Thomas Hobson was the owner of a livery stable in Cambridge in the 16th century. When travellers came to change their horse, they had to take the horse standing nearest the door, or they would not get a horse. Although there were 40 horses in the stable, the traveller did not have a choice. So Hobson’s Choice means the choice of one.

This article will discuss if investors in coming years really have more than the Hobson’s choice of one.

Gold has been one of the top performing asset classes in this century and still nobody owns it with only 0.5% of world financial assets invested in gold.

Most investors don’t follow gold since the banking and investment management industries neither promote gold nor understand it. They obviously don’t like to recommend physical gold since it doesn’t lend itself to commission churning. And the precious metal mining stocks is such a small sector that few bother about it.

Everybody talks about how bad gold has been as an investment.

In January 2000 gold was $290 and currently the price is $1,855, a 6.4X increase in the last 22 years which is better than any other asset class.

Does Gold Perform Better Than The Dow?

The timing of an investment is clearly critical.

So let’s look at the performance of the Dow and gold from 1971 to date.

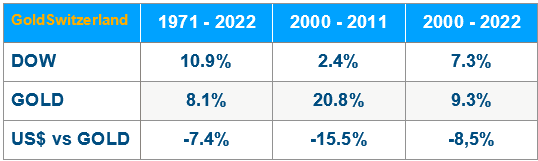

The table below shows total annualised returns for gold and the Dow (including reinvested dividends).

From the time the gold window was closed in 1971 to date, gold has yielded 8.1% p.a. whilst the annual yield on the Dow (dividends reinvested) 1971-2022 is 10.9%. So an important outperformance by the Dow of 2.8% p.a.

But if we look at 2000 to 2011, gold outperformed the Dow by 18.4% annually (20.8%-2.4%). So gold was a star performer for 11 years. But if we then look at the whole of the 2000s, gold has outperformed the Dow by 2% per annum (9.3%-7.3%).

Annualised Return: Dow – Gold – US$ (Vs Gold)

And if we take another look at the very important table above. We can see that the dollar has lost 7.4% annually against gold between 1971 and 2022. Since the dollar fall is likely to accelerate in coming years, it cannot make sense for anyone to hold US dollars.

Pandora’s Box

In 1971 Nixon closed the Gold Window which opened up Pandora’s Box of deficit spending, debt explosion and collapse of the dollar as well as all currencies.

Gold, which had been fixed at $35 per ounce since 1933, surged 24X from $35 in August 1971 to $850 in January 1980. Gold then corrected for almost 20 years and bottomed at $250 in 1999. Not until 2008 did gold reach $850 again.

We could of course blame Nixon for the disastrous half a century of debt, deficits and epic asset bubbles. But “plus ça change, plus c’est la même choose” (the more it changes, the more it stays the same).

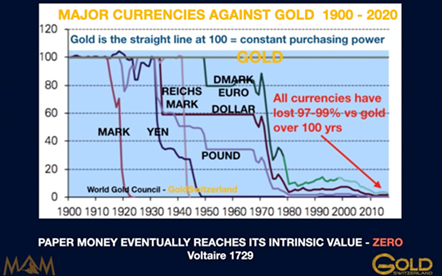

Anyone who has studied history would know that no currency has ever survived in its original form except for gold. Every single currency has gone to ZERO.

And Nixon’s fatal decision was the clearest signal that the end of the Central Bank era, which started with the formation of the Fed in 1913, was over.

But the death of money is a slow and gruesome process that takes place without anyone noticing. It seems that things are just getting dearer due to inflation and no one understands that this is the consequence of money and debt creation leading to currency debasement.

As the chart below shows, it is not prices going up but the value of money going down.

Whether you start in 1913 or in 1971, relative to gold all currencies have declined between 97-99% to date.

End Of Monetary Era

So there we have it. Without the discipline of currencies being linked to gold, which has maintained its purchasing power for 5,000 years, governments and central banks will just create unlimited amounts of paper money to buy votes.

They clearly have no understanding of the epic asset and debt bubbles they create which at the end of a monetary cycle leads to, not only a collapse of the financial system but also of the global economy, with wars and social unrest contributing to the misery.

And sadly we are now entering the finale of this monetary era which will lead to suffering on a global level that the world has never experienced before. Add to that the risk of a major war or a nuclear war which will clearly have cataclysmic consequences.

The world has never previously experienced a time when every single major economy as well as emerging countries are all indebted to the hilt.

13,000 Nuclear Warheads

Nor has the world been in a situation where 13 countries possess 13,000 nuclear warheads. Probably 10-15 of those would be enough to finish most life on earth.

So the world is facing a very daunting prospect – a prospect which is not even worth thinking about since virtually nobody can do anything about it. But the risks are high, especially since the US and Europe currently have no desire to find a peaceful solution but instead are sending money and weapons to Ukraine. That is clearly not conducive to peace.

But we must remember that whilst the US and Europe are directly involved in the sanctioning of Russia, this only represents 15% of the world’s population. Countries representing 85% of global population including China, India, Africa and South America are still trading with Russia.

So these US led sanctions are really the tail wagging the dog. We also know that sanctions are not only extremely bad for the world economy but also not conducive to achieving peace.

Why Hold Any Wealth In Paper Money

At the beginning of this century, we felt uncomfortable with the risks in the financial system and the growth in credit and in particular derivatives. Also, since my working life started in the late 60s to the beginning of the 2000s, I had experienced a decline of just under 90% in most currencies.

For anyone who had studied history, this was not new since every single currency in history had gone to ZERO.

