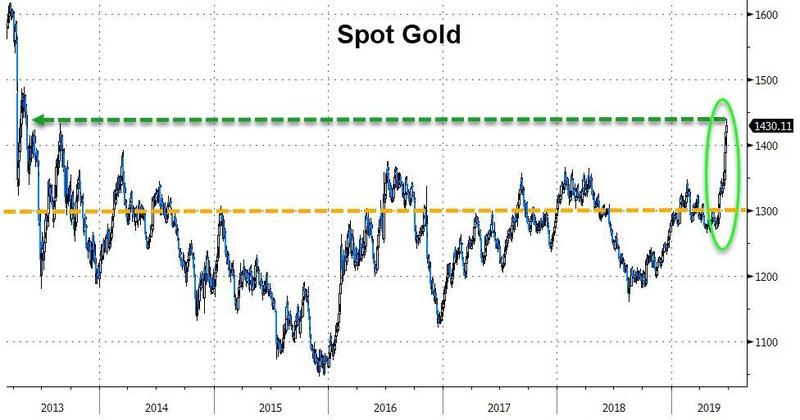

Having tested $1300 numerous times over the past few years, gold has broken dramatically higher in the last month, hitting 6-year highs as President Trump rhetoric around the world raises tensions and increases the odds of WWIII.

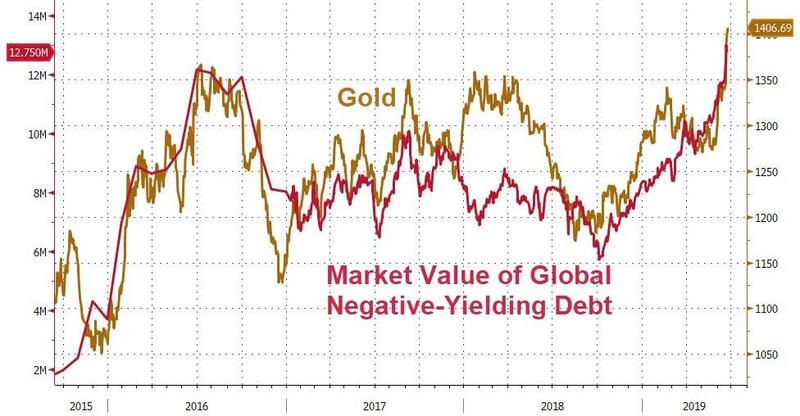

The surge in the precious metal has accompanied a collapse in bond yields around the world and a record level of negative-yielding debt...

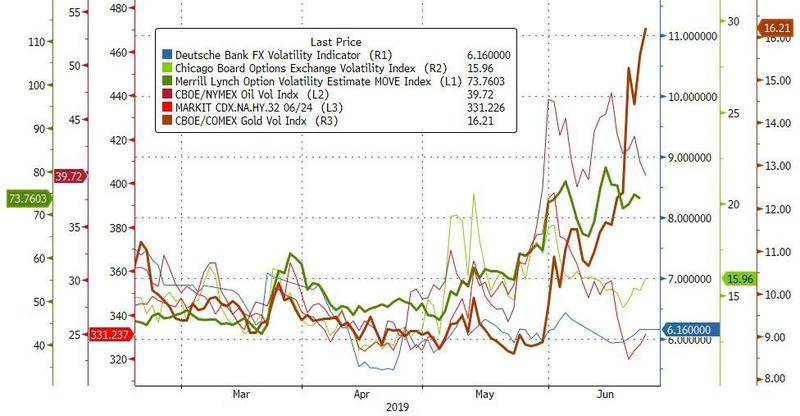

And while Gold volatility is soaring...

