The central bank of Venezuela has paid $172 million to the American bank Citigroup to recover the gold it had swapped with the bank. According to Reuters, "the precious metal was previously provided by the central bank as collateral for a dollar loan".

Venezuela has used a part of its gold supply in recent years to take out dollar loans from foreign banks, but due to the new American sanctions, U.S. banks are no longer allowed to carry out these swaps.

As a result, Venezuela had no other option than to end the currency swap with Citigroup and to return the gold.

The reversal of this currency swap shows that Venezuela still managed to get enough dollars to repay the loan.

“Citibank got paid,” said a local finance industry source familiar with the negotiation who asked not to be identified.

“The policy is to recover the gold,” added a second source consulted.

The country however is still in trouble, because the American sanctions made it almost impossible for companies and financial institutions in Venezuela to do business via American banks.

Crisis in Venezuela

Venezuela has ended up in a severe financial crisis due to a combination of low oil prices and a failed economic policy. The oil price has recovered to some extent, but the Latin American country is hardly benefiting from this. Due to the crisis, there was little investment in the oil industry, resulting in a decrease in oil production. This makes it even more difficult to restore the balance of payments.

Venezuela is strongly dependent on dollars for its imports, but due to the declining oil revenues, the flow of dollars became increasingly scarce. The problem was so bad that the central bank started to offer their gold as collateral to various banks, in exchange for dollar loans. The central bank made a similar deal with Deutsche Bank in order to get dollars from their gold hoard.

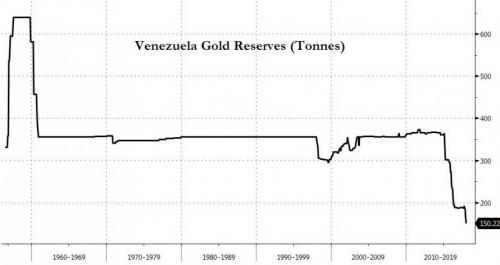

Due to the financial crisis in Venezuela, the gold reserves of the country declined by over 50 percent in a few years, from around 360 tonnes in 2014 to just 150 tonnes at the end of 2017.

The central bank had to use part of its gold supply to pay for imported goods.

Original source: Zero Hedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.