Investors in most countries make the mistake of measuring their returns based on their home market and their domestic currency. This might have worked when they only had access to their local investment market. But that time is long gone. Now we have a global economy and most Westerners have access to securities worldwide. Still, in for example Germany, the UK or Japan, investors measure returns in their local currency. Even more so in the US. Due to the size of the US economy and the importance of the dollar, few Americans look at investment markets or currencies in other countries.

US stocks – Poor performance and overvalued

Recently a reader commented that I personally have not considered the US stock market as a good place to invest and therefore missed a massive opportunity. Let me state that for many reasons the US market has not been a good place to invest. Firstly, I consider a market which is greatly overvalued as high risk and therefore best to avoid even if it can go higher. It is of course totally right that someone who sold the US stock market in 2000 bought back in 2002, got out in 2007 and invested again in 2009 could have made a lot of money. But that is not the way the average investor trades except for in hindsight.

There are two main types of investors. The most typical investor seldom sells and therefore rides through every storm in the hope that stocks go up perpetually. That theory has worked wonderfully for long periods in the last 100 years. There have of course been periods of severe exceptions like after the 1929 crash and the 1932 bottom. Investors at that time had to wait 25 years to get their money back.

Then there are investors who trade the market regularly. Many of these buy high and sell low thus continuously underperforming the market.

S&P’s abysmal real performance

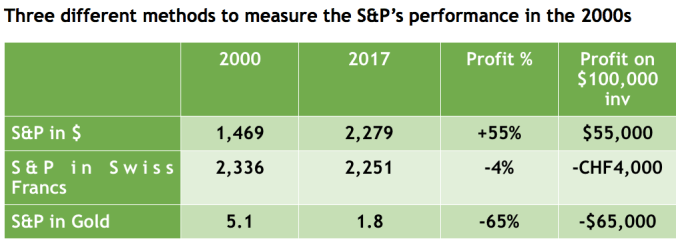

Overall stocks have been a great investment for the last 100 years due to the massive credit expansion and money printing worldwide. But if we, for example, critically analyse the real return for a US stock investor who has been long the S&P index since the beginning of this century we get some interesting results:

The above table gives very different results for the same investment. For an American measuring in dollars, it looks like a decent return. But 55% over 16 years is actually only 2.8% per year (plus dividends) which is nothing remarkable. Most Americans just look at their return in dollars. This is acceptable if the currency is strong. But this is not the case with the dollar which has been extremely weak since 1971. A country that continuously lives beyond its means will always pay in the form of a weakening currency. In relation to the Swiss Franc, the dollar has lost 77% since 1971 and 37% since 2000. So if we measure the performance of the S&P index in Swiss Francs since January 2000, it has declined by 4%! Most American investor will think that this is irrelevant to them but that is flawed thinking. A return of 55% that comes down to -4% if measured in a different currency, shows that the gain measured in dollars is mainly due to the weak currency. Thus the 56% gain is not a real gain but just a measure of inflation.

Gold reveals real performance

But to find out what the real performance of the S&P has been in this century, we must use a currency that can’t be printed and that over time maintains constant purchasing power, namely gold. And now the picture looks very different. Instead of a 55% gain in fiat dollars, the S&P has lost 65% measured in real money.

Governments constantly try to fool the people by debasing the currency. This is why governments hate gold because it reveals the truth by exposing their total mismanagement of the economy. Although the gold price is also manipulated, especially in the paper market, it is still the best measure of real performance. And the reason for this is that gold is the only money which is not man-made. Gold is nature’s currency and will continue to be the only money that will survive throughout history.

Coming back to the table above, very few people understand that an illusory $55,000 gain actually is a loss of $65,000 measured in real money. This shows how dangerous it is to measure performance and wealth based on the wrong measuring rod.

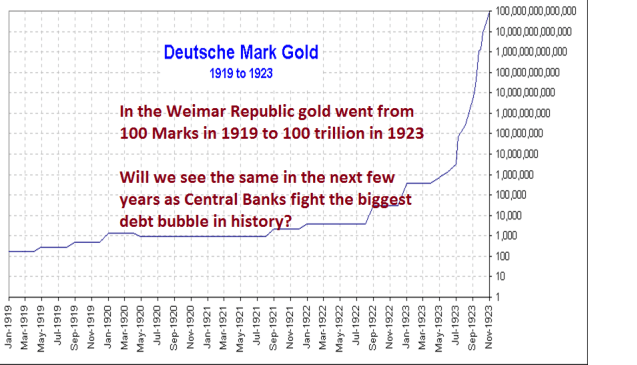

As I have explained in many interviews and articles, the destruction of paper money will soon accelerate as governments around the world try to save a bankrupt world economy and financial system. In relation to gold, stocks, bonds and property will all decline by another 90% at least in coming years.

Globally we now have the most perfect recipe for disaster:

- All major economies, USA, China, Japan, Europe and Emerging markets have debt which have grown exponentially and will never be repaid.

- The financial system has a gross exposure of over $2 quadrillion. This will all collapse when counterparty fails.

- With the Trump administration leading, the world will soon enter the final spending spree which will accelerate the velocity of money and lead to hyperinflation. This will in turn finish off the value of most major currencies until they reach zero.

- 1-3 above will result in a deflationary implosion of the financial system. This will get rid of all debt and reduce the value of most assets by at least 90%.

- This total debt destruction is the only way to put a world on a sound footing for future growth and prosperity.

The Antidote

Gold will of course perform very well during the coming hyperinflationary period and could reach levels seen during the Weimar Republic.

But the absolute level of the gold price is totally irrelevant. What is more important is that gold will be the best form of wealth preservation and insurance. Gold will also at least maintain its purchasing power but most probably perform a lot better. Gold also does well in deflationary periods although it will then come down from the hyperinflationary highs. But so will prices of all goods and services. At the beginning of the deflationary implosion, there is unlikely to be a functioning banking system. Gold will then be the only money available and therefore play a critical role.

2017 looks like the year when gold and silver could challenge the old highs. At current levels, physical precious metals are the cheapest insurance and best wealth preservation investment that anyone can own.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.