By Clive Maund

Some silver bulls lacking patience are being driven mad by its seemingly interminable sideways pattern, yet you shouldn’t be, because the continuing sideways movement allows more time to build a portfolio of silver investments ahead of the major bullmarket that we know is incubating. Right now it is being held in restraint like gold, by the dollar rallying, but that won’t carry on forever, and as is the case with gold, the dollar may be rallying against most other currencies, but they are all spiraling the drain.

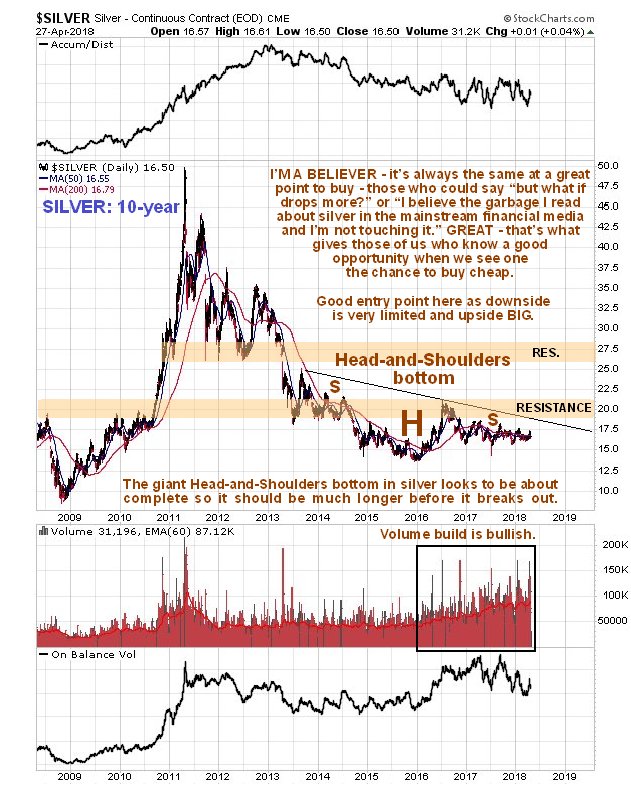

Like gold, silver has marked out a giant Head-and-Shoulders bottom pattern which is fast approaching completion, but it is less obvious than gold’s because it is downsloping, which is normal because silver tends to underperform gold towards the latter part of bearmarkets. We can see this on the latest 10-year chart below. Most investors won’t touch it with a 10 foot pole, because it has been too low for too long – they are attracted to high and rising prices, not to things that are depressed and cheap. This is a situation that suits us just fine of course, because not only is silver itself cheap, but silver investments that are highly leveraged are very cheap too, like many silver stocks and various leveraged ETFs, so we can continue to mop them up and build and adjust portfolios before the big action starts. One guy wrote me in a somewhat hysterical state because I had recommended silver saying “You said it was going up and two days later it dropped!!” so I replied “Listen, Buster – you are never going to make any money with an attitude like that – me, I’m a believer.” Before leaving the 10-year chart, another point to note is that, like gold, we have seen a steady and pronounced volume buildup in silver for over 2 years – since the final low of the Head of the Head-and-Shoulders bottom late in 2015 and early in 2016. This is very bullish although volume indicators have not fared so well as with gold.

On silver’s 3-year chart we see that it has been underperforming gold in recent months, which, as mentioned above, is quite normal at this stage in the cycle. It is still not far off the Right Shoulder lows, which means that this is a good time to continue accumulating silver investments. Although we could see some minor weakness in the event of continued dollar strength, downside is considered to be very limited. Actually, with the price down close to support and the continued volume buildup, silver looks like a coiled spring here. When it decides it’s going to make a big move it usually happens when it’s least expected, leaving most investors watching as mere spectators.

On the 6-month chart we can see that silver is in a broadly neutral trend on a near-term time horizon. The rather rare “Pinocchio Nose” pattern that formed about a week ago was due to a sharp break higher when traders suddenly got excited about silver, only to have their hopes dashed by the dollar rally, so they scurried back into the shadows. It doesn’t mean much, just that silver is not quite ready to break out yet, and will probably wait until it gets the “all clear” from the dollar.

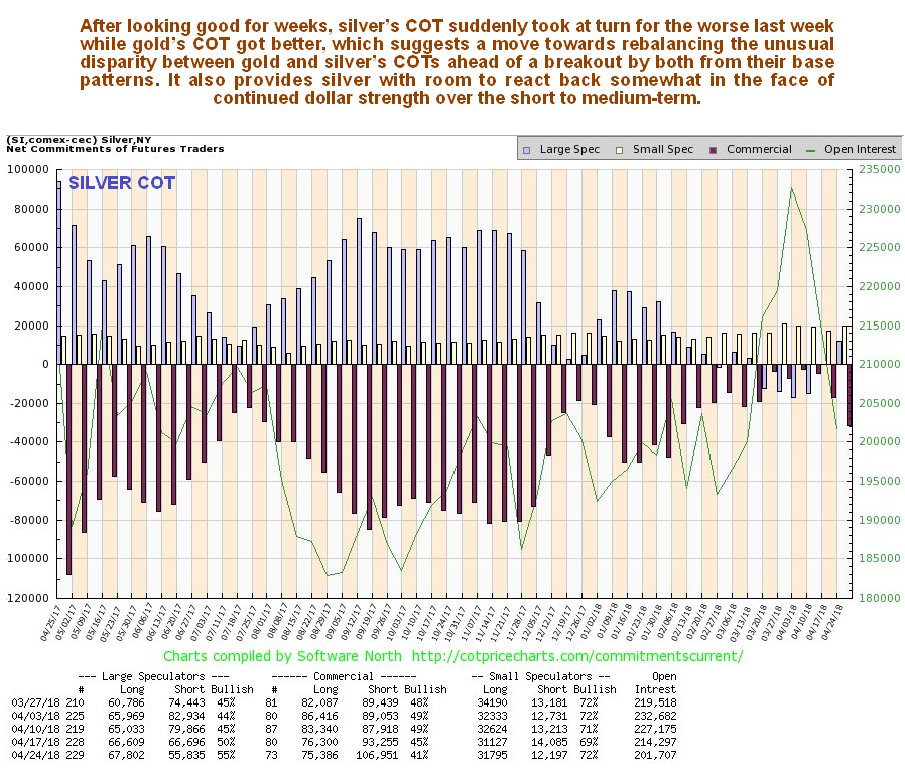

A disconcerting development for silver bulls last week was that silver’s COT took a somewhat dramatic turn for the worse. This probably doesn’t mean a lot because Commercial short and Large Spec long positions rose from nothing and have a long way to go to reach levels that would be construed as bearish. Another important point in relation to this is that at the same time gold’s COTs improved significantly, which is good for both metals, and the action in the two follows them being way out of whack with each other in recent weeks, with gold’s COTs rather bearish and silver’s strongly bullish. Last week’s action saw them start to normalize in relation to each other, which is probably a good thing ahead of a breakout and major upleg.

The possible impact of the dollar on the gold price is discussed in the parallel Gold Market update, and this applies also to silver as gold and silver largely move together. Geopolitical aspects also applicable to silver are likewise discussed in the Gold Market update and do not need to be repeated here.

So to conclude, silver appears to be in the very late stages of its Head-and-Shoulders bottom, and with the price still not far off the Right Shoulder lows, we are a very good point to continue accumulating silver investments – silver itself, silver coins, silver stocks and ETFs, and for those who are set up to do so and know what they are doing, silver futures and options.

Original source: Clivemaund

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.