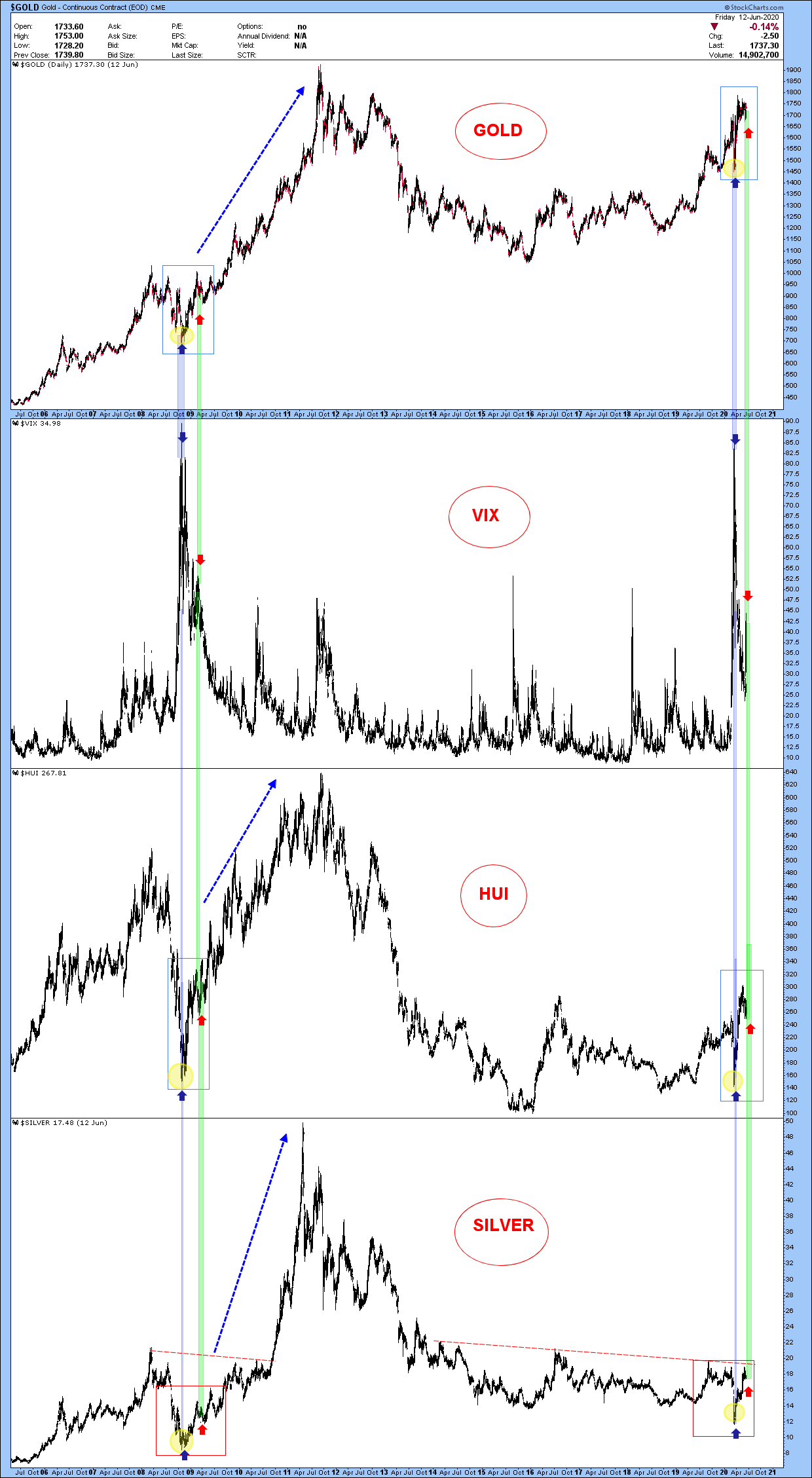

$GOLD $VIX $SILVER $HUI watch 2008 and you decide where we are:

The extreme movements of volatility (VIX) have often accompanied movements of opposite sign in the precious metals. If we review the phase of extreme volatility seen in 2008, we find several similarities with the current phase: after a violent sell-off coincided with a violent increase in volatility, both gold (but also gold stocks) and silver reacted to the upside in a choral way. The aspect that unites these two periods concerns the enormous injection of liquidity made by the central banks then and today (not only but above all) and this analogy (not only technical therefore) suggests that the recent sell-off in the precious metals sector is only a momentary phase in sight further and ambitious progress in this area.

