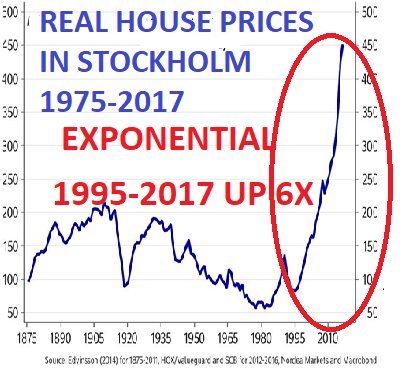

We are currently standing before one of the most unique and frightening periods in history. Never have there been so many extremes in so many different areas. In the last 100 years everything seems to have developed so much faster, including population, technology, inflation, debt, money printing, budget deficits, stock, bond and property prices, crypto currencies etc.

All of these areas are now in an exponential growth phase. The final stage of exponential growth is explosive and looks like a spike that goes straight up. A spike for a major sample like global population or the Dow never finishes with just a sideways move. Once a spike move has finished, it always results in a spike move down.

It seems that everything in the world is developing much faster today like computers and mobile phones or robots. The world assumes that this exponential growth in so many areas will continue or even accelerate further. But sadly, that is unlikely to be the case.

EXPONENTIAL MOVES ARE TERMINAL

There is a more scientific illustration how these exponential moves occur and also how they end.

Imagine a football stadium which is filled with water. Every minute one drop is added. The number of drops doubles every minute. Thus it goes from 1 to 2, 4, 8 16 etc. So how long would it take to fill the entire stadium? One day, one month or a year? No it would be a lot quicker and only take 50 minutes! That in itself is hard to understand but even more interestingly, how full is the stadium after 45 minutes? Most people would guess 75-90%. Totally wrong. After 45 minutes the stadium is only 7% full! In the final 5 minutes the stadium goes from 7% full to 100% full.

That is the simple explanation why we are seeing this very fast exponential move in so many areas. It is of course impossible to say exactly when the global stadium or individual stadiums will be filled especially since we don’t know the size of these stadiums. What we do know is that when it is full, the water level will not only stop rising but the stadium will collapse.

We are probably now in the final minute, or probably seconds, of the move since we are in the exponential phase that has lasted around 100 years.

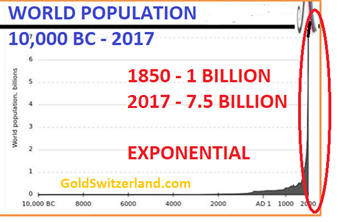

WORLD POPULATION DO DECLINE BY 2-3 BILLION

If we look at a few examples of exponential growth, we can start with world population. For thousands of years global population grew very slowly but finally reached 1 billion in the 1850s. Since then it has gone up over 7x to 7.5 billion. Many “experts” now forecast that we will soon reach 15 or 20 billion.

Yes, global population could grow slightly from here but more likely is that we will see a major reduction in the coming decades. It could even happen a lot faster depending on the type of event that the world is facing. Looking at the size of the exponential move, 6.5 billion people have been added to world population since the mid 1850s. A normal correction to such an exponential growth would be 38% to 50%. This would mean that world population could go down between 2.5 and 3.7 billion to 3.8 to 5 billion people. This clearly sounds horrendous and improbable but looking at the chart, it is likely to happen. It is of course possible that we could see some further growth before global population goes down. But the risk of the downturn starting soon is much greater than a significant further increase.

The triggers for such a major reduction could be manifold like war, epidemic disease, economic collapse leading to poverty and famine or a combination of these events.

For example, around 1340-50 there was the Black Plague that reduced the European population by up to 60% and world population by an estimated 30 to 50%.

A nuclear war between North Korea and the US would eventually involve China, Russia, Iran, Pakistan, India and many other countries and would be just as devastating, probably leading to world population going down by much more than 60%

Likewise, a collapse of the financial system, which is not improbable, would be cataclysmic for the world.

It is absolutely clear that one or several of these events will take place in coming years but when exactly is of course impossible to say.

