On a day where real yields are spiking, seemingly sparking a degrossing in gold futures, we found it rather noptable that BofA's Global Commodities Research team publish a note highlighting the fact that recent flow data suggests that paper gold is no longer as important as it used to be.

Specifically, BofA notes that the recent gold price rally has been driven by investors, who have increased their exposure to the yellow metal, a dynamic that is, as such, not unusual.

Digging a bit deeper, positioning through futures was historically the marginal price driver, as these contracts used to be the most popular product through which non-commercial market participants invested in the precious metal.

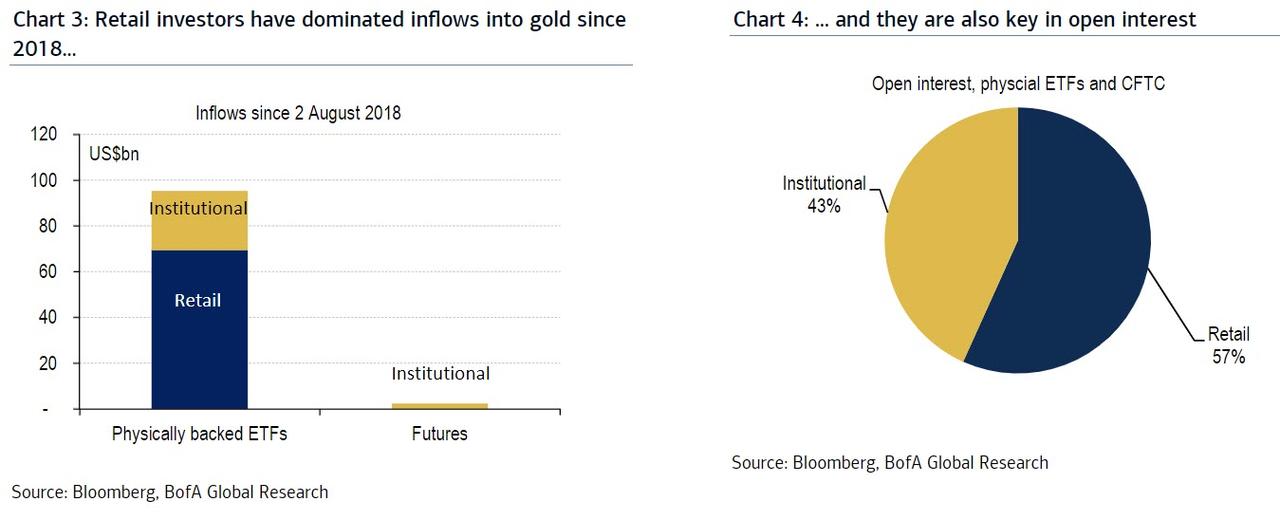

Broadly speaking, as Chart 1 highlights, investor positions have trended higher since the precious metal bottomed out in 2018, so this was one element in the recent rally.

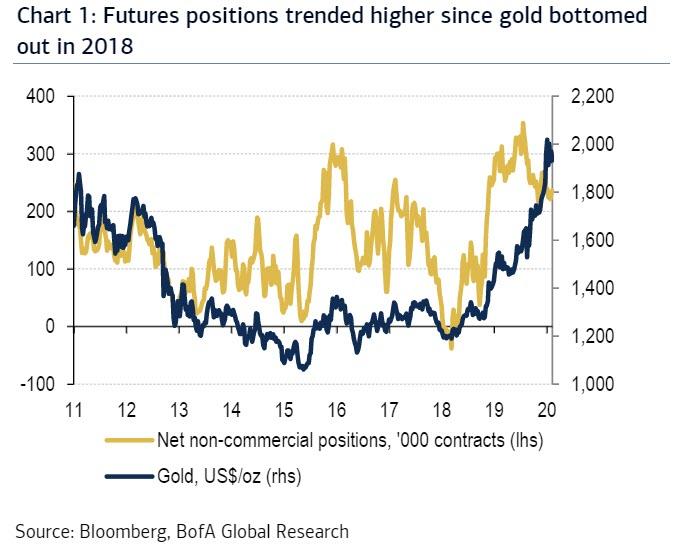

However, as Chart 2 illustrates, assets under management at physically-backed ETFs have also risen materially.