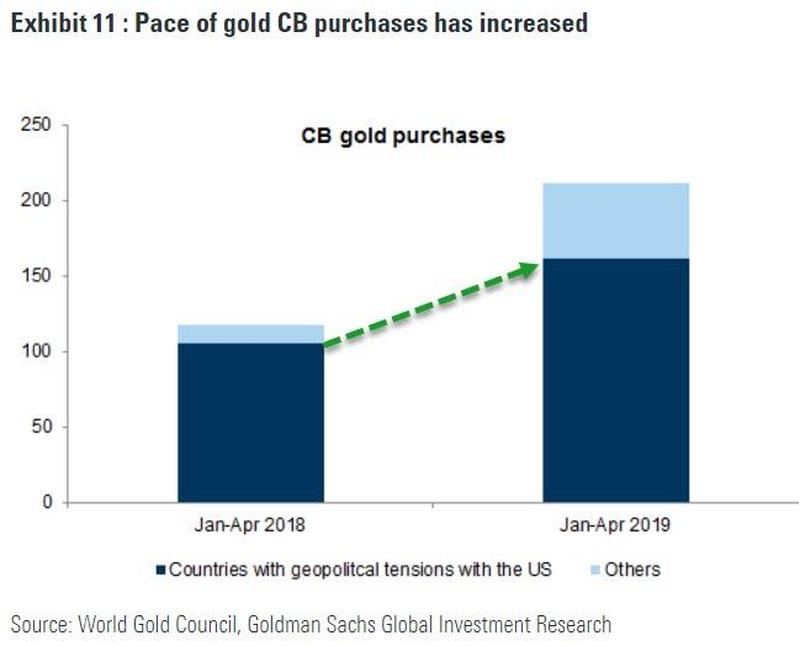

Demand remains abundant, as Goldman details in its latest note, raising its outlook for gold, countries with "geopolitical tensions with the US" are buying everything:

Central bank demand is gaining momentum and we now expect 2019 purchases to reach 750 tonnes vs 650 tonnes last year. Visible gold purchases YTD are running at 211 tonnes until April vs 117 tonnes over the same period last year (see Exhibit 11).

Importantly, China just raised its gold purchasing pace from 10 tonnes per month to 15 tonnes for April and May as it aims to diversify its reserve holdings.

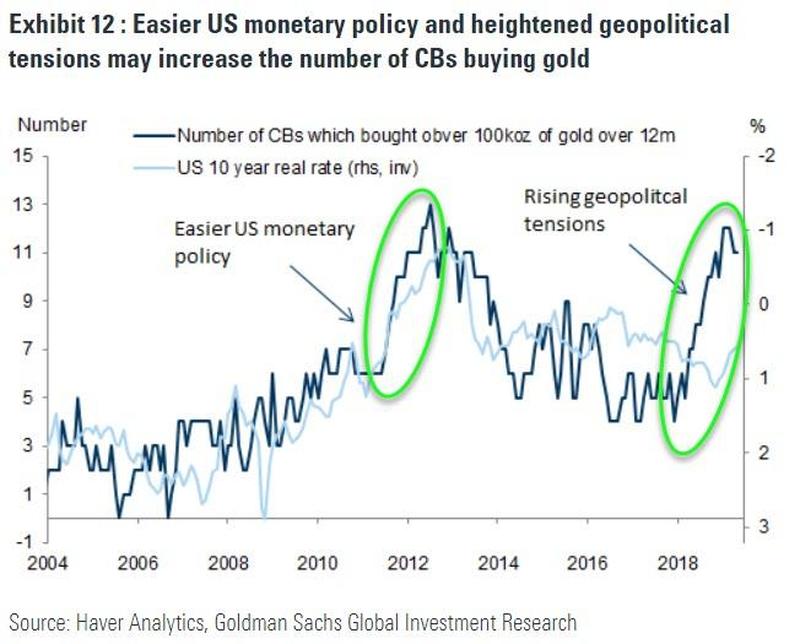

With the Fed and ECB now both likely easing monetary policy, more CBs may decide to add gold to their portfolios as they did between 2008 and 2012 (see Exhibit 12).

