By Ned Naylor-Leyland

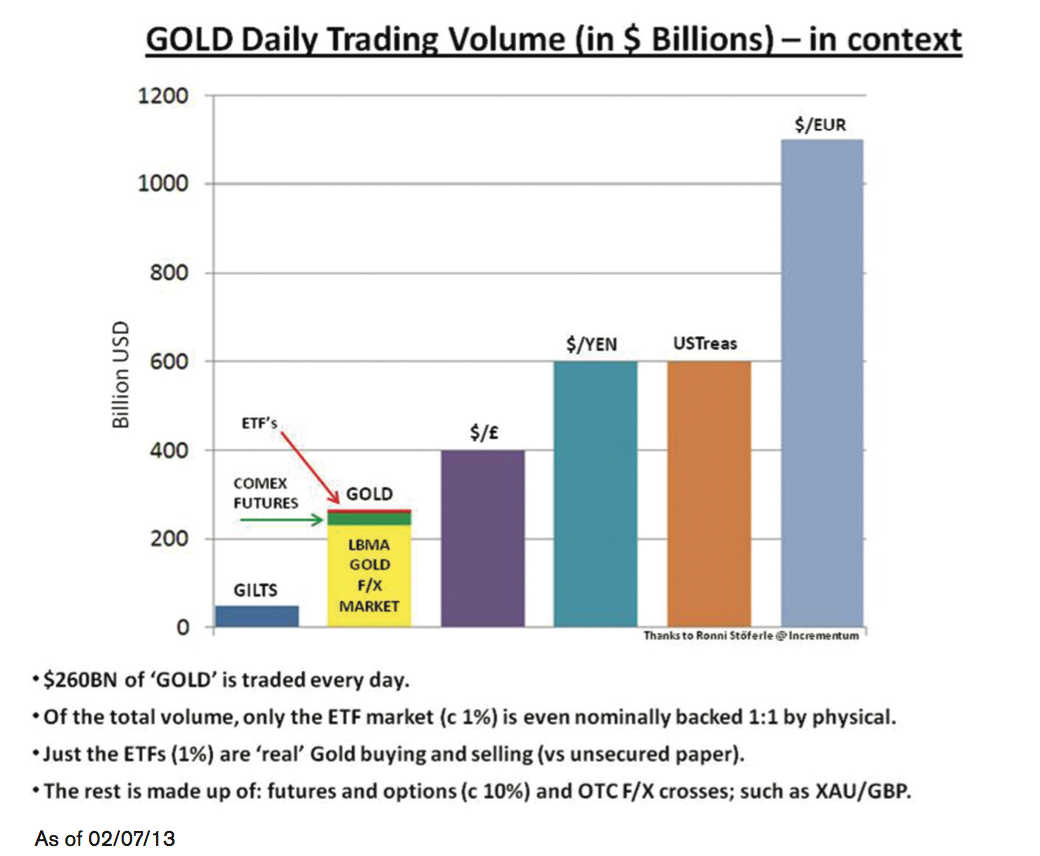

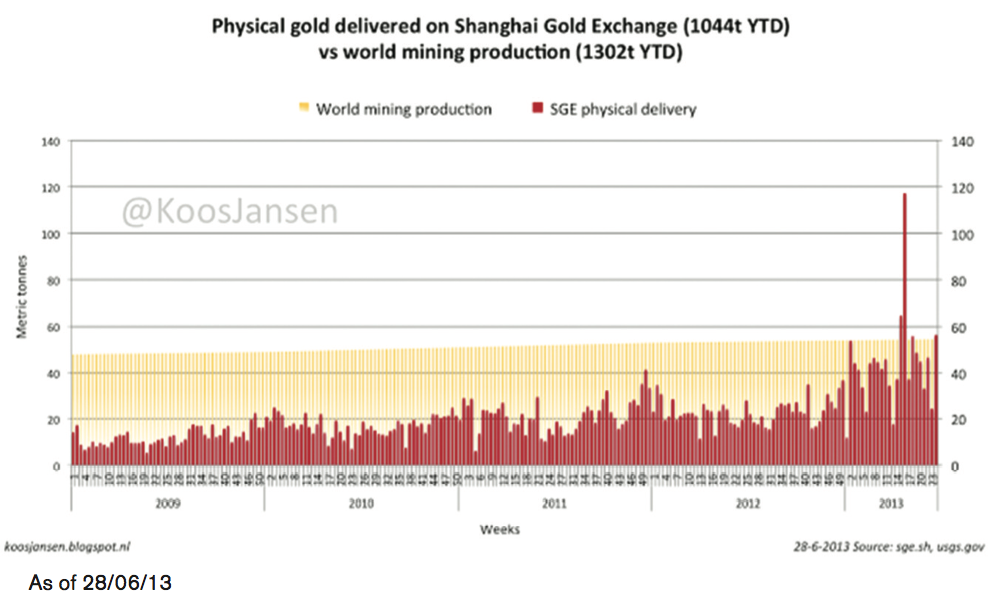

In light of the deep sell-off in the Gold price, I present 3 charts to clarify what has (and hasn’t) happened. Chart 1 is a chart of Spot Gold, the second an illustration of what makes up the daily ‘Gold’ market, the third shows the enormous flow of physical metal from West to East in the context of Global mine supply. There is an ongoing clash between the forces of paper supply and physical demand – paper supply has won the latest round, but its objective of satisfying and slaking demand for the real metal has failed entirely.

