By srsroccoreport.com

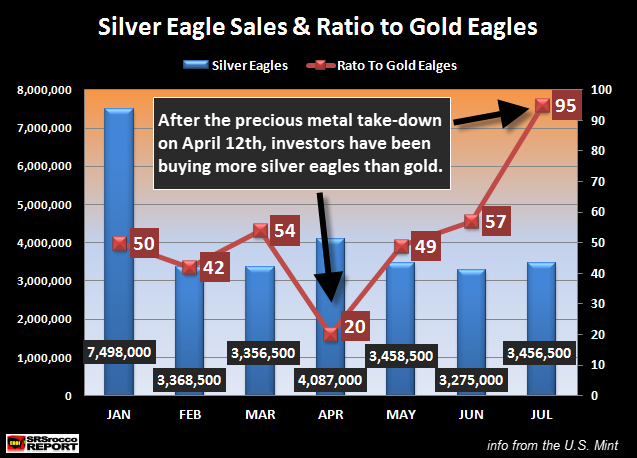

While owning precious metals will be a very wise store of wealth and investment in the future, silver will actually turn out to be the “King of Investment Gains.” A good barometer of the retail gold and silver market is shown by the eagle sales at the U.S. Mint.

In the first three months of the year, investors were purchasing silver eagles at an average ratio of 48 to 1 to gold eagles. However, after the huge April 12th precious metals take-down, investors overwhelming purchased a great deal more gold eagles in percentage terms that month as the price of the yellow metal fell $200 in two days.

Here we can see the result of that price action as the ratio of silver to gold eagles declined from 54 to 1 in March, down to 20 to 1 in April. According to the U.S. mint, 4,087,000 silver eagles was sold in April, while investors purchased 209,500 oz of gold eagles.

Below are the total amount of gold eagles sold each month in 2013:

GOLD EAGLE SALES 2013 (total oz)

JAN = 150,000

FEB = 80,500

MAR = 62,000

APR = 209,500

MAY = 70,000

JUN = 57,000

JUL = 36,500

Now, if we look at the chart above, we will see that the ratio increased after April and moved up to 49 to 1 in May and then to 57 to 1 in June. However, something startling has taken place in the month of July. Investors have been purchasing silver eagles at ratio of 95 to 1 compared to gold eagles.

This is indeed a very interesting trend taking place. If we take the average price of gold and silver for the month of July (Kitco) and multiply it by the sales of each, we find that investors have purchased approximately $46.6 million in gold eagles and $68 million in silver eagles. Investors are presently buying, nearly 50% more in silver eagles than in gold eagles in dollar terms.

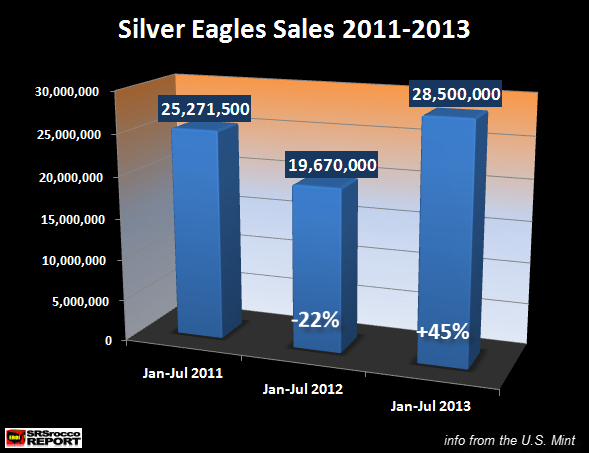

Furthermore, silver eagle sales for the first seven months of the year are a staggering 45% higher than they were in 2012. If we look at the chart below, we can see that silver eagle sales are setting new all time records:

In the first seven months of 2012, the U.S. mint sold 19.67 million silver eagles which were down 22% compared to the year before. Not only have the sales (28.5 million) in 2013 surpassed 2011 by 45%, they are also higher than 2011 by 3.2 million or 13%… and this doesn’t include a final update to take place next week when the total July figures are posted.

The prior annual record for silver eagle sales were nearly 40 million in 2011. If the present trend continues, silver eagle sales may reach 44-46 million in 2013.

SILVER: The King of Future Investment Gains

Even though gold is the king monetary metal, the real gains in the future will be made in silver. Some of the more prominent precious metal analysts believe gold and silver are stores of value, and not true investments. While I believe the precious metals are an excellent store of value, they will also behave as great investments in the future.

