On Friday, Turkey unveiled its latest unorthodox financial surprise, when a local newspaper reported that Ankara will repatriate all of its gold held at the NY Fed. The stated reason: an attempt to circumvent the dollar. "Why do we make all loans in dollars? Let’s use another currency" said Turkey's president Recep Tayyip Erdogan during a speech at the Global Entrepreneurship Congress in Istanbul on April 16, according to Hurriyet. "I suggest that the loans should be made based on gold."

In what some saw an appeal for a gold standard by the Turkish president and a bid to sever ties with the US Dollar, Erdogan added that “with the dollar the world is always under exchange rate pressure. We should save states and nations from this exchange rate pressure. Gold has never been a tool of oppression throughout history."

While Erdogan may have had honest, and even noble, intentions (yes, one can smirk here) it is worth noting that Turkey is hardly the first country to demand its gold back from western nations, having been preceded in recent years by Germany, Austria, Netherlands and Hungary.

But the most notable, and ominous for the people of Turkey, example of gold repatriation is also the first one in the post-crisis period, when Venezuela's then-leader Hugo Chavez demanded all Venezuela gold located in offshore central banks be returned to the motherland. At the time, Chavez said he did it for the people, and since he died shortly after, there was no way to gauge what his real intentions were.

The problem is what happened later.

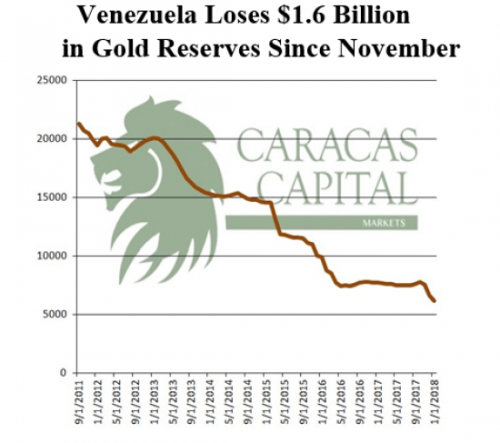

Conveniently, last week Russ Dallen of Caracas Capital wrote inform his clients what Venezuela has been doing over the course of the past several years regarding is repatriated, and now swiftly dwindling gold reserves.

"In September 2011, Venezuela had $21.269 billion in gold reserves. After a rash of selling gold in Switzerland to pay bonds maturities and coupons in early 2016 (which we tracked assiduously and reported on in these reports), Venezuela's gold reserves had fallen to $7.7 billion where they held steady until November 2017. But as we reported in October of 2017, there were loans backed by gold that Venezuela had taken out that were coming due. As we reported last month, in the last two months of 2017, Venezuela had lost $1.1 billion in gold and reported that they held $6.6 billion in gold on December 31. In January, Venezuela's gold reserves fell another $500 million.

As of January 31, Venezuela had just $6.1 billion in gold reserves, down another half billion from the $6.6 billion Venezuela reported a month earlier on December 31. In short, Venezuela burned through $1.6 billion of its gold reserves in 3 months, and it is important to note that this fall in gold reserves is without Venezuela paying its bond debts."

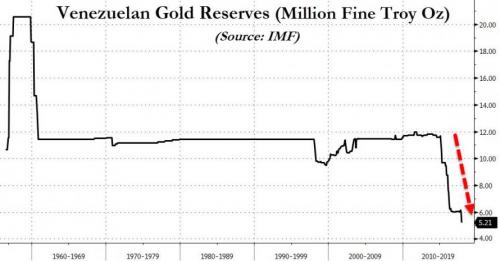

Here is a chart of the recent declines in Venezuela's gold...

... and the dramatic plunge in the past 2 years in context.

As Dennis Gartman summarized in his Friday letter to clients, "at the current pace of sales, Venezuela will effectively be out of gold by May or June of next year. Having fallen from $21.3 billion seven years ago, it’s now down to $6.6 billion as of the end of January and we suspect that it’s sold another billion since then." His conclusion:

"The trend is clear; "The Seller" is almost sated."

He certainly is, and soon the world's poorest socialist paradise will also have no gold left unleashing the final stage of Venezuela's social collapse. Still, one wonders who is on the other side of the trade, and is so eagerly buying all the gold Venezuela has to sell.

Meanwhile, we hope Venezuela's tragic experience with its soon-to-be-vaporized physical gold which was converted to paper money so Venezuela could repay the country's debts to the west will be a lesson to the people of Turkey: keep a close eye on what Erdogan is about to do with the people's gold. If the "president for life" follows in Maduro's footsteps, Turkey's gold will soon be gone, all 591 tonnes of it.

Original source: Zero Hedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.