Some interesting coincidences…

“We are going to have to have some kind of a grand global economic reordering.”

Scott Bessent, the incoming Treasury Secretary, is stepping into the spotlight to manage the monumental task of selling trillions in U.S. government bonds.

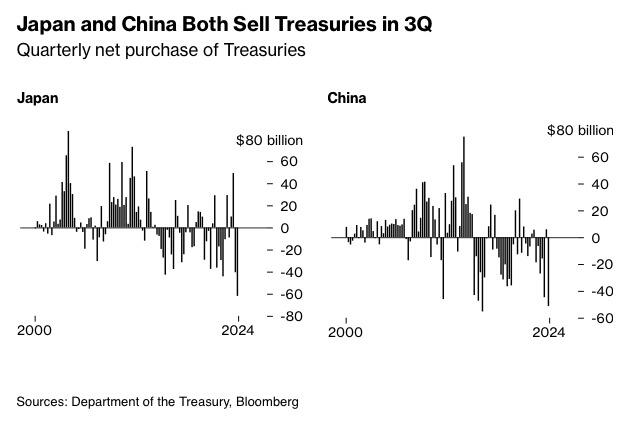

Japan has been grappling with a dramatic currency crisis, prompting the government to intervene repeatedly to support and stabilize the yen.

They have spent over $100 billion in recent years to support their currency—a staggering figure.

China has been actively reducing its exposure to U.S. debt as it pushes to dedollarize, safeguard its economy against potential sanctions, internationalize its currency, and navigate escalating tensions over Taiwan.

- Japanese investors sold a record $61.9 billion in U.S. securities in Q3, per U.S. Treasury data.

- Chinese funds offloaded $51.3 billion in the same period, the second-largest amount on record.

Now, what does this have to do with anything?

The incoming Treasury Secretary has voiced support for the U.S. issuing ultra-long-term bonds, a concept previously explored during the Trump administration under then-Treasury Secretary Steven Mnuchin.

However, a compelling idea is now being openly discussed by an economic advisor from President Trump’s first administration.

Judy Shelton is advocating for a Treasury instrument that includes the gold convertibility of the dollar upon maturity:

GOLD TELEGRAPH CONVERSATIONS #1:

— Gold Telegraph ⚡ (@GoldTelegraph_) November 3, 2024

JUDY SHELTON

“I want the United States to be the leader if there's any kind of gold backing to a currency.” - @judyshel

Economic advisor to former President Donald Trump, Judy Shelton, joins me for a captivating conversation spanning a wide… pic.twitter.com/gmk9GqBCPz

She recently tweeted about a proposal for a 50-year Treasury bond, convertible into gold, to be issued at the initiative of President Trump on July 4, 2026:

Proposal for a 50-year Treasury bond convertible into gold issued at the initiative of President Trump on July 4, 2026. pic.twitter.com/vXVy0SnIq6

— Judy Shelton (@judyshel) November 22, 2024

That would undoubtedly command the world’s attention.

Scott Bessent is a proud economic historian and, I am sure, also understands the role of gold in the international monetary system.

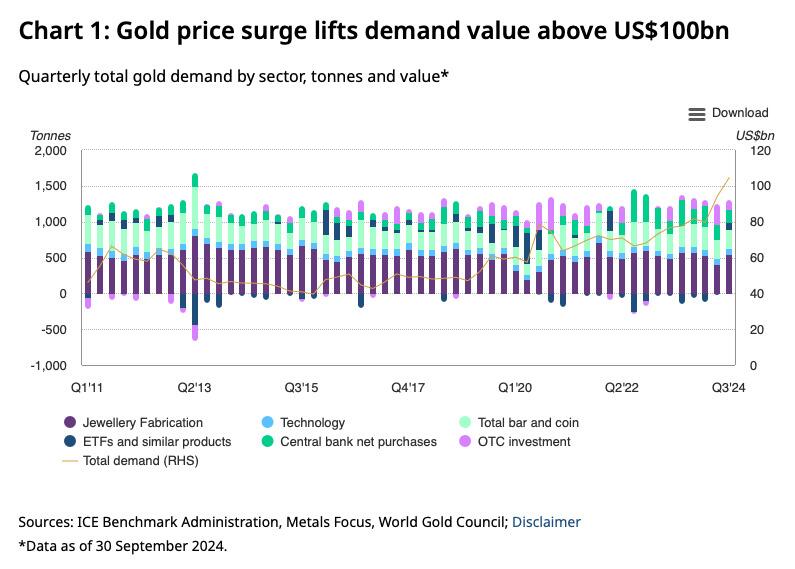

This would come at a time when central banks are increasingly diversifying their strategies and turning to hard assets like gold.

In fact, global gold demand hit record highs for any third quarter during the past three months, reaching 1,313 tonnes—a 5% increase year over year:

BRICS appears to have positioned gold as the cornerstone of its financial strategy, with the UAE emerging as Asia’s gold hub in the bloc’s new economic corridor.

Notably, the UAE has already surpassed London as the world’s second-largest gold trade center.

The West must act swiftly to restore monetary integrity, and physical gold—time-tested and proven as a reliable store of value—could hold the key.

The time is ticking.

Original source: ZeroHedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.