ETERNAL WEALTH PORTFOLIO

Depending on the magnitude of the problem, including the geographical spread, it is very difficult to prepare for it for normal people. Very few have their private jet and residences in many parts of the world. However, for people who have savings, now is the time to take defensive measures if you haven’t already. I know of very old family wealth who for hundreds of years have kept their wealth in property, art and gold with 1/3 in each. With productive land, this has of course been a superb portfolio and will continue to do very well during the coming downturn. Gold and agricultural land are real wealth preservations assets whilst some art today is a bubble asset and therefore will suffer. But 2/3 of the assets in this family’s portfolio are likely to perform extremely well in coming years.

A contrarian or a risk averse investor can today look at any chart of stocks, bonds or property which will all tell him that we are now at extremes. On a risk / reward basis, very few investors make money by buying in the very final stages of a move. Yes, it is true that anyone who bought into the Nasdaq in early 1999 had more than doubled his money by March 2000. The problem is that more than 95% of investors stayed in at that point and most did not get out until they had lost 50-80%.

DON’T BE A VICTIM

As the superb Chairman of Sprott USA, Rick Rule, stated at the New Orleans Investment Conference last week: “Either you are a contrarian, or you will be a victim”. The reality is that most people will be victims in coming years.

Very few will realise that what we will see next is the end of a major era or cycle of a major degree. Whether it is a 300 year cycle or a 2,000 year cycle doesn’t really matter. Historians will know afterwards. What we need to focus on today is to protect ourselves against these risks rather than to become victims.

