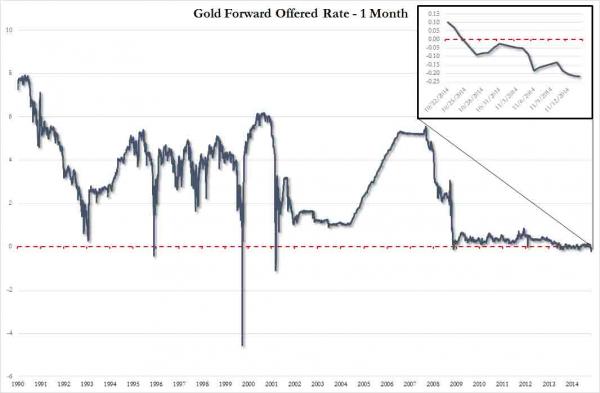

Deutsche Bank Says "Yes" Vote Has "Narrow But Clear Lead" In Swiss Gold Referendum As 1M GOFO Hits Most Negative Since 2001.

As we explained over the weekend, should the Swiss gold referendum pass successfully, the price of gold will surge. It was none other than JPM who warned that the "markets under appreciate this event", explaing that "If the referendum is passed, the Swiss National Bank (SNB) will be forced to increase reserves by around 1,500 tonnes over five years, i.e. 300 tonnes per year. This 300 tonnes per year accounts for 7.5% of annual gold demand of 4,000 tonnes per year."

Well, even as the SNB has been scrambling to make the referendum seem like a non-event, with very little chance of passing, moments ago Deutsche Bank released a piece that roundly refuted everything the Swiss Central Bank has been peddling. To wit, here is a note just out from DB's Robin Winkler:

- On 30 November, the Swiss will vote in a referendum to decide whether the SNB’s constitutional mandate should be changed to require the central bank to 1) never sell any gold reserves once acquired, 2) store all its gold on Swiss territory, 3) hold at least 20% of its official reserve assets in gold.

- The likelihood of a yes vote is considerable. The proposal requires a simple country-wide majority to pass, as well as a majority in at least 50% of Swiss cantons. Current polling shows the ‘yes’ campaign with a narrow but clear lead and there are reasons to believe that factors on the day could be favourable for the amendment. If an affirmative vote was recorded, there is little political leeway to delay or dilute implementation.

- We find that some of the concerns over the technical implementation of the 20% rule may be overblown. The SNB should be able to meet its gold demands with relative ease. Nor do we subscribe to the view that this would have a long term impact on gold price trends. In the event of further intervention, SNB rebalancing into gold could have a more marked impact on short term price trends, however. The SNB should easily be able to repatriate its gold holdings from abroad.

- The possibility that the SNB could circumvent the requirement through the creation of a sovereign wealth fund is remote. While technically attractive, this option is not politically feasible. However, the SNB could use gold swaps to mitigate some of the adverse implications of the gold vote, in particular with respect to asset return risk and market footprint.

- The amendment would carry significant balance sheet risks for the SNB. As well as concentrating market risk, the SNB would be effectively short an option on gold but without having received a premium. Balance sheet risks could be mitigated by the SNB returning to marking gold at purchase rather than market prices.

Some more:

The proposal requires a simple 50% majority to pass (Volksmehr), with the further proviso that there be a majority in at least 50% of Switzerland’s 26 cantons (Ständemehr). There is no minimum turnout. The Ständemehr is the lower hurdle, since the vote is biased towards smaller, conservative cantons more likely to vote yes. In the absence of official polls, the proposal’s likelihood of success can only be gauged from polls conducted by newspapers and other media outlets. The most respected polls are published by the radio and TV platform SRG. According to their latest poll (another poll is due next week), 44% of respondents intended to vote in favour of the amendment, with 39% rejecting it.

Swiss pre-referendum polls commonly see the share of ‘no’ votes rise during the lead up to the actual vote, as the political and business establishment ramp up campaigns against radical proposals. However, it is important to note that the Swiss vote on three separate referenda on 30 November. Most of the political debate has concerned the ‘EcoPop’ initiative which seeks to curtail immigration to Switzerland based on a quota system. Some observers fear that the political focus on the immigration debate might lead voters to pay less attention to the gold proposal. There is also a concern that moderately conservative voters uncomfortable with the anti-immigration initiative might vote in favour of the gold proposal in compensation.

* * *

The SNB should face little technical difficulty in repatriating its gold within two years. Switzerland stores about 300 tonnes of gold abroad, almost exclusively in the UK and Canada. History suggests that this gold could be shipped to Switzerland within a short period of time (for more detail, see appendix). It would be easier to repo Swiss gold held abroad and insist on physical delivery upon expiry, or to sell the gold abroad to fund contracts deliverable over the next five years. Counterparties could source the gold to be delivered most cheaply in Switzerland itself, given the country’s large private holdings

Well, after Germany's miserable failure to reclaim its gold when the Bundesbank received a tap on its shoulder "strongly hinting" the NY Fed and BNP may have serious procurement problems of gold that is 'already there', it appears at least one European nation is about to have access to its gold, and judging by the increasing warnings about the global fiat bubble popping by none other than the BIS (yet again, more shortly), probably not a moment too soon.

As for the SNB being easily "able to repatriate its gold holdings from abroad" we appreciate the optimism, just don't point out to the DB analyst that 6 Month GOFO just want negative once again even as 1M GOFO rate hit the most negative it has been since... 2001!

Original source: Zerohedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.