By Philip N. Diehl

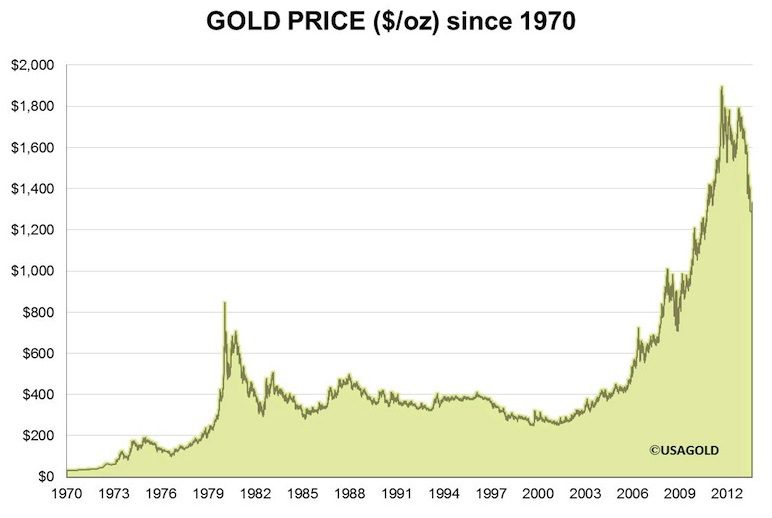

It’s official. After breaking $1416, the new bull market is underway. So as an obituary for the recently interred bear, here is a look at how it stacked up against others of the recent past.

The following graph certainly makes 2011-2013 look pretty grizzly.

Between September 6, 2011, and July 5, 2013, gold lost $682 an ounce. By comparison, the savage bear of 1980-1982 devoured $552 off gold’s peak.

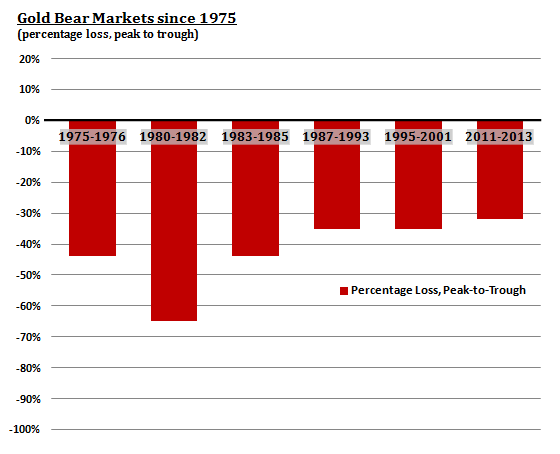

But this graph understates the magnitude of the five bear markets that preceded the most recent one. The next graph compares these six bears based on the percentage loss from peak to trough.

Now, the 2011-2013 bear market looks less ferocious, considerably less so than the three that occurred between 1975 and 1985, and similar in size to the two between 1987 and 2001.

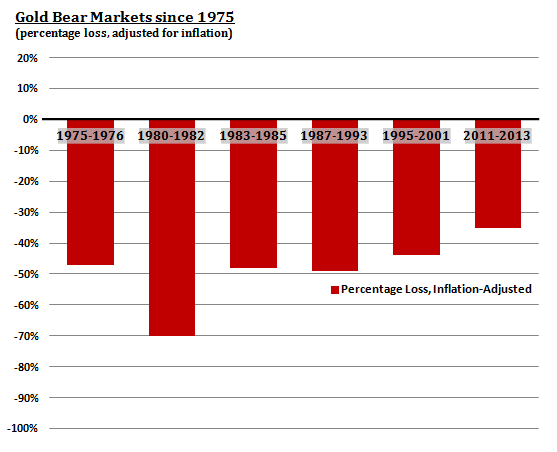

But this chart, too, distorts the comparison. By using nominal prices, it understates losses in periods of high inflation (e.g., 1980-1982) and during bear markets that persisted over many years (e.g., 1987-1993 and 1995-2001). The next chart removes this distortion with an inflation adjustment.

As you can see, when adjusted for inflation, the 2011-2013 bear is significantly smaller than the others.

A final word about inflation adjustments: what you’ve heard about how gold hit its all-time high in November 2011 is misinformed.

The all-time high was set in January 1980 when gold closed at $850. Adjust this price for 33 years of inflation and the comparable price today is about $2600 an ounce. That leaves a lot of room before gold enters new territory.

I think the forces that determine the price of gold are aligning to drive prices above $2600 an ounce. When the record price was set in 1980, double-digit inflation in the U.S. was the primary force behind its rise.

A much broader set of forces is driving today’s bull market and will persist for many years. These include short- and long-term supply/demand dynamics, fragility of the world’s financial system, political and economic uncertainty around the globe, unprecedented monetary policies in the West, and threats to the world’s oil supplies.

Thanks to the sharp decline in prices earlier this year, gold is a bargain today. Now is an excellent buying opportunity.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.