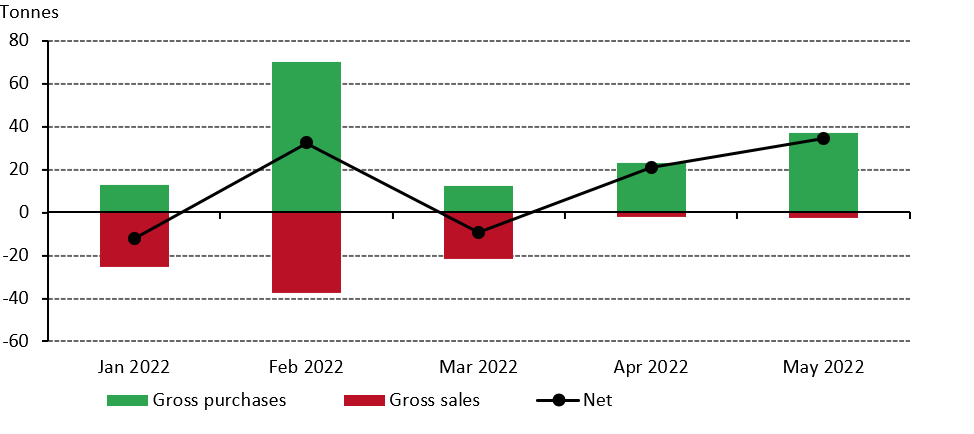

The latest update to our central bank holdings data set – capturing data to end-May – is now available. It shows that in May, central banks reported adding a net 35t to global gold reserves. [1] This is the second consecutive month of net buying, having recently oscillated between monthly net purchases and sales (Chart 1).

Chart 1: Central banks have added to global gold reserves for the second consecutive month*

*Data to 31 May 2022. On Goldhub, see: Central bank holdings - Source: IMF IFS, respective central banks, World Gold Council

