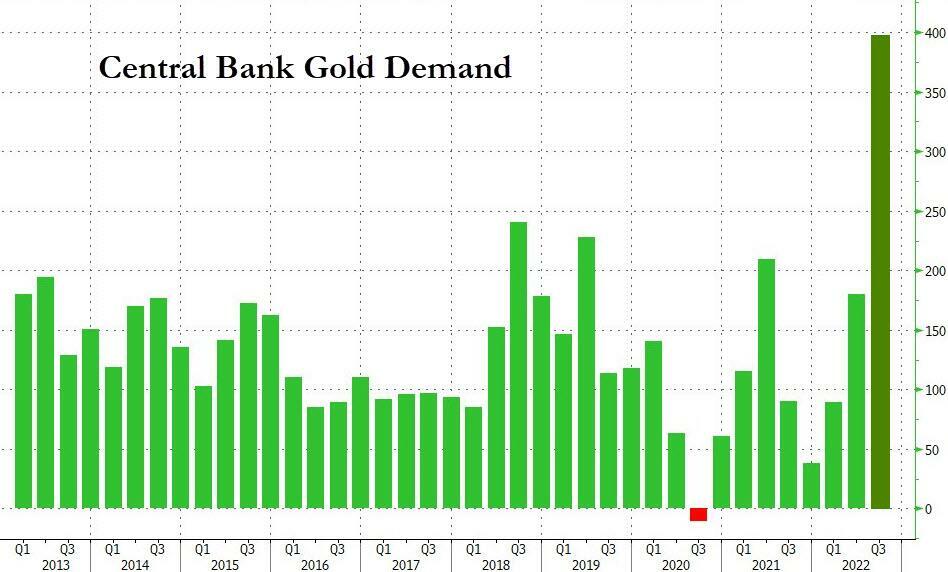

One month ago, we sparked a frenzy across precious metals circles when we reported that a "mystery" buyer had bought some 300 tons of gold, roughly three quarters of what would be a record 399 tons of central bank gold purchases in the third quarter.

While regular readers already know the details, here again is the bigger picture: Central banks bought a net 399.3 tonnes of gold in the July-September period, more than quadrupling on the year, according to the World Gold Council. The latest amount marks a steep jump from 186 tonnes in the preceding quarter and 87.7 tonnes in the first quarter, while the year-to-date total alone surpasses any full year since 1967.

Buyers such as the central banks of Turkey, Uzbekistan and India reported purchases of 31.2 tonnes, 26.1 tonnes and 17.5 tonnes, respectively. The problem, as we calculated at the start of November, is that those amounts only add up to roughly 90 tonnes - "meaning it is unclear who bought the remaining roughly 300 tonnes net."

And while we clearly had one name as the most likely suspect behind the residual buying, it wasn't until a report two weeks later by Japan's Nikkei that said name emerged front and center.

According to the Nikkei, with central banks snapping up gold this year amid uncertainty which ones are behind most of that shopping spree, "speculation emerged that China is a big player." And citing analysts, the Nikkei then goes on to suggest that seeing how Russia has been hit by monetary sanctions by the West, "China and some other countries must be hurrying to reduce dependence on the dollar."

"Seeing how Russia's overseas assets were frozen after its invasion of Ukraine, anti-Western countries are eager to accumulate gold holdings on hand," said Emin Yurumazu, a Japan-based economist from Turkey.