The reason why gold and silver will be more than just stores of value, is due to the serious misallocation of supposed wealth in the world. I am not going to get into details here, but the world has invested itself into paper assets which only a fraction could be redeemed today.

The problem with these supposed paper assets, is that they are based upon the burning of energy to create economic growth in which these are settled or repaid. Only so much energy can be burned in a year which means only a small fraction of these paper investments can be satisfied. The quality of these paper investments will degrade substantially as the world is impacted by energy constraints in the future.

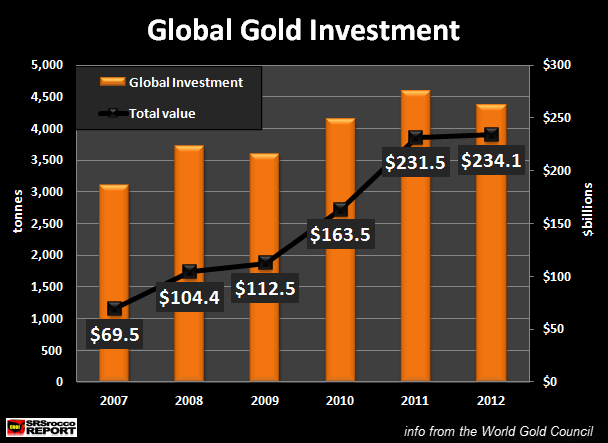

If we compare the total global investment in gold and silver over the past 5 years, we can see that silver is barely on the radar screen.

According to the World Gold Council, total gold investment, increased from $69.5 billion in 2007 to over $234 billion in 2012. Thus, the world has invested 3.4 times the amount of money in gold in 2012 than it did in 2007.

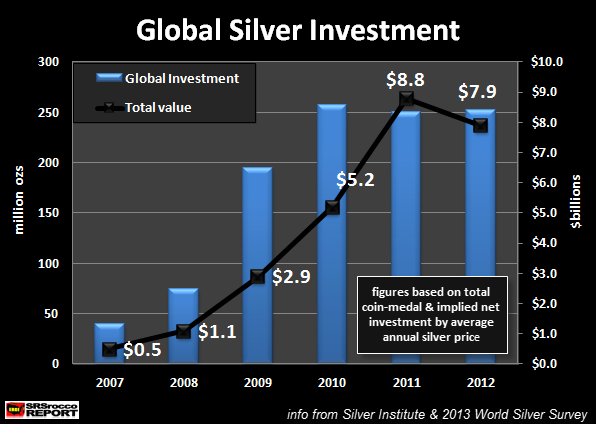

In the next chart, we can see just how much less investment funds have been flowing into silver compared to gold:

In 2007, the world invested $500 million in silver, but by 2012 this amount increased nearly 16 times to $7.9 billion. In addition, the amount of world silver bullion investment increased more than 5 fold from 40 million oz in 2007 to 253 million oz in 2012.

If we compare the data from the two charts, we can see a very interesting trend. In 2007, there were $139 invested in gold for each dollar invested in silver. However, in 2012 this ratio declined significantly when investors only purchased $30 dollars of gold for every dollar in silver. I would imagine as the world’s fiat monetary system continues to disintegrate, the demand for precious metals will increase exponentially.

This is when silver will outshine gold. We are currently witnessing a run on the Global Gold banks of the world. Rumors are that gold is being drained from the GLD ETF to help meet the insatiable demand since the price of the yellow metal has declined nearly $400 in 2013.

At some point in time, the availability of physical gold bullion will dry up, forcing large and small investors to purchase the next best precious metal… silver. Because the price of silver is currently 65 times less than gold, any sizable amount of currency to flow into this metal will push its value significantly higher in percentage terms compared to gold. (You will notice I used the term “currency instead of money… as fiat currency is not money).

Investors who believe that the FED may taper soon due to improving economic indicators, need to read my new article coming out next week on U.S. Energy Consumption vs. the GDP Growth Rate. If the FED decides to taper to a large degree, the U.S. economy will receive a stroke and begin to fall into a coma in the following quarters.

Silver will be the KING precious metal as it pertains to investment gains. Only a few realize this potential… but I bet my bottom silver dollar that in time, the world will find out this hidden secret.

Original source: Srsroccoreport

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.