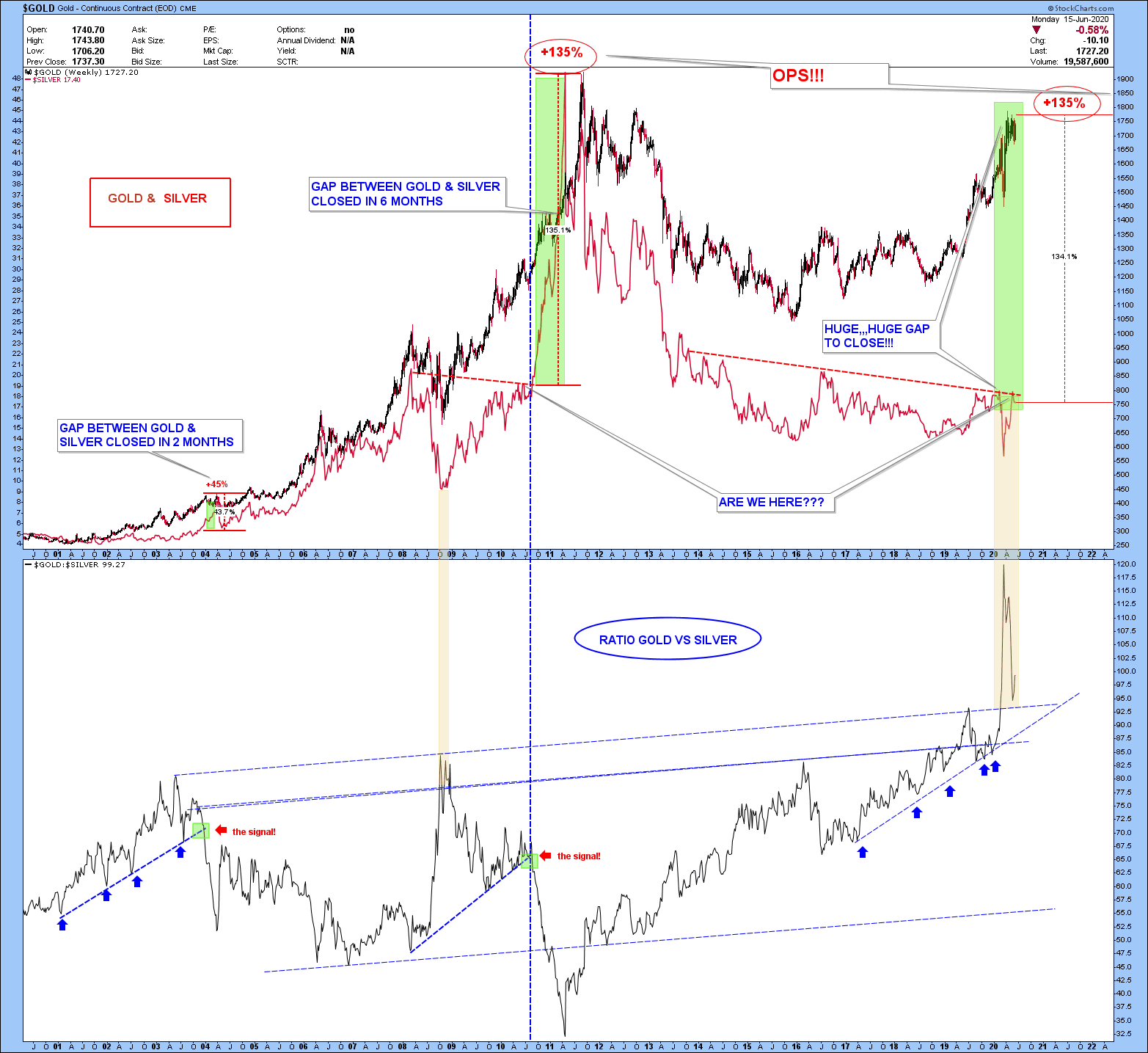

$SILVER $GOLD are we there? Do you remember summer 2010? And what happened next on silver?

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.