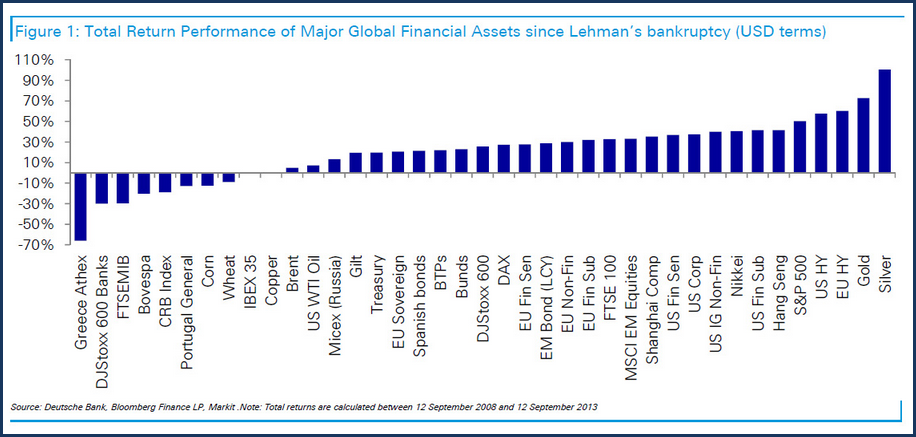

Sunday 12 september 2013 marked the five-year anniversary of the collapse of Lehman Brothers (12 september 2008). A good moment to size up how well global markets have recovered.

According to Deutsche Bank, the total return performance of Major Global Financial Assets shows that Silver had the highest percentage gain. Gold takes the second position amongst these global financial assets.

Deutsche Bank's commentary:

"As one might have expected, on a total return basis (all in $ terms), Silver (100%) and Gold (73%) were the top two performers followed by European HY (60%), US HY (58%) and the S&P 500 (50%). Core rates have also done well as central banks propped up the fixed income markets by artificially keeping interest rates low for many years (even with the recent sell-off). Bunds, Treasuries, and Gilts managed to gain 23%, 20% and 20% respectively over the 5-year period. Despite the wobbles this year, EM equities and bonds are still up 33% and 29% over the same period as they have benefited from global liquidity and a mostly favourable growth outlook relative to DM. At the other end of the performance spectrum, Greek equities, down -66% since the Lehman bankruptcy to rank as the worst performer in our sample, are clearly still bearing the brunt of the European sovereign crisis. This is followed by the Stoxx600 Banks index (-30%), the FTSEMIB (-30%), and the Bovespa (-20%). The overall picture though is one of positive returns for most asset classes. We should add that this period ties in with our 5yr rolling nominal global growth being at the lowest since the 1930s so the performance of financial assets is almost entirely down to liquidity and not growth. Food for thought as tapering starts before growth has proved it’s self-sustaining."

Silver has outperformed all of the financial assets as well as the major commodities such as copper, Brent Crude, corn and wheat. What is even more amazing is that silver has still taken the number one position even though its price has fallen 56% since its high in May of 2011.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.