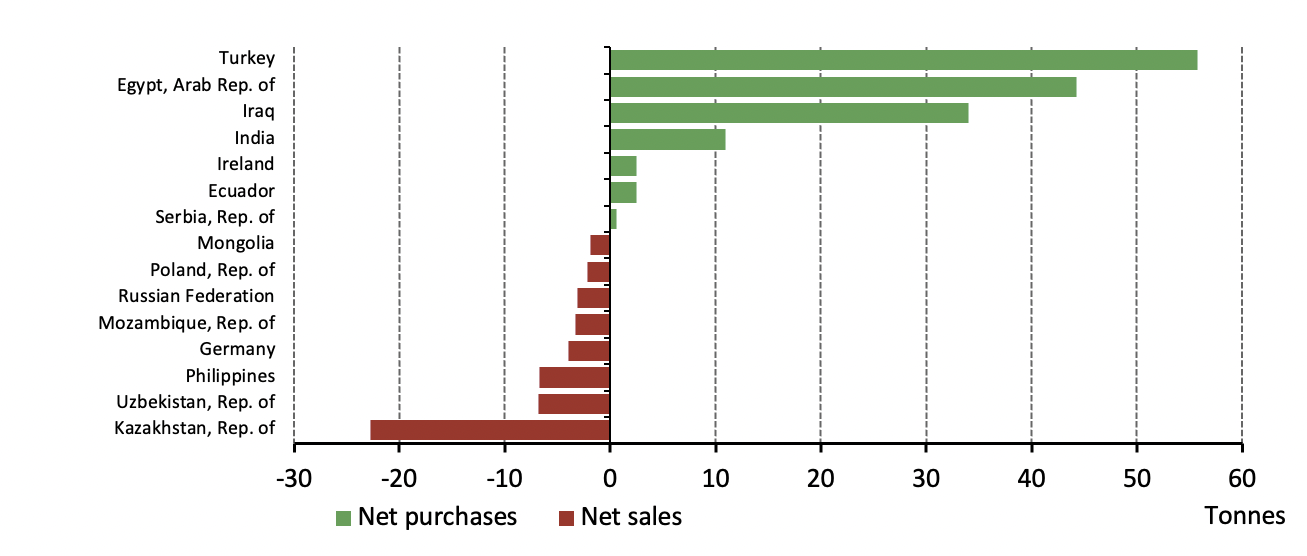

Purchases were primarily concentrated among the same four banks that dominated buying in April. Turkey (13t), Uzbekistan (9t), Kazakhstan (6t) and India (4t) all added to their gold reserves again in May, accounting for most of the month’s buying. Qatar added 5t to its gold reserves in May, taking total gold reserves back to 56.7t, the same level as the start of 2022. Contrastingly, Germany was the only notable seller during the month, reducing its gold reserves by 2t, likely for its longstanding coin-minting programme.

Last week, the Central Bank of Iraq (CBI) also announced it had bought around 34 tonnes in June, lifting its total gold reserves to just over 130 tonnes. This is the first significant gold purchase from the CBI since September 2018 (6.5t). This is not yet reflected in IMF data, but we will add this to our statistics next month.

Year-to-date, reported buying has been dominated by Turkey (56t), Egypt (44t) and Iraq (34t), and supported by more modest buying from a small number of other banks (Chart 2). And while we have seen a larger number of banks reduce their gold holdings so far in 2022, the total volume of sales is below that of purchases.

Chart 2: Year-to-date purchases by country*

*Data to 31 May 2022. Note: chart includes the recent purchase by the Central Bank of Iraq which took place in June 2022. On Goldhub, see: Central bank holdings

Source: IMF IFS, respective central banks, World Gold Council

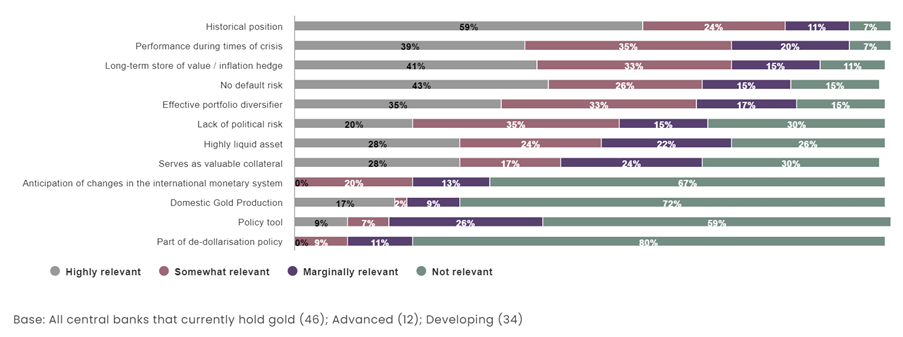

This data supports the findings from our recently published annual central bank survey. The survey found that 25% of central banks who responded intend to increase their gold reserves in the next 12 months (versus 21% in 2021). It also shows that gold’s performance during a time of crisis and its role as a long-term store of value/inflation hedge are key determinants of central banks’ decision to hold gold (Chart 3). More detail on the survey can be found here.

Chart 3: How relevant are the following factors in your organization’s decision to hold gold?

On Goldhub, see: Annual central bank survey - Source: World Gold Council

In June, it was also reported that the Central Bank of Bolivia (BCB) has proposed a new law enabling it to become the sole purchaser of domestically-produced gold. This would be similar to policies used in some other gold-producing nations, where the central bank is given first refusal on gold production before it can be sold on the international market. Ecuador, for example, recently bought gold through a domestic buying programme. No details were given as to the amount of gold the BCB might buy if the law were to be passed. The report also notes that the new law would allow the central bank to use its gold reserves (43t) as collateral or in swaps without the need for legislative approval.

Footnotes

[1] Our data set is based on IMF data but is supplemented with data from respective central banks where it is available and not reported through the IMF at the time of publication. This data may be revised in our next monthly update should more data become available. All figures are net except where otherwise indicated.

Original source: World Gold Council

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.