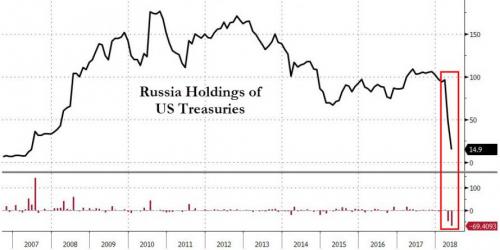

Russia has all but fully liquidated its US Treasury holdings through the months of April and May.

In those two months, Russia sold a whopping $81 billion in Treasurys, a liquidation flow that was likely responsible for much if not all the blow out in rates over the period.

In 2010, Russia was among the top 10 holders of US Treasuries at $176.3 billion. With its holdings falling to $14.9 billion in May, the country is now below the $30 billion threshold for inclusion on the Treasury Department’s monthly report of major holders. On Tuesday, the Treasury released a list of 33 countries which includes the biggest holder China to the smallest Chile. Russia is no longer on the list.

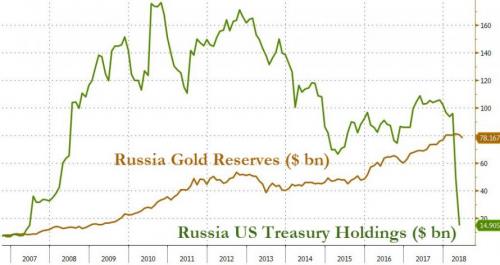

However, that left two questions - why was Russia dumping USTs and what will do with all the funds it garnered from liquidating US debt instruments?

The head of the Central Bank of Russia (CBR) Elvira Nabiullina explained that the slashing of the holdings was result of the systematic assessment of all kinds of risks, including financial, economic and geopolitical.

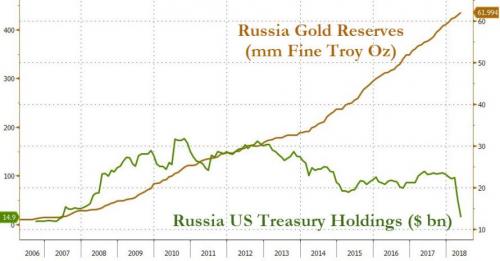

Meanwhile, Russia’s gold holdings have been steadily increasing - for 39 straight months - bringing its share of the precious metal to its highest level in nearly two decades.

Russia’s gold holdings in May grew by one percent to 62 million troy ounces, worth $80.5 billion, according to the CBR.

According to Nabiullina, gold purchases helped to diversify reserves.

Global geopolitical conflicts along with trade tensions triggered by the US earlier this year have made some countries follow suit. Turkey nearly halved its US Treasury holdings from almost $62 billion in November to $32.6 billion in May. Germany has reduced its holdings from $86 billion in April to $78.3 billion in May.

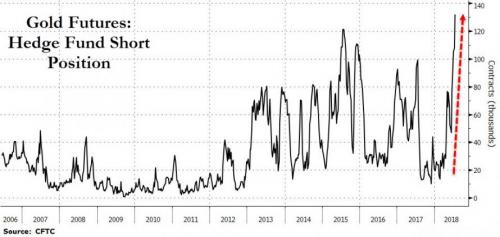

And while Russia and others were busily buying physical gold, speculators were unwinding their net long positions to the lowest since January 2016.

But, Hedge funds and other large speculators raised their bets on gold-price declines to the highest since at least 2006 in the week to July 17, according to government data.

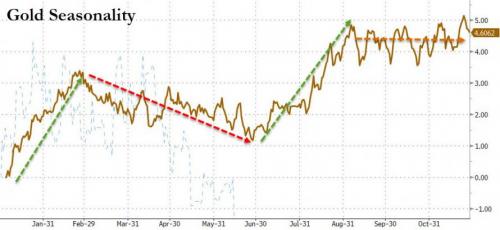

While bullion rallied on Friday, the massive surge in leverage money short positions is potentially the catalyst to support the usual seasonal pattern in gold prices...

Especially if Trump keeps jawboning the dollar lower.

Original source: Zero Hedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.