Why should anyone ever hold any of their wealth in paper money when they know it will become worthless over time.

At the beginning of 2002, we told our investors to switch a major part of their assets into physical gold held outside the banking system. Gold was then $300.

At the time we found the heightened risks in the financial system necessitated wealth preservation in the form of gold. Also, gold was then unloved and oversold, just like today.

Dow 5,000 And Gold $10,000

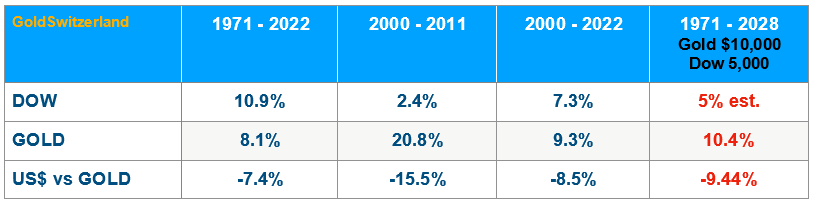

Let’s look at the table again but now with a forecast of $10,000 gold and 5,000 Dow in 2028 which we believe are realistic targets. (Again, dividends are reinvested in the Dow calculation.) The Dow return is an estimate since it is difficult to forecast exact dividends. If the Dow falls to 5,000 that is an 85% fall and many companies will not pay dividends.

Annualised Return: Dow – Gold – US$ (Vs Gold)

The Dow Jones, with dividends reinvested, has had an excellent return between 1971 – 2022 and returned 10.9% annually against gold’s 8.1%.

But in our view, stock markets globally have peaked and have started a devastating secular bear market which is likely to involve a 75-90% fall. Remember that the 1929-32 decline was 90% with much more favourable conditions than today.

So stocks will definitely not be the place to be in the next 5-10 years. Gold on the other hand is still oversold and unloved and at the same level, in relation to the US money supply, as in 2000 when gold was $290 and in 1971 when gold was $35. See my previous article.

The Dow/Gold ratio peaked in 1999 and is now in a downtrend. As I show in the chart below, the ratio is very likely to reach the downtrend support line at 0.5 which means a fall in the ratio of 97% from here. Personally I believe the ratio could go a lot lower.

Obviously we will know the outcome in the next few years. Still this is in my view a conservative forecast for the relative movements of gold and the stock market.

But if this projection plays out as I expect, a major part of the stock market gains in the last decades will be wiped out.

Priced in Gold

Finally let’s look at a few other items measured in gold, courtesy my friend Charles Vollum and his excellent service pricedingold.com

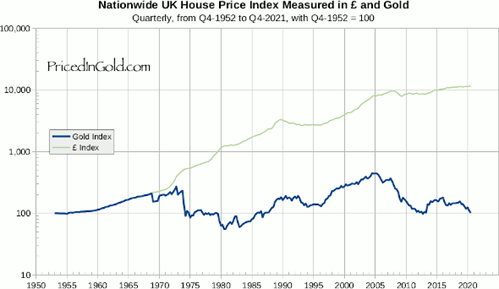

Let’s first look at UK House Prices from 1952, measured in gold and pounds.

Since 1952, UK house prices are up 100X. But measured in Gold, (blue line) UK house prices are the same as 70 years ago. Few house owners realise that their gains are all due to the debasement of their currency rather than the house value going up.

Or look at the US minimum wage.

US Federal Minimum Wage, from 1930:

The minimum wage in the US is today lower than in 1940 in real terms. Clearly any improvement in standard of living is based on individuals taking on more debt rather than real wages going up.

And if we look at US GDP measured in real terms – gold, we find that it is at the same level as in the late 1950s.

Hold Gold Instead of Paper Money

I could go on but I think the message is crystal clear already. Namely that prices or values are not going up but the value of paper or fiat money is crashing just as it has throughout history.

We can ask why this pattern which has repeated itself through millennia is only understood by a fraction of a percent of world population.

What I have made clear above is that nobody should hold any paper money since gold over time vastly outperforms all currencies.

Have we ever heard governments or central banks advising people not to hold cash but to hold gold? Of course not since that would mean that no one would accept governments’ fake money and they would go bankrupt.

Clearly no one understands that their government is bankrupt already since there is no limit to the amount of fake money they can produce.

End Of Monetary Era & The Bursting Of A $3 Quadrillion Bubble

But we are now fast approaching the end of this monetary era. And that will involve the financial system collapsing under the weight of all the fake money and debt.

If we add derivatives to the global debt, the world is facing at least $2-3 quadrillion of debt and liabilities which will implode and with that all the bubble assets that this debt supported.

Could my forecast be wrong? Yes of course it could but I doubt it since all debt bubbles end in the same way.

So we are only looking at WHEN not IF.

What investors and ordinary people should take from this article is that keeping your wealth in real money that has maintained its purchasing power for 5,000 years, is far superior to speculating in assets which temporarily outperform gold but over time represent a much higher risk but not a higher return than gold.

Also, holding physical gold in a safe jurisdiction and vault/place, certainly gives more peace of mind than volatile markets.

So coming back to Thomas Hobson, all you need to do is to follow his simple rule for selecting a horse when you choose your investment in these very precarious times. This means you have a Hobson’s choice of one, which obviously is GOLD.

I am certainly not a gold bug but have understood that gold offers the advantage of superior returns over time combined with being the best wealth preservation asset you can hold to protect against the substantial risks in the financial system.

We and our investors have understood this for 20 years. I sincerely hope that more investors than the current 0.5% of global financial asset in gold will discover it very soon.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.