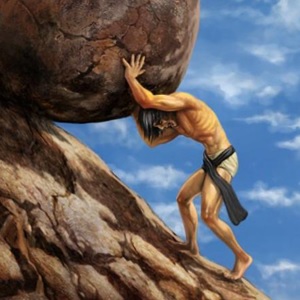

Zeus punished the hubristic King Sisyphus to roll a huge boulder up a very steep hill in Hades. Before Sisyphus reached the top, the stone rolled down and he had to start all over again.

Hubris is serious sin that seldom goes unpunished. The arrogance and uber-confidence which TPTB (the powers that be) have displayed in leading the world to ruin will clearly be severely punished. But sadly the punishment will affect the whole world and not just the Elite that caused it.

BANKERS AND GOVERNMENTS HAVE INFLICTED INCREDIBLE DAMAGE

It could be argued that blaming one group for the coming global collapse might be unfair. The world economy has always oscillated between boom and bust and is thus a natural phenomenon like the seasons. But the main difference this time is the incredible damage that governments, central bankers and bankers have inflicted on the world.

In 2006 when the Great Financial Crisis started, US Federal debt was $8.5 trillion and today it is $26.5t. In 14 years debt has more than trebled. GDP in 2006 was $14t and is now $21.5t. So debt to GDP has gone from 60% to 123%.

This is what is called running on empty. US debt creation has nothing to do with investing in productive assets. With the debt to GDP ratio doubling in 14 years it is clear evidence that all the printed money is not going into the real economy but is supporting a bankrupt financial system which has kept the money to prop up their own insolvent balance sheets and to remunerate the top executives with fantasy money.

PRINTED MONEY TO FATTEN CORPORATE EXECUTIVES

The printed money has also gone to inefficient mega-corporations which have leveraged their balance sheets with total borrowings going from $3t in 2006 to $7t today. During the same period, US companies have spent in excess of $6t in share buybacks. So instead of investing in the business, companies have borrowed money in order to buy back their own shares with the purpose of inflating the share price and executive remuneration in options and stocks.

This is hubris of the highest degree. Ignore investing to grow the business. Instead leverage the company to the hilt to inflate the share price and compensation for the top echelon. Will this corporate arrogance go unpunished? The executives will hardly roll a big boulder up a hill in Hades but when the US and global economy collapses and social unrest spreads, the have-nots are not going to treat the haves kindly.

GLOBAL SAND CASTLE BUILT ON MMT

As I have stated many times, it is absolutely guaranteed that the global sand castle resting on worthless debt will crumble. Timing is always tricky and central banks have performed the most outstanding act of wizardry since 2006.

By increasing global debt from $125t in 2006 to $270t today, they have drowned the world in so much worthless money that virtually nobody has understood that it is all fake money and fake wealth that has been created.

Actually, nobody understands it, not even Nobel prize winners who believe that MMT or Modern Money Theory is the solution to everything. You wonder how anybody can believe that creating money out of thin air can actually create wealth. But since so many have benefitted why worry. The Elite has become mega wealthy (measured in fake money) and the masses have a perceived improvement in living standards with more gadgets like cars or iPhones. What few realise is that it all comes from debt. Either increased personal debt or more government borrowing.

BIGGEST SWINDLE IN HISTORY

You can fool most of the people for quite a long time and sadly the world will only realise that all of this was only possible due to the biggest swindle in history. Charles Ponzi or Bernerd Madoff was kindergarten stuff compared to this mega-fraud.

And soon the chickens will come home to roost. Timing is always tricky. It could all happen very quickly as my good friend Alasdair Macleod has described in many excellent articles on KWN. Or it could take 1-2 years longer. Alasdair foresees a bank and currency collapse before the end of 2020. He is not a sensational man but rather a conservative Englishman who has a deep knowledge of both currency and economic matters. Above all he understands history. There we are in full agreement. The majority of economists and bankers think it is different today because they are alive. But they will soon be proven wrong again.

FINAL CURRENCY COLLAPSE COMING NEXT

Whether we go back to for example the Roman Empire in the 3rd century or John Law around 1720, we can see how history repeats itself over and over. Virtually all economic collapses involve a total debasement of the currency. We are now in the very final innings of a global currency collapse. All major currencies are down 97-99% in real purchasing power (gold) since 1971. August 15, 1971 was a significant date for the currency system. That was the day when Nixon pulled the rug of the dollar and thus all currencies since they were tied to the dollar.

With gold no longer backing the currency system and irresponsible governments issuing unlimited amount of debt, this was the beginning of the end of the current currency system. The second leg of the currency race to the bottom started in the early 2000s and since then all currencies are down around 80-85%.

GOLD WILL NOT LOOK BACK

Gold made a temporary peak in 2011 and resumed the uptrend in 2016. The massive amounts of money that have been printed since 2006, and accelerating now in 2020, have not yet been reflected properly in the gold price. But this is what is coming next.

Prospects for a currency collapse have never been greater for the West. This means that the prospects for gold are absolutely outstanding.

NO PHYSICAL TO BACK UP PAPER GOLD

But there are more factors that affect the gold price. There is a massive shortage of physical gold in the futures markets and LBMA system. As gold goes up and the holders of gold ask for physical delivery, there will be no gold available to settle the paper claims. There are only two potential outcomes. A default of the LBMA system which would also mean a total bank collapse. They will attempt to settle the claims in paper money but that will also lead to defaults eventually.

It is of course possible that central banks print trillions of dollars to save the banks so that they can buy the gold. The problem is that there is no gold available at current prices but only at multiples of the current price. And the more money central banks print, the less it will be worth and the more the gold will cost. So a real Sisyphean task that is guaranteed to fail.

INSTITUTIONAL GOLD BUYING

Another important factor is that only 0.5% of world financial assets are in physical gold. As inflation goes up and the bubble assets like stocks, bonds and property collapse, private and institutional investors all want to own gold. Institutions will need gold to protect against inflation and risk. Let’s say that an institution wants to buy around $120m worth of gold and that multiplied a few hundred times for all the institutional demand. Instead of getting 2 tonnes at $1,900 per ounce they will get 200 kilos at $19,000 per ounce. So they have got their $100b of gold but at a price 10x higher. As production can’t be increased, higher demand can only be satisfied by a higher price.

There is of course a total of 170,000 tonnes of gold in the world, including 50% in jewellery and 35,000 tonnes in central bank gold. But only a minuscule percentage of this gold will be available at current prices. Bigger quantities will cost multiples of today’s price. Annual production of gold and scrap gold is all absorbed every year and we have reached peak gold.

Currently Swiss refiners are seeing low demand but this is only the lull after a very hectic period and before the next big move down in stocks and up in the metals.

FOUR FACTORS TO DRIVE THE GOLD PRICE

To summarise, the gold price will be fuelled by four incredibly strong factors:

- Major debasement of currencies due to money printing

- Substantial shortages of gold in LBMA and Futures markets

- Major new private and institutional gold investors entering the market

- Only smaller quantities of gold available at current prices

Silver is likely to move 3x as fast as gold but remember that it is very volatile and the corrections will be vicious. If you want to sleep well at night, own only gold. Still with the gold/silver ratio historically high at 93, an allocation of 75% physical gold and 25% in silver, is what we advise our clients currently.

Bigger quantities of precious metals should preferably be stored outside your country of residence and outside the financial system. It is very risky to store wealth preservation assets in a bankrupt banking system whether in the bank’s general vault or in safe deposit boxes.

Gold and silver are in the acceleration phase. The trend will be strongly up but with the normal corrections. The time when you can buy gold below $2,000 and silver below $25 is very limited.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.