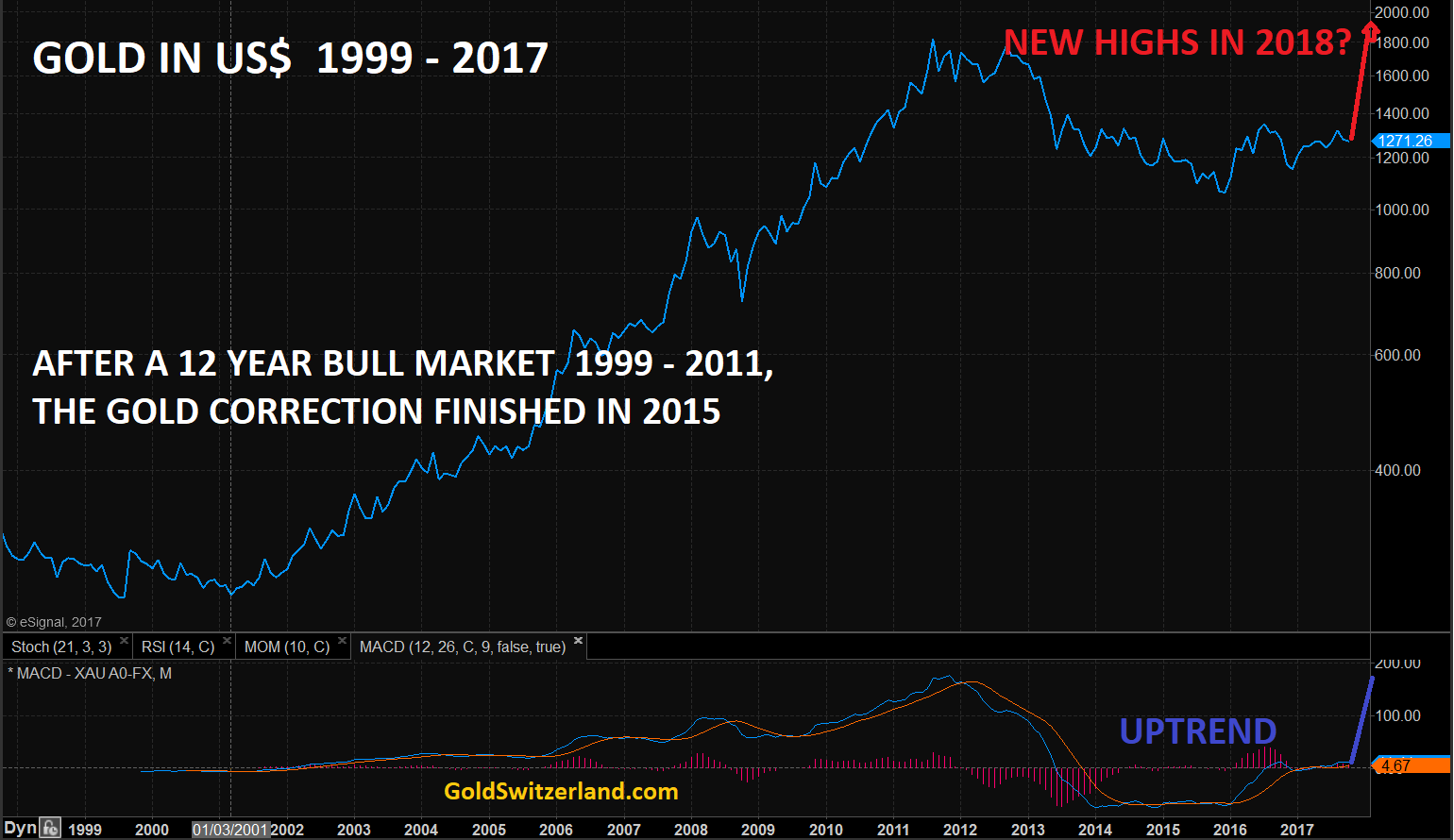

BUY UNLOVED AND UNDERVALUED ASSETS

Back in 2002, we decided as a company that risk in the world would accelerate in coming years and it was the right time to protect ourselves and our clients. Gold was at that time unloved and undervalued. It had been going down for 20 years and nobody was interested. Gold bottomed in 1999 at $250, having gone down from the $850 peak in January 1980.

The average investor obviously did not get very excited that gold had gone up $50 since 1999 and was $300 in February 2002. That was when we decided to put a significant percentage of our own funds as well to recommend to our investors to do the same.

This is a typical contrarian investment. You buy an asset that is on nobody’s radar screen and in the case of gold in 2002, 65% below its peak price 22 years earlier. But it is of course not enough just to buy something which is cheap. What you buy must also have an intrinsic value and the potential to grow substantially. Gold’s role as the only money that has existed and survived for almost 5,000 years makes it clear that function is likely to continue for many thousand years to come.

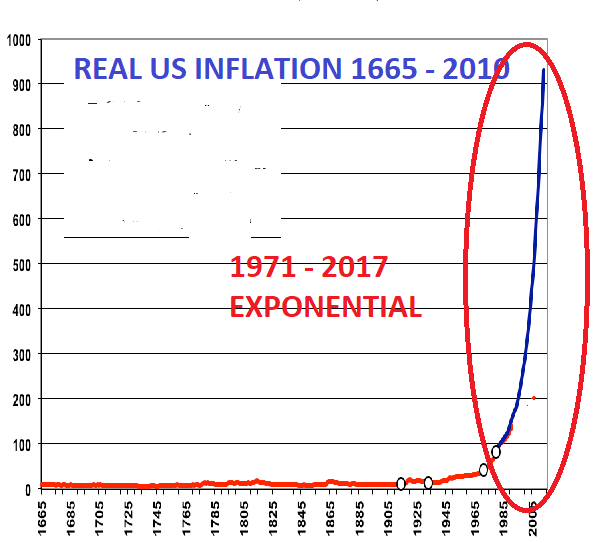

RATES GOING FROM 18% TO ZERO = CREDIT BUBBLE

Also, Greenspan’s easy money policy had started in 1987 when Fed Funds reached 10%. With a weak economy, and weak asset markets Greenspan started his stimulative policy and lowered rates down to 3% in 1992. They had gone under 2% in early 2002 when we bought gold. Eventually rates came down to 1% on Greenspan’s watch. When Bernanke then needed to sort out the mess during the great financial crisis, rates were lowered from 5% in 2007 to 0% in 2009 where they stayed until 2015.

The continual reduction of rates from when Greenspan took over in 1987 had already started in 1981 when the Fed Funds rate was 18.5%. That was the top of a 35 year up cycle since WWII.

This policy of lower interest rates for 35 years combined with credit expansion and money printing has created the biggest global asset bubble in the history of the world.

