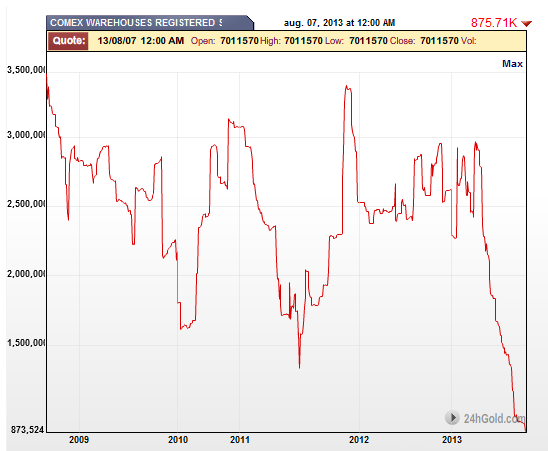

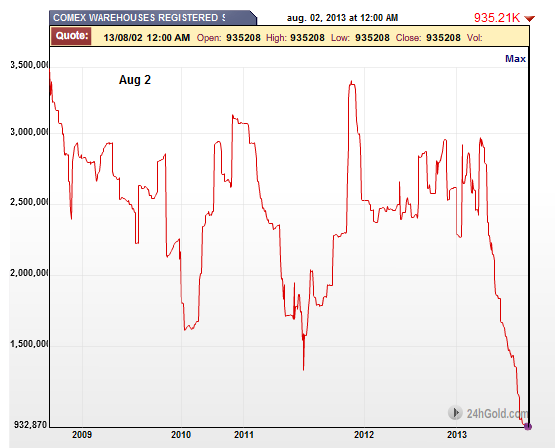

Since last Friday the registered gold in the COMEX warehouse has declined by almost 60,000 ounces to a new recent low of 875,710 ounces.

Total gold including eligible gold stored by customers in COMEX warehouses but not offered for sale holds steady at around 7 million ounces.

There was a transfer of about 6,445 ounces of customer gold from HSBC to JPM. But this was not deliverable gold as indicated on a popular website, but merely a transfer of eligible ounces from one warehouse to another.

I noted today that about 8,300 ounces of gold bullion in 400 oz. bars was redeemed from the Sprott Physical Gold Trust. Gold in this form is ready for delivery to Asia. I cannot imagine why else someone would go through the redemption process unless there was an immediate need for physical gold.

Given the amount of bullion actually being offered for sale at the COMEX, higher prices seem to be indicated in this delivery cycle with a little over 200,000 ounces worth of contracts standing for delivery, at least for now.

GLD lost about 4.5 tonnes of bullion due to paper induced selling. At some point when the price of gold turns and GLD must start adding bullion back the pressure on physical supply could be interesting.

But why debate or belabor this any further? Hit the paper price again if you dare, with the government of India doing all that it can already to stop the flow of gold into that country, and the gold forward rates negative over twenty days as the search for deliverable gold at these prices is becoming increasingly desperate.

People wish to protect at least some portion of their wealth from opaque counterparty risks.

Weighed, and found wanting.

Stand and deliver.

Original source: Jessescrossroadscafe

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.