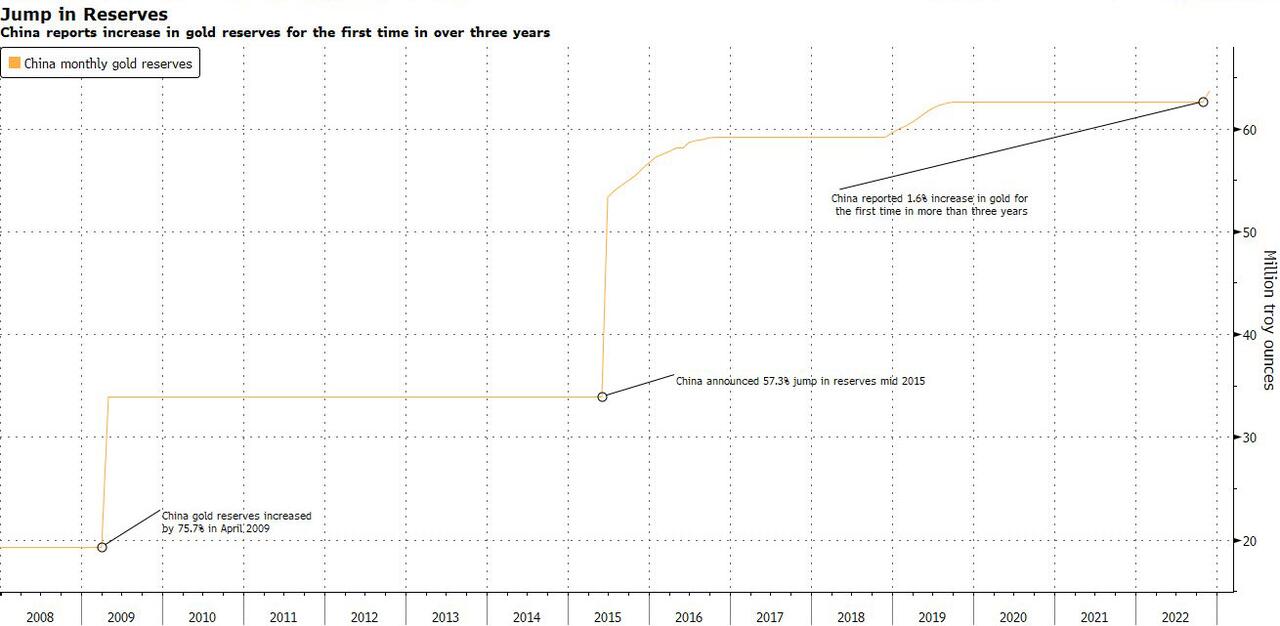

Those familiar with China's gold buying patterns are all too aware that Beijing has made similar moves in the past. After keeping radio-silent since 2009, Beijing shocked the market in 2015 when it disclosed it had boosted gold holdings by about 600 tonnes. It has not reported any activity since September 2019.

"China likely bought a substantial amount of gold from Russia," added market analyst Itsuo Toshima. According to Toshima, the People's Bank of China likely bought a portion of the Central Bank of the Russian Federation's gold holdings of over 2,000 tonnes.

* * *

Fast forward to today when while we still don't know if Russia sold some of its gold to China - all we know is that Russia did sell some gold in recent months after its holdings hit a record in 2020...

... what we do know for a fact is that China was indeed loading up on gold.

We know this, because overnight the PBOC officially reported an increase in its gold reserves for the first time in more than three years, confirming that the world's most populous country was indeed the mystery buyer in the bullion market.

In keeping with a time-honored practice of masking its purchases for years (the "dormant" period between 2009 and 2015 when China did not reveal any purchases, and then suddenly reported a 57% jump in reserves being the most famous) and then only gradually letting on how much it had purchased, on Wednesday the Chinese central bank raised its holdings by 32 tons in November from the month before and really from the last official update in Sept 2019, according to data on its website.

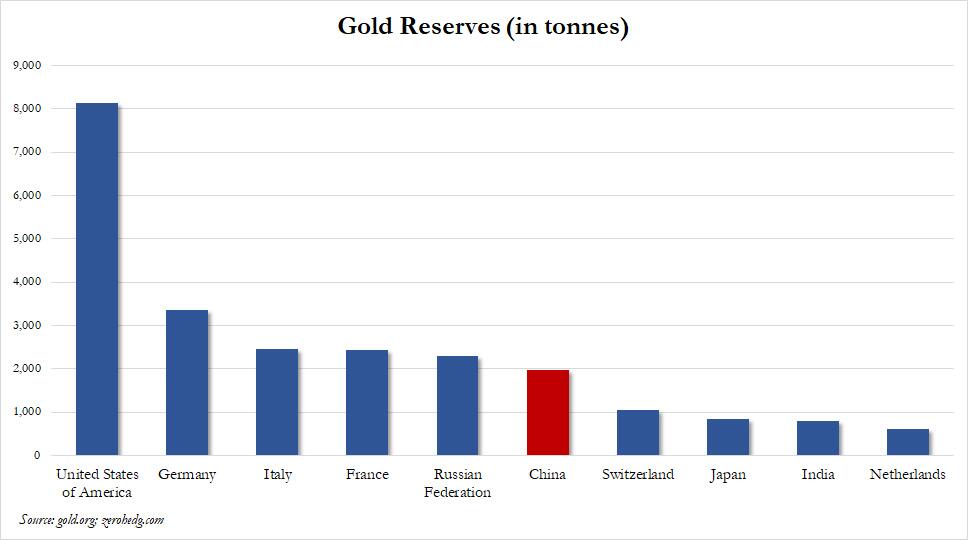

That brought its total to 1,980 tons (or 63.67m fine troy ounces) the sixth-biggest central bank bullion hoard in the world, but similar to previous disclosures it is likely that China has purchased far more in the past three years but will only reveal just how much in coming months. That said, China has a long way to go for its gold holdings to catch up to the US (which may or may not have the gold it represents), and even if combined with Russia's holdings, the two countries would still not be the world's largest gold holder.

"Russia’s decision to link gold to oil could bring gold back as a settlement medium and increase its intrinsic value sharply. Banks active in the paper gold market would face a liquidity shortfall,

— Ronnie Stoeferle (@RonStoeferle) December 6, 2022

Original source: ZeroHedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.