Indeed, the close correlation between those two metrics suggests that physically-backed ETFs have become the dominant drivers of gold quotations.

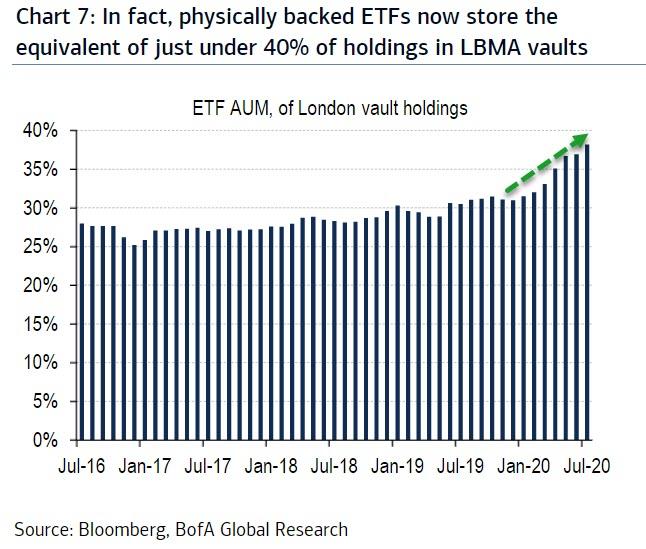

Critically, physically backed ETFs are now approaching 40% of gold held in LBMA vaults.

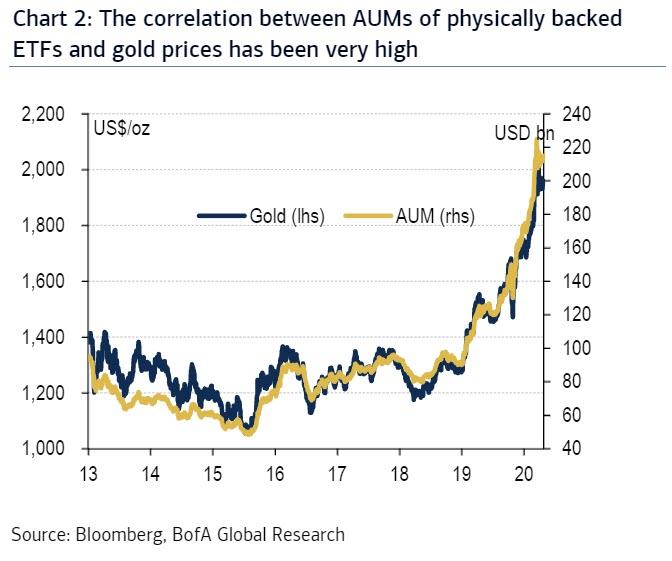

The data reinforces that paper gold is no longer as important.

Additionally, while institutional investors, who in the past often traded futures, still hold a large share in open interest, retail investors have become materially more important...

And who can blame them. As Peter Schiff recently highlighted after The Fed's latest farcical press conference, central bank policy is creating a very bullish environment for precious metals prices to continue to rise. Unfortunately, a lot of other prices will rise as well.

"Well, certainly the prospects for the precious metals are very bright. But you know, the prospects for a lot of prices to move up, unfortunately, are not good. The Federal Reserve is creating a tremendous amount of inflation. It claims that its goal is for the cost of living to rise at a more rapid pace than it has in the past. Jerome Powell claims that we need to make up for the cost of living rising too slowly in the past by making sure it rises more rapidly in the future. But I think really, what Powell is trying to do, is provide cover to maintain the asset bubbles that he denies exist.”

Original source: Zero Hedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.