Today, if gold had the same kind of performance as the Dow since around the creation of the Federal Reserve in 1913, then it would have topped out at around $7 758 [(29568/78.78)*20.67]. Yet, it only has an all-time high of about $2 089.

In 1973 gold was in a similar type of position. The Dow had peaked at 1067.2 (in Jan 1973), which represented a X13.55 (1067.2/78.78) since 1913. If gold had scored a similar performance, it would have had a peak of about $280 (13.55*20.67), yet its peak at that time (the beginning of 1973) was only around $70.

Of course gold eventually reached $280 to match the Dow’s performance, and peaked at around $880 in 1980. Thus, in my opinion, it is virtually guaranteed that gold will again catch up with the Dow’s performance since 1913, and significantly surpass it just like in the 70s.

This means we will likely see gold reach $7 758 (in the near future) and eventually go on to reach multiples of that high.

I did a similar comparison for silver (now vs 1973), and it is interesting to note that silver actually surpassed its standing all-time in the same year (1973). Also, gold had a great year in 1973, going from around $65.2 to a high for that year of around $126.45.

The current year has a lot in common with 1973 (as illustrated in previous posts), and I have every expectation that we will see a great year for gold and silver prices.

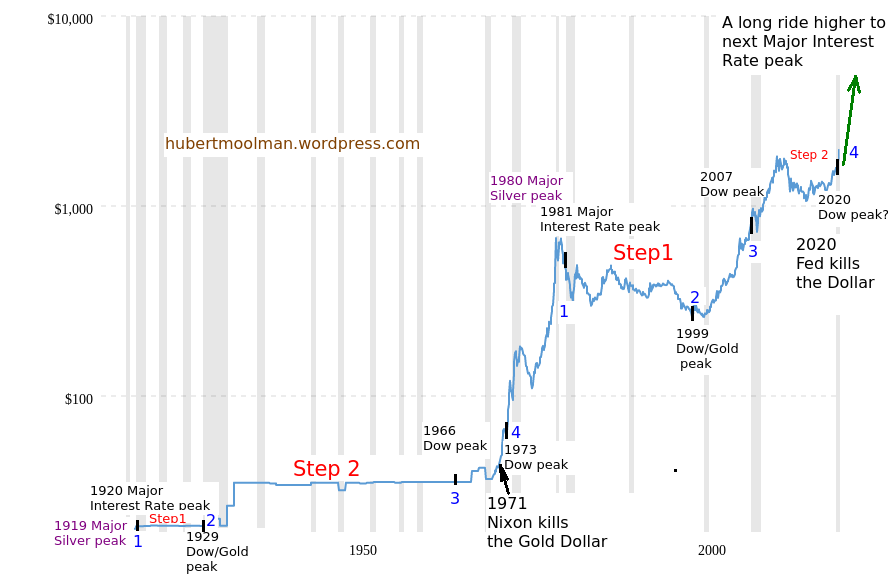

Here is a long-term chart of gold (macrotrends.net) that shows how 2020 and 1973 could be similar for gold from a cycles point of view:

I have marked two patterns, both starting at a major silver peak (1919 and 1980), with major interest rate peaks following soon after. I have also marked them 1 to 6, to show how the cycles could be compared.

We are now potentially after the all-time high of the Dow (Feb 2020), just like after the all-time high in January 1973. We are now in a time after the decision was taken to virtually kill the US dollar, just like 1973 was a time after Nixon killed the Gold dollar in 1971. We are now in Gold A.D.(after dollar).

Gold is going much higher, and trading in and out of one’s position is generally a foolish exercise.

Original source: Hubert Moolman on SILVER and GOLD

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.