lending rate.

Why is this important for precious metals investors? Because it was the first Fed Rate hike in nearly a decade last December that marked major turning points in several interrelated markets, including the 2015 bottom in gold and silver prices.

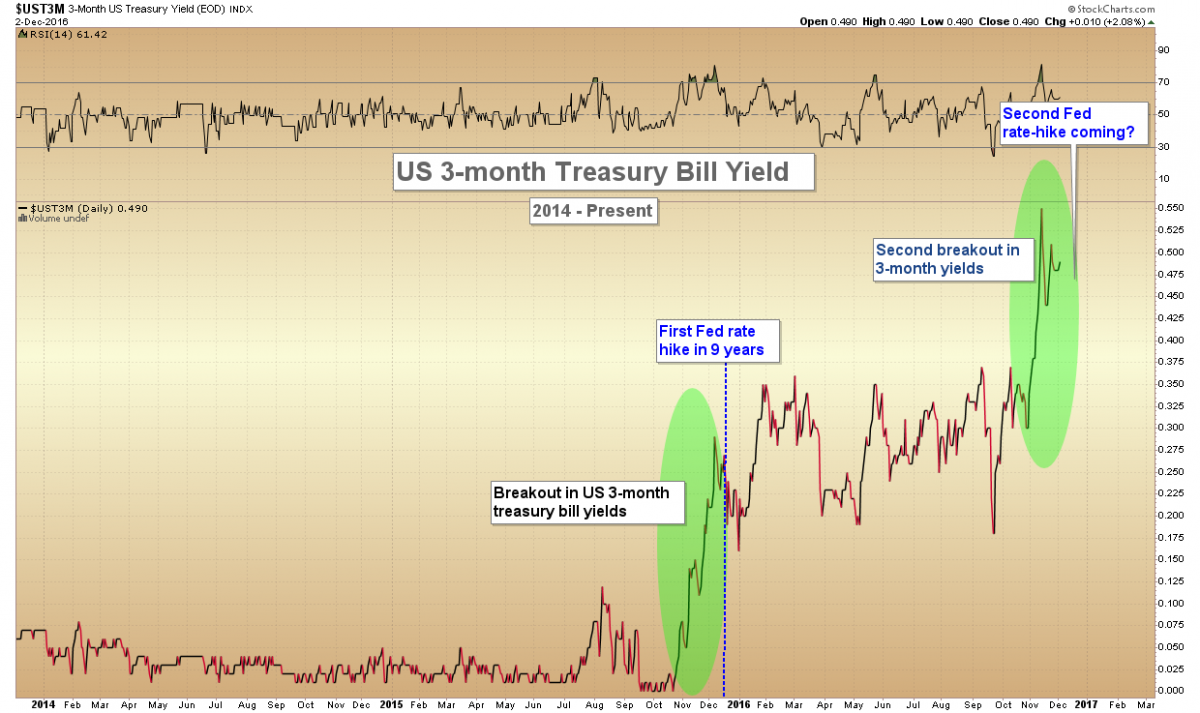

The graph below shows the 3-Month Treasury Yield since 2014.

Note how the yield on this short-term government debt spiked higher to break out of the prior trading range in November 2015 (first green highlight), moving from 0.0% to 0.28% by early December.

The 3-month Treasury market effectively predicted that the Federal Reserve Board would vote to raise the Fed Funds interest rate two weeks before the central bank actually decided to do so. For reference, the blue dashed line shows the day, December 16, on which the Fed released its historic interest rate decision after the longest period held at 0% ever. Rates on that day were raised from zero to 0.25%.

As we can see by the second breakout in 3-Month Treasury Rates (second green highlight), this same market is now predicting, exactly one year later, another rate hike to come by the Fed next week. Will the 3-Month Treasury be correct again? While no indicator is accurate 100% of the time, this is the only market to have correctly anticipated the first Fed rate hike in such a clear manner in late 2015.

What Impact Did The 2015 Rate Hike Have On Gold?

The four-part chart below illustrates the action leading up to and immediately following that first rate hike amongst four interrelated asset classes: 3-Month Treasuries, gold, the US dollar and the US stock market:

Note that gold had fallen precipitously from $1,190 in October 2015 through $1,045 days before the hike, only to reverse strongly in the weeks following it, and exceeding the $1,190 level in February.

Conversely, the US dollar had been rising in the months prior to the rate hike up to the 100 level on the US Dollar Index, only to begin to roll over and then drop during the subsequent five months after decision, down to 92 by May.

Similarly, the US stock market, which had been strong prior to the December rate hike, fell nearly 11% in the three weeks after the Federal Reserve hiked.

Next Week's Fed Meeting -- A Repeat Of 2015?

With slight variations in the specific price points, we are seeing the same setups today as in 2015.

Similar to 2015:

- 3-Month Treasury Rates have spiked a month prior to the Fed meeting.

- Gold has fallen prior to the meeting.

- The dollar has risen in the preceding three months.

- The stock market has remained firm prior to the rate hike.

In sum, these four markets are showing similar interrelated action prior to the upcoming December 14 decision as they did one year ago, prior to the last interest rate hike.

We must recall that interest rate hikes have a high correlation with rising gold prices throughout history -- not the opposite, as often purported by the mainstream media. See our past article, Rising Interest Rates? Watch for Higher Gold Prices for a review of the correlation between gold prices and rising interest rates.

We will know if the Treasury market is correct in its prediction in eight days. Precious metals investors are advised to monitor for what could be explosive action again after a second Fed rate hike.

Original source: Gold-eagle

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.