The spot price graph is annotated with events that have happened since Q3 2012. All of these points (1-6) seem pertinent when evaluating the sell-off in paper Gold, but none more so than the entry of the Gold market into a state of permanent backwardation around a year ago (1). With vast above ground inventories (supposedly) available to borrow, the Gold and Silver markets should not offer a risk-free arbitrage for any amount of time. The fact that it has remained and widened over a year indicates that the physical market has tightened up substantially, a postulation that is corroborated by the growing premiums being paid in Shanghai and Delhi (in Delhi dealers are paying over a 25% premium for NNS 8g fine Gold vs 2% in Q4 2012) and the ongoing wholesale delays in the delivery of substantial bullion tonnage (2 tons or above).

• Why did Germany do a massive and highly embarrassing U-turn about its sovereign Gold reserves being held in New York?

• Why did the NYFed then say it would take 7 years to return that Gold?

• Wouldn’t the reality of bank deposits being lined up for bank ‘bail-ins’ be exceptionally bullish for a liability-free form of wealth preservation?

• What does the scale of interest in buying physical in Asia (growing rapidly) mean for the dynamics of price discovery going forwards? Is it sustainable for nigh on all this year’s physical Gold mine supply to have been delivered through one small futures market in Shanghai?

None of these questions have been satisfactorily answered by sellers, or bears, of Precious Metals who focus solely on the ‘spot price’ without reference to the ‘spot mechanism’. Few understand what money flows come together to create the ‘spot price’ of Gold. My Chart of Daily Volumes shows the Gold investment ‘market’ up for what it really is – a vast, sprawling, OTC and almost totally unregulated dark pool.

It seems evident to me that as backwardation first started to properly grip the bullion market mid last year (where the shaded area of the graph starts), the playbook to manage the Gold price went into overdrive. In light of the backwardation between spot and the front month, the spot price duly broke out from its consolidation pattern (see purple annotation). This was a ‘code red’ signal for the bullion banking system, I wrote about it last year although I felt the inevitable disconnect would happen in a rising rather than falling price environment. Everything that followed from Point 1 should be observed in light of this crucial ongoing silence from the Golden canary in the fiat coalmine.

To understand what is meant by that, let us look at the ‘Gold’ market in context of average daily volumes in currency markets. Gold is a huge and misunderstood market. Most investors see it as a ‘simple’ asset class and assume broadly that, outside of futures and options, the market is 1:1 backed by physical metal. Nothing could be further from the truth. The ETF market is nominally backed 1:1, but in terms of daily volumes represents a meagre 1-2% overall. The rest is split between the COMEX futures market and the OTC ‘loco London’ currency pair market, where banks and investors cross vast amounts of money against Gold, generally without allocated metal backing. If the LBMA want to come out from behind the curtain and talk about true bullion inventories versus traded volumes then I would happily assess that data, but for the time being they prefer to remain conveniently opaque.

The best information we have is from The Reserve Bank of India, an LBMA member, who state that the OTC market and futures and options are 92x greater than the underlying physical market. The ratio expressed in my adapted ‘Daily Volumes in Context’ chart pretty much confirms the best-guess RBI leverage ratio. Considering that the Bank of England is worried about Barclays’ leverage ratio (having risen to the giddy heights of 40:1 again with the need for a minimum of £8bn in fresh capital asap) I find it extraordinary that investors do not notice that the Gold price is presently defined by a market which operates using around a 90:1 leverage ratio. This cannot, and will not, end well for holders of synthetic Gold, or the banking system overall. Indeed, the recent raids on the spot price have just brought forward the day of reckoning for the present price discovery mechanism by stimulating yet further drawdowns on physical inventories.

Most of the purchasers of ‘Gold’ in f/x markets (ticker XAU) have no physical backing to their trades (estimated to be around 90% unallocated). This is the nature of the OTC ‘Gold’ currency market. Considering that most people invest in Gold exactly because they fear the fractional reserve nature of the banking system, this is a bizarre state of affairs and I believe has led us to the widening backwardation we now see as the new ‘normal’. What is happening now is that the absolutely inevitable ‘run’ on the 100:1 leveraged Bullion banking system is truly underway.

The bullion banks want to get Gold back into contango and stop the movement of the remaining inventories by shaking the market lower, using paper leverage to do so. It hasn’t worked, indeed more and more investors are now seeking allocation, delivery and physical metal at the expense of synthetic products offered by the banks. The squeeze we have been waiting for is closing in, it is always darkest just before dawn.

Original source: Scribd

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.