The coming hyperinflation will start slowly and few people will realise what is coming. But once the first real inflation signals are appearing, the process will speed up fast as the currency debasement accelerates.

Right now we are most probably seeing the first signs of inflation. The rising CRB index, together with rising oil, silver and interest rates are all telling us that inflation is coming. Initially, we will see a gradual increase but soon inflation will accelerate until we in the next few years reach hyperinflation.

HYPERINFLATION IS A CURRENCY EVENT

Of course, nobody sees hyperinflation as a credible outcome of todays’s low growth environment. But hyperinflation is a currency event and it will come as a result of all major currencies finishing the move that started with the creation of the Fed in 1913. Since then, all currencies have fallen 97-99% in real terms. So there is only 1-3% to go to reach zero. But the problem is that they won’t just fall 1-3% but 100% from today. This will be achieved by massive money printing in an attempt to save a debt infested global economy.

So why will central banks now succeed with creating inflation when they have failed for so long? They have for some time used their two major tools to create inflation by printing money and lowering interest rates to zero or negative. But why do they want inflation since it destroys the value of money? For example, an inflation rate of average 3% halves the value of money in 24 years. What is desirable about that?

The simple answer is that inflationary growth creates the impression of real growth. Inflation gives the illusion that people are better off whilst it instead makes them poorer and destroys the value of their savings.

WHY LOW INFLATION DESPITE MASSIVE QE

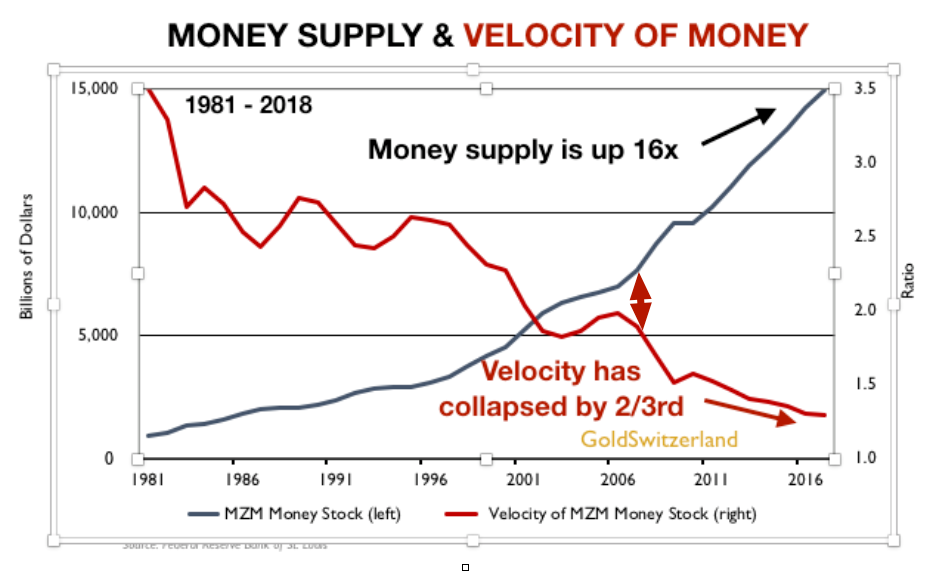

So in spite of unlimited money printing and credit creation, governments around the world have failed to create their desired growth by inflation. The reason for this is that the velocity of money has declined to the lowest levels for over 60 years. As the graph shows, money supply is up 16x from $0.9 trillion to $15 trillion since 1981. At the same time the velocity of money has declined by almost 2/3rd.

The more money that is printed, the less it is used. As the chart shows, money printing has gone exponential from 2006 whilst velocity has crashed. This is really a paradox and a new phenomenon. There are some simple explanations. Firstly, the printed money is not reaching the people. The banks have not been lending the printed money as they were more interested in shoring up their weak balance sheets. So where has all this printed money gone? The banks have used it for their own trading. It has also gone to the benefit of the top 1% or less who have invested in stocks, bonds and property. In these asset classes we have seen massive inflation fuelled by cheap money and unlimited credit. But those figures don’t show up in the official inflation numbers or the velocity ratio.

Another reason why velocity and inflation are not going up is that the world is now over borrowed and ordinary people have so much debt that they can’t take on any more. We have reached debt saturation and the printed money is not creating growth. And why should it?

EVER MORE DEBT TO GENERATE GDP GROWTH

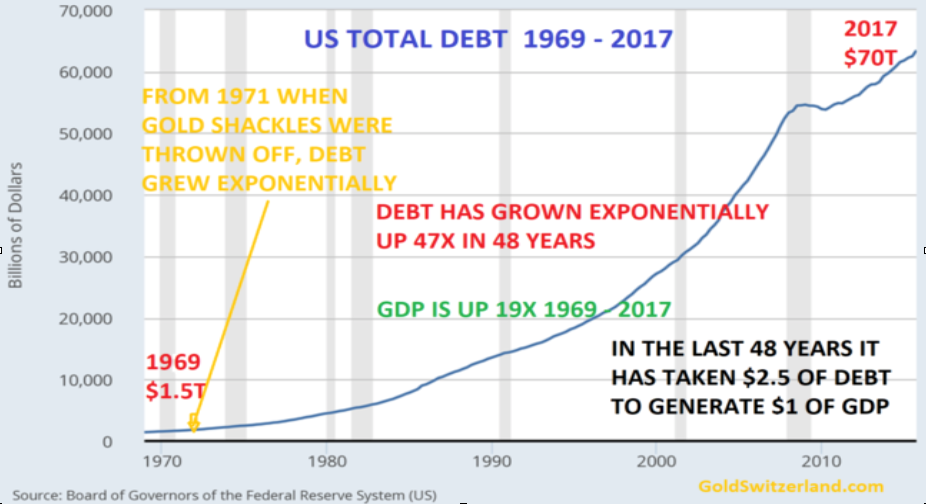

If printed money would create wealth, we could all stop working and just print more. As the graph shows, since 1971 total US debt has gone up 47x from $1.5 trillion to $70t whilst GDP has gone up only 19x.

