Seriously? “Simon Black” (it’s a nom de plume) wrote an article titled “Demand For Physical Is Collapsing.” He focused on retail bullion demand numbers. The headline and the content is largely fake news as it focuses on the demand for minted coins vs the paper gold market. We’re not really sure about the intent of article, but the content was devoid of any relevance to the actual global demand for physical gold.

While the retail minted coin and small-size bar demand is down from last year’s levels, there’s two factors to explain this. First is price. The price of gold and silver was lower in early 2016 than it is now. The price of gold in February 2017 averaged $1230-$1240 while the price of gold a year ago February averaged $1175. Retail buyers of gold/silver coins are highly sensitive to price and tend to chase the price higher, up to a point. On this basis, it’s not surprising that more minted coins were sold a year ago compared to this year. This “price effect” on the demand for retail gold and silver coins likely explains about 25% of the demand comparison between 2016 and now.

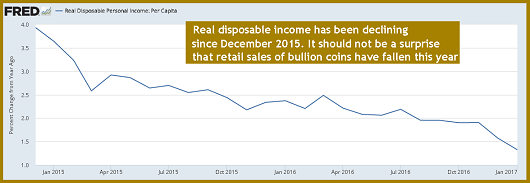

The second factor is the economy. Remember, the end user of minted bullion products is largely the retail buyer. In the first two months of 2017, real wages have declined. Even more negative for retail sales of any sort is the fact that real disposable income has been declining on a year over basis since December 2015:

While we at the Shadow of Truth do not consider buying and owning bullion to be “discretionary,” retail sales, including sales of bullion coins, is highly dependent on the relative level of real disposable income. Thus once again it should not surprise, based on just looking at retail demand for physical bullion, that retail bullion sales are falling.

On the other hand, the Black article purports the idea that retail bullion sales represents global demand for gold and silver. Nothing could be further from the truth. Retail demand at the margin has no affect on price other than maybe the price premiums in the coin market based on mint supply and retail demand.

The majority of gold bullion demand comes from the jewelry industry, eastern hemisphere Central Banks and sophisticated wealthy and institutional investors. India and China alone import more gold than is produced from mines globally. This is why Black’s “paper gold” price is rising. It’s why the BIS and western Central Banks have failed to eliminate the significance of gold in the global monetary system.

Gold imports into India jumped 175% in February from February 2016 to 96.4 tonnes (LINK). In fact, official gold imports into India have been rising since December. And that does not include dore bars or smuggled gold. 179 tonnes of gold was withdrawn from the Shanghai Gold Exchange in February. This is 60% higher than February 2016. The Russian Central Bank gold reserves have been rising almost monthly since mid-2007.

To claim that the global demand for physical gold is collapsing is seeded in either ignorance or mal-intent. But either way, the assertion is outright idiotic when the facts are examined, which we do in today’s episode of the Shadow of Truth:

Original source: Investment Research Dynamics

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.