Also, just recently, trade tensions between India and the US have begun to escalate as India retaliated with tariffs on US goods in response to US steel tariffs. Rising tensions with the US often create upside potential to a country's gold purchases

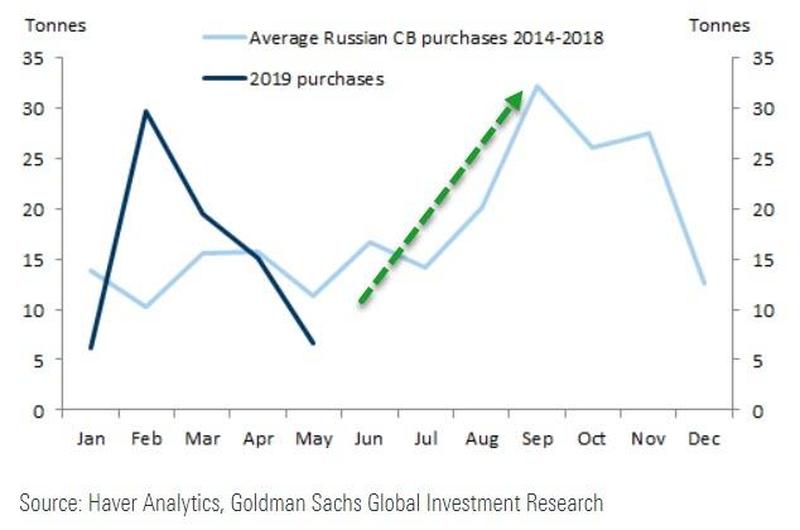

Additionally, in case you thought the move was exhausted, Goldman notes that there is about to a pick up in demand as Russia purchases tend to be strongest in Q3...

And finally, Goldman notes that good economic news and bad economic news could both be positive for the precious metal at this point in the cycle.

If DM growth fails to pick up in the second half, gold has substantial upside potential.

"If DM growth continues to underperform, there is room for a much more substantial build in ETF positions. Last time we were in a similar environment was in 2016. DM growth back then was as weak as it is now and both the Fed and the ECB turned more dovish."

"But back then the push into ETFs was significantly higher than it is currently... we think that current low growth makes owning gold appealing from a diversification perspective."

And Goldman notes that an improvement in global economic growth is not necessarily bearish for gold.

"Our economists expect the bulk of the acceleration in GDP growth to come from ex-US and EM countries in particular. This should support gold through the "wealth" channel. Importantly, a reduced US growth outperformance points to a weakening of the dollar, which should boost the dollar purchasing power of the world ex-US (see Exhibit 7). In addition to this, gold is starting to build momentum in the local currencies of its two biggest consumers, India and China."

And the momentum gold prices built in the first half of 2019 can lead to an increase in EM retail gold demand in the second half.

Goldman concludes, "we believe that gold continues to offer significant diversification value with substantial upside if DM growth continues to underperform... or, as we noted above, global tensions continue to rise."

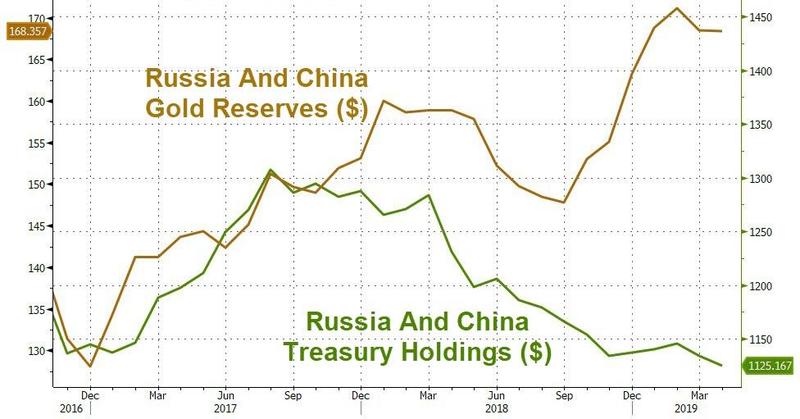

As we noted previously, combined Russia and China Treasury holdings are at their lowest since June 2010 as China and Russia's gold holdings have soared...

De-dollarization?

Original source: Zero Hedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.