Thus in the last 48 years it has taken $2.50 to create $1 of GDP. And since 2006, it is around $5 debt for $1 of GDP. This means that the US is running on empty. The country can’t even grow by printing money. How can the US then grow now when QE stops and QT (tightening) starts combined with higher rates? The simple answer is that it can’t. The US economy will come to an abrupt halt very soon and go into a massive reversal in the coming years.

INTEREST RATES WILL GO UP FOR DECADES

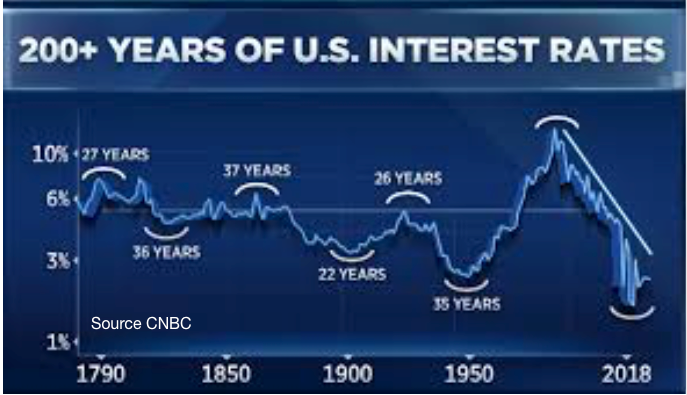

US rates bottomed in 2016. The 10 year Treasury then hit a low of 1.3%. It is now almost 3%.

The 35 year cycle chart which touched all-time lows in 2016 has now turned up with a vengeance. Although we will see corrections, the trend in rates is now strongly up and the current cycle will not turn until rates are in the high teens or even above.

Higher rates will come as a result of higher inflation and defaults. Credit markets will become very risky and lenders will only lend if they get paid for the risk. Bond holders will also panic out of the market when they realise that they will never be repaid with real money. I have never understood how anyone can lend money to bankrupt governments who at best will repay the money with more borrowed funds in a debased currency. More likely, most governments will default although they will find another fancy name for it like moratorium. So anyone holding government bonds is likely to end up with nothing but a worthless IOU.

OIL BACK TO $150

Oil is also in a strong uptrend which is likely to reach the 2008 highs of $150. Oil is already up 260% from the 2016 lows. A global economic downturn would speak against that but there are many other factors that will drive the oil price up. Firstly oil is still priced in dollars although that will change gradually as the Petroyuan gains hold. But hyperinflation and a collapsing dollar will lead to a record price of oil in US dollars. So would any geopolitical conflict, with Saudi Arabia or Iran especially.

SILVER BREAKING OUT

Finally, silver is in the process of breaking out at the apex of a 2 year triangle. This is a very strong indication that silver will now start a major move that will reach multiples of the present price. See my article last week.

The Gold / Silver ratio is a very important indicator of the trend in the precious metals. I have previously written about the importance of the 80 level in the ratio and that every time it is reached, it the ratio turns down. We have just seen a 3% fall in this ratio in the last couple of weeks. Normally when the precious metals turn, silver is the leader and it now looks like silver is taking the lead in the next phase of the bull market for gold and silver.

GOLD IN BOLIVAR 75 MILLION PER OZ – STILL TO COME IN US$ AND EURO

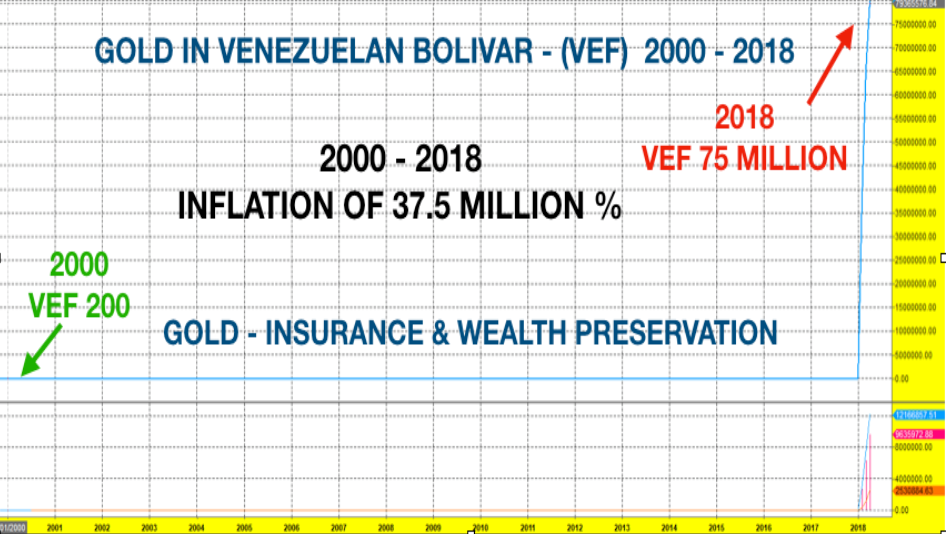

Since we are very likely to go into a hyperinflationary economy in coming years, let us just remind ourselves what that means in relation to gold.

In the chart above is gold in Venezuelan Bolivars. It moves up exponentially every week. The price has gone from VEF 200 to VEF 75 million in this century and that won’t be the end.

We will see similar moves in all currencies in coming years including the Dollar, Euro, Pound, Yen etc.

But don’t see physical gold and silver as a way to make money. Instead buy it as critical life insurance because without it your personal economy might not survive.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.