MASSIVE EXCESSES WILL BE PUNISHED

We are now at the point when the world will be punished for 35 years of excesses which is the culmination of the 100 year experiment of Fiat money started by the Fed in 1913. The $2.5 quadrillion bubble of debt and liabilities (including derivatives and unfunded liabilities) is 35x greater than global GDP and can of course never be repaid. The 2006-9 crisis was a serious rehearsal of what is still to come. Governments and central banks managed to deal with the inevitable collapse for a few years by a massive stimulative package.

Looking at the exponential nature of where we are now in history, it is clear that next time around the central banks will not succeed in saving the system. Interest rates are now so low and still negative in many countries that there is very little flexibility to stimulate by lowering rates. The only tool that remains is money printing. Interestingly, central banks who are always behind the curve are now believing that they can withdraw liquidity from markets rather than needing to add.

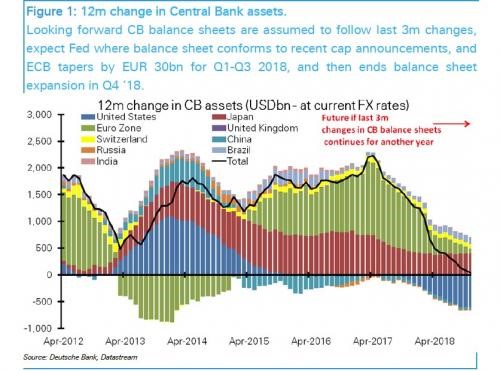

CENTRAL BANKS TO DRAIN LIQUIDITY BY $2 TRILLION

From having added $2 trillion a year, the proposed tapering will by 2019 mean that all of this added liquidity will be withdrawn and eventually turn negative. In addition, central banks are planning to increase interest rates as inflation is starting to rise.

Anyone who has the slightest knowledge of markets knows that it is the trillions of dollars of credit expansion and money printing that has created the biggest asset bubbles in history and especially inflated stock markets. To stop feeding an addicted world with debt, will not only kill stock markets but also all the other bubble markets. Addicts don’t just stop feeling good when they no longer receive their daily injection. No, they start feeling absolutely awful and go into a crisis that they seldom recover from.

It is the same with the world economy. It is today totally dependent on continuous injections of credit and liquidity. Taking $2 trillion of liquidity away from a liquidity needy world will make it permanently sick.

THE BIGGEST ABOUT TURN IN HISTORY

The effect will be collapsing stock, property and credit markets leading to panic in the financial system. That will lead to the biggest Volte Face ever in global monetary history in the next 6-18 months. Central banks will panic and start printing more money than ever before. First in the tens of trillions of dollars leading on to hundreds of trillions and eventually quadrillions of dollars as the derivative bubble blows up. The initial printing might have some short term beneficial effect on markets. But soon the world will realise that worthless pieces of paper or zeros on a computer can never create wealth or save the world whatever the Keynesians or Krugman says.

Eventually this will lead the world to hyperinflation followed by a deflationary implosion. But the course of events will not be straight forward in this process because we will have a combination of hyperinflation and deflation simultaneously. The value real assets including many commodities like precious metals, food and agricultural land will increase in value. Money will of course hyperinflate as it is printed in unlimited quantities whilst stocks, bonds and property will collapse in real times.

NOW IS THE TIME TO BUY WHAT NOBODY IS LOOKING AT

For anyone with capital to invest, this is probably one of the most interesting opportunities in history. But that presupposes that the investor is prepared to take the contrarian position. Now is the time to buy what nobody wants but which has a high intrinsic value and will benefit from the coming collapse of conventional bubble assets.

We particularly favour:

- Physical precious metals stored outside the financial system

- Precious metals mining stocks which are incredible value currently

- Agricultural land in politically stable countries

- Defence industry stocks

From a wealth preservation point of view, precious metals are our favourite. When buying stocks, an investor is exposed to the financial system, the survival of which is doubtful. The only way to avoid that is thorough direct registration which is difficult for most investors. Also, direct ownership of agricultural land is not practical for everyone. And if it is bought via a fund, it entails exposure to the financial system.

Thus, in our view, the biggest exposure should be in physical gold and silver with a smaller allocation to the other areas above.

Anyone who is not prepared to take a contrarian view today, risks to be a real victim in the next 5-7 years.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.